Direct Drive Wind Turbine Market Research, 2030

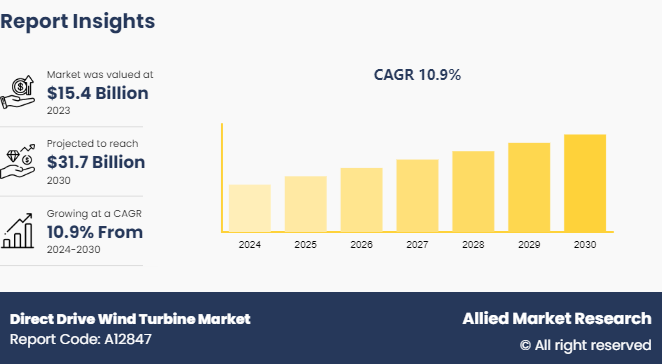

The global direct drive wind turbine market size was valued at $15.4 billion in 2023, and is projected to reach $31.7 billion by 2030, growing at a CAGR of 10.9% from 2024 to 2030.

Market Introduction and Definition

A direct drive wind turbine is a type of wind turbine that operates without a gearbox. In traditional wind turbines, the gearbox converts the low rotational speed of the turbine blades into higher speeds needed to generate electricity. However, direct drive wind turbines use a low-speed generator that is directly connected to the rotor, eliminating the need for a gearbox. This design reduces mechanical complexity, improves reliability, and lowers maintenance requirements. Direct drive systems are known for their efficiency and preferred in offshore and onshore wind farms where maintenance is challenging and costly.

Key Takeaways

- The direct drive wind turbine market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major direct drive wind turbine industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

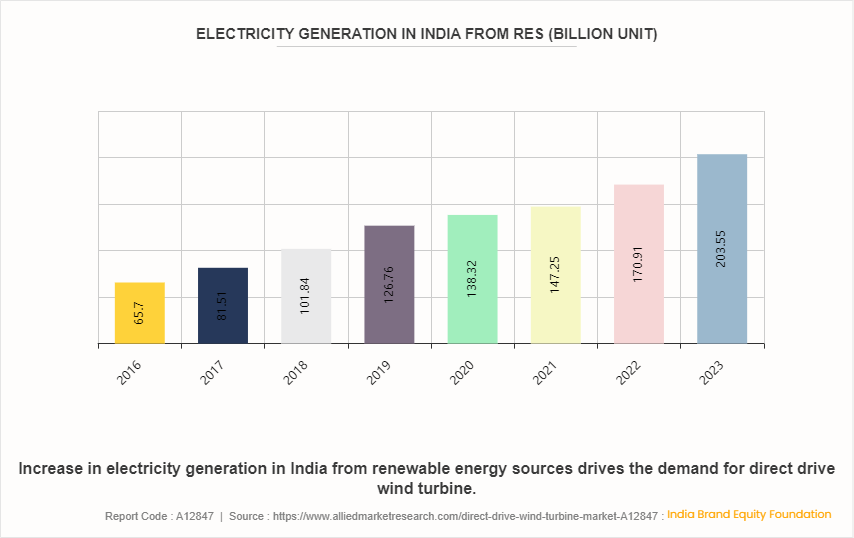

The global shift towards renewable energy sources drives the demand for direct drive wind turbines. As countries strive to meet their climate goals and reduce reliance on fossil fuels, the adoption of wind energy has become increasingly preferred. Direct drive wind turbines eliminate the need for a gearbox and offer significant advantages in terms of efficiency, reliability, and maintenance that makes them a preferred choice for modern wind energy projects. Furthermore, the growing awareness of environmental issues and the need for sustainable energy solutions are influencing public and corporate attitudes towards renewable energy. Consumers and businesses are increasingly prioritizing eco-friendly practices, leading to greater demand for renewable energy sources. As wind energy becomes more mainstream, the advantages of direct drive technology, such as reduced noise pollution and lower environmental impact are expected to drive the growth in the direct drive wind turbine market forecast.

However, the installation and infrastructure costs for direct drive wind turbines are higher compared to conventional systems. The larger and heavier components of direct drive turbines necessitate specialized transportation and installation equipment, as well as more robust foundation structures. These added logistical and construction expenses inflate the total project cost, posing a significant barrier to widespread adoption, particularly in regions with limited infrastructure capabilities or budget constraints. All these factors hamper the direct drive wind turbine market growth.

Technological advancements in turbine design are creating substantial opportunities for the growth and adoption of direct drive wind turbines. Innovations in materials science, engineering, and manufacturing processes are contributing to the development of more efficient, reliable, and cost-effective direct drive systems. These advancements are enhancing the performance of direct drive turbines and addressing some of the challenges associated with their high initial capital investment. Moreover, advancements in digital technology and smart grid integration are providing new opportunities for direct drive wind turbines. The incorporation of sensors, data analytics, and machine learning algorithms into turbine design and operation allows for real-time monitoring and predictive maintenance. All these factors are anticipated to offer new growth opportunities for the global direct drive wind turbine market during the forecast period.

Market Segmentation

The direct drive wind turbine market is segmented into capacity, technology, installation, end use and region. By capacity, the market is classified into less than 1MW, 1MW to 3MW, and more than 3MW. By technology, the market is bifurcated into permanent magnet synchronous generator (PMSG) and electrically excited synchronous generator (EESG) . By installation, the market is divided into offshore and onshore. By end use, the market is classified into industrial, commercial, residential, and utility. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

Direct drive wind turbines known for their higher efficiency and lower maintenance requirements compared to traditional geared turbines. Their ability to operate with fewer mechanical parts reduces the risk of failures and extends the lifespan of the turbines, making them economically attractive over the long term. Moreover, government policies and incentives in countries such as China, India, Japan, and South Korea are significantly influencing the market. These countries have set ambitious targets for renewable energy generation, offering subsidies, tax incentives, and favorable regulatory frameworks to encourage the adoption of wind energy. For instance, China's aggressive push for renewable energy to combat pollution and reduce reliance on coal has led to substantial investments in wind power infrastructure, including direct drive wind turbines.

Direct drive wind turbine technology is rapidly evolving, with significant improvements in turbine design, materials, and efficiency. Innovations such as larger rotor diameters and advanced control systems are enhancing the performance and reliability of direct drive turbines. The development of high-efficiency generators and the integration of digital technologies for real-time monitoring and predictive maintenance are also contributing to the growth of the industry.

Governments across the Asia-Pacific region is implementing supportive policies and incentives to promote the adoption of renewable energy, including direct drive wind turbines. For instance, countries such as China, India, and Japan have set ambitious renewable energy targets and offer financial incentives such as subsidies, tax credits, and preferential tariffs. These policies are fostering a favorable investment climate and driving the deployment of direct drive wind turbines.

The rapid growth in energy demand due to urbanization and industrialization in the Asia-Pacific region is driving the need for scalable and efficient renewable energy solutions. Direct drive wind turbines are well-suited to meet this demand, offering high efficiency and reliability. The increase in focus on reducing carbon emissions and transitioning to cleaner energy sources is accelerating the adoption of direct drive wind technology.

Competitive Landscape

The major players operating in the direct drive wind turbine market include Siemens Gamesa Renewable Energy, S.A.U., Goldwind, GE VERNOVA, ENERCON Global GmbH, Nordex SE, Senvion India Pvt. Ltd., Hitachi Energy Ltd., ABB Ltd, Voith GmbH & Co. KGaA, and Emergya Wind Technologies BV.

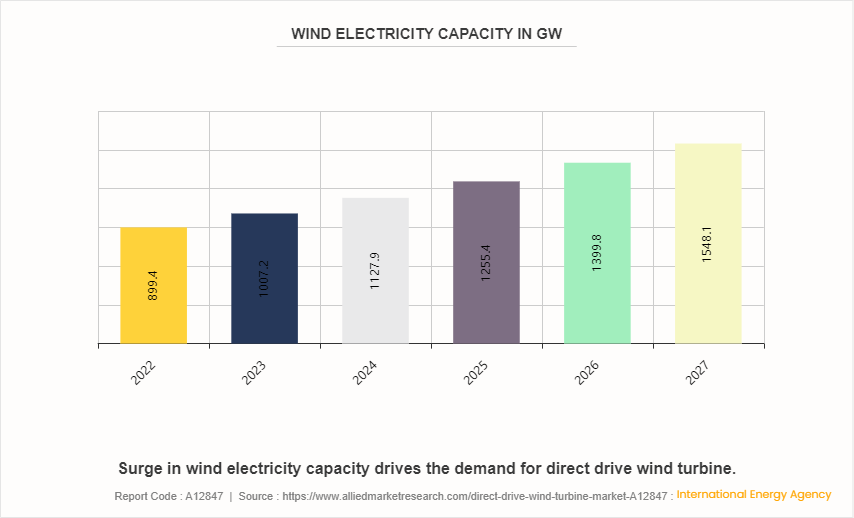

Impact of Wind Electricity Capacity on Direct Drive Wind Turbine

As the wind electricity capacity rises from 899.4 GW in 2022 to an anticipated 1, 548.1 GW in 2027, the demand for efficient and reliable wind turbines becomes more critical. Direct drive wind turbines, known for their higher efficiency and reduced maintenance needs, are well-positioned to meet this growing demand. Their ability to operate without a gearbox makes them particularly suited for large-scale installations, which are becoming increasingly prevalent as wind capacity expands. This trend drives the investment in direct drive technology, as its benefits align with the industry's need for more robust and cost-effective solutions.

Moreover, the expansion in wind capacity encourages the development of larger and more powerful turbines, including those utilizing direct drive systems. As the market grows, manufacturers are scale up their production of direct drive turbines that reduce the costs and improve performance. This scaling effect led to innovations that enhanced the technology's efficiency and affordability, making it a preferable option for new wind farms. Furthermore, the increasing wind capacity highlights the importance of minimizing operational downtime and maintenance costs.

Industry Trends

Direct drive technology is well-suited for large-scale turbines, especially those used in offshore wind farms. Manufacturers are developing larger and more powerful turbines to take advantage of the higher wind speeds and more consistent conditions offshore.

Direct drive wind turbines are increasingly being integrated with smart grid technologies. This allows for better grid stability and the efficient management of variable renewable energy sources.

As the industry focuses more on sustainability, direct drive wind turbines are being designed with materials and processes that have a lower environmental impact.

Direct drive wind turbines are increasingly being adopted for both onshore and offshore wind farms. This is due to their efficiency in converting wind energy into electricity and reduced maintenance needs compared to gear-driven systems.

Key Sources Referred

International Trade Administration

Department of Energy

International Energy Agency (IEA)

International Renewable Energy Agency (IRENA)

The American Clean Power Association

The European Wind Energy Association

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the direct drive wind turbine market analysis from 2024 to 2030 to identify the prevailing direct drive wind turbine market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the direct drive wind turbine market share and segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global direct drive wind turbine market trends, key players, market segments, application areas, and market growth strategies.

Direct Drive Wind Turbine Market Report Highlights

| Aspects | Details |

| Market Size By 2030 | USD 31.7 Billion |

| Growth Rate | CAGR of 10.9% |

| Forecast period | 2024 - 2030 |

| Report Pages | 320 |

| By Capacity |

|

| By Technology |

|

| By Installation |

|

| By End Use |

|

| By Region |

|

| Key Market Players | GE VERNOVA, ENERCON Global GmbH, Voith GmbH & Co. KGaA, Emergya Wind Technologies BV, Nordex SE, Hitachi Energy Ltd., ABB Ltd, Senvion India Pvt. Ltd., Siemens Gamesa Renewable Energy, S.A.U., Goldwind |

The global direct drive wind turbine market was valued at $15.4 billion in 2023, and is projected to reach $31.7 billion by 2030, growing at a CAGR of 10.9% from 2024 to 2030.

Asia-Pacific is the largest regional market for Direct Drive Wind Turbine.

Utility is the leading application of Direct Drive Wind Turbine Market.

Technological advancements in turbine design is the upcoming trends of Direct Drive Wind Turbine Market in the globe.

The major players operating in the direct drive wind turbine market include Siemens Gamesa Renewable Energy, S.A.U., Goldwind, GE VERNOVA, ENERCON Global GmbH, Nordex SE, Senvion India Pvt. Ltd., Hitachi Energy Ltd., ABB Ltd, Voith GmbH & Co. KGaA, and Emergya Wind Technologies BV.

Loading Table Of Content...