Dirt Bike Market Overview

The global dirt bike market was valued at USD 9.1 billion in 2021, and is projected to reach USD 18 billion by 2031, growing at a CAGR of 7.0% from 2022 to 2031.

A dirt bike is an off-road motorcycle specialized for riding on rough terrains like rocks, unsurfaced tracks or roads, mud, and dirt. Like regular motorcycles, dirt bikes are two-wheeled but lightweight and have way more rugged suspensions and tires than traditional bikes. Numerous dirt bike types are available for various uses, including racing, touring, and more. Further, the size & functionality of a dirt bike is determined by the rider and the sort of riding. Perhaps the most common type of dirt bike is the motocross bike. A motocross bike is designed primarily for off-road racing; these dirt bikes are built to be fast and robust without adding too much to the bike's overall weight. Currently, motocross has evolved as a major sport worldwide; hence riders or racers are focusing on different aspects of this sporting event.

In addition, with the rising trend of motorcycle riding and the growing popularity of dirt bikes, new technologies on dirt bikes have been appearing every day. These bikes are getting more and more advanced every year. For instance, in September 2021, Kawasaki launched two updated dirt motorcycles in India, the Kawasaki KX250 & Kawasaki KX450. Yamaha has not disclosed the power figure of any motorcycles yet but claims to have upped the peak power by 1.2bhp with a hydraulic clutch on both dirt bikes.

The factors such as rise in popularity & evolution of motocross events, rise in disposable income, and adoption of electric dirt bikes supplement the growth of the dirt bike market. However, high purchase and maintenance cost of dirt bikes and uncomfortable seating structure are the factors expected to hamper the growth of the market. In addition, rising focus by manufacturers in the automobile industry on superior performance & comfort and technology advancement in dirt bikes creates market opportunities for the key players operating in the dirt bike market.

Segment Overview

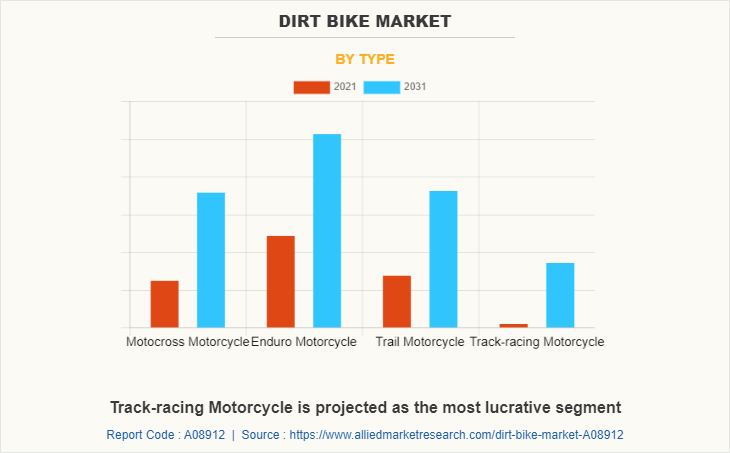

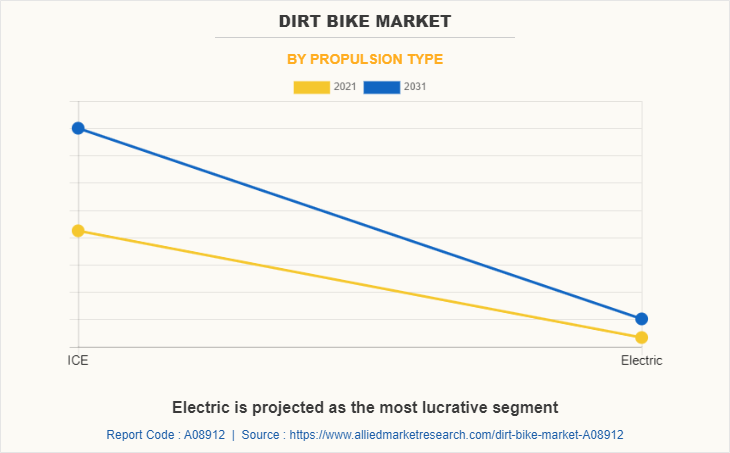

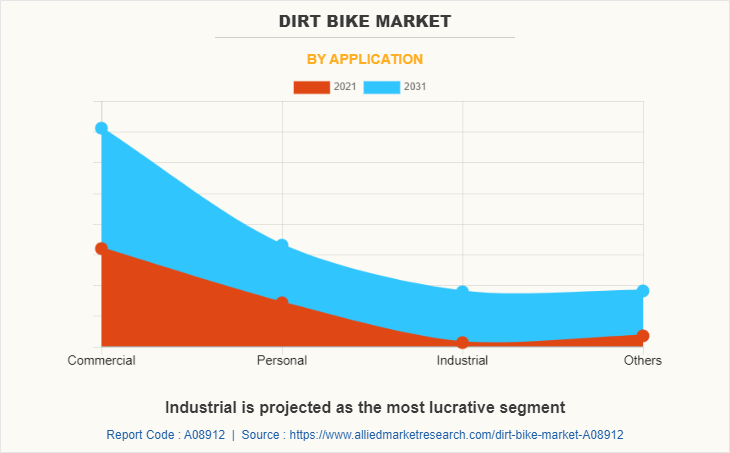

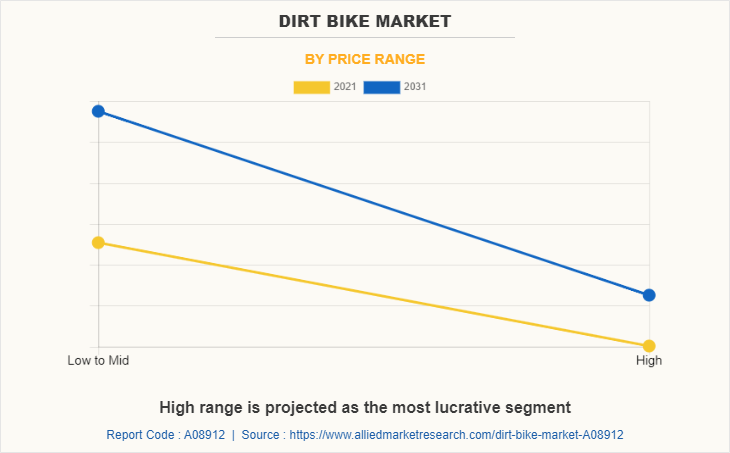

The dirt bike market is segmented into type, propulsion type, application, price range, and region. By type, the market is divided into motocross motorcycle, enduro motorcycle, trail motorcycle, and track-racing motorcycle. By propulsion type, it is fragmented into internal combustion engine (ICE) and electric. By application, it is categorized into commercial, personal, industrial, and others. By price range, it is further classified into low to mid and high. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key Market Players

The leading players operating in the dirt bike market are Benelli, Betamotor S.p.A., BMW AG, Bultaco Bikes, Cobra Moto, Honda Motor Co., Ltd., Husqvarna motorcycles, Kawasaki Heavy Industries, Ltd., KTM AG, Piaggio & C. SpA (Aprilla), Polini motori, Scorpa, Sherco, SSR Motorsports, Suzuki Motor Corporation, Yamaha Corporation, and Zero Motorcycles, Inc.

Top Impacting Factors

Rise in popularity & evolution of motocross events

Motocross racing was first introduced in the UK. This type of motorcycle racing takes place on physically demanding off-road tracks. Motocross racing events are held in almost all-weather conditions making it more difficult for the participants. Currently, motocross has evolved as a major sport worldwide, and riders or racers need to focus on different aspects of this sporting event. For instance, motocross has garnered more fans in China after the Motocross World Championship, the most influential of the sport's events globally, hosted its annual showcase at the China International Import Expo in Shanghai for two consecutive years from 2020 to 2021. The event entered China for the first time in 2019, filling the gap in first-class motocross events in the country. Also, increased focus on R&D in the dirt bikes and their ability to improve their reliability and safety, especially regarding the safety of the riders and the spectators, supported the market’s growth. Hence, the rise in popularity & evolution of motocross events primarily drive the growth of the dirt bike market.

Adoption of electric dirt bikes

Governments of various countries are taking initiatives to reduce their carbon footprints by encouraging the use of small electric vehicles such as electric dirt bikes, fuel cell bikes, and e-scooters, owing to increased awareness of the hazardous effects of using vehicles running on fossil fuels. Furthermore, governments worldwide support the purchase of electric dirt bikes in terms of tax credits and incentives to encourage the use of these bikes. Besides, the maintenance of the electric dirt bike is also less due to fewer moving parts, as these bikes are extremely quiet. Considering the advantages offered by the electrification of dirt bikes, automakers are investing in producing an electric dirt bikes. For instance, in July 2021, Zero Motorcycles, Inc. launched the Zero FXE electric dirt bike. It featured a 7.2kWh battery pack with a promised range of 161 km with two riding modes, eco, and sport. Hence, the favorable government regulations to reduce carbon footprints lead to the adoption of electric dirt bikes, propelling the market’s growth.

High purchase and maintenance cost of dirt bikes

The high cost of dirt bikes is a major factor that restrains the growth of the dirt bike market. Dirt bikes are typically outfitted with high-performance shocks, brakes, and engines that can withstand the demands of off-road riding. As a result, dirt bikes can range in price from a few hundred dollars to several thousand. Also, dirt bikes require regular maintenance to keep them running correctly. Hence, the upsurge in adopting dirt bikes in other than developed countries, such as China and the U.S., is limited by high costs. Therefore, high maintenance, as well as the purchase cost, is a significant factor that restrains the growth of the dirt bike industry.

Technology advancement in dirt bikes

With the growing popularity of dirt bikes, new technologies on dirt bikes have been appearing every day. They are getting more and more advanced every year. The goal is to one-day make a solar-powered dirt bike. Hence, consumers are eager to welcome innovations in the automobile industry regarding rough, strong, and high-speed dirt bikes. Also, female consumers are inclined towards off-road bike riding. Therefore, raising technological innovation in the automobile industry increases the demand for dirt bikes which helps to drive the growth of the market.

For instance, in May 2019, Hero launched XPulse 200, XPulse 200T, and Xtreme 200S off-road motorcycles (dirt bikes). This product was found to provide 200cc vehicles at a low price. Furthermore, dirt bike manufacturers are also focusing on new inventions related to frame metals, riding styles, and shapes to make them more advanced. Thus, the continuous focus & improvement in dirt bikes owing to their demand is expected to offer lucrative growth opportunities for the dirt bike market.

Key Benefits For Stakeholders

This study presents analytical depiction of the global dirt bike market analysis along with current trends and future estimations to depict imminent investment pockets.

The overall dirt bike market opportunity is determined by understanding profitable trends to gain a stronger foothold.

The report presents information related to the key drivers, restraints, and opportunities of the global dirt bike market with a detailed impact analysis.

The current dirt bike market is quantitatively analyzed from 2022 to 2031 to benchmark the financial competency.

Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Dirt Bike Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 18 billion |

| Growth Rate | CAGR of 7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 299 |

| By Type |

|

| By Propulsion Type |

|

| By Application |

|

| By Price Range |

|

| By Region |

|

| Key Market Players | Cobra MOTO, Zero Motorcycles, Inc., Betamotor S.p.A., KTM AG, Husqvarna Motorcycles, BMW AG, Kawasaki Heavy Industries, Ltd., Bultaco Bikes, POLINI MOTORI, Piaggio & C. SpA, Yamaha Corporation, Benelli, SSR Motorsports, Honda Motor Co., Ltd., Sherco, Scorpa, Suzuki Motor Corporation |

Analyst Review

This section provides the opinions of various top-level CXOs in the global dirt bike market. The rise in popularity of motocross events and rise in number of motocross enthusiasts along with growing media influence for the viewers has proliferated the events which, in turn, increases the demand for dirt bikes. Meanwhile, the dirt bike industry is witnessing significant growth in demand for advanced dirt bikes, intensifying competition among bike manufacturers. For instance, according to leading global professional services firm Aon's 26th salary increase survey in India, organizations across industries project a 9.9% salary increase in 2022, compared to 9.3% in 2021. As per the survey, salary increments in Brazil will be 5.0%, in Russia at 6.1%, and in China at 6.0%. Thus, the improving financial conditions across developing regions lead to higher demand for dirt bikes, which is presumed to benefit the global dirt bike market in the forecast period.

Furthermore, improving living standards encourage consumers to take part in adventure activities, supporting the growth of the market. Also, growth in off road motorcycling events and initiatives by private organizations to promote biking activities has accelerated the adoption of dirt bikes across the globe. For instance, in 2022, GASGAS, a Spanish dirt bike manufacturer is making plans for the participants of 2022 ISDE in Le Puy en Valley, France to offer rental and race service packages to riders of all abilities from all nations.

The market growth is supplemented by factors such as rise in popularity & evolution of motocross events, rise in disposable income, and adoption of electric dirt bikes supplement the growth of the dirt bike market. However, high purchase and maintenance cost of dirt bikes and uncomfortable seating structure are the factors expected to hamper the growth of the dirt bike market. In addition, rising focus by manufacturers in the automobile industry on superior performance & comfort and technology advancement in dirt bikes creates market opportunities for the key players operating in the dirt bike market.

Among the analyzed regions, North America is the highest revenue contributor, followed by Asia-Pacific, Europe, and LAMEA. On the basis of forecast analysis, Europe is expected to lead during the forecast period, due to the growing popularity of motocross and off-road racing in countries such as France, Germany, and Italy and increasing demand for electric motorcycles, and rising tourism activities.

The global dirt bike market was valued at $9.10 billion in 2021, and is projected to reach $18.01 billion by 2031, registering a CAGR of 7.0% from 2022 to 2031.

The leading players operating in the dirt bike market are Benelli, Betamotor S.p.A., BMW AG, Bultaco Bikes, Cobra Moto, Honda Motor Co., Ltd., Husqvarna motorcycles, Kawasaki Heavy Industries, Ltd., KTM AG, Piaggio & C. SpA (Aprilla), Polini motori, Scorpa, Sherco, SSR Motorsports, Suzuki Motor Corporation, Yamaha Corporation, and Zero Motorcycles, Inc.

North America is the largest regional market for dirt bike

Increased usage of dirt bikes in racing are the upcoming trends of dirt bike market in the world

Commercial usage is the leading application of dirt bike market

Loading Table Of Content...