Disability Insurance Market Research, 2031

The global disability insurance market was valued at $3.3 billion in 2021, and is projected to reach $9.2 billion by 2031, growing at a CAGR of 11.2% from 2022 to 2031.

The disability insurance market is segmented into Insurance Type, End User and Coverage Type.

Disability insurance is a type of insurance that pays out if a policyholder is unable to work and earn an income due to a disability. The policy can protect policyholder financially if they become disabled in case of an accident or disease. It can replace a portion of the income if the insured individual is unable to work due to their condition. The standard disability insurance plan will also cover any medical bills, which policyholder may incur as a result of the therapy, depending on the policy terms.

Rising awareness about the benefits of social security disability insurance policies and tax benefits under various sections of the income tax act is boosting the growth of the global disability insurance market. In addition, development of new offers and schemes by insurance companies is positively impacts growth of the disability insurance market.

However, lack of awareness among the customers is hampering the growth of the disability insurance market.

On the contrary, the disability insurance market is expected to offer numerous opportunities for new players in the market. Rise in disability insurance demand driven by global population aging, more individuals are seeking long-term financial protection against disability risks, leading to increase in the need for disability insurance. In addition, the surge in awareness of long-term disabilities and financial planning has led individuals to purchase disability insurance, particularly in emerging markets. Furthermore, there is a growing opportunity to offer customized insurance solutions tailored to specific groups. For freelancers and gig economy workers, individualized coverage can fill the gap left by the lack of employer-sponsored disability insurance. Young professionals, who may not yet have families but still need protection against unexpected disabilities, can benefit from affordable plans. In addition, short-term disability insurance is gaining popularity as people seek temporary income replacement for shorter periods. These factors are expected to offer remunerative opportunities for market growth.

For instance, on September 12, 2024, Pacific Life launched the addition of two new disability insurance products to its employee benefits lineup. These include Short-Term Disability Insurance, which helps employees protect a portion of their paycheck if they’re unable to work for a shorter duration due to sickness, injury, or recovery from childbirth, and Long-Term Disability Insurance, which provides similar protection for extended periods.

Moreover, the upsurge in the adoption of disability insurance by small and medium enterprises (SMEs), often underserved in terms of group disability insurance offerings, presenting a growing opportunity for insurers to develop affordable disability insurance products tailored to the needs of smaller businesses. In addition, with the rise of remote work, employers are seeking ways to offer benefits like disability insurance to a dispersed workforce, creating an opportunity for insurers to provide flexible plans that cater to this new work environment. Furthermore, the expanding into emerging markets such as Asia, Africa, and Latin America, where disability insurance products are underpenetrated, offers high growth potential for insurers. In addition, in some countries, government-driven programs aim to provide basic disability coverage to citizens, presenting a disability insurance market opportunity for insurers to collaborate with governments to offer supplementary insurance products. Moreover, the increase in reinsurance companies expanding their offerings in the disability insurance landscape enables insurers to manage their risk exposure more effectively and increase their capacity to take on more customers. These factors are expected to offer lucrative opportunities for the growth of disability insurance market.

For instance, on August 31, 2023, Sun Life U.S. launched enhanced disability coverage options specifically designed for healthcare professionals, including physicians, dentists, nurse practitioners, and physician assistants. These new offerings, part of the "Sun Life for Healthcare Professionals" suite, provide tailored short- and long-term disability plans to meet the unique income protection needs of healthcare providers. This initiative aims to support the healthcare community by offering competitive benefits that improve health outcomes and help medical practices recruit and retain talent.

Segment Review

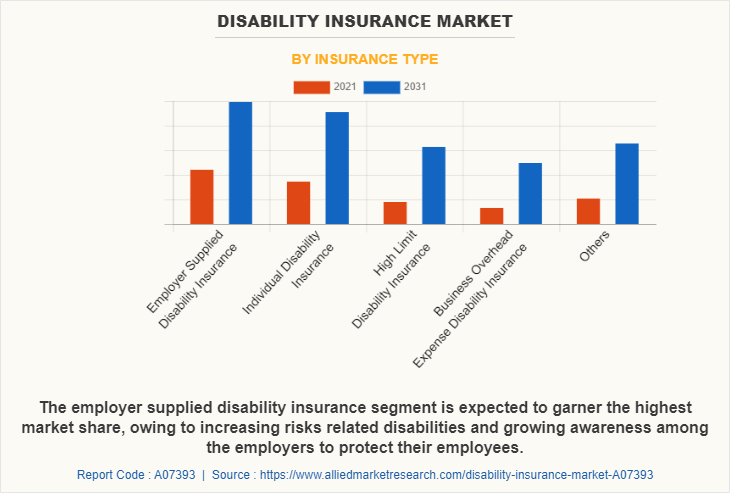

The disability insurance market is segmented on the basis of by insurance type, end user, coverage type, and region. On the basis of insurance type, the market is categorized into employer supplied disability insurance, individual disability insurance, high limit disability insurance, business overhead expense disability insurance, and others. On the basis of end user, the market is bifurcated into government, enterprise, and individual. By coverage type, it is classified into short term disability insurance and long term disability insurance. By region, the disability insurance market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Analysis

The key players that operate in the market are Aegon N.V., Ahana, Assurity Group, Inc., Allianz, Assicurazioni Generali SpA, Asteya, Aviva, AXA, Guardian Life Insurance Company, Illinois Mutual, Petersen International Underwriters (PIU), Massmutual, Mutual of Omaha, MetLife Services and Solutions, LLC, Ping An Insurance, Nippon Life Insurance, and Zurich Insurance Group. These disability Insurance companies have adopted various strategies to increase their market penetration and strengthen their position in the disability insurance market.

Key Industry Developments

In September 2024, Star Health Insurance launched India's first insurance policy in Braille, named "Special Care Gold." This innovative policy is designed to provide comprehensive medical coverage for visually impaired individuals, ensuring they have access to critical health information and can make informed decisions independently. Additionally, Star Health is offering job opportunities to visually impaired individuals as insurance agents, providing training and support to promote financial inclusivity.

In September 2023, Prudential partnered with EvolutionIQ to enhance its disability claims ecosystem using an AI-driven platform. This collaboration aims to help disability insurance claimants recover and return to work more efficiently. EvolutionIQ's technology provides specialized insights, allowing Prudential's examiners to manage short- and long-term disability claims more effectively by focusing on where their expertise is most needed.

In May 2023, Ameritas launched its new disability income insurance product called DInamic Cornerstone. This product offers greater strength and flexibility for policyholders, including features such as Lump Sum Savings, Enhanced Plus Residual, and Benefit Increase riders. It also provides coverage up to the maximum benefit period for mental, nervous, drug, and alcohol conditions, along with discounts for digital applications and policy delivery.

In terms of insurance type, the employer supplied disability insurance segment holds the highest disability insurance market share as it protects skilled employees from danger and proves a competitive edge from competitors. However, the business overhead expense disability insurance segment is expected to grow at the highest rate during the forecast period as it protects the company from bankruptcy or losses during the disability period of the employer.

Region-wise, the disability insurance market size was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to the presence of major players that offer advanced solutions and invest heavily in solutions such as faster claim management offers lucrative opportunity for the market. However, Asia-Pacific is expected to witness significant growth during the forecast period owing to growth in awareness regarding importance of disability insurance among employers and employees working in dangerous fields.

Top Impacting Factors

Rising awareness about benefits of disability insurance policies

Rising awareness about the benefits of disability insurance policies is driving the growth of the disability insurance industry. This is attributed to greater transparency of information encouraging customers to participate more actively in purchasing disability insurance. In addition, adoption of automated claim technology plays a major role for the market growth for faster claims process as disability insurance sector takes a lot of time to process the claim. Furthermore, enhancing overall customer experiences along with lower operational expenses are also positively impacting the growth of the industry. Moreover, the growing preference for technology and the importance of knowing requirements of the user and available products of insurance is driving the market growth. In such a competitive marketplace, brokers need to invest time to get know their customers on a personal level and what they truly needed. It results to find the right fit, also largely lifting the growth of the market. These are the factors that drives the market growth.

Tax benefits under various sections of income tax act

Taxes are an integral component, accounting for a major portion of the income earned by the government, which is utilized to provide certain basic provisions to citizens. In addition, individuals who earn more than a certain amount are expected to pay taxes, as per the existing tax slabs. The government also provides certain provisions wherein one can save tax. Furthermore, tax deductions can help one reduce the taxable income, lowering their overall tax liability and thereby helping them save on taxes. The tax deduction depends on many factors, with different limits set for different purposes. Moreover, individuals can claim tax deduction benefits for payments made towards disability insurance platform and other insurance policies, fixed deposits, superannuation funds, tuition fees, and purchase of residential properties under Section 80C of the Income Tax Act. Owing to this, Department of Labor and Training of state of Rhode Island stated Temporary Disability Insurance (TDI) provides benefit payments to insured RI workers for weeks of unemployment caused by a temporary disability or injury. Enacted in 1942, TDI was the first of its kind in the U.S. It protects workers against wage loss resulting from a non-work-related illness or injury and is funded exclusively by Rhode Island workers. Thus, increasing tax benefits is driving the Disability Insurance Market Opportunity.

Opportunity

Increasing government support for medical and health insurance

The increase in the government's support for medical and health insurance is expected to create numerous opportunities for the growth of the disability insurance market. The disability insurance market is a critical component of the healthcare and social security systems, providing financial protection to individuals unable to work due to illness or injury. The rise in the global population ages and the incidence of chronic health conditions increases has led to the increase in the need for comprehensive disability insurance. Governments globally are acknowledging the significance of enhancing support for medical and health insurance, especially regarding disabilities.

One of the significant factors driving the increasing government support for disability insurance is the rise in cost of healthcare in disability insurance market. As healthcare advancements increase life expectancy, a growing number of individuals are managing chronic illnesses that necessitate extended care. In the absence of sufficient insurance, those dealing with disabilities might endure financial strain in addition to the physical and emotional challenges posed by their conditions. Governments are stepping in to ensure that citizens have access to affordable healthcare and insurance options, reducing the risk of poverty and financial instability for people with disabilities.

Furthermore, the economic impact of disability on the workforce is significant, often leading to lost productivity. Recognizing this, governments are expanding disability insurance programs to cover a broader range of disabilities, providing more comprehensive medical and financial support. These programs help mitigate productivity losses by assisting individuals in transitioning back into the workforce or maintaining their quality of life.

For instance, on February 19, 2025, Prudential launched OneLeave™, a new initiative designed to simplify and improve the workplace leave experience. This program integrates Prudential’s leave and disability management capabilities into a single, easy-to-navigate platform. OneLeave™ aims to help employers minimize extended absences while providing a better experience for employees by offering a unified claims process, real-time information access, and proactive support from vocational rehab specialists and return-to-work experts.

In addition, there is a growing emphasis on mental health and the recognition that mental disabilities can be equally incapacitating as physical ones. This has prompted governments to broaden the scope of disability insurance coverage, incorporating mental health conditions more fully into the benefits package. These efforts reflect a growing commitment to ensuring that people with disabilities have the resources necessary for a dignified and stable life.

Report Coverage & Deliverables

Type Insights

The report covers the disability insurance market by examining various types of disability insurance, including short-term and long-term disability policies. It details the features, benefits, and key differences between these types to provide a comprehensive understanding of their market presence.

End User Insights

Focuses on the disability insurance market growth across different end users, such as individuals, employers, and government programs. The analysis highlights how different segments contribute to market expansion and the factors driving increased adoption in each category.

Coverage Type Insights

Analyzes the disability insurance market value based on coverage types, including income protection, rehabilitation benefits, and partial disability coverage. This section provides insights into the value and demand for various coverage types and their impact on the overall market.

Regional Insights

Provides an overview of the Disability Insurance Market across key regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. It highlights regional market size, growth trends, and the influence of local regulations and economic conditions.

Key Companies & Market Share Insights

Offers an analysis of leading companies in the Disability Insurance Market, detailing their market share, competitive strategies, and recent developments. This section identifies major players and their impact on market dynamics, providing insights into competitive positioning and industry trends.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the Disability Insurance Market Forecast, current trends, estimations, and dynamics of the disability insurance market analysis from 2021 to 2031 to identify the prevailing market opportunities.

The disability insurance market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the disability insurance market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the Disability Insurance Market Outlook.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global disability insurance market trends, key players, market opportunity, application areas, and market growth strategies.

Disability Insurance Market Report Highlights

| Aspects | Details |

| By Insurance Type |

|

| By End User |

|

| By Coverage Type |

|

| By Region |

|

| Key Market Players | Massmutual, Mutual of Omaha, Aviva plc, AXA Group, Assurity Group, Inc., Ping An Insurance, assicurazioni generali spa, MetLife Services and Solutions, LLC ., Ahana, Allianz SE, Nippon life insurance, Guardian Life Insurance Company, AEGON N.V., Zurich Insurance Group, Petersen International Underwriters (PIU), Illinois Mutual, Asteya |

Analyst Review

Individuals are dominating the disability insurance market as the disability insurance provided by the employers are not sufficient for their additional expenses, such as treatment and normal expenses. Moreover, on receiving the claim intimation and required documents, the insurance company assess policyholders’ injury and then compensate for them within 7-30 days from the date of the accident.

Key providers of the disability insurance market, such as Massmutual, Nippon Life Insurance, and Mutual of Omaha account for a significant share in the market. With growth in requirement for disability insurance, various companies have started acquiring other companies to increase their capabilities. For instance, in February 2022, the Guardian Life Insurance Company of America® (Guardian), one of the nation’s largest life insurers and a leading provider of employee benefits, acquired a minority equity stake in HPS Investment Partners (HPS). HPS is a leading global investment firm that currently manages approximately $80 billion in assets. Partnering with HPS expands the capabilities of Guardian’s in-house investment platform and offers the opportunity to co-develop bespoke investment strategies suitable for the insurance market. This transaction is expected to significantly strengthen Guardian’s financial profile, further grow and diversify its investment portfolio, and position the company for continued long-term growth.

In addition, with further growth in investment globally, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in February 2022, Assurity Life Insurance Company launched Criticalillness.com, a complete self-service platform for buying critical illness insurance. The website, which is available now, simplifies the process of getting coverage for serious diseases by offering a streamlined product with a short application. In addition, Criticalillness.com is Assurity’s first consumer-direct offering and focuses on coverage for four of the most common serious diseases, such as heart attack, stroke, cancer, and advanced Alzheimer’s disease. It was built for speed and ease of use, with most coverage decisions made after an application of only five health questions. The insurance policy pays a cash benefit for the diagnosis of covered diseases and conditions that customers can use for whatever they want.

Rising awareness about the benefits of disability insurance policies and tax benefits under various sections of the income tax act is boosting the growth of the global disability insurance market. In addition, development of new offers and schemes by insurance companies is positively impacts growth of the disability insurance market.

Region-wise, the disability insurance market size was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to the presence of major players that offer advanced solutions and invest heavily in solutions such as faster claim management offers lucrative opportunity for the market.

The global disability insurance market was valued at $3.25 billion in 2021, and is projected to reach $9.21 billion by 2031, registering a CAGR of 11.2% from 2022 to 2031.

The key players that operate in the disability insurance market are Aegon N.V., Ahana, Assurity Group, Inc., Allianz, Assicurazioni Generali SpA, Asteya, Aviva, AXA, Guardian Life Insurance Company, Illinois Mutual, Petersen International Underwriters (PIU), Massmutual, Mutual of Omaha, MetLife Services and Solutions, LLC, Ping An Insurance, Nippon Life Insurance, and Zurich Insurance Group. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Loading Table Of Content...