Disaster Recovery-as-a-Service Market Insights, 2031

The global disaster recovery-as-a-service market was valued at USD 6.5 billion in 2021, and is projected to reach USD 60.4 billion by 2031, growing at a CAGR of 23.9% from 2022 to 2031.

Disaster Recovery-as-a-Service market is gaining huge popularity as it helps millions of businesses across the world in case of natural disasters such as hardware failure, file corruption, power outage, and others. It also helps in encountering interruptions in business due to natural calamities such as hurricanes, floods, earthquakes, wildfires, and others.

Disaster Recovery-as-a-Service industry is growing at a rapid pace as it helps organizations in case of problematic events such as cyber-attacks, blackouts, and others thereby ensuring the continuity of businesses and protecting their crucial data. Disaster recovery-as-a-Service (DRaaS) is a cloud computing model that allows businesses to back up their data and IT architecture on a third-party cloud computing system and deliver all disaster recovery (DR) orchestration through a software as a service (SaaS) solution to recover functionality and access to IT infrastructure after a disaster. Due to this service model, a business needs to rely on the disaster recovery service provider to manage all of the resources in the event of a disaster rather than try to do it themselves.

Many companies with small IT staffs simply cannot afford to invest the necessary time in disaster recovery plans' study, implementation, and thorough testing. DRaaS relieves the organization from the tedious data recovery relying on the disaster recovery-as-a-service providers. It is considerably less expensive than maintaining its own disaster management infrastructure, which reduces the tasks of the IT team within an organization. DRaaS offers many enterprises a practical answer to a persistent issue. However, a cyberattack that results in a data breach is one in which confidential, sensitive data that should have been kept private has been disclosed without authorization, is expected to hinder the disaster recovery-as-a-Service market growth.

The industry players are investing a lot of effort in the research and development of smart and unique strategies to sustain their growth in the disaster recovery-as-a-service market forecast. These strategies include product launches, mergers & acquisitions, collaborations, partnerships, and technological advancements. For instance, on October 15, 2020, a disaster recovery site has been created by IBM using IBM Cloud infrastructure to assist KAZ Minerals, a major copper producer in Kazakhstan, in protecting and maintaining operations even in the condition of a disaster.

The key players profiled in this report include IBM Corporation, Axcient, Sunguard, Amazon Web Services, Inc., Cable & Wireless Communications Limited., TierPoint, LLC., Microsoft Corporation, VMware Inc., NTT Communications Corporation, and Rackspace Technology.

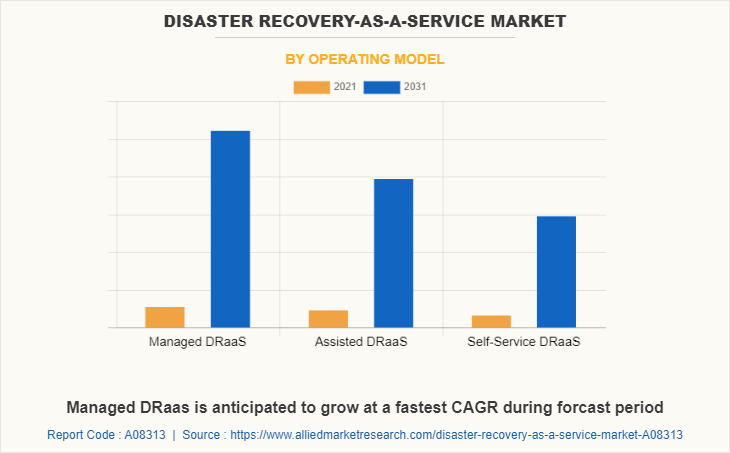

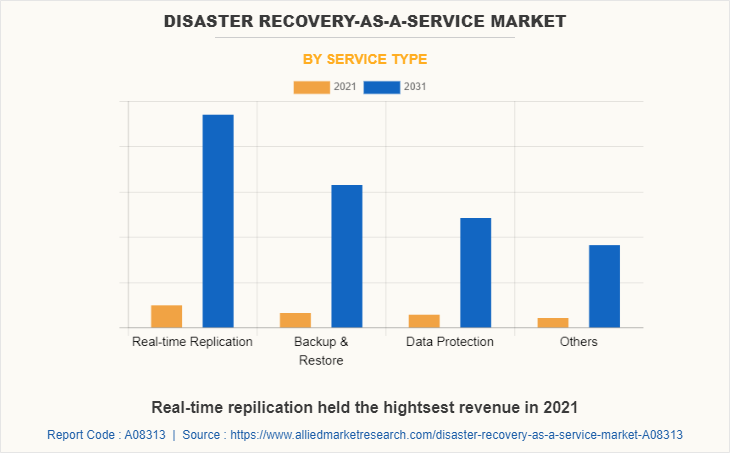

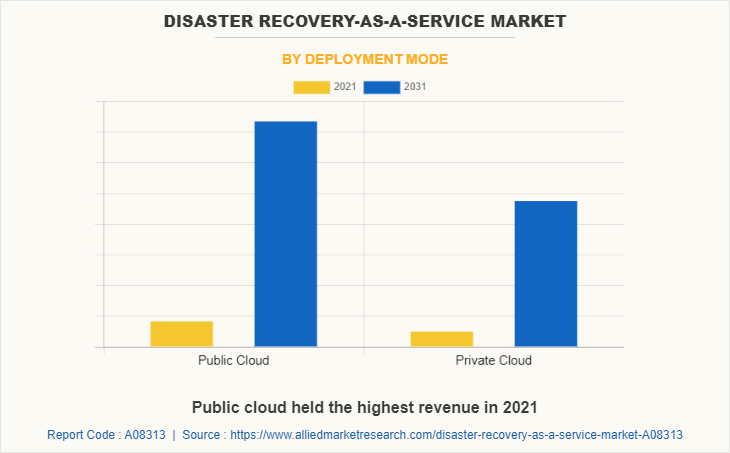

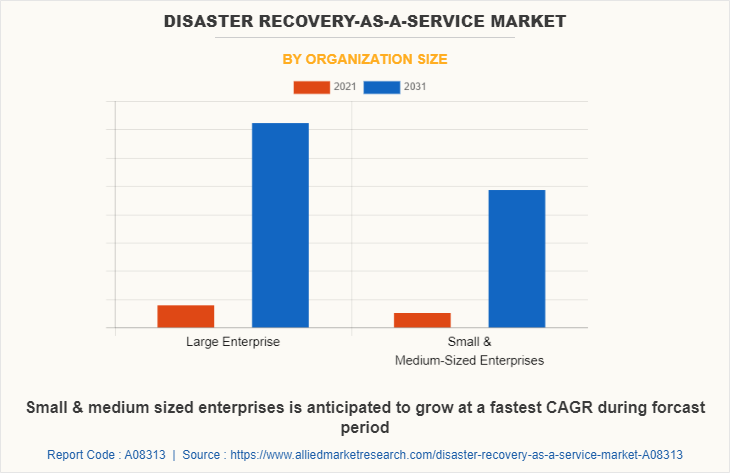

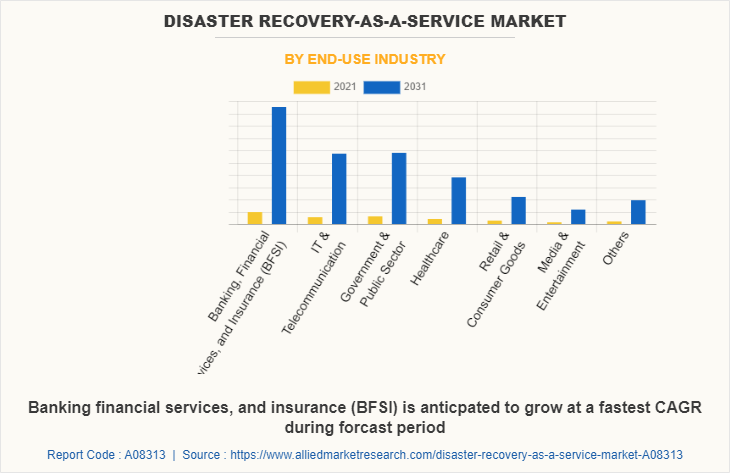

The global disaster recovery-as-a-service market is segmented on the basis of operating model, service type, deployment mode, organization size, end-use industry, and region. By operating model, the market is sub-segmented into managed DRaaS, assisted DRaaS, and self-service DRaaS. By service type, the market is classified into real-time replication, backup & restore, data protection, and others. By deployment mode, the market is sub-segmented into public cloud and private cloud. By organization size, the market is sub-segmented into managed large enterprise and small & medium-sized enterprises. By end-use industry, the market is sub-segmented into banking, financial services, & insurance (BFSI), IT & telecommunication, government & public sector, healthcare, retail & consumer goods, media & entertainment, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The disaster recovery-as-a-service market is segmented into Operating Model, Service Type, Deployment Mode, Organization Size and End-use Industry.

By operating model, the managed DRaaS gas sub-segment dominated the market in 2021. The managed DRaaS model entails that every recovery strategy's planning, testing, and monitoring are handled by the provider. Every aspect of recovery has to be handled by a managed DRaaS provider so that team can concentrate on other business priorities. A managed DRaaS provider manages recovery process in the event of a disaster, whether this is cooperating with IT team or doing the workflow tasks on own. Although managed DRaaS typically costs more than other DRaaS options, it provides the highest degree of support and ensures that the recovery will address and satisfy specific business demands. These are predicted to be the major factors driving the disaster recovery-as-a-service market share during the forecast period.

By service type, the real-time replication sub-segment dominated the global disaster recovery-as-a-service market size in 2021. Real-time file replication safeguards files of any type and size across sites in an event of disaster, enabling it to achieve sub-five-second RPOs (Recovery Point Objectives) and RTOs (Recovery Time Objectives) within minutes of an outage. Such applications of disaster recovery-as-a-service in real-time replication are bound to create a scope of growth for the sub-segment during the forecast period.

By deployment mode, public cloud sub-segment dominated the market in 2021. The public cloud offers hyper-scale and on-demand scalability with simplified disaster recovery. The public cloud can automate data backup, offers automated scalable disaster recovery services, and supports geographic diversity with business continuity. Public clouds provide resource optimization by dealing with time-intensive & error-prone activities. Additionally, there are certain cloud backup and disaster recovery products available that are similar to conventional on-premises products that use agents to safeguard virtual computers and their data. Public clouds are very dependable; they keep all the data in a small number of copies and offer up to 100% uptime. They are excellent for use as failover sites, as there is no need for a separate disaster recovery site for software, hardware, licenses, and maintenance.

By organization size, large enterprise sub-segment dominated the disaster recovery-as-a-service market in 2021. Various companies operating in disaster recovery-as-a-service offer various disaster recovery services to large enterprises. For instance, the Acronis Cyber Backup-based system is quick to deploy, simple to use, and offers comprehensive restore, disaster recovery, and enhanced threat protection. Acronis Cyber Disaster Recovery provides instant availability and business continuity for larger enterprises that choose to handle disaster recovery internally. Every component can be mapped in a disaster recovery tool, allowing critical data linked to the operating system, network information, security rules, or application-related data to be quickly replicated and made live in an offsite DR (Disaster Recovery) site. The ability to access information from anywhere in the world is the most important aspect of disaster recovery. This enables businesses to launch a DR site even from their mobile device. This is only possible for a large enterprise that has the financial capability. These factors are predicted to boost the growth of the large enterprise sub-segment during the forecast period.

By end-use industry, the Banking, Financial Services, and Insurance (BFSI) sub-segment dominated the disaster recovery-as-a-service market in 2021. BFSI organizations comprehend the principles of "Predictive Intelligence," which include incident prevention, detection, response, recovery, and restoration, and develop the necessary approach to execute resilience. RTO and RPO are significant in the context of business continuity. Recovery Time Objective (RTO) indicates the amount of time between an incident and the restoration of activities, whereas Recovery Point Objective (RPO) relates to the maximum tolerable data loss in terms of time. The rapid growth in online/mobile banking, digitization, blockchain, and Unified Payment Interface (UPI) has led to an increase in demand for the disaster recovery-as-a-service market in present years.

By region, North America dominated the market in 2021 and the Asia-Pacific region is estimated to show the fastest growth during the forecast period. The growth of the North America Disaster Recovery-as-a-Service industry is majorly attributed to huge investments and technological advancements in the disaster recovery sector. In addition, the growing need to secure the crucial data of several companies operating in BFSI, government, healthcare, and other sectors has increased the demand and adoption of disaster recovery-as-a-service (DRaaS) in the present years.

Impact of COVID-19

- The COVID-19 had a positive impact on the disaster recovery-as-a-service market. This is majorly owing to work-from-home imposed by several companies to safeguard the lives of their employees and to prevent the spread of the COVID-19 virus.

- The work-from-home model has pushed several organizations across the world to opt for cloud-based solutions that have increased the need for data backup, data recovery, and data privacy. This has paved the way for the disaster recovery-as-a-service industry due to which it has gained significant traction.

- Lockdown imposed across several countries is driving the adoption of cloud-based disaster recovery-as-a-service solutions to prevent data breach.

- The flexibility and cost-effectiveness offered by various DRaaS solutions have positively impacted the market growth during the COVID-19 pandemic.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the disaster recovery-as-a-service market analysis from 2021 to 2031 to identify the prevailing disaster recovery-as-a-service market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the disaster recovery-as-a-service market segmentation helps determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global disaster recovery-as-a-service market trends, key players, market segments, application areas, and market growth strategies.

Disaster Recovery-as-a-Service Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 60.4 billion |

| Growth Rate | CAGR of 23.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 320 |

| By Operating Model |

|

| By Service Type |

|

| By Deployment Mode |

|

| By Organization Size |

|

| By End-use Industry |

|

| By Region |

|

| Key Market Players | Sungard Availability Services, VMware, Inc., Acronis International GmbH, Infrascale, InterVision, IBM, Recovery Point, TierPoint, LLC, Microsoft Corporation, Amazon Web Services, Inc |

Analyst Review

Disaster Recovery-as-a-Service (DRaaS) is a cloud computing model that enables businesses to back up their data and IT architecture on a third-party cloud computing system for efficient disaster recovery (DR) and to reduce the downtime associated with business operations. Disaster Recovery-as-a-Service offers enhanced security to business enterprises for dealing with ransomware attacks which in turn helps in customer retention, cost efficiency, and increased productivity. However, data breaches and security associated with the Disaster Recovery-as-a-Service market are the key factors expected to hamper the market growth during the forecast period. On the contrary, the industry players are investing a lot of effort in the research and development of smart and unique strategies to sustain their growth in the market. These strategies include product launches, mergers & acquisitions, collaborations, partnerships, and refurbishing of existing technology. They create opportunities for key players to maintain the pace of the Disaster Recovery-as-a-Service market in the upcoming years.

Among the analyzed regions, North America is expected to account for the highest revenue in the market by the end of 2031, followed by Asia-Pacific, Europe, and LAMEA. Cost-effectiveness and greater flexibility are the key factors responsible for the leading positions of North America and Asia-Pacific in the global Disaster Recovery-as-a-Service market.

Cost-effectiveness and flexibility offered by disaster recovery-as-a-service solutions that help in mitigating the downtime by faster recovery of business operations are the major growth drivers estimated to generate excellent growth opportunities in the market.

Banking, financial services, & insurance (BFSI) sub-segment of the end-use industry acquired the maximum share of the global disaster recovery-as-a-service market in 2021.

Asia-Pacific will provide more business opportunities for the global disaster recovery-as-a-service market in the future.

IBM Corporation, Axcient, Sunguard, and Amazon Web Services, Inc. are the major players in the disaster recovery-as-a-service market.

The major growth strategies adopted by disaster recovery-as-a-service market players are technological advancements, investments, and partnerships.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global disaster recovery as a service market from 2021 to 2031 to determine the prevailing opportunities.

Loading Table Of Content...