Discount Events And Experiences Market Research, 2031

The global discount events and experiences market size was valued at $77.4 billion in 2021, and is projected to reach $202.6 billion by 2031, growing at a CAGR of 7.6% from 2022 to 2031.

The discount events and experiences market is segmented into and Service Type.

Discount events and experiences refer to various events and experiences services that are offered to consumers at discounted prices through various organizers and discount sellers, such as Zouton, Bookmyshow, Eventbrite, Groupon, Clarion Events Ltd., and other similar players in the market.

The demand for the discount events and experiences is significantly driven by rise in disposable income, rise in consumer spending on leisure activities, and increasing indulgence of people in various adventure and recreational activities. The demand for the leisure, entertainment, adventure, and recreational activities is significantly higher in the developed regions like Europe and North America. The strong economic growth coupled with rise in employment levels, and improving standards of living are a major driver behind the surging the discount events and experiences market demand across the globe. In the modern world, experiences have become more crucial than products. According to the Centre for Agriculture and Bioscience International (CABI), an average UK household spends around $60.65 per week on leisure and culture. Recreation spending in the U.S. has witnessed an increase of 24% from 2012 to 2017, while that of UK has increased by 17% in the same time frame. With the rise in economic growth and rise in disposable income of the consumers, consumers are spending more on upgrading their lifestyle. It is estimated that the expenditure on travel and entertainment increased from 5.5% in 2011 to 11% in 2017, in China. Therefore, the rise in consumer expenditure on recreational and leisure activities is expected to boost the global discount events and experiences market growth during the forecast period.

To increase awareness about products and services offered by various companies, the leading players operating in myriad industry sponsor events, such as music concerts, arts & crafts, theaters, exhibitions, and sports events. Sponsorship is done to provide material support to an event or an organization. In addition, sponsorship enables the leading players to advertise their products and reach to a wide range of consumer base, thereby fueling the adoption of their products. Moreover, it helps to focus on consumer preference and to foster brand loyalty. Furthermore, it draws attention of the existing and potential customers of a brand or company and creates a positive impact on them, thereby leading to increase brand loyalty. Sponsors further check the past proven records of a particular event as well as the probability of success of the event before they sponsor an event, as they invest in a plan, and expect positive return on the investment. The most common sponsorship can be seen in the field of sports and entertainment, ranging from local to regional events.

The huge adoption of digital devices like smartphones and laptops along with the rise in penetration of internet across the globe has led to the democratization of information. Moreover, there are several platforms and service providers that offer customers’ reviews on various experiential products or experiences that might help people to gain more insights and information regarding the different experiential products and services, such as trips, driving, restaurants for food, and art and crafts. For instance, TripAdvisor provides over 730 million reviews of more than 8 million hotels, vacation homes, restaurants, and tourist attractions and it also hosts more than 160 million photos of travelers. With the establishment of various efficient digital business models and rise in penetration of internet, the democratization of information has evolved rapidly. According to the International Telecommunication Union (ITU), around 4.9 billion people across the globe had access to the internet in 2021. Thus, the democratization of the information is expected to play a crucial role in the further growth of the discount events and experiences market in the foreseeable future.

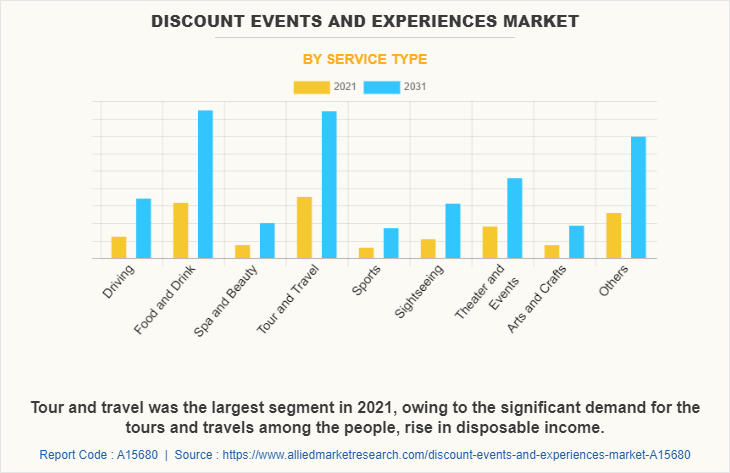

According to the discount events and experiences market analysis, the market is segmented on the basis of service type and region. By service type, the market is segmented into driving, food and drink, spa and beauty, tour and travel, sports, sightseeing, theater and events, arts and crafts, and others. Region-wise, the discount events and experiences market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, Russia, Netherlands, Sweden, Belgium, Denmark, Finland, Poland, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, Singapore, Thailand, Malaysia and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, Saudi Arabia, South Africa, UAE, rest of LAMEA).

As per the discount events and experiences market forecast, by service type, the tour and travel segment dominated the market, accounting for 22.7% of the discount events and experiences market share in 2021. The significant demand for the tours and travels among the people, rise in disposable income, and rise in desire for exploring new places among the millennials are some of the major drivers of the tour and travel segment.

The global tourism industry has witnessed a significant and rapid downfall during the COVID-19 pandemic and it has become very tough for this sector to grow and stand again. Airlines sector as well as the hotel industry suffered a major downfall during pandemic period. According to World Travel and Tour Council latest Annual Economic Benefits Report (EIR), spending by foreign visitors in 2021 increased by only 1.4% to $40.3 billion, to $190.9 billion in 2019. It remained far short. The report predicts that the travel and tourism sector in many countries will return to pre-pandemic figures by 2021. The tour & travel industry is bouncing back to new heights with proper strategies in the market. The need and importance the consumers are feeling to maintain personal time and wellbeing is driving the industry with a faster growth rate. The growth in technology has helped the industry to lure more and more customers. Having control of everything, from experience of journey purchase, lodging & maintaining facilities like room service and dinning at their fingertips with the help of proper AI and app had definitely earned a star for the tour & travel industry. So, discount events and experiences can be a bonus point to attract the consumers as it will lure the consumers towards the players.

Further, as per the discount events and experiences market trends, by service type, sightseeing is expected to witness the highest CAGR of 8.7% from 2022 to 2031. Discounts can be offered for a variety of reasons, including to promote a new destination, to encourage repeat visits, or to entice customers to book during off-peak times. The market is driven by a number of factors, including economic growth, increased air travel, and a growing desire for unique experiences. Economic growth is a major driver of the sightseeing segment. As economies around the globe expand, more people have disposable income to spend on leisure travel. This increase in disposable income has led to a boom in sightseeing, as more people are able to afford to travel to see new and interesting places. Similarly, the increased availability of air travel has made it easier for people to travel to different parts of the world. This has led to a growth in the number of people taking sightseeing trips, as it is now easier than ever to visit new and exciting places. Finally, a growing desire for unique experiences has also contributed to the growth of the market.

Region-wise, Europe dominated the global market in 2021, garnering a market share of 36.9%, followed by North America with 29.8% and Asia-Pacific with 28.0%. Asia-Pacific is estimated to be the fastest-growing market during the forecast period, owing to the upsurge in the frequency various exhibitions, concerts, and sports events.

The rise in participation of European population in various sports, physical activities, and other recreational activities has significantly fostered the growth of the discount events and experiences market in the past few years. According to the Eurostat, in 2019, around 44% of the European Union population participated in sports, physical, and recreational activities at least once a week. Furthermore, the rise in trend of online ticket bookings for events and experiences in Europe is playing a crucial role in the growth of the market. The surging adoption of internet, rise in usage of social media, developments in the tourism industry, increasing inclination of population towards exotic and unique experiences, and higher personal disposable income of the consumers are the major factors that has led to the dominance of Europe in the discount events and experiences market. Moreover, the rise in interests of the people towards sports is expected to boost the growth of the sports segment in the European discount events and experiences market in the forthcoming future.

The demand for the discount events and experiences in Asia-Pacific is expected to grow significantly owing to the rise in participation of people in numerous recreational and leisure activities. The growing disposable income of the consumers due to strong economic growth in the past few years, improving standards of living, growing penetration of internet, rise in adoption of social media, presence of huge number of middle income consumers, and presence of huge number of millennial and Gen Z population are the major factors that are expected to foster the growth of the discount events and experiences market. The increasing number of exotic spa, unique theme based restaurants, rise in government initiatives to promote domestic and international tourism, and surge in the number of leisure trips in the region is expected to further drive the market growth in this region. According to the Centre for Agriculture and Bioscience International (CABI), the expenditure on travel and entertainment increased from 5.5% in 2011 to 11% in 2017, in China. This rise in expenditure on travel and entertainment in the developing nations like China is presenting a lucrative growth opportunities to the players operating in the global discount events and experiences market.

Groupon, Inc., Eventbrite, Zoutons, GrabOn, Virgin Experience Days, Activity Superstore, Buyagift, Red Letter Days, GFM ClearComms, Anschutz Entertainment Group, CL Events, Clarion Events Ltd., DRPG Group, and Entertaining Asia are some of the leading players in the global discount events and experiences industry. These market players are constantly engaged in various developmental strategies such as partnerships, acquisitions & mergers, agreement, and joint ventures to gain competitive edge over others and exploit the prevailing discount events and experiences market opportunities.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the discount events and experiences market analysis from 2021 to 2031 to identify the prevailing discount events and experiences market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the discount events and experiences market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global discount events and experiences market trends, key players, market segments, application areas, and market growth strategies.

Discount Events And Experiences Market Report Highlights

| Aspects | Details |

| By Service Type |

|

| By Region |

|

| Key Market Players | GrabOn, DRPG Group, Clarion Events Limited, buyagift, gfm clearcomms, Zoutons, virgin experience days, Groupon, Inc., activity superstore, Eventbrite, Inc., CL Events, red letter days, vagaro inc, ENTERTAINING ASIA, ANSCHUTZ ENTERTAINMENT GROUP |

Analyst Review

The discount events and experiences market is growing at a significant pace, and is anticipated to continue this trend in the coming years. It has been witnessed that the Gen X and millennials are significantly spending on the experiential products and services, owing to the rise in disposable income and improvement in the standards of living. The rise in employment rate and gradual rise of the middle class is expected to be a key growth factor for the market, especially in the developing economies like China, India, and Brazil. The rise in consumer expenditure on experiential services is boosting the demand for the discount events and experiences significantly. Furthermore, the increasing indulgences of consumers in developed economies like Canada, the U.S., Germany, and UK in leisure and recreational activities owing to the rise in disposable income and improving living standards is expected to further fuel the growth of the market during the forecast period. The presence of huge millennials and gen z population in the U.S. is presenting a lucrative growth opportunity for the market players, as these generations spend more on experiences and recreational activities. According to The Brookings Institution, a non-profit public policy organization in the U.S., around 50.7% of the U.S. population consisted of millennials, Gen Z, and younger (post Gen Z) generations in 2019.

The global discount events and experiences market size was valued at $77,374.5 million in 2021, and is estimated to reach $202,563.2 million by 2031, registering a CAGR of 7.6% from 2022 to 2031.The demand for the discount events and experiences is significantly driven by rise in disposable income, rise in consumer spending on leisure activities, and increasing indulgence of people in various adventure and recreational activities. The demand for the leisure, entertainment, adventure, and recreational activities is significantly higher in the developed regions like Europe and North America.

The report is available on request on the website of Allied Market Research.

The forecast period considered in the global discount events and experiences market report is from 2022 to 2031. The report analyzes the market sizes from 2022 to 2031 along with the upcoming market trends and opportunities. The report also covers the key strategies adopted by the key players operating in the market.

Groupon, Inc., Eventbrite, Zoutons, GrabOn, Virgin Experience Days, Activity Superstore, Buyagift, Red Letter Days, GFM ClearComms, Anschutz Entertainment Group, CL Events, Clarion Events Ltd., DRPG Group, and Entertaining Asia are some of the leading players in the global discount events and experiences industry.

The market is segmented on the basis of service type and region. By service type, the market is segmented into driving, food and drink, spa and beauty, tour and travel, sports, sightseeing, theater and events, arts and crafts, and others. Region-wise, the discount events and experiences market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The demand for the discount events and experiences in Asia-Pacific is expected to grow significantly owing to the rise in participation of people in numerous recreational and leisure activities. The growing disposable income of the consumers due to strong economic growth in the past few years, improving standards of living, growing penetration of internet, rise in adoption of social media, presence of huge number of middle income consumers, and presence of huge number of millennial and Gen Z population are the major factors that are expected to foster the growth of the discount events and experiences market.

The global tourism industry has witnessed a significant and rapid downfall during the COVID-19 pandemic and it has become very tough for this sector to grow and stand again. The tour & travel industry is bouncing back to new heights with proper strategies in the market. The need and importance the consumers are feeling to maintain personal time and wellbeing is driving the industry with a faster growth rate.

Loading Table Of Content...