Disposable Medical Gloves Market Outlook - 2025

The global disposable medical gloves market was valued at $4,047 million in 2017, and is expected to reach $8,444 million by 2025, registering a CAGR of 9.5% during the forecast period. Disposable medical gloves majorly act as a protection utility to avoid infection of healthcare professionals and patients. During time, numerous variants of disposable medical gloves have been developed, which include nitrile, natural rubber, neoprene, and vinyl. Each of these variants have different benefits as compared with conventional (usually rubber) gloves, and provides wide application in healthcare industry. For instance, nitrile gloves are friction less, puncture-resistant, and have a long shelf life than latex gloves. Subsequently, nitrile gloves are used by tattoo artists, medical and dental professionals as well as in laboratories as they provide barrier protection and high durability as well are highly rupture resistant. Rise in incidence of pandemic diseases such as swine flu (H1N1 pandemic) and a subsequent need for infection control drives the growth of the global disposable medical gloves market. High durability of gloves coupled with protection from chemicals makes disposable medical gloves a major revenue generating segment in the chemical industries as well.

The adoption of disposable medical gloves has increased over the years owing to the rise in safety concerns and hygiene. In addition, the growth in number of end users in the healthcare industry coupled with the advancements in technology also aid in supplementing the disposable medical gloves market growth. Further, significant increase in frequent outbreak of epidemics and pandemics across the globe propels the disposable medical gloves market in near future. However, toxic reaction caused by gloves and high price competition from local manufactures impede the growth of the disposable medical gloves market. For instance, the accelerators and other chemicals used to manufacture latex and non-latex gloves causes allergic reactions such as irritant contact dermatitis. Moreover, the introduction of disposable medical gloves in untapped economies is expected to create lucrative opportunities in the market. In addition, disposable medical gloves find their application in surgical and examination purposes. Examination application was the highest contributor in the disposable medical gloves industry owing to the wide array of uses such as emergency medical services, general medical exam, first response, and laboratory application for personal protection during operative procedures.

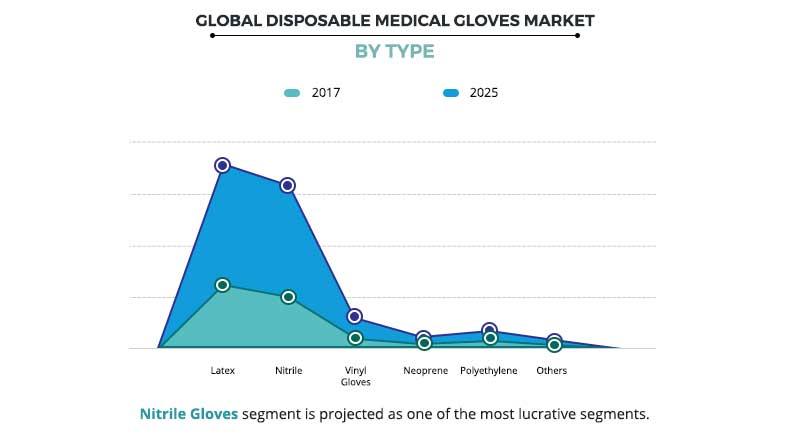

Type segment review

The global disposable medical gloves market based on type is divided into natural rubber gloves, nitrile gloves, vinyl gloves, neoprene, polyethylene and others. The natural rubber gloves segment accounted for the highest revenue in 2017, owing to the fact that these gloves are the choice of preference among medical professionals to perform surgeries and for examination purposes. However, the nitrile gloves segment is anticipated to grow at the fastest rate during the forecast period owing to various cost efficiency and ease of availability. Moreover, nitrile gloves are primarily being used in the medical sector, as a safety tool to prevent spreading of infection between caretakers and patients. The benefits offered by nitrile gloves include superior strength, longevity, and better protection against blood borne pathogens. In addition, nitrile gloves are latex-free, thereby, it becomes the preferable of choice for medical professionals who are allergic to latex gloves.

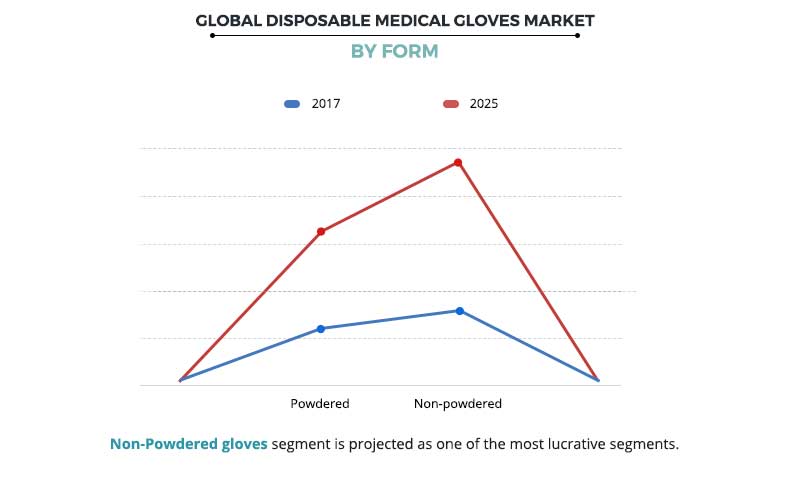

Form segment review

Based on form segment, the disposable medical gloves market is segmented into powdered and non-powdered. Non-powdered disposable gloves segment generated the highest revenue in 2017 ad is anticipated to continue the same during the forecast period. This is attributed to the ban of powdered disposable medical gloves by FDA in December 2016 due to unreasonable and substantial risk of illness or injury to individuals exposed to the powdered gloves. Many other developed countries including Germany, UK and others have also imposed a ban on disposable medical gloves usage for surgical and examination purpose.

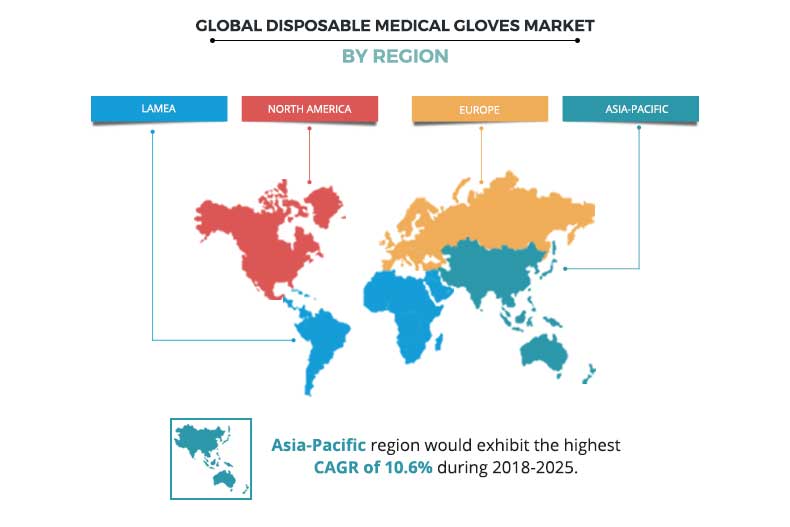

Disposable medical gloves market, by region

The disposable medical gloves market based on region is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America dominated the disposable medical gloves market in terms of revenue in 2017, and is expected to retain its dominance throughout the forecast period. This is attributed to the well-established healthcare infrastructure and the increase in adoption of disposable medical gloves across healthcare settings for preventing healthcare associated infections. However, Asia-Pacific is expected to grow at the fastest growth rate during the forecast period owing to the rise in adoption of disposable gloves for examination purposes, and surge in awareness pertaining to wellbeing and hygiene amongst medical professionals in this region.

The report provides a comprehensive global disposable medical gloves analysis of the key players operating in the market such as Top Glove Corporation Berhad, Supermax Corporation Berhad, Semperit AG Holding, Rubberex Corp. M Bhd, Kossan Rubber Industries Bhd., Hartalega Holdings Berhad, Dynarex Corporation, Cardinal Health, Inc., B. Braun Melsungen AG and Ansell Limited. Other players operating in the value chain are Unigloves (UK) Limited, Smart Glove Corporation Sdn Bhd, Cypress Medical Products LLC, Microflex Corporation, Mölnlycke Health Care, and YTY Industry Holdings Berhad.

Key Benefits for Disposable Medical Gloves Market:

- The study provides an in-depth analysis of the global disposable medical gloves market share with the current trends and future estimations to elucidate the imminent investment pockets.

- A comprehensive analysis of the factors that drive and restrict the global disposable medical gloves market size is provided.

- A comprehensive quantitative analysis is provided from 2018 to 2025 to assist stakeholders to capitalize on the prevailing market opportunities.

- An extensive analysis of the key segments of the industry helps to understand the global disposable medical gloves market trends.

- Key players and their strategies are provided to understand the competitive outlook of the disposable medical gloves market forecast.

Disposable Medical Gloves Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Form |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | Cardinal Health, Inc., Kossan Rubber Industries Bhd., Ansell Limited, Hartalega Holdings Berhad, Rubberex Corp. M Bhd., Semperit AG Holding, Supermax Corporation Berhad, B. Braun Melsungen AG, Top Glove Corporation Berhad, Dynarex Corporation |

Analyst Review

The utilization of disposable medical gloves is projected to witness a significant increase, owing to high incidence of diseases across the globe. The market is largely fragmented, and several manufacturers have focused on offering advanced and novel disposable medical gloves, which aid in curbing latex-associated allergies and hospital acquired infections. In addition, market players have successfully manufactured gloves with different properties such as higher resistance against chemicals, superior anti-tear properties and gloves with limited thickness thereby not affecting the wearing and removing process, which is anticipated to create lucrative opportunities for the growth of disposable medical gloves industry.

Disposable medical gloves are primarily used across health care industry, as a protective tool that avoids cross infection between caregivers and patients or the users. Over time, numerous variants of disposable medical gloves have been developed. These include natural rubber, nitrile, vinyl, and neoprene. Latex rubber, as a material is the major component used during the production of disposable medical gloves; however, this trend is shifting from latex gloves to nitrile or vinyl due to the increase in cases of infection from the latex gloves. Each of these variants render unique benefits over conventional gloves; this also paves way for a wide application spanning range of industries such as clean room, and other medical applications. For instance, nitrile gloves are more puncture resistant and friction less with a long shelf life as compared to latex gloves, thus are utilized in many medical surgeries.

Increase in incidences of pandemic diseases such as swine flu (H1N1 pandemic) and a resultant need for infection prevention/control aids, such as “disposable medical gloves”, (economically, can be used) drive the growth of global disposable medical gloves market volume (billion gloves). Moreover, polyethylene-based disposable medical gloves are in high demand in the industry, due to their cost effectiveness and ease of availability. The use of non-powder gloves aids in supplementing the market growth, as these gloves do not develop adhesion and granulomas, thereby reducing the risk of post-operative wound infection as well as latex allergens sensitizations, and hypersensitivity.

Loading Table Of Content...