Distribution System Market Overview

The global distribution system market was valued at USD 7.5 billion in 2022, and is projected to reach USD 15.4 billion by 2032, growing at a CAGR of 7.8% from 2023 to 2032.

Surge in rising levels of globalization and modernization of technology primarily drives the growth of the distribution system market. However, rising implementation costs and complexity and the difficulty of integration hamper market growth to some extent. Moreover, enhanced effectiveness and output is expected to provide lucrative opportunities for market growth during the forecast period.

Travel agencies, travel management firms, and other travel service providers use technological platforms and networks to access and distribute travel-related content and services. This market is known as the global distribution system (GDS) market. GDS serve as interface bringing together providers including hotels, rental car agencies, airlines, and travel agencies to ease information sharing, reservation-making, and transaction processing.

Additionally, companies in this market provide all-inclusive platforms that compile and present current travel inventory, such as flight times, hotel availability, rental car choices, and cost details. Travel agencies and other users are endowed to search, evaluate, and make reservations for travel services on behalf of their clients with the help of these platforms. GDS platforms connect users with a global network of suppliers and travel-related content, making them renowned for their broad reach. The entire travel booking experience is improved by these platforms as it expedites the reservation process, automate procedures, and facilitate effective communication between travel agents and service suppliers.

Furthermore, the growing complexity of the travel sector and the rising demand for travel are the main drivers of the worldwide distribution system market. GDS platforms are essential for streamlining the booking process, giving users access to a large variety of travel options, and guaranteeing accurate and current information as the travel industry grows more varied and competitive.

Key Finding of the Study

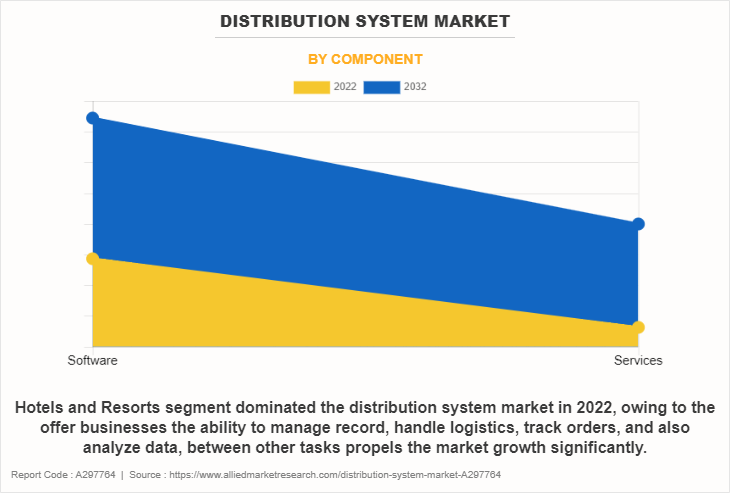

- By application, the software segment accounted for the distribution system market share in 2022.

- On the basis of application, the hotel and resort segment generated the highest revenue in 2022.

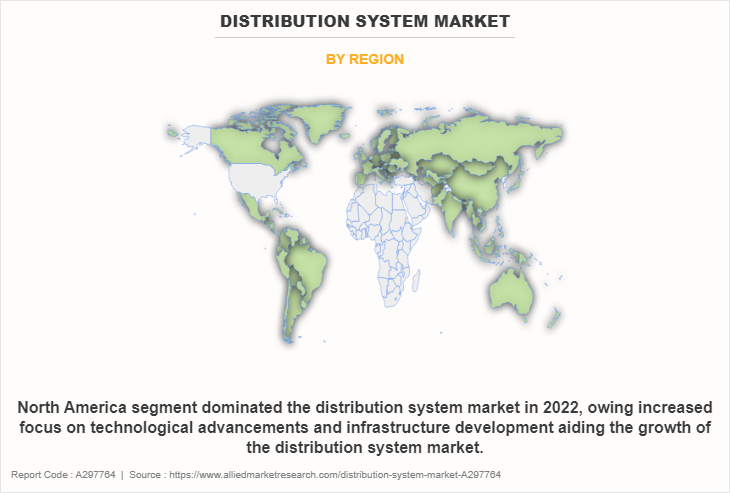

- According to the distribution system market analysis, region-wise, North America generated the highest revenue in 2022.

Top Impacting Factors

Rising Levels of Globalization

The market for global distribution systems is significantly driven by expanding globalisation, which raises demand for effective and all-inclusive trip booking solutions. As global trade, business, and tourism grow, more people are crossing borders for a variety of reasons. Due to the rising globalisation, a centralised platform that links suppliers, travel agents, and travel management firms globally and offers a variety of travel alternatives and services is crucial.

Moreover, due to the expansion of markets and travel locations brought about by globalisation, it is critical that service providers and travel agencies have access to a wide range of travel products. Distribution systems are essential for compiling and dispersing this inventory so that travel firms may effectively seek up, evaluate, and reserve travel services.

Furthermore, the global distribution system market makes it possible to access a variety of travel options, such as flights, hotels, transportation, tours, and activities from other destinations, as travellers get adventurous and seek out unique experiences. In addition to giving travellers more options, this enables travel agencies to satisfy the personalised demands and preferences of their customer base. Globalisation has led to an increase in competition in the hospitality industry.

Technological Advancement

The global distribution system market is significantly influenced by technological breakthroughs that improve operational efficiency and user experience. The way travel agencies and service providers function within the distribution system was completely transformed by the integration of technologies like artificial intelligence, machine learning, big data analytics, and cloud computing. One of the primary methods that technology is influencing the distribution system market is through personalized recommendations.

Distribution systems offer personalized travel recommendations by analyzing user preferences, search history, and behaviour patterns with the aid of artificial intelligence and machine learning algorithms. By providing personalized recommendations, this not only improves the user experience but also raises the opportunity of conversions by presenting consumers with options that are both relevant and appealing.

Moreover, big data analytics facilitate to analyze enormous volumes of data, including market demand, competitor rates, and past price trends, in order to identify the most profitable and competitive pricing strategies. This enables service providers and travel agencies to maximize their earnings while providing clients with competitive pricing. Additionally, another area where technology developments are driving the distribution system market is operational efficiency. Large volumes of data may be stored and accessed via cloud computing, which facilitates the management of inventory, reservations, and client data by travel agencies and service providers. This increases efficiency and decreases manual mistake rates throughout the process.

Segment Review

The distribution system market is segmented on the basis of component, application and region. On the basis of component, it is divided into software and services. On the basis of application, it is fragmented into hotels and resorts, cruises, car rental, aviation, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

The report focuses on growth prospects, restraints, and analysis of the Distribution system trend. The study provides Porter’s five forces analysis to understand the impact of numerous factors, such as the bargaining power of suppliers, the competitive intensity of competitors, the threat of new entrants, the threat of substitutes, and the bargaining power of buyers on the Distribution system market share.

On the basis of component, software segment dominated the Distribution system market in 2022 and is expected to maintain its dominance in the upcoming years owing to the offer businesses the ability to manage record, handle logistics, track orders, and also analyze data, between other tasks propels the market growth significantly. However, the services segment is expected to witness the highest growth, owing to organization to help organizations leverage the data generated by the global distribution system to optimize their operations, gain valuable insights, and make informed decisions.

Region-wise, the distribution system market size was dominated by North America in 2022 and is expected to retain its position during the distribution system market forecast period, owing to the increased focus on technological advancements and infrastructure development aiding the growth of the distribution system market. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to the increased need for strong distribution networks and efficient order fulfillment processes, which is expected to fuel the market growth in this region.

Competition Analysis

The key players operating in the distribution system industry include Amadeus IT Group SA, Sabre GLBL Inc., Travelport, Pegasus, TravelSky Technology Limited., Sirena-Travel JSC, SiteMinder, INFINI, TravelPerk and kiu system solutions. Furthermore, it highlights the strategies of the key players to improve the market share and sustain competition in distribution system industry.

Recent Partnership in the Distribution System Market

In March 2023, Amadeus partnered with SAS, following the signature of the new agreement, the flag-carrier benefited from Amadeus Altéa for the distribution of advanced merchandising offers via NDC. Travel sellers able to access SAS NDC-sourced content through the Amadeus Travel Platform in addition to the existing non-NDC content. Agents continue to play an essential role for SAS, with the new partnership providing technology to efficiently offer content through the travel seller channel.

In June 2021, Qatar Airways extended its partnership with Amadeus, embracing NDC solutions to enhance its retailing capabilities, to strengthen distribution and IT partnership. The airline signed a Letter of Agreement with Amadeus to confirm Amadeus's continued role as its long-term distribution and IT partner, realizing the importance of the travel agent channel to support its aggressive expansion goals. Through the Amadeus Travel Platform, Qatar Airways was able to provide content via NDC to travel agencies and businesses worldwide. As a result, in this following stage of travel, the airline enhanced its retailing capabilities, continued to execute on its omni-channel distribution plan, and expanded its global reach.

In November 2023, easyJet holidays, the UK’s fastest-growing tour operator, partnered with SiteMinder, for software platform that unlocks the full revenue potential of hotels, to provide its 5000 listed hotels the ability to become bookable until the last minute. The partnership helps easyJet holidays integrated into SiteMinder’s platform, so listed hotels can offer dynamic room rates to travellers and make their full inventory bookable. Listed hotels now maximize their yield and inventory in high-compression times when they need to fill their remaining rooms at the best possible price. This is made possible by their ability to sell all of their rooms on easyJet trips.

Recent Collaboration in the Distribution System Market

In November 2023, Paytm collaborated with global travel technology company Amadeus to redefine travel experience with Artificial Intelligence. Under this collaboration, for the next three years, the company able to integrate Amadeus's expansive travel platform, enhancing the travellers' experience from search to booking, and finally to payment. Leveraging Amadeus' advanced automation and New Distribution Capability (NDC), technologies enabling Paytm to secure precise results and establish a consistent and robust travel shopping ecosystem.

In November 2023, AirAsia MOVE, formally known as AirAsia Superapp, collaborated with SiteMinder, for software platform that unlocks the full revenue potential of hotels, to offer a wider range of hotels and accommodations to travellers on its platform. The collaboration allows AirAsia MOVE to tap into SiteMinder’s thousands of hotel customers in the Asian region, while enabling SiteMinder’s customers to offer more value-added deals such as SNAP, the exclusive flight-and-accommodation travel package, to millions of AirAsia MOVE users.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the distribution system market analysis from 2022 to 2032 to identify the prevailing distribution system market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the distribution system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global distribution system market trends, key players, market segments, application areas, and distribution system market growth strategies.

Distribution System Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 340 |

| By Application |

|

| By Component |

|

| By Region |

|

| Key Market Players | Sirena-Travel JSC, Sabre GLBL Inc., INFINI, Travelport, Amadeus IT Group SA, Pegasus, kiu system solutions, TravelSky Technology Limited., SiteMinder |

Analyst Review

The global distribution system (GDS) market, which offers the technological networks and platforms that link suppliers, travel agents, and travel management businesses globally, is an essential part of the travel and tourism sector. Travel service providers and agents are able to share information, make reservations, and complete transactions more easily when GDS platforms operate as intermediates. These systems allow travel agents to quickly explore, compare, and book travel services on behalf of their clients by aggregating and displaying real-time travel inventory, such as flight schedules, hotel availability, car rental possibilities, and pricing data. A number of important factors are driving the GDS market growth. The demand for effective and all-inclusive travel booking solutions has increased due to the rising demand for travel, both for business and pleasure. GDS platforms simplify the booking process for travel agencies and improve the entire consumer experience by giving access to a broad selection of travel options and services in one convenient location. Additionally, there are a wide range of suppliers and service providers operating worldwide in the travel sector, which are getting more complex. It facilitates smooth communication between suppliers and travel brokers, guaranteeing current and accurate data and expediting the booking procedure. Innovations in technology are also propelling the GDS market's expansion and development. In order to give personalized recommendations, optimize pricing strategies, and boost travel operations efficiency, GDS providers are integrating AI, ML, and DW capabilities. These technical advancements facilitate more focused marketing and sales strategies, increase efficiency, and improve user experience. Furthermore, the global distribution system market is dominated by a few significant companies and is quite competitive. However, as the advancements in new technologies and the need for travel keeps growing, there will always be space for innovation and new players. The market is anticipated to increase significantly over the next several years, propelled by factors such as growing disposable incomes, growing globalization, and the expanding trend of online travel booking.

For December 2023, Trip.com Group and Amadeus expanded their partnership, to include hospitality distribution. Continuing as the preferred GDS (Global Distribution System) hotel content provider for Trip.Biz, Amadeus continued to work closely with and support Trip.Biz as it implements its global growth strategy. Additionally, Trip.com Group has signed a new agreement with Amadeus to provide its customers with access to content options from Amadeus Value Hotels (AVH) on the Trip.com Group platform. Enabling access to AVH content for Trip.com Group customers provide access to more than 500,000 properties globally, including directly sourced content by Amadeus.

The distribution system market was valued at $7,499.26 million in 2022 and is estimated to reach $15,435.32 million by 2032, exhibiting a CAGR of 7.8% from 2023 to 2032.

Rise in levels of globalization and advancements and modernization of technology are the upcoming trends of Distribution System Market in the world

Enhanced effectiveness and output is the leading application of Distribution System Market.

North America is the largest regional market for Distribution System.

Amadeus IT Group SA, Sabre GLBL Inc., Travelport, Pegasus, TravelSky Technology Limited., Sirena-Travel JSC, SiteMinder, INFINI, TravelPerk and kiu system solutions, are the top companies to hold the market share in Distribution System

Loading Table Of Content...

Loading Research Methodology...