DIY Home Décor Market Research, 2031

The global DIY Home Decor Market Size was valued at $240.64 billion in 2021, and is projected to reach $372.06 billion by 2031, growing at a CAGR of 4.7% from 2022 to 2031.

The diy home décor market is segmented into Product Type, Income Group, Price Point and Distribution Channel. DIY is an abbreviation for "do-it-yourself”. DIY home décor market enable homeowners to perform chores independently using DIY home improvement tools, equipment, and appliances. Lifestyle changes have raised interest in do-it-yourself interior design. Moreover, in emerging countries, the increasing number of working women and their participation in the decision-making process for home design contribute to a rise in demand for necessary items. DIY home décor is the activity of self-designing and self-modifying of home decoration project. This technique allows customers to develop eye-catching home decoration projects without any professional help. It is a comprehensive term that mainly refers to developing or modifying innovative products such as shoe holders, letter boards, wall painting, and many others DIY home decorations. Lifestyle of consumers, especially in urban areas, is enhancing significantly, owing to increase in disposable income. Furthermore, owing rise in construction activities and luxurious lifestyle of consumers, the demand for DIY home décor products such as floor coverings, textiles, and furniture is rising, as they have become an integral part of to modern lifestyles.

There is an increase in the number of social media users owing to rise in internet penetration. Moreover, social media usage growth from 2019 to 2020 in North America has increased to +6.96% and in Europe +4.32%. In addition, more than 4.55 billion people around the world uses social media and during the Covid-19 pandemic period the penetration of social media has increased exponentially. Considering this, most of the key players in the DIY home decor market strategize on promoting their products and services on these social media platforms such as Facebook, Instagram, YouTube, and others. Social media marketing is one of the major strategies adopted by various companies and industries on imparting awareness about their product offerings among target customers on social media channels. Thus, the DIY home décor market sights critical opportunity in gaining traction and increases the customer reach among its target segments, through social media marketing strategy.

Furthermore, rise in willingness to spend more on DIY home décor products is anticipated to offer remunerative opportunities for the expansion of the global market, as these products enhance the aesthetical appearance of homes. Thus, improvement in lifestyle is expected to provide potential opportunities for players operating in the market.

The demand for DIY home décor market has been greatly influenced by the rise in urbanization in emerging nations and the increase in spending on home decor items, such as rough textiles and carpets.

Consequently, there is an increase in DIY home renovation product usage. The adoption of do-it-yourself items reduce long-term expenses compared to labor-intensive outsourcing. Consequently, the desire for do- it-yourself home decor goods is a crucial element drives the industry.

The DIY home decor market DIY Home Decor Market Segmentationinto type, income group, price point, and distribution channel, and region. On the basis of type, the market is classified into furniture, home textile, and floor covering. By income group, it is categorized into Lower-middle Income, Upper-middle Income, and Higher Income. Depending on price point, it is bifurcated into Mass and Premium. As per distribution channel, it is segregated into supermarkets & hypermarkets, specialty stores, online sales channel, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

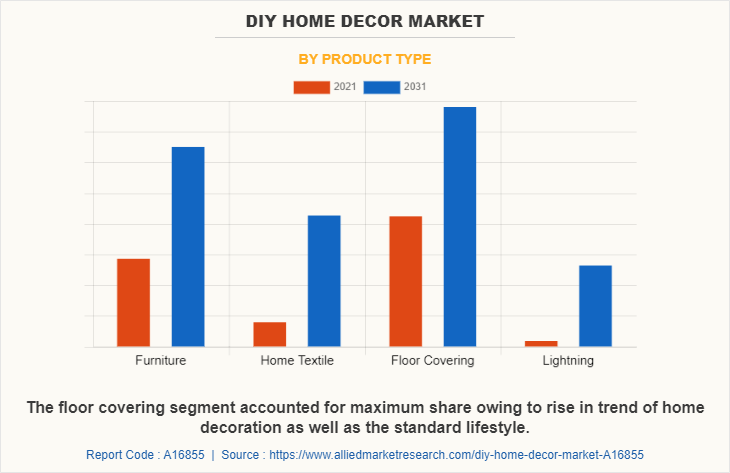

Floor coverings segment accounted for maximum DIY Home Decor Market Share. This can be attributed to rise in trend of home decoration as well as standard lifestyle. However, the e-commerce segment is expected to witness the highest DIY Home Decor Market Growth, owing to increase in penetration of internet and online shopping.

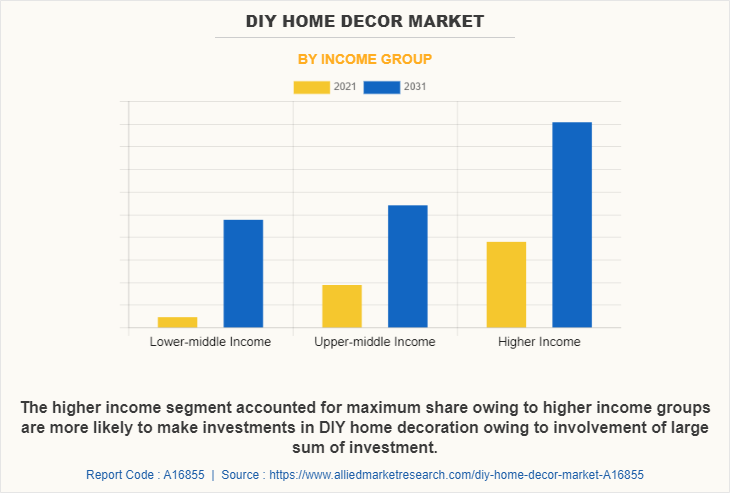

Higher income group segment holds the major share in the home decor market share, globally. People for higher income groups are more likely to make investments in DIY home decoration owing to involvement of large sum of investment.

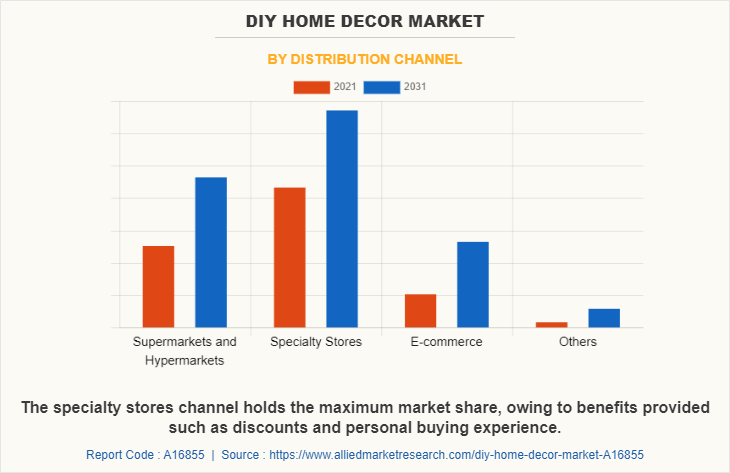

Consumers purchase home decor by various distribution channels including supermarkets & hypermarkets, specialty stores, online sales channel, and others. The specialty stores channel holds the maximum market share, owing to benefits provided such as discounts and personal buying experience.

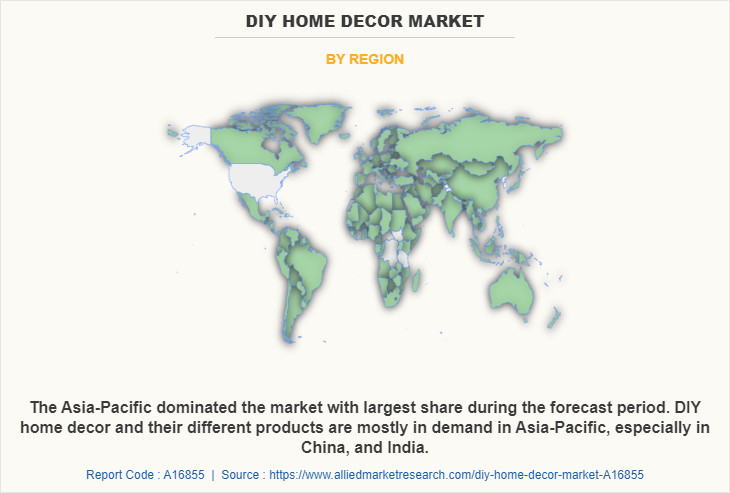

Region wise, Asia-Pacific dominated the market with largest share during the DIY Home Decor Market Forecastperiod. DIY home décor and their different products are mostly in demand inAsia-Pacific, especially in China, and India. The preference for home décor changes with change in geographical locations and different income groups. Thus, the growth in demand for furniture and floor coverings augment demand for home décor products and are drive the growth of DIY home decor market in Asia-Pacific.

The major players analyzed for the DIY home decor industry are Inter IKEA Systems BV, Forbo International SA. Armstrong World Industries, Inc., Mannington Mills Inc., Mohawk Industries Inc., Shaw Industries Group, Inc., Herman Miller Inc., Ashley Furniture Industries Ltd., Kimball International, Duresta Upholstery Ltd, Overstock.com, Inc., Target Corporation, Walmart Inc., Wayfair INC., and Williams-Sonoma, Inc.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the diy home décor market analysis from 2021 to 2031 to identify the prevailing DIY Home Decor Market Opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces DIY Home Decor Market Analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the diy home décor market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global DIY Home Decor Market Trends, key players, market segments, application areas, and market growth strategies.

DIY Home Decor Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Income Group |

|

| By Price Point |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Williams-Sonoma, Inc., Kimball International, Duresta Upholstery Ltd., WAYFAIR INC, Shaw Industries Group, Inc, Ashley Furniture Industries Ltd., TARGET CORPORATION, OVERSTOCK.COM, INC., Mannington Mills Inc., WALMART INC., Armstrong World Industries, Inc., Forbo International SA, Inter IKEA Systems BV, Herman Miller Inc., Mohawk Industries Inc. |

Analyst Review

The global DIY home decor market is expected to exhibit notable growth during the forecast period, owing to increase in consumer’s interest toward the concept of DIY home decor. In addition, upsurge in urban population and development of the real estate industry in emerging economies have fostered the sales of DIY home décor products, thereby fueling the growth of the global market. Asia-Pacific is leading the global DIY home décor market, owing to the high demand from residential buyers. It is anticipated that Asia-Pacific would exhibit a significant growth trend during period, owing to surge in demand for DIY home decor products from countries such as India and China. Number of houses and size of households are further expected to impact the market growth.

Furthermore, rise in disposable income and improvement in life style of individuals are expected to offer remunerative opportunities for investors in the DIY home decor market. In the current scenario, eco-friendly home decor products have gained high acceptance among consumers. Thus, players operating in the market are consolidating their efforts in developing eco-friendly products to capitalize on the increasing demand. Operating players in the market compete on certain parameters such as product design, style, and quality of raw materials. Furthermore, many manufacturers are collaborating with importers, contractors, and interior designers to sell their home decor products. Companies have further opted for e-commerce platforms to sell their products and increase their profit margins by reducing the distribution costs.

The increasing number of working women and their participation in the decision-making process for home design contribute to a rise in demand for necessary items. DIY home décor is the activity of self-designing and self-modifying of home decoration project. This technique allows customers to develop eye-catching home decoration projects without any professional help are some of the upcoming trends of DIY Home Décor Market in the world

The floor covering segment is the lading application in DIY Home decor market. This can be attributed to rise in trend of home decoration as well as standard lifestyle. However, the e-commerce segment is expected to witness the highest growth, owing to increase in penetration of internet and online shopping.

Region wise, Asia-Pacific dominated the market with largest share during the forecast period. DIY home décor and their different products are mostly in demand in Asia-Pacific, especially in China, and India. The preference for home décor changes with change in geographical locations and different income groups. Thus, the growth in demand for furniture and floor coverings augment demand for home décor products and are drive the growth of DIY home decor market in Asia-Pacific.

The DIY home decor market was valued at $68,485 million in 2021, and is projected to reach $105,001million by 2031, registering a CAGR of 4.6% from 2022 to 2031. DIY is an abbreviation for "do-it-yourself”. DIY home décor market enable homeowners to perform chores independently using DIY home improvement tools, equipment, and appliances.

The major players analyzed for the DIY home decor industry are Inter IKEA Systems BV, Forbo International SA. Armstrong World Industries, Inc., Mannington Mills Inc., Mohawk Industries Inc., Shaw Industries Group, Inc., Herman Miller Inc., Ashley Furniture Industries Ltd., Kimball International, Duresta Upholstery Ltd, Overstock.com, Inc., Target Corporation, Walmart Inc., Wayfair INC., and Williams-Sonoma, Inc.

Loading Table Of Content...