Donor Egg IVF Services Market Overview:

The global donor egg IVF services market accounted for $1,668 million in 2017 and is projected to reach $3,290 million by 2025, growing at a CAGR of 8.8% from 2018 to 2025. In vitro fertilization is an assisted reproductive technology (ART), which involves retrieving eggs from a womans ovaries and fertilizing them with a sperm in vitro, that is, outside the body.

The global donor egg IVF services market is anticipated to exhibit significant market growth during the forecast period, owing to rise in infertility rate, increase in trend of delayed pregnancies, surge in IVF success rate, and rise in disposable income globally. However, high cost, complications associated with IVF treatment, and low awareness level for IVF in some underdeveloped regions hinder the growth of the market. Conversely, upsurge in fertility tourism, increase in number of fertility clinics, and growth opportunities in the emerging markets are expected to make way for market development during the forecast period.

Donor Egg IVF Services Market Segmentation

The global donor egg IVF services market is segmented based on cycle type, end user, and country. Based on cycle type, the market is divided into fresh donor egg IVF cycle and frozen donor egg IVF cycle. According to end user, the market is classified as fertility clinic, hospital, surgical center, and clinical research institute. As per country, the market is studied across Australia, New Zealand, Thailand, Malaysia, Rest of Asia-Pacific, South Africa, Canada, Ireland, and Rest of the World.

Segment Review

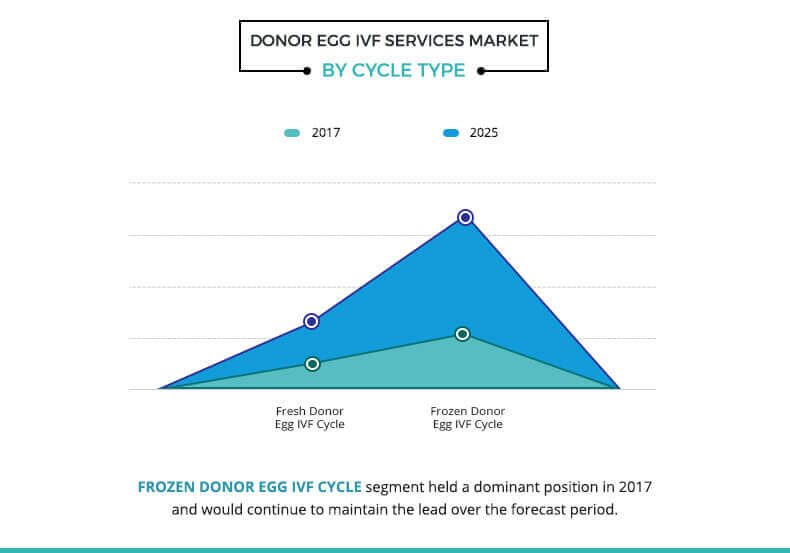

The cycle type category is sub-segmented into fresh donor egg IVF cycle and frozen donor egg IVF cycle. The frozen donor egg IVF cycle is the largest segment, which accounted for more than two-thirds of the total IVF cycles in 2017. The fresh eggs obtained from a donor are further frozen for future use. This is a more convenient option as frozen donor eggs are retrieved from highly screened egg donors and are ready to be shipped, thawed, and used on the schedule of the recipient only. In addition, frozen donor eggs offer a more affordable option as compared to fresh donor eggs, as the recipients do not have to pay for the egg donors travel expenses.

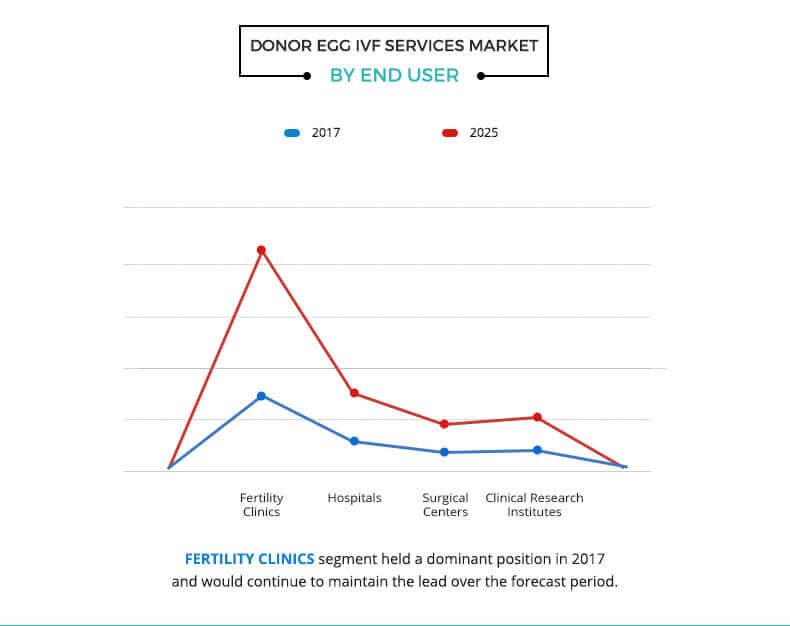

Fertility clinics and specialty hospitals play a crucial role in providing IVF treatments to couples seeking assistance for infertility treatments. Fertility clinics provide technologically advanced IVF treatments to patients having fertility problems. Availability of a wide range of fertility treatments under one roof coupled with government reimbursement majorly drives the growth of the fertility clinic segment of the global donor egg IVF services market.

Snapshot of the South Africa Donor egg IVF Services Market

Low IVF treatment cost and rise in trends of fertility tourism in South Africa drive the growth of the donor egg IVF services market in the country. South Africas liberal constitution allows single parents and same-sex couples to undergo IVF treatment. However, no one is allowed to be paid for donating their eggs or sperm in South Africa, and the donors identity is protected by law. In South Africa, a surrogate mother has no rights of the child after the baby is born. No money is exchanged for the act of surrogacy, although the surrogate mothers life insurance and medical health bills are paid by the commissioning parents. In addition, majority of the insurance plans in South Africa do not cover infertility treatments.

The key players profiled in the global donor egg IVF services market include Virtus Health, Monash IVF Wesley Hospital Auchenflower, Fertility First, Flinders Reproductive Medicine Pty Ltd, Fertility Associates, Genea Oxford Fertility Limited, Repromed, SAFE Fertility Center, Bangkok IVF Center (Bangkok Hospital), Bangkok IVF Center, Damai Service Hospital, TMC Fertility Centre, KL Fertility & Gynecology Centre, Bourn Hall Fertility Center, Southend Fertility and IVF, Morpheus Life Sciences Pvt. Ltd., Bloom Fertility Center, Cloudnine Fertility, Chennai Fertility Center, Shanghai Ji Ai Genetics & IVF Institute, Shanghai United Family Hospital, IVF NAMBA Clinic, Sanno Hospital, Thomson Medical Pte. Ltd., Raffles Medical Group, TRIO Fertility, The Montreal Fertility Center, Procrea Fertility, IVF Canada, Sims IVF, Merrion Fertility Clinic, Beacon CARE Fertility, Medfem Fertility Clinic, The Cape Fertility Clinic, and Aevitas Fertility Clinic.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the market along with current trends and future estimations to elucidate the imminent investment pockets.

- It offers a quantitative analysis from 2017 to 2025 in terms of revenue and volume, which is expected to enable the stakeholders to capitalize on prevailing market opportunities.

- A comprehensive analysis of the cycle type is provided to determine the prevailing opportunities.

- The key players are profiled to understand the competitive outlook of the market.

Donor Egg IVF Services Market Report Highlights

| Aspects | Details |

| By Cycle Type |

|

| By End User |

|

| By Country |

|

Analyst Review

The adoption of IVF procedure is expected to increase, owing to rise in infertile population across the world and growth in fertility tourism in the developing countries. Additionally, increase in success rate of IVF, surge in disposable income, and rise in trend of delayed pregnancies are expected to drive the market growth during the forecast period. However, complications associated with the use of IVF and higher cost are expected to hinder the market growth.

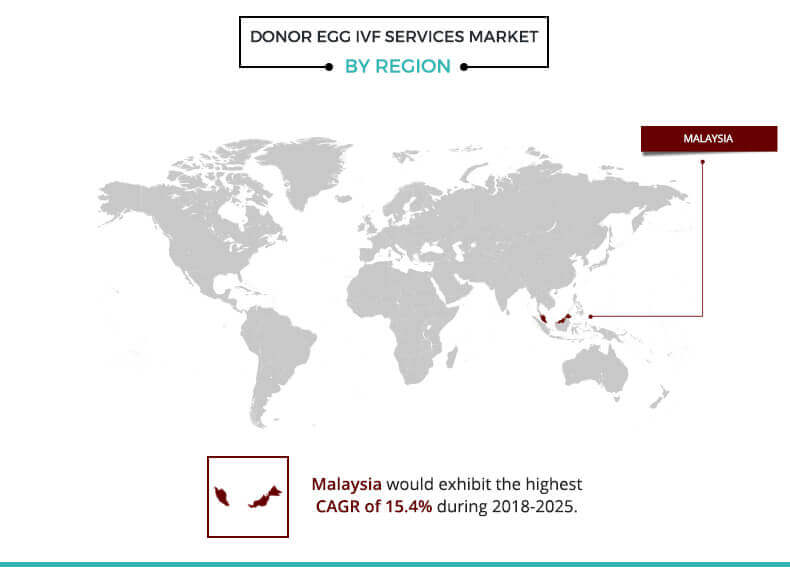

Canada is expected to remain dominant during the forecast period, followed by Australia. Presence of private funding (such as private and provincial health insurance funding) for IVF treatments in Canada boosts the adoption of IVF treatment for infertile couples in this country. Moreover, decrease in fertility rate and presence of developed healthcare infrastructure have increased the adoption of IVF treatment in Australia, thereby driving the growth of the donor egg IVF services market in this country. On the contrary, the Malaysia market is anticipated to exhibit the highest CAGR. This is owing to the high infertility among women due to lack of egg production, abnormal menstrual periods, blockages in the fallopian tubes because of some infection, and womb distortion. In addition, male-related factors, such as lack of sperm production, bad quality of sperm, and sexual dysfunctional problems, further increase infertility in the country.

Loading Table Of Content...