DRAM Market Overview, 2032

The Global DRAM Market was valued at $6.2 billion in 2022, and is projected to reach $10.2 billion by 2032, growing at a CAGR of 5.4% from 2023 to 2032. This is driven by rising demand for advanced computing devices such as ultra-thin notebooks and hybrid systems. Technological advancements and the widespread use of DRAM in these devices are key growth factors. Additionally, increasing investments in digital infrastructure by individuals and organizations further support market expansion.

Market Dynamics & Insights

The DRAM industry in Asia-Pacific held a significant share of over 49.1% in 2022.

The DRAM industry in Germany is expected to grow significantly at a CAGR of 4.6% from 2023 to 2032.

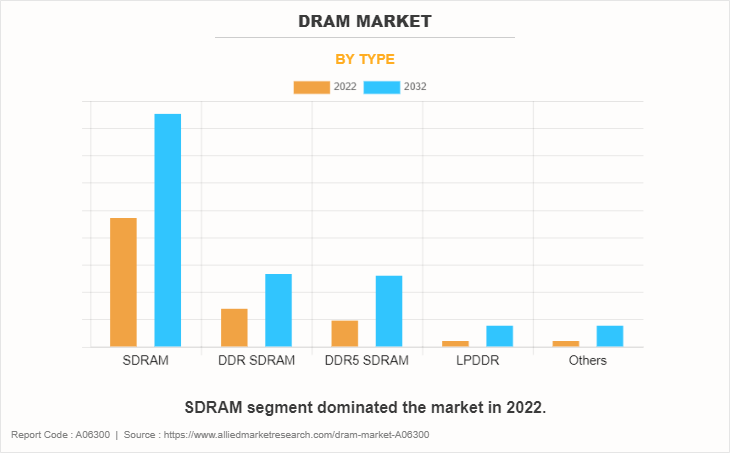

By type, SDRAM segment is one of the dominating segments in the market and accounted for the revenue share of over 46% in 2022.

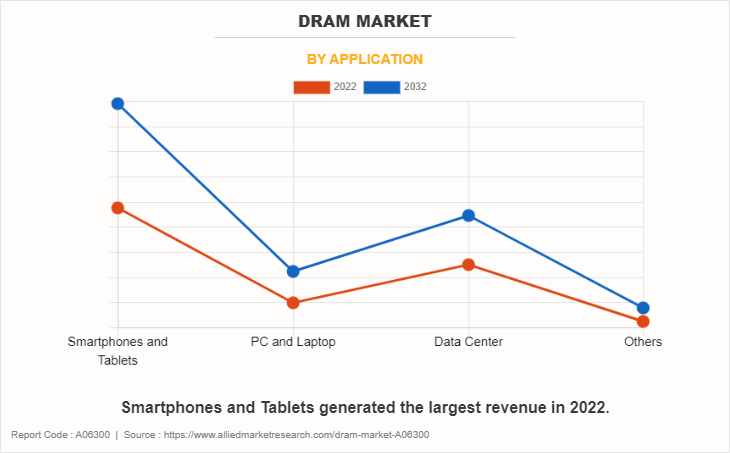

By application, the smartphones and tablets segment is the fastest growing segment in the market.

Market Size & Future Outlook

2022 Market Size: $6.2 Billion

2032 Projected Market Size: $10.2 Billion

CAGR (2023-2032): 5.4%

Asia-Pacific: Largest market in 2022

LAMEA: Fastest growing market

The main benefits of DRAM are its simple architecture and single transistor need. In comparison to SRAM, it is also more affordable and offers higher densities. More data may be stored in it, and its memory can be cleared or updated. DRAM volatile memory and high-power consumption in comparison to other choices are its drawbacks. The device requires advanced production, data in storage cells must be updated, and it operates more slowly than SRAM. The DRAM industry has a lot of potential to develop while mobile devices require high-performance, low-power DRAM. The growing number of smartphones in developing countries such as China, India, and Japan would propel market expansion.

Key Takeaways:

- The global DRAM market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major DRAM market participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global DRAM market and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The DRAM (Dynamic Random Access Memory) market is driven by the growing demand for memory-intensive applications across various sectors, including consumer electronics, data centers, and telecommunications. There are some key growth factors, such as the increasing usage of cloud computing, AI, as well as IoT, which all need speed and high-performance memory. The development of 5G technology also contributes to the increasing consumption of DRAM, particularly in smartphones and communication network devices. However, price volatility and supply chain interruptions are still major issues owing to local politics and clustering of production and supply of DRAM Market as to overall capacity and distribution.

Segment Overview

The DRAM Market Outlook is segmented into Type and Application.

By type, the DRAM Market is classified into SDRAM, DDR SDRAM, DDR5 SDRAM, LPDDR, and others. The SDRAM segment accounted for the largest share in 2022.

Additionally, the development of computing devices, such as ultra-thin laptops and hybrid devices, is anticipated to fuel DRAM market demand throughout the forecast period. Growing data centers, a growing reliance on big data,eDRAM, AI/ML, IoT, industrial and consumer electronics, and ICT infrastructure are some of the causes propelling the DRAM manufacturing industry.

By application, it is bifurcated into smartphones and tablets, PC and laptop, data centers, and others. Smartphones and Tablets generated the largest revenue in 2022.

Short-term demands for DRAM include growing specifications for gaming and educational notebooks, ongoing low- and mid-end 5G smartphone launches, rising GPU demand due to the increased cryptocurrency mining, stricter requirements for gaming consoles, and increased demand for home entertainment devices such as TVs, smart speakers, and set-top boxes owing to rising disposable income worldwide.

Region wise, the DRAM market is analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

Country-wise, the U.S. acquired a prime share in the market and it is expected to grow at a significant CAGR during the forecast period of 2023-2032.

In Europe, the UK dominated the DRAM market share, in terms of revenue, in 2022 and is expected to follow the same trend during the forecast period. However, the UK is expected to emerge as the fastest-growing country in Europe's surrounding market with a CAGR of 3.56%.

In Asia-Pacific, China, is expected to emerge as a significant market for the DRAM market, owing to a significant rise in investment by prime players due to increase in growth of consumer electronics in rural and urban regions.

In the LAMEA region, the Middle East garnered a significant market share in 2022. The LAMEA market has witnessed an improvement, owing to the growth in inclination of prime vendors towards utilizing the DRAM across this region. Moreover, the Middle East region is expected to grow at a high CAGR of 7.06% from 2023 to 2032.

Report Coverage & Deliverables

This report delivers in-depth insights into the DRAM market, covering types, distribution channels, applications, and key strategies employed by major players. It offers detailed market forecasts and emerging trends.

Type Insights

Synchronous DRAM (SDRAM), DDR (Double Data Rate), LPDDR (Low Power DDR), and GDDR (Graphics DDR) dominate the DRAM Market. DDR variants, especially DDR5, are gaining prominence due to high-speed data processing needs.

Application Insights

The primary areas of information that make use of DRAM are smartphones, tablets, Personal computers, laptops, data center and other such segments. The growth of smartphones and tablets market make more use of DRAM, in mobile high definition video, AI applications and gaming. As the usage of applications that require high processing speeds and the ability to run multiple applications simultaneously increases, manufacturers seek to add LPDDR5 and LPDDR5X DRAM OSD onto the device in order to speed up the processing and power efficiency, as well as support the growing trends of 5G. Besides, in any mobile device, DRAM performs the same function in AR/VR which is equally responsible for the innovations of the device.

Regional Insights

Asia-Pacific leads in manufacturing, while North America drives demand from data-intensive applications. Europe is seeing DRAM market growth specially in the automotive sector, with increased DRAM use in advanced vehicle systems.

Competitive Analysis

Competitive analysis and profiles of the major global DRAM market players that have been provided in the report include Samsung Electronics, Micron Technology Inc., SK HYNIX INC., Nanya Technology Corporation, Winbond Electronics Corporation, Powerchip Technology Corporation, Transcend Information, Kingston Technology, Integrated Silicon Solutions, and Intel Corporation. The key strategies adopted by the major players of the DRAM are product launch.

Top Impacting Factors

The DRAM market growth is expected to witness notable growth owing to surge in demand for smartphones and increase in number of data center installation. Moreover, rise in bitcoin mining and demand for gaming consoles are DRAM Market Opportunity. However, manufacturing process of DRAM is complex which may hamper the DRAM Market growth.

Historical Data & Information

The global DRAM market analysis is highly competitive, owing to the strong presence of existing vendors. Vendors of the market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to worsen as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Strategies and Developments

- In 2024, Samsung Electronics announced a significant investment in its Pyeongtaek complex in South Korea to expand DRAM production capacity. The investment is part of the company’s strategy to maintain its leadership in the global memory market amid increasing demand for AI and machine learning applications. This expansion focuses on ramping up the production of DDR5 DRAM, which is essential for high-performance computing and server markets.

- In 2023, SK Hynix unveiled its latest High Bandwidth Memory (HBM3) technology aimed at supporting advanced AI models, including generative AI and high-performance computing (HPC). The company is collaborating with major cloud service providers to integrate HBM3 into their infrastructure, offering faster data processing speeds and improved energy efficiency. This positions SK Hynix as a leader in the future of data center memory solutions.

Key Benefits For Stakeholders

This study comprises analytical depiction of the DRAM market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall DRAM analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current DRAM market forecast is quantitatively analyzed from 2022 to 2032 to benchmark the financial competency.

- Porters five forces analysis illustrates the potency of the buyers and suppliers in the DRAM.

- The report includes the market share of key vendors and DRAM market trends.

Dram Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 10.2 billion |

| Growth Rate | CAGR of 5.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 338 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Micron Technology Inc., Integrated Silicon Solution Inc., Nanya Technology Corporation, Transcend Information, Samsung Electronics, Winbond, Kingston Technology, Powerchip Semiconductor Manufacturing Corporation, SK HYNIX INC., Intel Corporation |

Analyst Review

The DRAM market is expected to leverage high potential for the SDRAM and DDR SDRAM during the forecast period. DRAM vendors, investing in R&D and skilled workforce, are anticipated to gain a competitive edge over their rivals. The competitive environment in this market is expected to further intensify with an increase in technological innovations, product extensions, and different strategies adopted by key vendors.

The surge in demand for DRAM for data centers across the globe for data storage drives the need for enhanced dynamic random-access memory. Moreover, major economies, such as the U.S., China, the UK, and Japan plan to develop and deploy advanced DRAM in various sectors.

Key DRAM market leaders profiled in the report include Samsung Electronics, Micron Technology Inc., SK HYNIX INC., Nanya Technology Corporation, Winbond Electronics Corporation, Power chip Technology Corporation, Transcend Information, Kingston Technology, Integrated Silicon Solutions, and Intel Corporation.

As of 2022, the global DRAM market was valued at $6.2 billion and is projected to reach $10.2 billion by 2032, growing at a CAGR of 5.4% from 2023 to 2032.

Dynamic Random Access Memory (DRAM) is a type of semiconductor memory used to store data that the computer's processor needs for proper operation. It's commonly found in servers, workstations, and personal computers, offering faster data access than solid-state drives and hard disk drives.

The DRAM market includes several prominent companies such as Samsung Electronics, SK Hynix, Micron Technology, Nanya Technology, and Winbond Electronics.

The Asia-Pacific region dominates the DRAM market, driven by the rapid adoption of mobile devices in emerging nations like China and India, along with supportive government policies promoting DRAM production

The increasing demand for high-performance, low-power DRAM in mobile devices, the proliferation of smartphones in developing countries, and the rise of memory-intensive applications across various sectors are key drivers of the DRAM market's growth.

Challenges in the DRAM market include price volatility, supply chain disruptions due to geopolitical factors, and the need for advanced manufacturing processes to meet evolving technological demands.

Loading Table Of Content...

Loading Research Methodology...