Driveline Additives Market Research - 2031

The global driveline additives market size was valued at $7.4 billion in 2021 and is projected to reach $10.7 billion by 2031, growing at a CAGR of 3.8% from 2022 to 2031.

The driveline additives market is segmented into Vehicle Type, Additive Type and Product Type.

Driveline additives are designed to improve vehicle performance in terms of fuel efficiency as well as vehicle longevity. Driveline additives are required in autos to achieve optimal lubrication. When these items are mixed into transmission fluids, they reduce friction and eliminate heat. Furthermore, driveline additives, such as high-pressure anti-corrosive additives, are used to avoid scuffing, spalling, wear & tear, and scoring from causing downtime or device failure. These products protect and shelter the automobiles from heat, foam, and copper rusting.

The market for driveline additives is predicted to develop in response to rise in customer interest in improving vehicle fuel efficiency. Driveline additives aid in the reduction of energy loss and, as a result, improve energy efficiency. Surge in fuel costs and growth in customer desire to improve vehicle fuel efficiency are expected to propel the market forward in the coming years. Furthermore, driveline additives aid in the reduction of carbon emissions from cars. Key players are always working to increase lubricity in order to ensure that automobiles adhere to strict carbon emission standards all over the world. Furthermore, as the automotive industry expands and the number of vehicles manufactured rises, the demand for efficient driveline additives is expected to increase. This is likely to raise demand for driveline additives and encourage producers to increase production and supply of the product. However, volatility in the supply of raw materials coupled with the general impact of higher crude oil prices is expected to hinder the market growth of driveline additives. Furthermore, increased number of partnerships for manufacturing of additives is projected to propel the driveline additives market growth over the forecast timeframe.

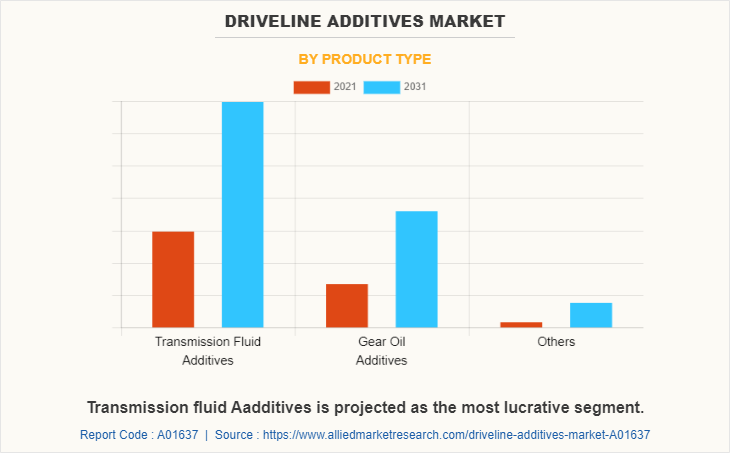

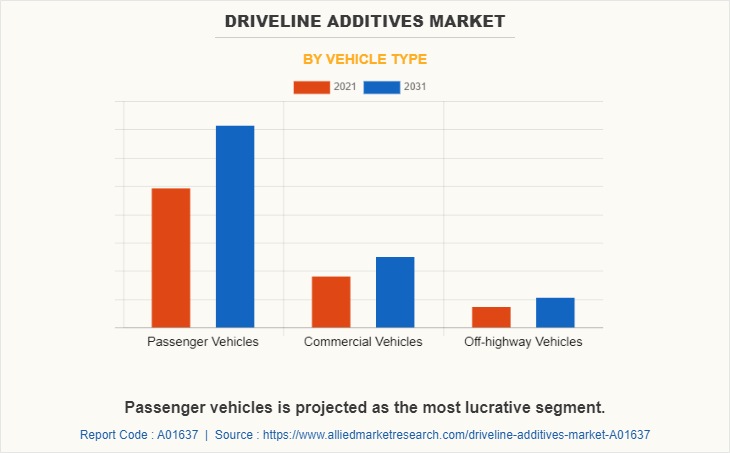

The driveline additives market is segmented into product type, vehicle type, additives type, and region. By product type, the market is categorized into transmission fluid additives, gear oil additives, and others. On the basis of vehicle type, it is fragmented into passenger vehicles, commercial vehicles, and off-highway vehicles. As per additives type, it is classified into dispersants, viscosity index improvers, detergents, anti-wear agents, antioxidants, corrosion inhibitors, friction modifiers, emulsifiers, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The global driveline additives market report covers in-depth information about the major industry participants. The key players operating and profiled in the report include AB Petrochem Pvt. Ltd., Afton Chemical Corporation, BASF SE, BRB International B.V., Chevron Oronite Company, LLC., Evonik Industries AG, International Petroleum & Additives Company, Inc., The Lubrizol Corporation, Vanderbilt Chemicals, LLC., VPS Lubricants.

By Product type, transmission fluid additives segment held a significant share in driveline additives market in 2021. New technology developments such as dual-clutch transmission (DCT) call for power train fluids with better fuel efficiency, and thus, manufacturers widen their focus on transmission fluid additives.

By vehicle type, passenger vehicles segment held a significant share in driveline additives market in 2021. Rise in the number of vehicles manufactured annually, need for longer service drain intervals for transmission fluids and axle fluids are anticipated to boost the driveline additives market share in near future.

As per additive type, dispersants segment held a significant share in driveline additives market in 2020 growing at a CAGR of 3.6% during the forecast period. Dispersants contribute to performance areas including cleanliness, filtration, oxidation, and other important attributes. They are soluble in a range of base oils, which leads to wide adoption in the lubricant industry.

Region-wise, Asia-Pacific dominated the driveline additives market with a share of more than 35.5% in 2020. Moreover, rise in disposable income in the region has increased their expenditure on the vehicles due to which driveline additives demand has expanded drastically.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the driveline additives market analysis from 2021 to 2031 to identify the prevailing driveline additives market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the driveline additives market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global driveline additives market trends, key players, market segments, application areas, and market growth strategies.

Driveline Additives Market Report Highlights

| Aspects | Details |

| By Vehicle Type |

|

| By Additive Type |

|

| By Product Type |

|

| By Region |

|

| Key Market Players | AB Petrochem Pvt.Ltd., BASF SE, VPS Lubricants, BRB International B.V., Evonik Industries AG, Afton Chemical Corporation, The Lubrizol Corporation, Vanderbilt Chemicals, LLC., International Petroleum & Additives Company, Inc., Chevron Oronite Company, LLC. |

Analyst Review

Driveline additives are lubricant additives that are used in axles, manual & automatic transmissions, synchromesh systems, and differentials to improve lubrication. Automatic transmission fluids used as driveline additives offer outstanding oxidative and low-temperature capabilities, which aid in improving the vehicle's fuel efficiency. The global growth and spread of driveline additives has been aided by factors such as expanding population of automobiles in developing countries.

Owing to increased number of on-road and off-road vehicles, as well as rise in demand for automobiles in developing nations such as India and China, the driveline additives market is expected to grow in the future. However, fluctuating raw material prices might restrict the growth of the driveline additives market. On the other hand, the stringent government norms and regulations considering the volatile organic content emission are likely to showcase growth opportunities for the driveline additives market during the forecast period.

Rising production of the vehicle around the globe coupled with an increasing number of on-road and off-road vehicles in operation is expected to fuel the market growth of the driveline additive.

The global driveline additives market was valued at $10.7 Billion in 2031

AB Petrochem Pvt. Ltd., Afton Chemical Corporation, BASF SE, BRB International B.V., Chevron Oronite Company, LLC. Companies are the top players in driveline additives market.

Passenger vehicles, commercial vehicles, and off-highway vehicles are projected to increase the demand for driveline additives market

Product type, vehicle type, and additives type segment are covered in driveline additives market report

Rising investment by major players for developing the additives for catering to the rising demand for additives is projected to propel the market growth.

Passenger vehicles is the major application which is expected to drive the adoption of driveline additives

The industry is gradually recovering from losses, resulting in strong sales expectations in the driveline additives market. In the coming years, rise in prospects for transmission fluid additives are likely to improve demand for the product

Loading Table Of Content...