Drone Camera Market Outlook, 2027

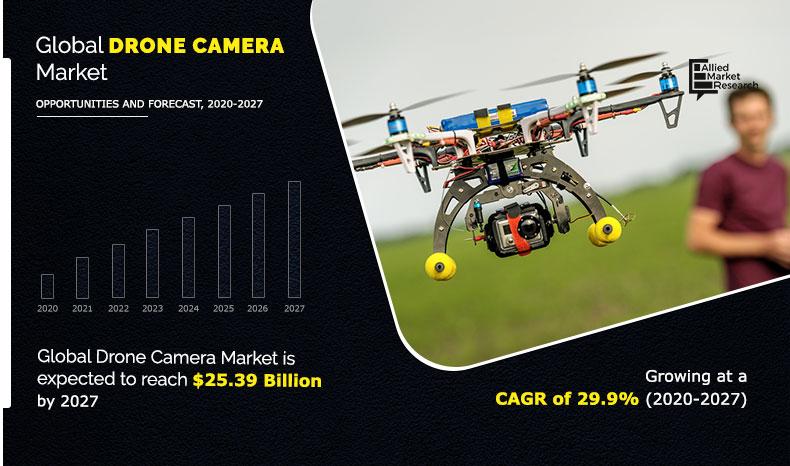

The global drone camera market size was valued at $3.33 billion in 2019, and is projected to reach $25.39 billion by 2027, registering a CAGR of 29.9%.Drone camera is a device installed in a drone that is meant to record videos or to capture photos while the drone is flying. Drone camera finds its application in performing a range of operations such as product & food delivery, surveillance over a specific area, and thermal imaging. Increase in application of drones in different industries has boosted the demand for high resolution camera to be installed in drones, which are capable of taking efficient quality images from a wider angel.

In addition, rise in the defense budget has enabled governments of various countries to enter into agreements with drone & component manufacturers such DJi, GoPro, and Controp Precision Technologies Ltd. to offer better & advanced products, which supplements the growth of the market across the globe.

The key factors that contribute toward the drone camera market growth are the introduction of technologically advanced products and promising growth rate of the supplements the growth of the global drone camera market. However, privacy & security concerns and the availability of high-resolution satellite imagery are the factors that hamper the growth of the market.

On the contrary, rise in demand of drones across emerging nations and increase in application areas of drone cameras such as GPS, LiDAR, and mapping services are expected to provide lucrative opportunities for the growth of the global market during the forecast period.

The global drone camera market is segmented into type, application, resolution, end user, and region. Depending on type, the market is categorized into SD camera & HD camera. The applications covered in the study include photography & videography, thermal imaging, and surveillance. Depending on resolution, the market is segregated into 12 MP, 12 to 20 MP, 20 to 32 MP, and 32 MP & above. On the basis of end user, it is fragmented into commercial, military, and homeland security. Region wise, the global market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Key players operating in the global the drone camera market include Aerialtronics DV B.V, Canon Inc., Controp Precision Technologies Ltd., DJI, DST Control, FLIR Systems, Inc., Garmin Ltd., GoPro, Inc., Panasonic Corporation, and Sony Corporation.

By Type

HD camera is projected as the most lucrative segments

Introduction Of Technologically Advanced Products

The drones industry has witnessed lucrative growth in recent years due to their advanced features such as high resolution cameras and advanced sensors systems. This has further encouraged key industry players to improve their product portfolio by introducing advanced technologies. Some of the popular drone cameras with advanced sensors are Aeryon HDZoom30 by Aeryon Labs Inc., SAFIRE series by FLIR Systems, Inc., Zenmuse Series by SZ DJI Technology Co., and Hero Series by Go Pro, Inc., which have advanced features such as micro four-thirds system, voice control mechanism, and shortwave infrared (SWIR) sensors.

Moreover, companies such as Elbit Systems Ltd., GoPro, Inc., Israel Aerospace Industries Ltd., FLIR Systems, Inc., and Aeryon Labs Inc. have advanced products in their UAV segment. For instance, Mantis i45 uses ultra-high-resolution EO and IR imagers, latest low-light camera, and high-power illuminator, and is equipped with on-board facility for high-definition video storage and an on-board image processor.

By Application

Surveillance is projected as the most lucrative segments

Promising Growth Rate Of The Drone Camera Market

Technological advancements in the industry & increased application areas such as precision agriculture, aerial imaging, cargo management, traffic monitoring, and security & surveillance trigger the growth of drone camera market. Since the market is in its growing stage, it is expected to witness high demand in the next few years due to the continuous availability of advanced products.

According to a report released by the Federal Aviation Administration, the global sales of drones crossed 8.3 million units in 2019, and is expected to grow lucratively in the upcoming years due to increase in demand for safety & security and the need for surveillance. Moreover, the industry has witnessed the entry of a number of new firms such as Lily Robotics Inc. (2013) and SkySafe (2015). Thus, all these factors collectively boost the growth rate of the drone market, which, in turn, supports the global drone camera market growth.

By Resolution

20 to 32 MP is projected as the most lucrative segments

Increase In Privacy & Security Concerns

Aerial imaging, green mapping, LiDAR, GIS services, and other related applications are involve the capturing of landscape information, including photographs and imagery solutions through drones with the help of EO/IR and other systems. To protect the private space of public and resolve the issues related with national security, governments of various nations have formulated laws, which restrict the growth of this market.

For example, in the North American market, the Federal Aviation Administration (FAA) stated that private & commercial UAVs can fly only up to 500 ft. above ground level and are not allowed in the radius of 3 miles around airports or flying strips.

Moreover, they are not allowed to violate any privacy acts, security laws, and cannot invade flight restricted and National Oceanic & Atmospheric Administration (NOAA) zones. However, regulations stated by the FAA and other governments are still under development, hence, no proper regulatory framework is defined for this market.

By End User

Military is projected as the most lucrative segments

Rise In Demand Of Drones Across Emerging Nations

Rise in safety & security concerns across countries has increased the need for drones to be used for such applications. This has further enabled drone manufacturers to develop & install advanced components, which are beneficial as per the safety & security concerns.

Moreover, countries across the globe are updating their UAV fleets with the new UAVs for effective operations and results. For instance, in December 2020, the UK Government deployed around 30 bug drones in the British army for spying, and is also in the process of adding more of UAVs in its existing drone fleet.

Furthermore, increase in trend of contactless product delivery has enabled numerous companies to adopt drones for product delivery. These delivery drones are equipped with advanced sensors and camera to maintain accuracy while delivering the product.

For instance, Amazon & UPS have been testing drone deliveries for products while other companies such as Flirtey, Skycatch, 3DR, and Aeryon have been operating in drone-based product delivery. Such advancements & introduction of new concepts in drones lead to rise in demand for drones across emerging nations, thereby augmenting the growth of the global market.

By Region

Asia-Pacific would exhibit the highest CAGR of 31.3% during 2020-2027.

Key Benefits For Stakeholders

This study presents the analytical depiction of the global drone camera market analysis along with the current trends and future estimations to depict imminent investment pockets.

The drone camera market opportunity is determined by understanding profitable trends to gain a stronger foothold.

The report presents information related to the key drivers, restraints, and opportunities of the global drone camera market with a detailed impact analysis.

The current drone camera market is quantitatively analyzed from 2019 to 2027 to benchmark the financial competency.

Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Key Market Segments

By Type

SD camera

HD camera

By Application

Photography & Videography

Thermal Imaging

- Surveillance

By Resolution

12 MP

12 to 20 MP

- 20 to 32 MP

- 32 MP and above

By End User

Commercial

Military

- Homeland security

By Region

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- France

- UK

- Russia

- Rest of Europe

Asia-Pacific

China

Japan

- India

- Australia

- Rest of Asia-Pacific

LAMEA

Latin America

Middle East

- Africa

Key Players

- Aerialtronics DV B.V

- Canon Inc.

- Controp Precision Technologies Ltd.

- DJI

- DST Control

- FLIR Systems, Inc.

- Garmin Ltd.

- GoPro, Inc.

- Panasonic Corporation

- Sony Corporation

Drone Camera Market Report Highlights

| Aspects | Details |

| By TYPE |

|

| By APPLICATION |

|

| By END-USER |

|

| By RESOLUTION |

|

| By Region |

|

| Key Market Players | Sony Corporation, DJI, Aerialtronics DV B.V., Garmin Ltd., FLIR Systems, Inc., Panasonic Corporation, DST CONTROL, Controp Precision Technologies Ltd., GoPro, Inc., .Canon Inc |

Analyst Review

Drone camera is a device that is installed in a drone and is meant to carry out specific tasks such as to record videos or to take photo while the drone is flying. The global drone camera market is expected to witness a significant growth due to increase in demand for drones equipped with advanced components such as high-resolution camera, LiDAR and GPS. The market in the developed countries, such as the U.S., Germany, and China are expected to provide lucrative opportunities for the growth of the market, due to increase in concern toward the safety and security of countries.

Drone manufacturers are focused on innovations related to drones. Recent developments have been carried out on drones & camera, which are expected to provide lucrative opportunity for the growth of the market. For instance, in January 2020, Controp Precision Technologies Ltd. introduced new payload capabilities for future tactical mission requirements, including the T-STAMP-XD for laser-designation missions and the STAMP-VMD for wide-area persistent surveillance with the concepts for SUAVs and drones in the future battlefield. Moreover, in August 2020, FLIR System Inc. introduced TZ20 as the first high resolution, dual thermal sensor gimbal built for the DJI Matrice V2 200 Series and Matrice 300 airframes that is suitable for rescue operations. Such developments carried out by companies across the globe supplement the growth of the market across the globe.

Factors such as technologically advanced products and promising growth rate of the drone market accelerate the growth of the global drone camera market. However, privacy & security concerns and the availability of high-resolution satellite imagery are the factors, which hamper the growth of the drone camera market. Conversely, rise in demand for drones across emerging nations and increase in application areas such as GPS, LiDAR, and mapping services are expected to provide lucrative opportunities for the expansion of the growth of the global market.

Among the analyzed regions, North America is the highest revenue contributor, followed by Asia-Pacific, Europe, and LAMEA. On the basis of forecast analysis, North America is expected to maintain its lead during the forecast period, owing to increase in production of drones across North America, followed by Asia-Pacific, Europe, and LAMEA.

The global drone camera market was valued at $3.32 billion in 2019, and is projected to reach $25.39 billion by 2027, registering a CAGR of 29.9%.

The global drone camera market to register a compound annual growth rate of 29.9%.

The key players analyzed in this report are Aerialtronics DV B.V, Canon Inc., Controp Precision Technologies Ltd., DJI, DST Control, FLIR Systems, Inc., Garmin Ltd., GoPro, Inc., Panasonic Corporation, and Sony Corporation.

North America holds a majority of market share in 2019 while Asia-Pacific is expected to provide lucrative growth opportunities for the growth of the market.

Factors such as technologically advanced products and promising growth rate of the drone market promote the growth of the global drone camera market.

Loading Table Of Content...