The global drone flight controller system market size was valued at $6.6 billion in 2022, and is projected to reach $13.8 billion by 2032, growing at a CAGR of 8% from 2023 to 2032.

Report Key Highlighters:

- The drone flight controller system market report studies more than 16 countries. The research includes a segment analysis of each country in terms of value ($ million) for the projected period 2022-2032.

- The research combined high-quality data, professional opinion and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market and help stakeholders make educated decisions to achieve ambitious growth goals.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The drone flight controller system market share is marginally fragmented, with BAE Systems, JIYI Robot (Shanghai) Co., Ltd., Collins Aerospace, Moog Inc., Safran, DJI, 3DR, Inc., Sky-Drones Technologies LTD, Fusion Engineering, and Honeywell International Inc. Major strategies such as contract, partnerships, product launches, and other strategies of players operating in the market are tracked and monitored.

The drone flight controller is a component in an unmanned aerial vehicle (UAV) or drone that is used for the management and control of its flight. It functions as the central processing unit of the drone, overseeing and regulating diverse aspects of its operation to guarantee a stable and controlled flight experience. Drone flight controller systems are circuit boards integrated with sensors designed to perceive the drone's movements and respond to user commands. Acting as a central hub, they facilitate the connection of various drone peripherals such as ESC, GPS, LED, servos, radio receivers, FPV cameras, and VTX. Moreover, these flight controllers possess the capability to automatically stabilize the drone, hover in a fixed position (loitering), and enable autonomous flight. Their significance lies in their critical role in piloting drones, making them an indispensable component for the construction of any drone.

The drone flight control system market is expanding due to factors such the increasing use of drones in a variety of industries, government policies that encourage drone operations, and developments in flight control technology. Regulating issues and growing privacy and security concerns, however, are impeding the market's expansion. Moreover, the market for drone flight controller systems presents significant development possibilities for manufacturers due to advancements in electric propulsion systems and the increasing need for autonomous drones.

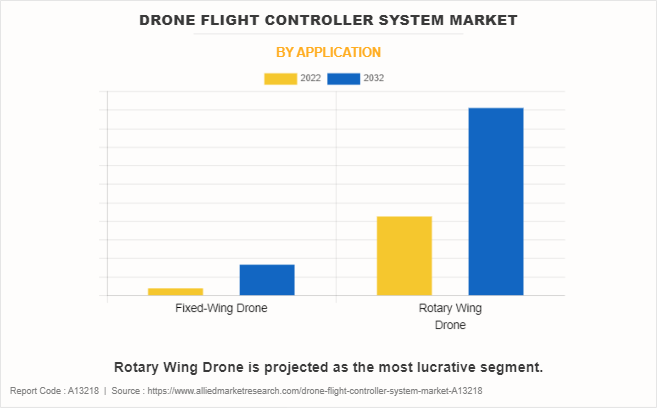

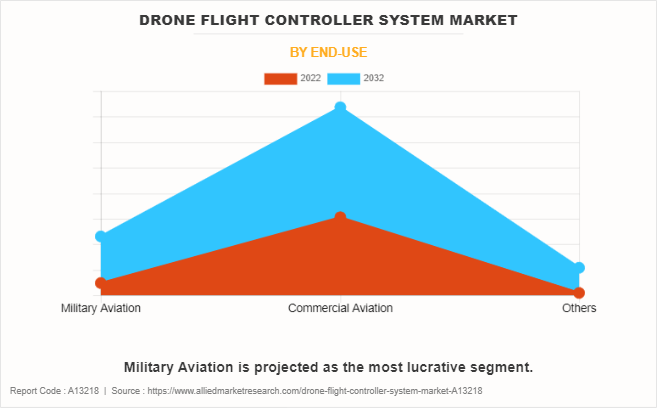

The drone flight controller system market is segmented on the basis of application, end-use, range of operation, sales channel, and region. By application, it is divided into fixed-wing drone, and rotary wing drone. By end use, the market is classified into military aviation, commercial aviation, and others.

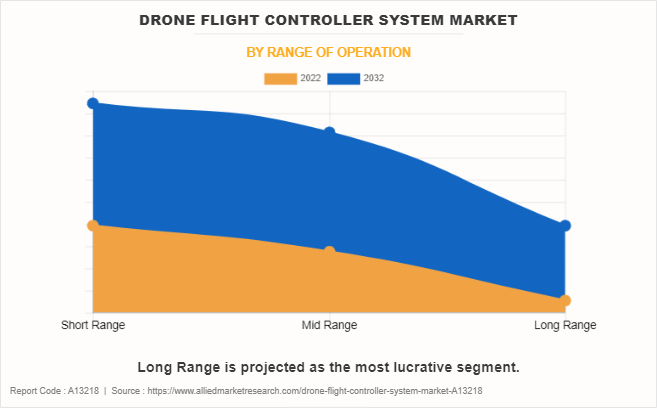

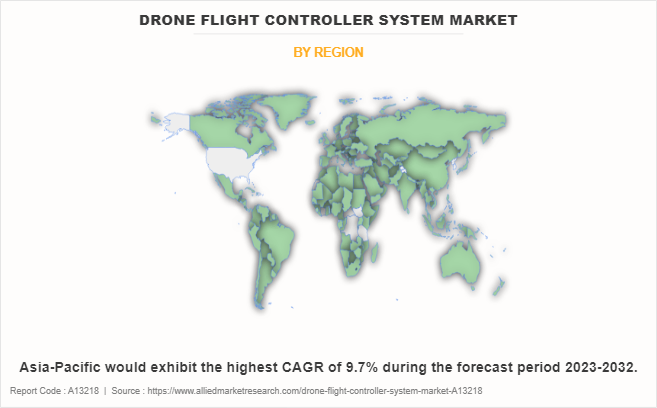

By range of operation, it is fragmented into short range, mid-range, and long range. By sales channel, it is bifurcated into online, and offline. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

North America is a major participant in the drone flight controller system market, because of the ongoing innovation and change in the emerging and next generation technologies. Drones with advanced flight controllers are applied across various sectors in North America, spanning agriculture, construction, energy, and public safety. The adaptability of drone technology promotes the requirement of advanced flight controller system specifically designed to meet the needs of numerous industries. In North America, drones are increasingly being used for commercial purposes. The commercial applications of drones includes surveillance, mapping, delivery and others.

Therefore, this increase in demand for commercial drones in the region is expected to drive the demand for high quality and performance drone flight controller systems. Moreveor, numerous drone manufactures are planning to expand their production plants. For example, the American drone maker Skydio stated in February 2023 that it will be building new manufacturing facilities in Hayward, California, in order to increase its production capacity. This demonstrates the growing trend in demand for drone technology. Such a rise in demand directly translates into a higher need for advanced drone flight controller systems.

Rise in Adoption of Drones across Various Industries

Numerous businesses, including energy, real estate, healthcare, construction, and agriculture, use drones. Crop management, mapping and surveying, infrastructure management, monitoring, and logistics are a few applications. Due to their ability to streamline operations like mapping, surveying, drones are becoming increasingly significant in the construction business. Additionally, drones are gaining utility in healthcare for services such as medication administration, patient monitoring, and emergency response.

The use of drones in agriculture is growing as a precision tool for activities including pest control, yield estimation, and crop monitoring. Drone technology is being used by agricultural technologists and farmers to increase productivity. For instance, the UK Civil Aviation Authority (CAA) granted XAG Agricultural Drones, notably the P40 and V40 models, their first operating licence to do agricultural spraying in February 2023. Drones are permitted to lawfully spray agricultural areas in the United Kingdom. It is expected that these developments would significantly change agricultural methods in the UK. Drones are also used in the energy industry to locate and monitor critical infrastructure, such as power lines and wind turbines.

Drones must meet certain regulations set by businesses, and flight control systems are needed to meet these needs by providing customized controls and navigation Customizing flight controller systems to support specific functionalities ensures drones can efficiently perform tasks and adhere to industry standards. The growing use of drones in various sectors drives the demand for specialized, efficient, and technologically advanced control solutions that cater to the unique needs of each industry.

Supportive Government Regulations and Guidelines for Drone Operations

Clear and supportive regulatory frameworks create a legal environment that motivates businesses and industries to embrace drone technology across various applications. When governments establish rules facilitating drone operations, industries are more likely to invest in sophisticated drone systems, including advanced flight controller technology.

Regulatory emphasis on safety standards for drone operations drives the demand for reliable flight control systems with features such as collision avoidance, emergency landing procedures, and compliance with airspace regulations. Governments may offer operational guidelines and best practices for drone users, outlining the required equipment and technologies, including flight controllers, to meet regulatory standards. This regulatory support encourages the adoption of advanced drone technologies while ensuring safe and responsible drone use.

Regulatory Challenges

The drone industry witnesses ongoing efforts by authorities to develop and refine regulations addressing safety, security, and operational concerns. The dynamic nature of regulatory changes poses challenges for manufacturers to ensure their flight control systems align with the latest standards. Certification processes for drone-related technologies, including flight controllers, demand rigorous testing and adherence to aviation standards.

Any delays or intricacies in obtaining certifications can impede the market entry of new flight control systems, potentially impacting their industry acceptance. Operational restrictions outlined in regulations, such as limitations on airspace usage or flying in overpopulated areas, necessitate the careful design of flight control systems to ensure compliance. These operational constraints can influence the capabilities and functionalities of the systems.

Rise in Security and Privacy Concerns

Drones with their advanced flight controllers routinely collect and transmit data for various operations, especially in areas such as surveillance, mapping, surveillance, and more. Manufacturers and operators should prioritize the implementation of strong cybersecurity measures to ensure that information governed by flight controller systems is transferred, stored and processed role in security

In addition, drones equipped with cameras and sensors can capture images and video, raising privacy concerns. The incorrect use of abusive technology to monitor poorly consenting participants can be problematic. Regulatory frameworks and industry standards should establish clear guidelines on the collection, storage and use of data to manage privacy and maintain ethical practices

Innovation in Electric Propulsion Systems

The drone flight controller system market trends indicate advancement in electric propulsion systems which provides tremendous growth opportunities for the market. With electric propulsion in the drone industry becoming increasingly popular due to its environmental benefits, efficiency and improved productivity, there is a growing need for a flight controller

Flight controllers specifically designed for electric propulsion can seamlessly integrate advanced algorithms, real-time monitoring, and adaptive controls to ensure optimal efficiency and responsiveness. These controllers address the distinctive challenges and characteristics of electric propulsion, contributing to improved overall flight stability, control, and safety.

Recent Developments in the Drone Flight Controller System Industry

- In November 2023, AIBOT awarded Honeywell a contract for the delivery of its Compact Fly-By-Wire (cFBW) system, which will be utilised in AIBOT's totally electric vertical takeoff and landing.

- In October 2022, BAE Systems announced a partnership with Supernal, a unit of Hyundai focused on advanced air mobility (AAM) aircraft to develop and manufacture the flight control technology for its upcoming electric takeoff and landing (eVTOL) air taxis.

- In January 2022, Moog Inc. signed a contract with the Defense Advanced Research Projects Agency (DARPA) to provide precision motion control for elements of the Gremlins demonstration system including GAV tail fin control, GAV wing deploys, and fin control.

- In October 2022, The latest drone flight controller, AirLink 5G, was introduced by Sky-Drones Technologies LTD. Any kind of UAV, including fixed-wing drones, hybrid VTOL drones, and VTOL multirotor drones, can be simply integrated with the flight control system.

- In March 2021, Fusion Engineering, a Dutch start-up based in Delft, announced the release of its first product, the Fusion Reflex Introductory Model. The flight controller allows drones to operate under more adverse weather conditions.

- In October 2020, Pipistrel, an unmanned aerial vehicle (UAV) company, awarded Honeywell International Inc. a contract to supply cutting-edge flight control technologies for unmanned freight aircraft.

Impact of Russia-Ukraine war on Drone Flight Controller System Industry

Russia launched an invasion of Ukraine on February 24, 2022, which was a major turning point in the ongoing Russo-Ukrainian War, which started in 2014. The prolonged battle may cause supply chain disruptions for drone parts, particularly flight controllers. If key manufacturers or suppliers are situated in the affected regions, there are anticipated to be delays in production, shortages, or heightened costs. Geopolitical tensions and uncertainties may prompt a reassessment of trade relationships and international collaborations, impacting the seamless exchange of drone-related technologies, including flight controllers, between countries.

Regulatory changes linked to drone technology and its components may emerge as a response to the conflict. Governments may introduce new regulations addressing security concerns, thereby influencing the development and deployment of drones and associated systems. The conflict may emphasize the criticality of security in drone operations, fostering increased attention and investment in counter-drone technologies. Geopolitical dynamics might impact the demand for drones in specific regions or industries. Shifts in security priorities, surveillance requirements, or infrastructure inspections due to geopolitical events are expected to influence the adoption of drone technologies.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the drone flight controller system market analysis from 2022 to 2032 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as market trends, key players, market segments, application areas, and market growth strategies.

Drone Flight Controller System Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 13.8 billion |

| Growth Rate | CAGR of 8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 280 |

| By Application |

|

| By End-Use |

|

| By Range of Operation |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Fusion Engineering, DJI, Honeywell International Inc., Sky-Drones Technologies LTD, Moog Inc., BAE Systems, Collins Aerospace, JIYI Robot (Shanghai) Co., Ltd., Safran, 3DR, Inc. |

The global drone flight controller system market was valued at $6,605.6 million in 2022, and is projected to reach $13,745.1 million by 2032, registering a CAGR of 8.0% from 2023 to 2032

Theop companies to hold the market share in Drone Flight Controller System include BAE Systems, JIYI Robot (Shanghai) Co., Ltd., Collins Aerospace, Moog Inc., Safran, DJI, 3DR, Inc., Sky-Drones Technologies LTD, Fusion Engineering, and Honeywell International Inc.

The largest regional market for drone flight controller system is North America.

The leading application of drone flight controller system market is rotary wing drone.

The upcoming trends of drone flight controller system market in the world are innovation in electric propulsion systems, and rise in demand for autonomous drones.

Loading Table Of Content...

Loading Research Methodology...