Drone-in-a-Box Solutions Market Research, 2033

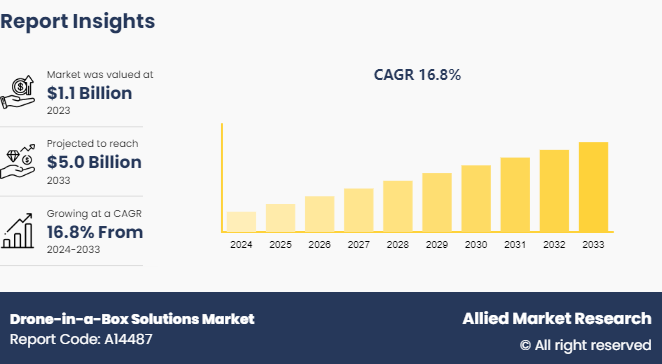

The global drone-in-a-box solutions market size was valued at $1.1 billion in 2023, and is projected to reach $5.0 billion by 2033, growing at a CAGR of 16.8% from 2024 to 2033.

Market Introduction and Definition

Drone-in-a-box solution is an emerging form of autonomous unmanned aerial vehicle (UAV) technology that uses drones that deploy from and return to self-contained landing boxes. Moreover, traditional drones, or UAVs, consist of both a non-manned aircraft and some form of ground-based controller. Whereas drone-in-a-box solutions, on the other hand, deploys drone autonomously from a box that also functions as a landing pad and charging base. After carrying out a pre-programmed list of instructions, they return to their base to charge and/or upload information.

Furthermore, stand-alone drone-in-a-box solutions are composed of three main components a ground station that charges & shelters the drone, the drone itself, and a computer management system that allows the operator to interact with the system, including multiple drones. The ground station also provides battery charging and conducts health checks and can be made of either metal or carbon fibre. Drone-in-a-box solution has improved the portability of drones and hassle-free usage in mobile location without any issue of charging. In addition, it is being used by military & defense for tactical missions, monitoring activities, traffic management, and others.

Key Takeaways

The drone-in-a-box solutions market share covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major drone-in-a-box solutions industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

On June 6, 2023, Airobotics and HHLA Sky partnered to offer drone services. A subsidiary of Hamburger Hafen und Logistik AG (HHLA) , a Europe-based port and transport logistics company, have entered a strategic partnership to offer advanced drone services to protect and support terminal operations, critical infrastructure and industrial operations. The companies will jointly focus on integrating Airobotics’ Optimus System, the world’s first FAA-certified drone-in-a-box system designed for autonomous 24/7 data capture and analytics in complex environments, in seaport operations and other critical facilities.

Key Market Dynamics

The global drone-in-a-box solutions market growth is growing due to several factors, such as growing demand for drones as a service, rising popularity of online retail and subscription model and increasing use of drone for personal use. However, strong regulations regarding commercial drones and the limited battery life of drones restrain the development of the market. In addition, increased use in the agriculture sector and technological advancement in drone technology provides drone-in-a-box solutions market opportunity during the forecast period.

In recent years, the demand for drones has increased significantly, especially due to its increased use in precision agriculture. Drones manufacturers are specifically upgrading the drones for specific use in farming. These drones are equipped with high-resolution cameras and sensors which are capable of monitoring crop health, detect pests and diseases, and optimize irrigation systems, leading to increased efficiency and productivity in farming. Moreover, these drones are also being used for surveying and mapping, reducing the need for manual labor and improving project accuracy.

However, as the farming industry requires drones for a specific period of time, there is increased growth in subscription and rental services of drones, which make them more accessible to both consumers and businesses. The subscription and rental services reduce the financial barrier, allowing customers to access high-quality drones without the need for a significant initial investment. Moreover, subscription services offer comprehensive packages that include not only the drone but also accessories, maintenance, insurance, and software updates. Thus, many end-use industries tend to rent or subscribe to drones as compared to buying them. Hence, the growing trend of drone subscription models facilitates the growth of the market.

However, the limited battery life of modern drones is restraining the growth of the market to some extent. The limited battery life affects the performance, efficiency, and overall utility of drones. The primary factor limiting drone flight times is the energy density of batteries. Most drones rely on lithium-ion (Li-ion) batteries, which, despite their relatively high energy density, still fall short of providing long endurance. Advances in battery technology are progressing, but current Li-ion batteries are unable to sustain prolonged flight durations due to their inherent energy storage limitations. Additionally, modern drones are equipped with various electronic components such as motors, sensors, cameras, and communication systems, which require high power output to perform optimally, thus draining the battery from drones. Thus, the limited battery life of drones is anticipated to continue to hinder the growth of the market during the forecast period.

Regulatory Analysis

The International Civil Aviation Organization (ICAO)

The International Civil Aviation Organization (ICAO) is a specialized agency of the United Nations, established in 1944 to manage the administration and governance of the convention on International Civil Aviation. ICAO sets international standards and regulations for aviation safety, security, efficiency, and environmental protection. These standards cover various aspects of aviation, including air navigation, flight operations, aircraft design, airport infrastructure, and air traffic management. The organization also serves as the global forum for international civil aviation, maintaining an administrative and expert bureaucracy to research and develop new aviation policies and standards, undertaking compliance audits, performing studies and analyses and providing assistance to member states.

Market Segmentation

The drone-in-a-box solutions industry is segmented into product, type, application and region. On the basis of product, the market is analyzed into hardware and software. Based on type, the global market is segregated into single rotor and multirotor. On the basis of application, the market is segregated into commercial, residential and military. Region-wise, the market is analyzed in North America, Europe, Asia-Pacific, Latin America, the Middle East, and Africa.

Regional/Country Market Outlook

The growth in the drone industry is still evolving, and regulations are being developed around the world. There are various laws related to insurance coverage, aircraft registration, drone license and pilot license, and flying of drones in restricted zones.

Europe

In most European nations, people can use drones for leisure activities without special permits or permission from aviation authorities.?However, national drone authority have various laws regarding use of personal and commercial drones, for instance, professional and licensed drone pilots have the exclusive right to sell photos and videos captured from flights. Furthermore, operating a drone weighing more than 250 grams needs to be registered with the nation’s National Aviation Authority (NAA) . The registration is valid for a specific time ordered by the NAA.

North America

The Federal Aviation Administration (FAA) in the U.S. has many regulations that have hampered the expansion of the drone industry. For both commercial and?recreational drones use, the FAA has separate limitations, although recreational drone regulations differ from commercial ones in several aspects. In the U.S., the FAA had registered 1, 509, 617 drones as of December 10, 2019. Furthermore, in some regions, pilots need to get a valid flying license from over 700 testing facilities for commercial drones.

Asia-Pacific

The drone industry in Asia-Pacific is evolving at a rapid pace. In countries such as Japan, drone deliveries and personal use are now legal although it will take a few years before flying drones around residential areas are permitted. Regulations in the region are continuously updated and revised, even in countries with established drone legislation.

Competitive Landscape

The major players operating in the drone-in-a-box solutions market include Airobotics, Atlas Dynamics, Azur Drones, Easy Aerial, American Robotics, DroneHive, Asylon, Antwork, Percepto and H3 Dynamics.

Other players in the drone-in-a-box solutions market include SkyX, HEISHA Technology Co., Ltd, Dronematrix, Fotokite, Matternet, Skycharge, Ondas Holding, ECA Group, Delta Drones and so on.

Industry Trends

Swarm Technology

Swarm drone technology is an emerging technology that includes the integration of multiple unmanned aerial vehicles (UAVs) that coordinate with each other to perform tasks cooperatively with minimal human intervention. These drones can range from a few to thousands in number and are designed to work together to achieve complex goals, such as surveillance, reconnaissance, and attack missions. In a swarm technology, each drone in a swarm can be equipped with different sensors (e.g., cameras, LIDAR, thermal sensors) , allowing the swarm to collect diverse and huge amounts of data to provide comprehensive information regarding the area in real-time.

Improved Battery Life and Power Efficiency in Drones

The growth in UAV and drone technology and its increased utilization in a wide range of industries such as defence, agriculture, surveillance and others. The growing demand for UAVs and drones resulted in their technological advancement and helped in the development of their battery range and power efficiency. To increase the power density and improve battery life, UAV and drone manufacturers are utilizing modern Lithium-Sulfur (Li-S) batteries and other solid-state batteries to offer a good balance between energy density, weight, and cost. Moreover, major UAV and drone manufacturers are experimenting with Hydrogen fuel cells, which are emerging as a promising alternative for powering drones as they offer a much longer flight duration compared to batteries, and the only byproduct is water, making them environmentally friendly.

Key Sources Referred

National Aeronautics and Space Administration (NASA)

European Space Agency (ESA)

Russian Federal Space Agency (Roscosmos)

China National Space Administration (CNSA)

Indian Space Research Organisation (ISRO)

Japan Aerospace Exploration Agency (JAXA)

United Launch Alliance (ULA)

Airports Council International (ACI)

Federal Aviation Administration (FAA)

European Union Aviation Safety Agency (EASA)

Motor & Equipment Manufacturers Association (MEMA) ?

Society of Automotive Engineers (SAE) ?

Aerospace Component Manufacturers Association (ACMA)

European Association of Aerospace Industries (ASD)

Aerospace Industries Association (AIA)

International Aerospace Quality Group (IAQG)

Japan Aerospace Exploration Agency (JAXA)

National Aerospace Standards (NAS)

German Aerospace Industries Association (BDLI)

Key Benefits For Stakeholders

This report provides a quantitative analysis of the drone-in-a-box solutions market forecast segments, current trends, estimations, and dynamics of the drone-in-a-box solutions market analysis from 2023 to 2033 to identify the prevailing drone-in-a-box solutions market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the drone-in-a-box solutions market trends segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global drone-in-a-box solutions market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global drone-in-a-box solutions market size, market trends, key players, market segments, application areas, and market growth strategies.

Drone-in-a-Box Solutions Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 5.0 Billion |

| Growth Rate | CAGR of 16.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Product |

|

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Percepto, Airobotics Ltd., Antwork, DroneHive, Asylon, Atlas Dynamics, American Robotics, Inc., H3 Dynamics, Easy Aerial, Azur Drones |

Integration of lightweight material in the manufacturing of drones is the upcoming trend in the drone-in-a-box solutions market.

Commercial aviation is the leading application of drone-in-a-box solutions market.

Asia-Pacific is the largest region for drone-in-a-box solutions market.

The drone-in-a-box solutions market was valued at $1.1 billion in 2023.

Airobotics, Atlas Dynamics, Azur Drones, Easy Aerial and American Robotics are some of the major companies operating in the market.

Loading Table Of Content...