The global drone package delivery market was valued at $0.94 billion in 2021, and is projected to reach $32.1 billion by 2031, growing at a CAGR of 43.3% from 2022 to 2031.

Package delivery drone also referred as unmanned aerial vehicle or unmanned aircraft systems is an aerial vehicle that is utilized for transportation of food, medical supplies, and other goods. These drones deliver goods in less time and with high accuracy with minimum intervention of humans. These drones are controlled through automation systems, which aids in reduction in labor costs and human errors. These package delivery drones also provide several benefits such as reduction in distribution costs, faster deliveries as well as reduction in urban traffic and CO2 emissions. Moreover, cargo and logistics transportation organization have also started to adopt drones for delivering goods to remote areas, vertical take-off, and landing along with its ability to fly at high speeds, making drones suitable for a range of delivery options.

Growth of the global drone package delivery market has propelled, owing to rise in demand for time-efficient delivery service, rise in demand for drones in last mile delivery, and technological advancements. However, limited operational bandwidth of drones, cybersecurity issues associated with drones, and short flying duration of drone hamper growth of the market. Furthermore, revamped government regulatory framework is the factor expected to offer growth opportunities during the forecast period.

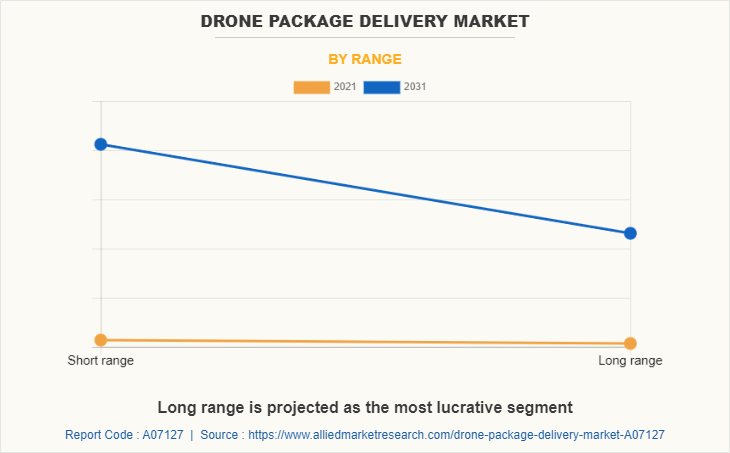

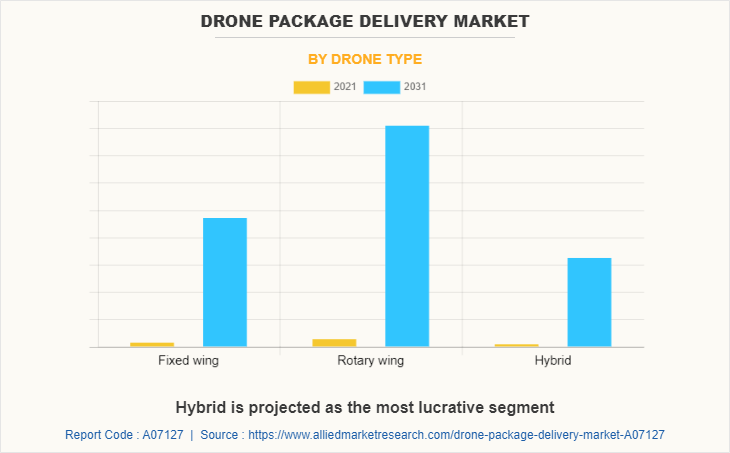

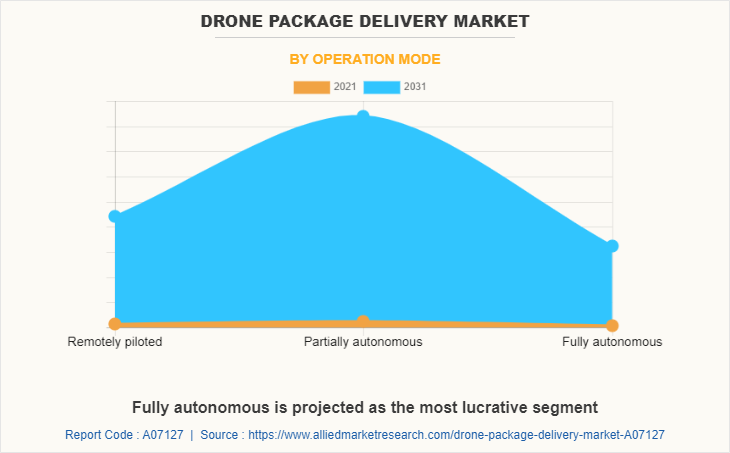

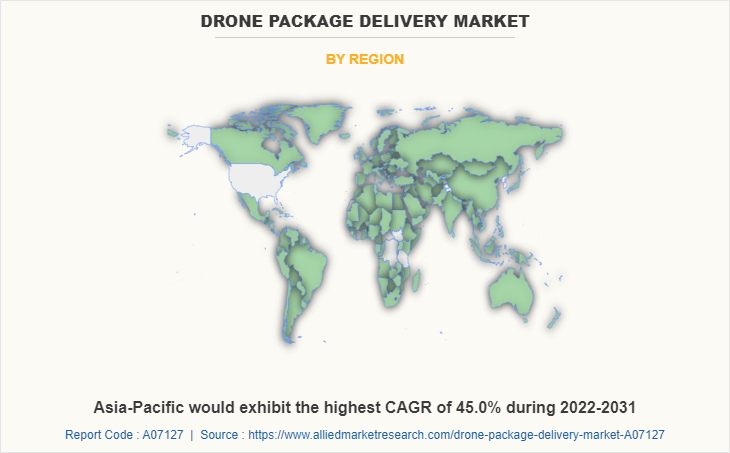

The drone package delivery market is segmented on the basis of drone type, range, package size, operation mode, end-use, and region. By drone type, it is segmented into fixed-wing, rotary wing, and hybrid. By range, it is classified into short-range and long-range. By package size, it is fragmented into less than 2 kg, between 2 kg and 5 kg, and greater than 5 kg. By operation mode, it is segmented into remotely piloted, partially autonomous, and fully autonomous. By end-use, it is categorized into logistics, healthcare & pharmaceuticals, retail & e-commerce, foods & beverages, and others. By region, the report is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Some leading companies profiled in the drone package delivery market report comprises Amazon.com, Inc., Deutsche Post DHL Group, Drone Delivery Canada, DroneScan, FedEx, Flytrex Inc., Matternet, Pinc Solutions, United Parcel Service of America, Inc., Wing Aviation LLC, Workhorse Group, Wingcopter, and Zipline International Inc.

Rise in demand for time-efficient delivery service

The global logistics and e-commerce market has experienced growth in recent years. Growth in e-commerce and logistics industries drives demand for time-efficient delivery solutions for transportation of critical goods across the globe. For instance, in April 2021, ANA Holdings Inc. and Wingcopter announced a partnership for accelerating development of vital pharmaceuticals and other consumer product drone delivery infrastructure.

The partnership is aimed at building a drone delivery infrastructure across Japan. The major e-commerce and logistics giants, namely, Amazon and DHL have launched drone delivery systems to make quick deliveries and transport packages to places inaccessible by conventional transport systems. For instance, in May 2019, DHL Express and EHang entered into a strategic partnership for launching an intelligent and fully automated smart drone delivery solution in the urban areas of China.

Smart drone delivery solution offer a less energy-consuming, efficient, and cost-effective autonomous delivery service in China. Aviation administration around the world is approving commercial delivery companies for operating drones to provide delivery services. For instance, Federal Aviation Administration approved Alphabet-owned startup, Wing, for making commercial deliveries through drones in the U.S. in April 2019. The approval will facilitate Wing in making drone-based deliveries in Virginia.

In addition, advantages such as safe and efficient operations associated with drone delivery solutions promote the adoption of drones for providing delivery and investment for developing drone delivery systems by commercial and logistics organizations across the globe. The increase in the adoption of drone delivery systems to enhance the efficiency and increase the cost-effectiveness of the delivery systems are the factors that propels the growth of drone package delivery market during the forecast period.

Rise in demand for drones in last mile delivery

Logistics is the backbone of every economy, however the pandemic outbreak has disrupted supply chains globally. Last mile delivery process of supply chain operation has been affected, owing to which retailers are struggling to meet growing customer demands for expedited deliveries. Therefore, several logistics stakeholders are exploring drone technology to reduce operational costs, overcome traffic bottlenecks, and quell vehicular emissions while satisfying the customer appetite for on-demand and instant delivery.

Drones are ideal for last-mile deliveries, owing to their compact size, quick speed, low operational costs and reduced environmental impact. Therefore, e-commerce giants such as Amazon and Walmart are trying to penetrate the rural and remote areas with drone deliveries.

Moreover, owing to enormous potential of last mile drone deliveries, drones are being deployed all across the globe for delivering medical supplies, vaccines, groceries and food items. The use cases of drone for last mile deliveries are rising each day across the globe. For instance, drone delivery startups TechEagle is partnering with Indian state governments to deliver COVID-19 vaccines, medical essentials and others. Hence, all the above-mentioned factors collectively result in increase in demand for drones for the logistics industry as well as in drone package delivery industry. Thus, rise in demand for drones in last mile delivery is the factor that drives growth of the drone package delivery industry.

Technological advancements

Drones have evolved significantly in past few years and offer a smart mobility alternative for businesses and consumers worldwide. The evolution of technologies such as artificial intelligence, 3D imaging, big data, analytics, and others has promoted the growth in the adoption of these advanced technologies in drones for accomplishing time-sensitive missions. For instance, the incorporation of artificial intelligence in drones enables autonomous or assisted flight by collecting and implementing visual and environmental data collected from the sensors attached to the drone. The technological advancement in drones propels the usage of modern drones in various industries. For instance, thermal sensor drones can find people and animals during a catastrophe which increases its rate of adoption in search and rescue operations. In addition, the utilization of sense & avoid systems in aerial delivery drones is also increasing owing to enhanced safety and beyond visual line of sight features they offer. Sense and avoid systems are a combination of cameras, radar, LiDAR and other systems that aids in detection and avoidance of obstacles successfully. Technological advancements in these systems aids in carrying out drone package delivery operations autonomously and safely. Moreover, increase in investments for developing novel drone services also fuel evolution of new drone technologies with multiple applications such as law enforcement and border control surveillance and storm tracking and forecasting hurricanes and tornadoes. Thus, technological advancements in drones drive growth of the drone package delivery market.

Revamped government regulatory framework

Drone operators need to pass certain aviation regulatory frameworks of respective countries that they operate in. Increase in usage of drones internationally has led regulatory bodies to incorporate drones in their framework for supporting drone service development owing to benefits offered by drones such as low energy consumption, less air pollution, and reduced road congestion. With increase in demand for Beyond Visual Line of Sight (BVLOS) operations, the Global Navigation Satellite System (GNSS) technology is utilized for navigation by drone operators. Use of regional global navigation satellite systems (GNSS) such as GPS, GLONASS, Galileo, and Beidou are regulated by governments. Aviation administrations around the world are developing new regulations for promoting growth in adoption of drones. For instance, in August 2019, the Kansas Department of Transportation was authorized by the Federal Aviation Administration (FAA) for conducting Beyond Visual Line of Sight (BVLOS) operations in the country.

The drone package delivery market is segmented into Drone Type, Range, Package size, Operation Mode and End-use.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the drone package delivery market analysis from 2021 to 2031 to identify the prevailing drone package delivery market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the drone package delivery market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global drone package delivery market trends, key players, market segments, application areas, and market growth strategies.

Drone Package Delivery Market Report Highlights

| Aspects | Details |

| By Drone Type |

|

| By Range |

|

| By Package size |

|

| By Operation Mode |

|

| By End-use |

|

| By Region |

|

| Key Market Players | Zipline International Inc., Matternet Inc., Workhorse Group, Wingcopter GmbH, DroneScan, Flytrex Inc., PINC Solutions, Amazon.com, Inc., Drone Delivery Canada Corp., Deutsche Post DHL Group, Wing Aviation LLC, United Parcel Service of America, Inc., FedEx Corporation |

Analyst Review

The drone package delivery market is expected to witness significant growth, owing to rise in demand for time-efficient delivery services, rise in demand for drones in last mile delivery, and technological advancements.

BVLOS operation was conducted by using onboard detect-and-avoid systems. Governments across the world are developing and implementing a new regulatory system for encouraging drone usage. For instance, the Norwegian Civil Aviation Authority issued European Light UAS Operator Certificate (LUC) to Nordic Unmanned in April 2021. The certificate enables Nordic unmanned in deploying its entire Unmanned Aerial System (UAS) fleet for beyond visual line of sight (BVLOS) flights throughout EASA member countries. Governing bodies have eased regulations for drone operations, namely, authorization, certification, and spatial limitations worldwide to facilitate adoption of drones by various industries. Hence, government regulatory framework presents an opportunity for growth of the drone package delivery market.

To gain a fair share of the market, major players adopted different strategies, for instance, partnership, product launch, and business expansion. Among these, product launch is the leading strategy used by prominent players such as Amazon.com, Inc., Deutsche Post DHL Group, and Drone Delivery Canada.

The global drone package delivery market was valued at $942.0 million in 2021 and is projected to reach $32,112.3 million in 2031, registering a CAGR of 43.3%.

The leading application of drone package delivery is retail and e-commerce.

The largest region is North America.

Some leading companies in the market include Amazon.com, Inc., Deutsche Post DHL Group, Drone Delivery Canada, DroneScan, FedEx, Flytrex Inc., Matternet, Pinc Solutions, United Parcel Service of America, Inc., Wing Aviation LLC, Workhorse Group, Wingcopter, and Zipline International Inc.

Some upcoming trends in the market include greater application in e-commerce and development of autonomous drones.

Loading Table Of Content...