Drug Abuse Testing Market Research, 2033

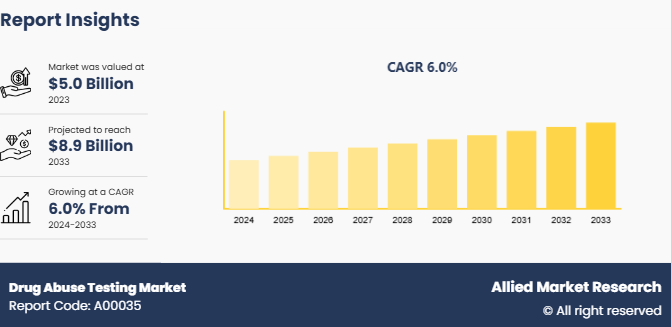

The global drug abuse testing market size was valued at $5.0 billion in 2023, and is projected to reach $8.9 billion by 2033, growing at a CAGR of 6% from 2024 to 2033. The surge in number of people who consume alcohol and illicit drugs such as marijuana, cocaine, and others, is one of the major drivers for the drug abuse testing market. In addition, technological advancements in drug screening/testing devices and stringent government regulations mandating drug screening boost the market growth

Market Introduction and Definition

Commercial protocols of drug abuse testing have undergone considerable change over the recent years, to stay abreast of the relentless rise in new substances being abused, alternative matrices, and market demands. Drug abuse test is a non-invasive technical analysis of biological samples such as blood, hair, urine, and others to diagnose the presence of illegal, prescription drugs, or their metabolites. Among these urine testing is the most common product & service of drug screening. Drug testing offers a critical adjunct to clinical care and substance use. Drug testing is now increasingly being used by sports organizations, employers, forensic purposes, and several other applications.

Key Takeaways

- The drug abuse testing market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period 2023-2033.

- More than 1, 500 Product & Service literatures, industry releases, annual reports, and other such documents of major drug abuse testing industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The drug abuse testing market size has experienced significant changes driven by technological advancements and expanded applications. Sophisticated immunoassay and chromatography analyzers, along with advanced breath analyzers, have improved the efficiency, accuracy, and speed of drug testing. These technological improvements are crucial for addressing the increasing complexity of substance abuse, including the detection of new psychoactive substances. Drug testing has broadened its reach beyond traditional medical settings, now encompassing workplaces, sports organizations, forensic applications, and educational institutions, which significantly broadens the market scope.

Regulatory and legal frameworks continue to be a major driver for the drug abuse testing market share. Stringent government regulations and workplace mandates, particularly in North America and Europe, require regular and comprehensive drug testing, thereby boosting market demand. Furthermore, the rising consumption of drugs and alcohol, along with increased awareness of substance abuse and its societal impacts, continues to fuel Drug Abuse Testing Market Growth. The ongoing opioid crisis and the emergence of new psychoactive substances have necessitated more robust and frequent testing protocols.

Emerging markets such as Asia-Pacific and Latin America present lucrative growth opportunities due to increasing governmental initiatives, improving healthcare infrastructure, and rising incidences of drug abuse. Despite these opportunities, challenges such as the perception of drug testing as a privacy violation and lack of awareness about advanced testing methods in some regions persist. However, continuous advancements in testing technology and the expansion of applications offer significant potential for market players to enhance their presence and meet the growing demand for drug testing services.

Statement from Industry leader

In 2022, Aegis Sciences Corporation CEO, Frank Basile, noted, "The rapid development of advanced testing technologies, particularly in the field of liquid chromatography-mass spectrometry (LC-MS), has significantly enhanced the sensitivity and specificity of drug tests. This technological leap is crucial for accurately detecting a wide range of substances, including newly emerging synthetic drugs. Additionally, Labcorp Diagnostics CEO, Brian Caveney, emphasized the importance of integrating artificial intelligence and machine learning in drug testing protocols. In a 2023 interview, he stated, "AI and machine learning are transforming our ability to quickly and accurately analyze complex datasets from drug tests. This not only improves the speed and reliability of results but also helps in identifying patterns and trends that were previously undetectable. |

Market Segmentation

The drug abuse testing market is segmented into product & service, sample type, and end user. By product & service, the market is divided into analyzers, rapid testing devices, consumables and laboratory services. Analyzers are further segmented into immunoassay analyzers, chromatography analyzers and breath analyzers. Rapid testing devices are further segmented into urine testing devices and oral fluid testing devices. Consumables are further segmented into assay kits, sample collection cups, calibrators & controls, and others. Based on sample type, the market is segmented into urine, oral fluid, breath, hair, and other samples. Based on end user, the market is segmented into workplaces and schools, criminal justice systems and law enforcement agencies, research laboratories and hospitals. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America and Europe are the two dominant regions in the drug abuse testing industry. These regions have significant demand for drug testing products and services due to various factors such as strict workplace regulations, substance abuse prevalence, and advancements in drug testing technologies.

Asia-Pacific witnessed highest growth rate for the drug abuse testing market and is expected to remain dominant throughout the Drug Abuse Testing Market Forecast period attributed to the rise in expenditure on healthcare, increased consumption of alcohol & illicit drugs, and surge in awareness among employers and government agencies toward adverse effects of drugs of abuse.

Industry Trends:

- In May 2024, the Quest Diagnostics Drug Testing Index (DTI) report for 2024 indicates a continued rise in overall drug positivity rates in the workplace. The increase in marijuana positivity persists despite its legalization in many states. Notably, specific industries such as professional office-based sectors, real estate, and technical services have seen significant jumps in positive drug tests. There has also been a notable rise in attempts to tamper with drug test samples.

- In April 2024, according to DISA Global Solutions Inc. there has been significant development in drug testing methodologies, including the adoption of more advanced urine analysis, hair testing, and oral fluid testing. These advancements aim to improve accuracy and address the rising use of synthetic opioids like fentanyl. The increasing inclusion of fentanyl in drug testing panels reflects its major role in overdose deaths among workforce-age adults.

Competitive Landscape

The major companies profiled in the report include Drägerwerk AG & Co. KGAA, Abbott Laboratories, Hoffmann-La Roche AG, Bio Rad Laboratories, Inc., Siemens AG, Thermo Fisher Scientific, Inc., Laboratory Corporation of America Holdings, Danaher Corporation, Quest Diagnostics Incorporated, and Express Diagnostics International Inc.

Recent Key Strategies and Developments

- In December 2023, Quest Diagnostics launched a new 88-compound novel psychoactive substance test panel. The new panel, which tests for 88 compounds, covers a broad array of drug classes, such as designer opioids, designer benzodiazepines, designer stimulants, fentanyl analogs, synthetic cannabinoids, and other illicit additives. Two of these classes are rapidly accelerating America's overdose crisis: other illicit additives (xylazine) and fentanyl analogs (acetyl fentanyl) .

- In December 2022, Omega Laboratories announced the launch of Urine Drugs of Abuse testing services in its modern laboratory in Ontario, Canada. The laboratory has started offering Urine Drug Testing services from January 3, 2022, to complement its molecular testing.

Key Sources Referred

- World Health Organization

- Substance Abuse and Mental Health Services Administration (SAMHSA)

- National Institute on Drug Abuse (NIDA)

- National Institutes of Health (NIH)

- Centers for Disease Control and Prevention (CDC)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the drug abuse testing market analysis from 2025 to 2033 to identify the prevailing drug abuse testing market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the drug abuse testing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global drug abuse testing market trends, key players, market segments, application areas, and market growth strategies.

Drug Abuse Testing Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 8.9 Billion |

| Growth Rate | CAGR of 6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Product And Service |

|

| By Sample Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Laboratory Corporation of America Holdings, Danaher Corporation, Abbott Laboratories, Siemens AG, Thermo Fisher Scientific, Inc., F. HOFFMANN-LA ROCHE AG, The Drägerwerk AG & Co. KGaA, Express Diagnostics International Inc., Quest Diagnostics Incorporated, Bio Rad Laboratories, Inc. |

Analyst Review

The drug testing market is a fragmented market and is largely influenced by the growth in population of drug addicts. Based on the sample type, urine is the most widely tested biological matrix, without the need for venipuncture or potential infection at the site of injection. Whereas, hair sample segment is projected to grow at a higher CAGR when compared with other segments due to advantages offered by it including high resistance to evasion by adulterating or substituting samples and also provides wider window of detection.

However, some countries have individual privacy protection rights, wherein drug abuse tests are considered as violations of an individual’s privacy. In addition, the most common drug test (urine test) that is used globally for its convenience, flexibility, and economical element can be manipulated to a certain extent, which can result in flawed conclusions. This could be a major hindrance for the growth of the drug screening market. Many key players have been working on rapid testing devices to avail the technology in the developing markets at reasonable costs.

North America accounted for the highest market share and is estimated to continue the same during the forecast period. This is attributed to the presence of better medical facilities and ease of availability of the drug abuse testing devices. However, untapped regions such as Asia-Pacific, Africa, and Latin America, are estimated to emerge as lucrative markets, owing to the introduction of promising drug screening technology, growth in demand for the latest drug screening devices, and increase in disposable incomes.

Upcoming trends in Drug Abuse Testing Market include advancements in rapid testing technologies, increased adoption of drug testing in workplaces and schools, and heightened awareness of substance abuse issues. Additionally, the integration of AI and machine learning for more accurate and efficient testing is a notable trend.

The leading product & service in the drug abuse testing market are analyzers.

North America the largest regional market for Drug Abuse Testing Market

The Drug Abuse Testing Market was valued at $5.01 billion in 2023 and is estimated to reach $8.81 billion by 2033, exhibiting a CAGR of 6.0% from 2024 to 2033.

Top companies to hold major market share in drug abuse testing market are Siemens, Danaher Corporation, and Thermo Fisher Scientific Inc.

Loading Table Of Content...