Drug-eluting Balloon Catheters Market Research, 2033

The global drug-eluting balloon catheters market size was valued at $0.6 billion in 2023, and is projected to reach $1.5 billion by 2033, growing at a CAGR of 8.7% from 2024 to 2033. The drug-eluting balloon catheters market is driven by the rising prevalence of cardiovascular diseases, technological advancements enhancing catheter efficacy and safety, and increasing demand for minimally invasive procedures with better clinical outcomes.

Market Introduction and Definition

Drug-eluting balloon catheters are medical devices used in minimally invasive cardiovascular procedures to treat narrowed or blocked blood vessels. These catheters are equipped with a balloon that, when inflated, delivers a therapeutic drug directly to the vessel wall. The drug, typically an anti-proliferative agent, helps prevent restenosis, or the re-narrowing of the artery, by inhibiting cell proliferation and scar tissue formation. Drug-eluting balloon catheters are primarily used in cases where stenting is not ideal, such as in small or difficult-to-access arteries, and offer an alternative to traditional angioplasty and stent-based interventions.

Key Takeaways

- The drug-eluting balloon catheters market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major Drug-eluting balloon catheters industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The drug-eluting balloon catheters market growth is driven by increasing prevalence of cardiovascular diseases, including coronary artery disease and peripheral artery disease, which heightened the demand for effective treatment options that can reduce the risks of restenosis (re-narrowing of arteries) and improve patient outcomes. DEB catheters offer a significant advantage by delivering localized drug therapy directly to the arterial wall during angioplasty, reducing the need for stents and subsequent interventions.

In addition, the rising preference for minimally invasive procedures among both patients and healthcare providers further boosts the growth during drug-eluting balloon catheters market forecast period, as these catheters allow for effective treatment with fewer complications and faster recovery times compared to traditional methods. Furthermore, advancements in catheter design and drug-eluting technologies have also contributed to market growth, with innovations in balloon coatings and drug formulations enhancing efficacy and safety profiles. Furthermore, the expansion of minimally invasive procedures in emerging economies, particularly in Asia-Pacific and LAMEA, is also a significant growth driver for the drug-eluting balloon catheters market size. As access to healthcare improves and the number of skilled interventional cardiologists increases in these regions, led to rise in the demand for advanced cardiovascular devices such as DEBs.

However, the high costs associated with the devices and procedures limiting accessibility, particularly in developing regions, limits market growth. In addition, regulatory hurdles and stringent approval processes delay product launches and further challenges market growth. On the other hand, the rise in adoption of minimally invasive cardiovascular treatments and the advancements in drug coatings and catheter technology, combined with favorable reimbursement policies, provide a drug-eluting balloon catheters market opportunity.

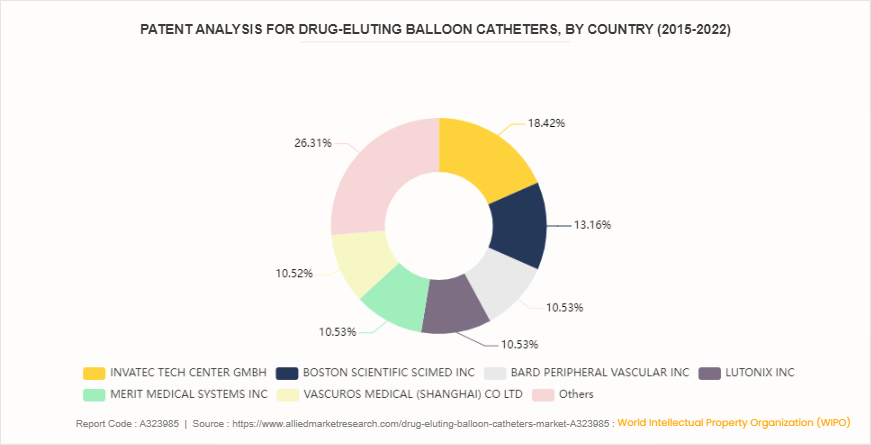

Patent Analysis for Drug-eluting Balloon Catheters, By Company (2015-2022)

According to the World Intellectual Property Organization (WIPO) patent analysis from 2015 to 2022, key players in the drug-eluting balloon catheters market have made significant strides in innovation. Invatec Tech Center GmbH leads with 18.4% of the patents, reflecting its strong focus on advancing catheter technology. Boston Scientific Scimed Inc follows with 13.2%, highlighting its commitment to developing cutting-edge solutions. Bard Peripheral Vascular Inc., Lutonix Inc, Merit Medical Systems Inc, and Vascuros Medical (Shanghai) CO., Ltd. each hold 10.5% of the patents, highlighting their substantial contributions to the field. The remaining 26.3% is attributed to other entities, indicating a broad spectrum of innovation across the industry. This patent distribution emphasizes the competitive landscape and technological advancements driving the drug-eluting balloon catheters market, which is characterized by continuous innovation and intense competition among leading firms to enhance treatment outcomes and expand market reach.

Market Segmentation

The drug-eluting balloon catheters market size is segmented into product type, indication, end user, and region. By product type, the market is bifurcated into paclitaxel drug-eluting balloon catheters and sirolimus drug-eluting balloon catheters. By indication, the market is classified into coronary intervention and peripheral intervention. By end user, the market is divided into hospitals and ASCs, catheterization laboratories, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

In North America, the drug-eluting balloon catheters market share is driven by advanced healthcare infrastructure, rise in prevalence of cardiovascular diseases, and significant investment in medical technology. In addition, well-established reimbursement policies and a strong focus on innovation further supports the market growth in this region. Asia-Pacific market is experiencing rapid growth due to increasing healthcare access, rising cardiovascular disease rates, and expanding patient populations, particularly in China, India, and Japan. Further, enhanced adoption of advanced medical technologies and supportive government initiatives to improve healthcare outcomes further supports market growth.

Industry Trends

- According to Centers for Disease Control and Prevention (CDC) , coronary heart disease is the most common type of heart disease. It killed 371, 506 people in 2022 and about 1 in 20 adults aged 20 and older had CAD in U.S. Rise in cases of CAD led to surge in need for effective intervention options such as drug-eluting balloon catheters. Increased awareness and diagnosis of CAD further drives the demand for innovative treatments, supporting market growth. Consequently, the Drug-eluting Balloon Catheters market stands to benefit from the ongoing need to manage CAD effectively.

- In April 2023, U.S. FDA granted the third IDE approval for Concept Medical’s Sirolimus Coated Balloon MagicTouch SCB. Along with this latest IDE approval for the treatment of Small Vessel indication, Concept Medical received two other IDE approvals for the Magic Touch SCB family of products for the treatment of coronary In-Stent Restenosis (ISR) indication and Below-the-Knee indication (PTA) . The approval drives the strong potential and demand for innovative DEB solutions in treating various vascular diseases, thereby boosting market growth.

Competitive Landscape

The major players operating in the Medtronic, Koninklijke Philips N.V., Boston Scientific Corporation, Becton, Dickinson and Company, Lepu Medical Technology (Beijing) Co., Ltd., Meril Life Sciences Pvt. Ltd., Biotronik, Zhejiang Barty Medical Technology Co., Ltd., Eurocor Tech GmbH, and iVascular. Other players in the drug-eluting balloon catheters market include Concept Medical.

Recent Key Strategies and Developments in Drug-eluting Balloon Catheters Industry

In October 2022, Cordis, a worldwide leader in the development and manufacturing of interventional cardiovascular and endovascular technologies announced its acquisition, subject to customary closing conditions including regulatory approvals, of MedAlliance, a Switzerland-based company at the forefront of transformative drug-eluting balloons. By acquiring MedAlliance, Cordis has the potential to serve two million patients globally by 2027 with the SELUTION SLR (Sustained Limus Release) drug-eluting balloon.

Key Sources Referred

- National Center for Biotechnology and Information (NCBI)

- Centers for Medicare and Medicaid Services (CMS)

- Government of Canada's Health and Wellness

- Ministry of Health and Family Welfare (MoHFW)

- National Health Mission (NHM)

- Centers for Disease Control and Prevention (CDC)

- Food and Drug Administration (FDA)

- National Institutes of Health (NIH)

- World Health Organization (WHO)

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the drug-eluting balloon catheters market analysis to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the drug-eluting balloon catheters market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global drug-eluting balloon catheters market trends, key players, market segments, application areas, and drug-eluting balloon catheters market growth strategies.

Drug-eluting Balloon Catheters Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1.5 Billion |

| Growth Rate | CAGR of 8.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 220 |

| By Product Type |

|

| By Indication |

|

| By End User |

|

| By Region |

|

| Key Market Players | Medtronic, Koninklijke Philips N.V., Meril Life Sciences Pvt. Ltd., iVascular, Zhejiang Barty Medical Technology Co., Ltd., Becton, Dickinson and Company, Lepu Medical Technology(Beijing)Co.,Ltd., Concept Medical, Eurocor Tech GmbH, Biotronik |

The total market value of drug-eluting balloon catheters market was $0.6 billion in 2023.

The market value of drug-eluting balloon catheters market is projected to reach $1.5 billion by 2033.

The forecast period for drug-eluting balloon catheters market is 2024 to 2033.

The base year is 2023 in drug-eluting balloon catheters market.

The market is primarily driven by the increasing prevalence of cardiovascular diseases, technological advancements in catheter designs, and a growing preference for minimally invasive procedures.

Drug-eluting balloon catheters are specialized medical devices used in cardiovascular procedures. They are equipped with a balloon coated with medication that is delivered directly to the arterial wall during balloon angioplasty.

Loading Table Of Content...