E-Brokerage Market Overview

The global e-brokerage market was valued at $11.7 billion in 2022, and is projected to reach $31.1 billion by 2032, growing at a CAGR of 10.6% from 2023 to 2032. The rise of internet access and digitalization, driven by convenience, cost efficiency, and advanced online platforms offering real-time trading tools, research, and investment management services, are contributing to the growth of the market.

Market Dynamics & Insights

- The e-brokerage industry in North America held a significant share of 38% in 2022.

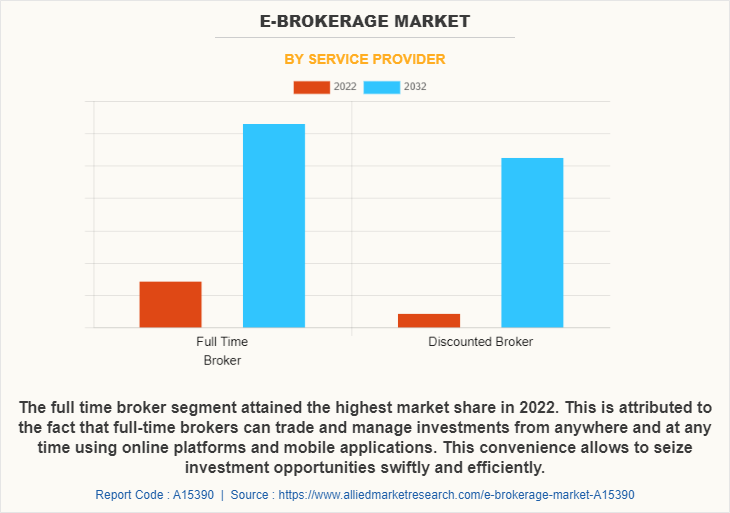

- By service provider, the full time broker segment accounted for the largest market share of 59% in 2022.

- By ownership, the publicly held segment accounted for the largest market share of 70% in 2022.

- By end user, the institutional investor segment accounted for the largest market share of 65% in 2022.

Market Size & Future Outlook

- 2022 Market Size: $11.7 Billion

- 2032 Market Size: $31.1 Billion

- CAGR (2023-2032): 10.6%

- North America: Dominated market share in 2022

- Asia-Pacific: Highest CAGR during the forecast period

What is Meant by E-Brokerage

E-brokerage, also known as electronic brokerage, refers to the provision of brokerage services through electronic platforms and technologies. It involves the buying and selling of financial securities such as stocks, bonds, mutual funds, and other investment products over the internet. E-brokerage platforms act as intermediaries between investors and the financial markets, allowing individuals to trade securities and manage their investment portfolios electronically.

Furthermore, e-brokerage platforms provide investors with various online tools and services, including real-time market data, research reports, investment analysis, portfolio tracking, and order placement capabilities. These platforms offer user-friendly interfaces that enable investors to execute trades, monitor market activity, and access relevant financial information.

The rapid advancements in technology, particularly the internet and mobile devices, have revolutionized the way financial services are accessed and consumed. E-brokerage platforms leverage these technological advancements to offer convenient, user-friendly, and accessible solutions to investors. Moreover, e-brokerage platforms have significantly reduced the cost of trading compared to traditional brokerages. Online brokers typically charge lower commissions and fees for trades, allowing investors to save money. This cost-efficiency appeals to both individual investors and institutional clients. Therefore, these factors notably promote the growth of the e-brokerage market.

However, security concerns and low investor awareness are limiting the e-brokerage industry expansion. Security concerns such as hacking, identity theft, and cybercrime can pose a significant risk to the e-brokerage market. Investors hesitate to use e-brokerage services due to concerns about the safety and security of their personal and financial information. The risk of identity theft, fraud, and hacking can lead to a lack of trust in online brokerage platforms. On the contrary, with the increasing penetration of smartphones and tablets, more and more investors are turning to online and mobile trading platforms to manage their investments. Furthermore, the growing popularity of online investment and trading platforms is anticipated to provide a potential growth opportunity for the market.

The report focuses on growth prospects, restraints, and trends of the e-brokerage market forecast. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the e-brokerage market outlook.

E-Brokerage Market Segment Review

The e-brokerage market is segmented into service provider, ownership, end user, and region. By service provider, the market is differentiated into full time broker and discounted broker. Depending on ownership, it is fragmented into privately held and publicly held. The end user segment is divided into retail investor and institutional investor. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By service provider, the full-time broker segment acquired the highest share in the e-brokerage market size in 2022. E-brokerage platforms provide full-time brokers with unparalleled accessibility to financial markets. They can trade and manage investments from anywhere and at any time using online platforms and mobile applications. This convenience allows brokers to seize investment opportunities swiftly and efficiently, contributing to the growth of the full-time broker segment in the e-brokerage market.

However, the discounted broker segment is attributed to be the fastest-growing segment during the forecast period. One of the primary driving factors for the discounted broker segment in the e-brokerage market is cost efficiency. Discounted brokers offer lower commission fees and transaction costs compared to traditional brokerage firms. This cost advantage attracts investors who are looking to minimize their expenses and retain a larger portion of their investment returns.

Region wise, North America dominated the e-brokerage market share in 2022. This was attributed to the result of a rapid increase in the adoption of high-speed internet, and mobile devices, and a growing awareness of online trading. With these trends, more investors are turning to e-brokerage platforms to execute trades, monitor their investments, and manage their portfolios. Furthermore, online brokerages typically charge lower transaction fees compared to traditional brokerage firms, making it more affordable for small investors to enter the market.

However, Asia-Pacific is considered to be the fastest-growing region during the forecast period. With the increasing availability of affordable smartphones and internet connectivity, more people in Asia-Pacific are accessing the internet, which has led to a surge in online transactions, including investments. Furthermore, several governments in the region are introducing policies that encourage the growth of the e-brokerage industry. For instance, India's SEBI has allowed e-brokers to operate without physical offices, reducing operational costs. Therefore, these factors contribute to the growth of the e-brokerage market.

The key players operating in the e-brokerage market include Charles Schwab & Co., FMR LLC, E*TRADE, Interactive Brokers LLC, eToro, FP Markets, eOption, tastytrade, Inc., XTB, and TD Ameritrade. These players have adopted various strategies to increase their market penetration and strengthen their position in the e-brokerage industry.

Country-specific Statistics & Information

E-brokerage firms offer online trading platforms that allow investors to access real-time market data, research investment opportunities, place orders, and monitor their portfolios. These platforms are usually web-based or mobile applications that provide a user-friendly interface for trading and investment management. Furthermore, e-brokerage platforms provide investors with a wide range of research tools, educational resources, and market analysis. These resources help investors make informed investment decisions by providing access to company financials, analyst reports, charts, and other relevant information.

In addition, e-brokerage platforms offer various trading features and order types to cater to different investor needs. These include market orders, limit orders, stop-loss orders, trailing stops, and more. Investors can customize their trading strategies and execute trades according to their preferences. Moreover, e-brokerage platforms enable investors to monitor and manage their investment portfolios efficiently. Investors can view their holdings, track performance, set alerts and notifications, and generate reports for tax purposes. Some platforms also provide automated portfolio rebalancing and asset allocation features.

The COVID-19 pandemic had a significant impact on the e-brokerage market size. With many people staying at home due to lockdowns and restrictions, there was a surge in retail trading activity. Individuals sought new opportunities to invest and engage in financial markets, leading to a substantial increase in the number of retail investors. This resulted in a boost for e-brokerage platforms as they provided easy access to trading and investment services. In addition, the pandemic accelerated the adoption of digital technologies across various industries, including finance. E-brokerage firms capitalized on this trend by offering user-friendly and technologically advanced platforms. They introduced new features such as mobile trading apps, advanced charting tools, and educational resources to attract and retain customers. For instance, in May 2023, Charles Schwab announced new enhancements to the trading experience on Schwab.com and the Schwab Mobile app. The updates include SnapTicket, a new order ticket that allows clients to enter orders directly from the Schwab.com pages they visit most frequently as part of their trading workflow.

What are the Top Impacting Factors in E-Brokerage Market

Convenience and Cost-effectiveness

One of the main drivers of the e-brokerage market is the convenience that online trading platforms offer. With e-brokerage, investors can easily buy and sell securities from the comfort of their homes or offices, without the need to physically visit a broker's office. This convenience has made online trading more accessible to retail investors who may not have had access to traditional brokerage services in the past.

In addition, e-brokerage platforms offer lower fees and commissions than traditional brokers. This is because online brokers don't have to pay for physical office space or employ as many people as traditional brokers do. For instance, Robinhood, a popular e-brokerage platform in the U.S., offers commission-free trading to its users. Therefore, these are the major growth factors for the e-brokerage market.

Rapid Growth in Digitalization

With the advent of digitalization and the use of the internet, the online brokerage industry has experienced significant growth. Technology has made it possible for brokers to offer a wide range of trading tools and services to their clients, such as real-time quotes, research, and analysis tools. In addition, key players in the e-brokerage market have embraced technology to offer their clients a seamless trading experience. For instance, Charles Schwab offers a mobile app that allows clients to trade and access their accounts from anywhere. Furthermore, TD Ameritrade offers a voice-enabled trading assistant that allows clients to place trades using voice commands. Therefore, this is the major growth factor of the e-brokerage market.

Increasing Internet Penetration

The increasing penetration of the internet has been a significant driver of the e-brokerage market. As more people gain access to the internet, they are more likely to use online brokerage services. Furthermore, key players in the e-brokerage market have recognized this trend and have invested in expanding their online presence. For instance, Fidelity has developed a robust online platform that allows clients to trade, access account information, and manage their investments. Therefore, this is the major factor driving the e-brokerage market growth.

Technological Advancements

The development of new technologies such as artificial intelligence (AI), machine learning (ML), and big data analytics is expected to create new opportunities for the e-brokerage market. These technologies can help e-brokerage firms provide better services to their clients, such as personalized investment recommendations, improved risk management, and faster transaction processing. In addition, key players in the e-brokerage market are also investing heavily in new technologies such as artificial intelligence, machine learning, and blockchain to improve the trading experience for their customers. For instance, TD Ameritrade has introduced AI-powered chatbots to provide 24/7 customer support. Furthermore, Charles Schwab has invested in artificial intelligence and machine learning to provide personalized investment recommendations to its clients.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the e-brokerage market analysis from 2022 to 2032 to identify the prevailing e-brokerage market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the e-brokerage market segmentation assists to determine the prevailing e-brokerage market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as e-brokerage market trends, key players, market segments, application areas, and market growth strategies.

E-Brokerage Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 31.1 billion |

| Growth Rate | CAGR of 10.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 214 |

| By Service Provider |

|

| By Ownership |

|

| By End User |

|

| By Region |

|

| Key Market Players | FMR LLC, Charles Schwab and Co., TastyTrade, Inc., eOption, eToro, Interactive Brokers LLC., TD Ameritrade, E-trade, XTB, FP Markets |

Analyst Review

E-brokerages provide investors with a modern, convenient, cost-effective, and knowledgeable way to trade and monitor their investments. By using an e-brokerage, investors have access to online trading software. Each broker generally has a unique trading platform that is used by their customers where there are real-time price quotes on stocks, mutual funds, exchange-traded funds (ETFs), currencies, commodities, or any other type of investment that is supported by the broker. The investor can usually access sought-after information easily in order to research investment options before making a decision.

In addition, the rise of automated investment solutions and robo-advisory services has contributed to the growth of the e-brokerage market. Robo-advisors use algorithms and artificial intelligence to provide personalized investment recommendations and manage portfolios automatically. This automated approach appeals to investors looking for low-cost and hands-off investment management.

The COVID-19 outbreak has had a moderate impact on the e-brokerage market. The pandemic led to a surge in retail trading activity as individuals sought alternative investment opportunities and sources of income. E-brokerage providers capitalized on this trend by enhancing their platforms and offerings to cater to the growing demand. They focused on user-friendly interfaces, educational resources, and simplified trading processes to attract and retain retail investors.

The E-brokerage market is fragmented with the presence of regional vendors such Charles Schwab & Co., FMR LLC, E*TRADE, Interactive Brokers LLC, eToro, FP Markets, eOption, tastytrade, Inc., XTB, and TD Ameritrade. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With the increase in awareness & demand for e-brokerage across the globe, major players are collaborating their product portfolio to provide differentiated and innovative products.

The e-brokerage market size was valued at $11,682.49 million in 2022, and is projected to reach $31,084.16 million by 2032, growing at a CAGR of 10.6% from 2023 to 2032.

By the end of 2032, the market value of E-Brokerage Market will be $31,084.16 million.

Convenience and cost-effectiveness Rapid growth in digitalization Increasing internet penetration Technological advancements

The key players operating in the e-brokerage market include Charles Schwab & Co., FMR LLC, E*TRADE, Interactive Brokers LLC, eToro, FP Markets, eOption, tastytrade, Inc., XTB, and TD Ameritrade.

The e-brokerage market is segmented into service provider, ownership, end user, and region. By service provider, the market is differentiated into full time broker and discounted broker. Depending on ownership, it is fragmented into privately held and publicly held. The end user segment is divided into retail investor and institutional investor.

Loading Table Of Content...

Loading Research Methodology...