E-Commerce Buy Now Pay Later Market Research, 2032

The global e-commerce buy now pay later market was valued at $4.2 billion in 2022, and is projected to reach $57.8 billion by 2032, growing at a CAGR of 30.4% from 2023 to 2032.

E-commerce buy now pay later market is a payment method that allows customers to buy things online and pay for them in installments over time rather than paying the entire price at once. This payment option has grown in popularity in e-commerce since it gives customers greater freedom and affordability in their purchase decisions. In addition, customers that use BNPL may divide their purchase from e-commerce websites into numerous smaller installments, interest-free payments spread out over several weeks or months. This may assist clients to manage their cash flow and planning, especially for larger purchases or unexpected bills.

Furthermore, many BNPL providers provide quick and easy approvals with little or no credit checks. Moreover, e-commerce buy now pay later is popular among customers because it provides flexibility and convenience. Customers make purchases that they might not be able to afford upfront, and they may spread the cost of those purchases over time. BNPL also allows customers to avoid high-interest credit card debt.

Low cost and practical payment options is a major driving factor for e-commerce buy now pay laterproviders since it allows the customers to use their debit card to make payments. This option is practical because it eliminates the need for a credit check, and customers may use their existing bank account to make payments. Debit card payments also tend to have lower fees compared to credit card payments. Furthermore, growth in number of e-commerce website and increase in the number of smartphone users are major propelling factors for the e-commerce BNPL market.

However, increase in bad debts of e-commerce BNPL is a major factor hampering the growth of the E-commerce buy now pay later market as bad debts are created when customers fail to make payments on their BNPL purchases, which may result in financial losses for BNPL providers and their retail partners. There are several factors contributing to the increase in bad debts in the BNPL space, such as the ease and convenience of BNPL have led to an increase in spending, with customers potentially overcommitting themselves and struggling to make payments. Another restraint factor is the lack of credit checks and the availability of BNPL to customers with poor credit history may increase the risk of bad debts.

Furthermore, e-commerce BNPL BNPL options are not available for several goods on e-commerce websites which is a major factor hampering the market growth. On the contrary, growth in consumer demand for flexible payment options is anticipated help customers to make purchases without having to pay the entire amount upfront, which is anticipated be more practical for people who do not have the required cash on hand at the time of purchase. Thus, it is projected to provide major lucrative opportunities for the growth of e-commerce buy now pay later market.

The report focuses on growth prospects, restraints, and trends of the e-commerce buy now pay later market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the e-commerce buy now pay later market.

Segment Review

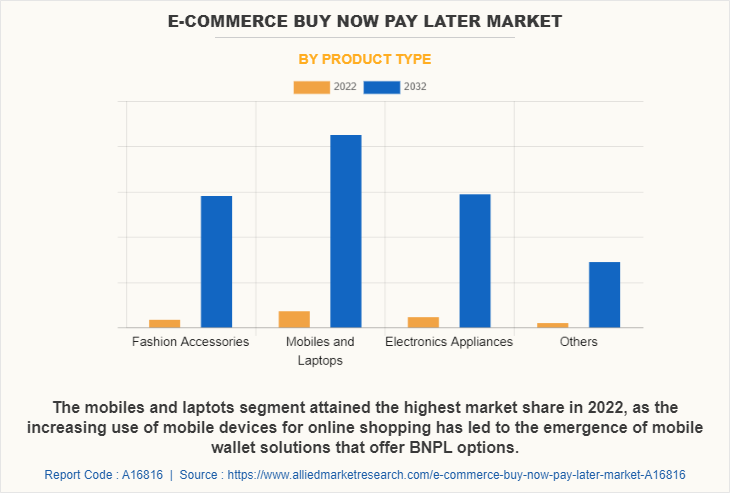

The E-commerce buy now pay later market is segmented on the basis of product type, repayment model, end user, and region. Based on product type, the market is segmented into fashion accessories, mobiles and laptops, electronic appliances, and others. By repayment model it is segmented into manual repayment schedules and automatic repayment. On the basis of end user, it is segmented into Gen Z (21-25), millennials (26-40), Gen X (41-55), and baby boomers (56-75). By region, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of product type, the mobiles and laptops segment attained the highest growth in 2022. This is because most consumers spend a lot of money on mobile phones and laptops, thus BNPL offers them a flexible and simple method to spread out the expense of these purchases over time. This enables customers to manage their finances more easily while still being able to purchase the goods they want. Furthermore, mobiles and laptops are products that are subject to rapid technological advancements, which means that consumers often need to replace them E-commerce buy now pay later (BNPL) frequently. BNPL provides a simple and easy way for consumers to purchase the latest models without having to pay the full cost upfront. In addition, a large number of customers who buy mobile devices and computers online do not have access to traditional credit or do not wish to utilize credit cards. For these customers, BNPL offers an alternate financing solution that is more straightforward and accessible.

However, the fashion accessories segment is attributed to be the fastest growing segment during the forecast period. This is due to the fact that fashion accessories are generally lower-cost products compared to high-value goods such as electronics or appliances, making them more affordable for consumers. Customers who want to buy fashion items but do not want to pay the whole price upfront have a tempting choice with E-commerce buy now pay later BNPL. Furthermore, consumers want to buy various accessories to match their outfits or keep up with the newest fashion trends because fashion accessories are usually trendy and seasonal products that change frequently. Moreover, BNPL provides a flexible payment option that enables consumers to keep up with these changes.

On the basis of region, North America attained the highest growth in 2022. This is attributed to the fact that BNPL options have gained popularity in North America for alternate payment method in online shopping. Number of suppliers have recently entered the E-commerce buy now pay later market, giving customers the choice of breaking up their purchases into smaller, interest-free payments over time. One reason for the popularity of BNPL options in North America is that they offer a convenient and flexible way for consumers to manage their finances. Consumers use BNPL to spread out their payments over time, which makes larger purchases more feasible, rather than paying for a product in full upfront or with a credit card. Many BNPL providers also provide transparent pricing and have no interest fees, which makes them a desirable choice for consumers on a tight budget.

However, Asia-Pacific is considered to be the fastest growing region during the forecast period. This is attributed to the fact that e-commerce adoption has significantly increased in the Asia-Pacific area in recent years as more people turn to online purchasing for accessibility and convenience. There is an increase in need for flexible payment methods, like BNPL, to reduce the cost and complexity of online shopping. In addition, the growth of e-commerce is being driven by the expanding middle class in many nations in the Asia-Pacific region, as more people now have disposable income to purchase online. Moreover, the larger purchases are made more reasonably with the help of BNPL options, which is essential for customers who are new to online shopping.

The report analyzes the profiles of key players operating in the e-commerce buy now pay later market such as Affirm Holdings Inc., Bread Financial, Klarna Bank, Laybuy Holdings Limited., Paypal, Payright Limited., QuickFee Group LLC., Sezzle Inc., Splitit Payments Ltd, and Zip Co Limited. These players have adopted various strategies to increase their market penetration and strengthen their position in the e-commerce buy now pay later market growth.

E-commerce buy now pay later Market Landscape and Trends

Several factors have contributed to the significant growth of the e-commerce buy now pay later market in recent years. One significant cause is the rise in popularity of internet shopping, which has encouraged more individuals to shop at online merchants. Furthermore, the COVID-19 has speed up the shift to online shopping because more people are being forced to shop from home as a result of lockdowns and other social isolated measures. Another factor driving the growth of the E-commerce BNPL market is the convenience it offers to consumers. By allowing customers to postpone payment for their purchases, BNPL services make it easier for people to make larger purchases that they not be able to afford upfront. This can help to increase sales for online retailers, while also providing customers with more flexibility and convenience. Furthermore, the rise in the number of businesses providing these services is one of the most significant trends in the E-commerce buy now pay later market.

Moreover, this includes both traditional financial institutions as well as new fintech startups, all looking to capitalize on the growing demand for buy now pay later services. Therefore, the e-commerce buy now pay later market is expected to continue to grow in the coming years, driven by these factors.

Top Impacting Factors

Low cost and Practical Payment Options

Customers obtain no-interest loans from some buy now pay later suppliers, this means that customers extend the cost of their purchase over time without paying any additional interest charges. As a result, customers who wish to make a purchase without paying the whole amount in advance now have a low-cost and practical choice. Furthermore, customers get deferred interest from several BNPL suppliers. Moreover, this means that customers extend the cost of their purchase over time but is expected to be charged interest if they do not pay the whole amount within a defined date. This is a practical option for customers who are confident that they pay off the purchase within the timeframe and want to avoid interest charges.

Furthermore, Customers of some BNPL suppliers pay little or no fees. Moreover, this make BNPL a more practical and inexpensive choice for customers who want to stretch the expense of their purchase over time. In addition, Payment plans are available on several e-commerce websites, allowing users to pay for their purchases in installments. Moreover, this led to a low-cost and practical option for clients who wanted to make a more significant purchase but were unable to afford to pay the entire amount upfront. Many e-commerce websites allow customers to pay with a credit card. This led to a low-cost and practical option for customers who have a credit card with a low interest rate and want to spread the cost of their purchase over time. There are several low-cost and practical payment options available to consumers in e-commerce BNPL.

Growth in Number of E-commerce Websites

The increased number of e-commerce companies offering Buy Now Pay Later (BNPL) alternatives is a recent trend. There is an increase in popularity of BNPL among consumers since it allows them to purchase products without having to pay the whole cost ahead, making it an appealing choice for individuals who do not have the necessary finances accessible immediately. Furthermore, one reason for the development in BNPL-enabled e-commerce websites is that it assist enhance sales and attracts clients who look for alternative payment methods. Moreover, e-commerce businesses that provide BNPL reach a growing E-commerce buy now pay later market of consumers who want to stretch the expense of their purchases over time. In addition, many BNPL providers have made it easier for e-commerce websites to integrate their services into their platforms.

Moreover, this has made it more convenient for e-commerce businesses to offer BNPL options to their customers without having to invest in developing their own payment solutions. BNPL providers are constantly pursuing partnerships with e-commerce websites in order to increase their reach and offer their services to a larger audience. This has resulted in a proliferation of BNPL options on e-commerce platforms, making it easier than ever for customers to select the supplier that best matches their needs. Therefore, the increase in number of e-commerce websites accepting BNPL reflects the growth in popularity of this payment method among consumers.

Increase in Number of Smartphone Users

The growth in use of smartphones has a huge impact on e-commerce buy now pay later (BNPL) services. BNPL providers work to make their services more accessible and user-friendly on mobile devices as more consumers shop online using their smartphones. Furthermore, one of the primary benefits of using smartphones for BNPL is the convenience it provides, customers quickly make purchases and manage their payment plans while on the road, without the need for a desktop or laptop computer. Moreover, many BNPL providers have created mobile apps that enable customers to apply for credit, view payment schedules, and make payments directly from their smartphones. In addition, cell phones have influenced BNPL by opening up a new channel of communication with clients.

Moreover, the BNPL providers now target smartphone users with personalized offers and promotions on the basis of their surfing and shopping behavior via mobile advertising. This has resulted in increased awareness of BNPL services and the acquisition of new consumers. The increased use of smartphones has also resulted in the creation of new technologies and breakthroughs at BNPL. For instance, some providers experiment with biometric authentication, allowing customers to complete purchases and manage their accounts using their fingerprints or facial recognition. This makes BNPL use even more convenient and secure for smartphone users. Therefore, the increase in number of smartphone users has a significant impact on the e-commerce buy now pay later market share, driving innovation and making BNPL services more accessible and user-friendly on mobile devices.

Increase in Bad Debts

Buy now, pay later (BNPL) services have become increasingly popular in the e-commerce business, and this increase in usage has resulted in an increase in bad debts for some suppliers. Furthermore, one reason for the increase in bad debts is that some customers may be using BNPL services to purchase items that they cannot afford, leading to an inability to repay the loan on time or in full. Moreover, some customers simply forget to make payments or do not understand the terms and conditions of the service, resulting in missed or late payments. In addition, fraud is another element that might contribute to bad debts.

Moreover, some fraudsters use stolen identities or credit card information to make transactions utilizing BNPL services, resulting in unpaid bills for the supplier. The ease and convenience of BNPL services encourage consumers to overspend and make purchases that they are not able to afford otherwise, which could increase the risk of bad debts. This is one of the most significant obstacles limiting the expansion of e-commerce buy now pay later market size.

Buy Now Pay Later Options not Available for Several Goods on E-commerce Websites

Third-party providers often offer buy now, pay later (BNPL) alternatives, which are not available for all goods on e-commerce platforms. This is due to the fact that the availability of BNPL alternatives is often determined by the terms and agreements between the e-commerce website and the BNPL provider. The e-commerce website may not have a partnership with a BNPL provider or may choose not to offer BNPL alternatives for particular types of goods. For instance, some e-commerce websites do not provide BNPL options for high-value or luxury items due to the increased risk of a payment default.

Furthermore, BNPL providers may have their own criteria for determining which purchases are eligible for their services. Moreover, this includes factors such as the credit score of customers or the purchase price. It is also worth mentioning that some BNPL providers may not be available in all countries or regions, which limit their availability on e-commerce platforms in such locations. Therefore, this is one of the major factors that hamper the growth of the e-commerce buy now pay later industry.

Growth in Consumer Demand for Flexible Payment Options

Buy now, pay later (BNPL) solutions on e-commerce websites assist address the growth in consumer need for flexible payment choices. BNPL services make buying products more affordable and accessible to a wider range of consumers, by allowing customers to spread out the cost of their purchases over time. The opportunity to pay for items in installments, especially for larger or more expensive purchases, for many customers, as it assists them manage their cash flow and avoid having to pay for the entire transaction upfront.

Furthermore, BNPL options may appeal to customers who do not have access to traditional credit options, such as credit cards, or personal loans, or who prefer to avoid incurring new debt. Moreover, e-commerce websites that offer BNPL choices attract and retain more clients who value flexible payment options, perhaps leading to greater sales and revenue. These factors are anticipated to provide major lucrative opportunities for the growth of the e-commerce buy now pay later industry in upcoming years.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the E-commerce buy now pay later market segments, current trends, estimations, and dynamics of the e-commerce buy now pay later market forecast from 2023 to 2032 to identify the prevailing e-commerce buy now pay later market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the e-commerce buy now pay later market outlook assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global e-commerce buy now pay later market trends, key players, market segments, application areas, and market growth strategies.

E-Commerce Buy Now Pay Later Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 57.8 billion |

| Growth Rate | CAGR of 30.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 435 |

| By Product Type |

|

| By Repayment Model |

|

| By End User |

|

| By Region |

|

| Key Market Players | Laybuy Holdings Limited, Splitit Payments Ltd, QuickFee Group LLC, Klarna Bank, Sezzle Inc., Affirm Holdings Inc., Payright Limited, Zip co limited, PayPal, Bread Financial |

Analyst Review

The e-commerce buy now pay later (BNPL) market has experienced significant growth in recent years and is expected to continue to grow. One major trend is to integrate their services with budgeting tools to help consumers better manage their finances. This trend is expected to continue as consumers look for more comprehensive financial management tools. Another major trend in the e-commerce BNPL market is that companies enter new businesses outside of typical E-commerce, such as healthcare and tourism. This trend is anticipated to continue as consumers seek greater flexibility in how they pay for goods and services. In addition, several companies that offer BNPL also give customers the option to reduce the carbon emissions caused by their purchases. Moreover, as customers become more aware of the environment and search for ways to lessen their influence, it is anticipated that this trend is anticipated to continue. However, as the market for BNPL expands, there are risks that consumers could end up with excessive debt and have trouble making payments. Moreover, this has increased defaults and a negative effect on the buy now pay later reputation of the market may result from this. In addition, a lot of companies who provide BNPL are connecting their services with mobile payment systems such as Apple Pay and Google Pay. Moreover, customers may now utilize their BNPL accounts to make purchases both online and in-person, which increases convenience and flexibility. One of the major opportunities is innovation in product offering BNPL providers differentiate themselves by offering innovative products like flexible payment schedules or rewards programs. Therefore, the e-commerce buy now pay later industry is expected to continue to evolve and adapt to changing consumer preferences and technological advances.

Furthermore, market players adopt various strategies for enhancing their services in the market and improving customer satisfaction. For instance, in January 2023, PayPal expanded its business by introducing buy now pay later for merchants. BNPL for merchants improves this e-commerce strategy rather than waiting for payment and then releasing the item, merchants receive payment in advance and delegate payback administration to a third party. Customers gain from BNPL as well, as it allows them to receive what they need when they need it. Furthermore, in November 2021, Affirm Holdings had partnered with Amazon.com to make its BNPL service available to certain customers of the e-commerce giant. This partnership has made BNPL services of Affirm more widely available to a large and growing customer base, potentially driving further growth for the company. These strategies by the market players operating at a global and regional level are anticipated to help the market to grow significantly during the forecast period.

Some of the key players profiled in the report include Affirm Holdings Inc., Bread Financial, Klarna Bank, Laybuy Holdings Limited., Paypal, Payright Limited., QuickFee Group LLC., Sezzle Inc., Splitit Payments Ltd, and Zip Co Limited. These players have adopted various strategies to increase their market penetration and strengthen their position in e-commerce buy now pay later market.

The E-Commerce Buy Now Pay Later Market will expand from 2023 - 2032 at a CAGR of 30.4%

The global e-commerce buy now pay later market was valued at $4,186.29 million in 2022 and is projected to reach $57,776.30 million by 2032, growing at a CAGR of 30.4% from 2023 to 2032.

Low cost and practical payment options Growth in number of e-commerce websites Increase in number of smartphone users

Affirm Holdings Inc., Bread Financial, Klarna Bank, Laybuy Holdings Limited., Paypal, Payright Limited., QuickFee Group LLC., Sezzle Inc., Splitit Payments Ltd, and Zip Co Limited.

The E-commerce buy now pay later market is segmented on the basis of product type, repayment model, end user, and region. Based on product type, the market is segmented into fashion accessories, mobiles and laptops, electronic appliances, and others. By repayment model it is segmented into manual repayment schedules and automatic repayment. On the basis of end user, it is segmented into Gen Z (21-25), millennials (26-40), Gen X (41-55), and baby boomers (56-75). By region, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

Loading Table Of Content...

Loading Research Methodology...