E-Commerce Logistics Market Size & Insights:

The global e-commerce logistics market size was valued at USD 235.70 billion in 2020, and is projected to reach USD 1,901.97 billion by 2030, growing at a CAGR of 23.5% from 2021 to 2030.

Booming e-commerce industry is projected to have prominent impact on the market growth during the forecast period. In addition, improved relationships between supplier & customers have fueled the market growth in the recent years. However, regulatory issues are expected to hamper the market growth during the forecast period. Supply chain solutions are being customized to serve the user requirements with the transformed fundamentals of product distribution and advancements in technology. Furthermore, business analytics has assisted logistics professionals to increase the speed and efficiency of work processes.

The ramification of e-commerce websites and availability of low-cost cargo have revolutionized the e-commerce logistics market across the globe. In addition, the widespread prominence of C2C and B2C e-commerce websites has boosted the demand for international and domestic e-commerce logistics. The growth of digital technology has increased the adoption rate of E- commerce Logistics Services. The market growth is driven by factors such as rise of cross-border e-commerce activities, sales of foreign goods, and upsurge in internet penetration, especially in developing countries.

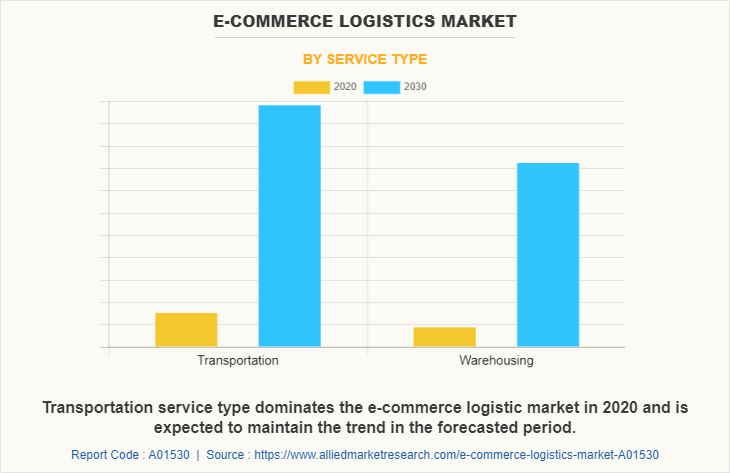

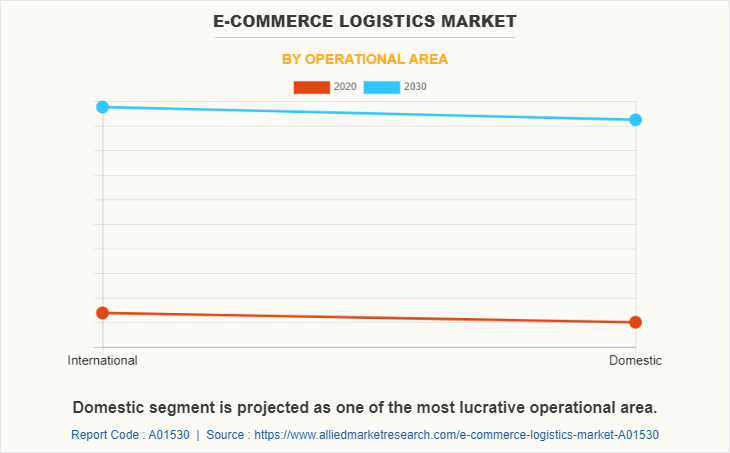

The e-commerce logistics market is segmented into Service Type and Operational Area. Transportation and warehousing are the service types of the e-commerce logistics industry; whereas, international and domestic are categorized under the operational area. The market is analyzed across four regions, namely North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa) along with the analyses of the respective countries.

On the basis of service type, the transportation segment dominated the overall e-commerce logistics industry in 2020, and is expected to continue this trend throughout the forecast period. The modes of transportation considered for the market are air/express delivery, freight/rail, trucking/over road, and maritime. The conventional supply chain of retailing was coupled with the development of economies of scale, which included shopping malls and large departmental stores. These systems face threat by innovative structures that have large warehouses located on the exterior of metropolitan areas, wherein, online packages or parcels are shipped through vans and trucks. The integration of e-commerce logistics with transportation management software (TMS) has boosted the e-commerce logistics market growth. TMS aids in planning deliveries across the supply chain.

Furthermore, optimizing the flow of goods and leveraging consolidated capacity have increased the growth potential of the market. However, the warehouse segment is expected to grow the most, and this trend is expected to continue during the forecast period. Warehouses can significantly vary in specifications, size, and location depending on the type of customers, products, share of online sales, and mode of delivery. Technological advancements are implemented in warehouses are according to the e-commerce and logistics requirements. The need for continuous management and frequent turnover of inventory on the basis of shelf life of products drive the market for warehousing. In addition, regular tracking of weights, expiration, & miscellaneous details and adding specific details to each product have increased the growth potential of the market.

Depending on the operational area, the international segment dominate the E-Commerce Logistics Market Share in 2020 and is expected to continue this trend during the forecast period. Depending on the operational area, the domestic segment captured the largest share in 2020 and is expected to continue this trend during the forecast period. Online trade is preferred by SMEs to drive and diversify the exports to increase their market share and increase their customer base. This helps in increasing social gains by enabling online presence and accessibility to global consumer. Domestic e-commerce unveils plethora of opportunities for small enterprises and individuals involved in trade, reduce the price of purchases, and expanding their sales in developed and developing countries. This enhances the domestic market.

However, the domestic segment is expected to witness the highest growth in the upcoming years. Domestic e-commerce unveils bucket of opportunities for small enterprises and individuals involved in trade, reduce the price of purchases, and expanding their sales in developed and developing countries. This enhances the domestic e-commerce logistics market.

E-commerce logistics market trends in Asia-Pacific is expected to exhibit highest growth during the forecast period, owing to strong economic growth along with the ongoing development in e-commerce logistics and inventory management, which drive organizations to invest heavily in e-commerce logistics market to sustain growth and improve productivity. In addition, factors such as major shift toward digital transformation, cloud deployment & technological advancement among small & medium businesses, and continuously ongoing modernization in work force management strategy in emerging economies notably contribute toward the market growth. Furthermore, key players in Asia-Pacific are focused on enhancing their operations and increasing their overall efficiency to stay competitive in the market, which is expected to provide lucrative opportunities for the growth of the market during the forecast period.

By Region

Asia-Pacific is projected as one of the most lucrative region.

Top Impacting Factors:

Cordial relationships between supplier and customers

E-commerce logistics reduces errors in processing orders and delivery lead times. This enhances the quality of service, i.e., higher productivity and efficiency, to improve the satisfaction and loyalty among customers. This helps in strengthening the supplier and customer relationships, and is a major driving force for the e-commerce logistics market.

Key Benefits for Stakeholders:

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the e-commerce logistics market analysis from 2020 to 2030 to identify the prevailing e-commerce logistics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the e-commerce logistics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global e-commerce logistics market trends, key players, market segments, application areas, and market growth strategies.

E-Commerce Logistics Market Report Highlights

| Aspects | Details |

| By Service Type |

|

| By Operational Area |

|

| By Region |

|

| Key Market Players | Ceva Holdings LLC, United Parcel Service, Inc., Clipper Logistics Plc., Kenco Group, Inc., S.F. Express, Gati Limited, FedEx Corporation, Amazon, Aramex International, DHL International GmbH |

Analyst Review

According to the insights of the CXOs of leading companies, the global e-commerce logistics market offers promising opportunities to the transportation service industry. The current business scenario has witnessed large-scale adoption of e-commerce logistics especially in the developing regions. Market players have developed innovative techniques to provide customers with advanced and innovative product offerings to cater to the needs of the customers.

Transportation and warehousing are the major types of e-commerce logistics in the industry. Transportation services are extensively used in the domestic and international operational areas. Among operational areas, domestic logistics exhibited the highest revenue growth over the past few years.

By region, Asia-Pacific exhibits the largest adoption of e-commerce logistics in the world. However, LAMEA is expected to witness significant growth during the forecast period.

Nevertheless, prominent market players are exploring new technologies and applications to meet the rise in customer demand. Product launches, collaborations, and acquisitions are expected to enable them to expand their product portfolios and penetrate in different regions. Emerging economies provide lucrative opportunities to market players for growth and expansion.

Booming e-commerce industry is projected to have prominent impact on the market growth during the forecast period. In addition, improved relationships between supplier & customers have fueled the market growth in the recent years. Furthermore, business analytics has assisted logistics professionals to increase the speed and efficiency of work processes.

North America dominates E-commerce Market in 2020 and is expected to maintain its position in the forecasted period.

The global E-commerce logistics market size was valued at $ 235.70 billion in 2020, and is projected to reach $ 1901.97 billion by 2030, growing at a CAGR of 23.5% from 2021 to 2030.

This report gives an in-depth profile of some key market players in the e-commerce logistics market areDHL International GmbH, Aramex International, FedEx Corporation, S.F. Express, Gati Limited, Amazon.com, Inc., Kenco Group, Inc., Ceva Holdings LLC, United Parcel Service, Inc., and Clipper Logistics Plc.

Loading Table Of Content...