E-Fuel Market Research, 2030

The global e-fuel market was valued at $6.2 billion in 2023, and is projected to reach $48.5 billion by 2030, growing at a CAGR of 34.3% from 2024 to 2030.

Introduction and Definition

E-fuels, also known as power-to-liquids, power-to-gas, or renewable synthetic fuels, are produced from renewable sources like solar and wind energy. These E-fuels offer a potential alternative to traditional fossil fuels in the transportation and energy sectors. The preparation process involves using renewable electricity to split water into hydrogen and oxygen. The hydrogen is then combined with carbon dioxide to create hydrocarbons such as diesel, gas, or jet fuel. However, the production of e-fuels is known to be inefficient and costly, with challenges in achieving low-cost production. Despite their promise as a sustainable fuel option, the efficiency and cost implications of e-fuels raise concerns regarding their widespread adoption.

Key Takeaways

- The E-fuel Market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033 and provides E-fuel market overview.

- More than 1, 500 product literature, industry releases, annual reports, and other documents of major valine industry participants, authentic E-fuel industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve the most ambitious growth objectives.

Market Dynamics

The rising demand for sustainable aviation fuels (SAFs) is a significant driver for the e-fuel market share. SAFs reduce CO2 emissions by up to 80%, making them a crucial component in the aviation industry's efforts to achieve net-zero carbon emissions by 2050. According to the International Air Transport Association (IATA) , SAF could contribute around 65% of the reduction in emissions needed for the aviation sector to reach this target. In 2023, SAF production tripled to 600 million liters from 300 million liters in 2022, representing 0.2% of global jet fuel use. The largest acceleration in SAF production is expected in the 2030s as policy support becomes global and SAF becomes competitive with fossil kerosene. This growing adoption and production of SAFs will significantly drive the e-fuel market forecast, providing a sustainable alternative to traditional fossil fuels and aligning with global environmental goals.

Government incentives and subsidies are pivotal in propelling the e-fuel market size by mitigating production costs and bolstering investments in sustainable fuel technologies. For instance, Germany channels over $120 million annually into research and development ventures linked to renewable fuels, extending substantial subsidies to foster E-fuel production. Similarly, the United States dedicates approximately $50 million each year to tax credits and incentives, nurturing the expansion of the renewable fuel sector. Brazil, renowned for its proficiency in biofuels, provides approximately $36.5 million yearly in subsidies for renewable fuel production and research utilization of E-fuels. These financial aids reduce E-fuels' cost impediments and boost technological progress and market assimilation, positioning E-fuels as a viable substitute for conventional fossil fuels. Such government incentives are imperative in nurturing innovation and hastening the shift towards a low-carbon economy, thereby propelling the e-fuel market advancement.

According to the German Biomass Research Centre DBFZ production costs of E-fuel are expected to range between 0.70 EUR and 1.33 EUR per liter by 2050. High production costs pose a significant restraint to the E-fuel market growth, as they deter widespread adoption and limit E-fuel's competitiveness compared to traditional fossil fuels. The cost implications are influenced by political framework conditions and investor signals, showing the need for supportive policies to drive down production costs and enhance market viability. The cross-sectoral deployment of sustainable renewable fuels, particularly in road transport, is identified as crucial for scaling up production and reducing prices. However, the challenge lies in addressing the high initial costs and incentivizing investment in e-fuel production to make them economically feasible. Overcoming the barrier of high production costs is essential to realizing the potential of e-fuels as affordable and climate-neutral alternatives to fossil fuels, especially in hard-to-abate sectors like maritime and aviation where cost sensitivity is pronounced. The gradual increase in blending E-fuel with conventional fuels and ramping up production volumes is expected to lead to cost reductions through economies of scale, paving the way for a more socially just and economically viable transition towards E-fuel as a sustainable energy solution.

However, renewable energy sources integration presents a significant opportunity for the E-fuels market development, offering a pathway towards a more sustainable and environmentally friendly energy ecosystem. By leveraging renewable sources such as solar, wind, and hydroelectric power in E-fuel production, the market can capitalize on clean energy generation to reduce carbon emissions and combat climate change. This integration enhances energy security and resilience to open up new possibilities for decarbonizing aviation and heavy-duty transportation sectors. As the world shifts towards a low-carbon economy, the synergy between E-fuels and renewable energy sources holds immense potential for driving innovation, attracting investments, and fostering a transition to cleaner energy solutions. Embracing this opportunity can accelerate the growth of the E-fuels market, positioning it as a key player in the global sustainability landscape.

Segment Overview

The E-fuel Market report is segmented into source, type, state, application, and region. By source, the market is classified into wind and solar. On the basis of the type, the market is segregated into E-Methane, E-Kerosene, E-Methanol, E-Ammonia, E-Diesel, and E-Gasoline. By state, the market is bifurcated into gas and liquid. By application, the market is divided into transportation, chemicals, and energy generation. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Analysis

Key market players in the E-fuel Market include Saudi Arabian Oil Co., Siemens Energy, Sunfire GmbH, Norsk E-fuel, Mitsubishi Corporation, Repsol, Man Energy Solutions, HIF Global, Orsted, INFINIUM, INERATECH GmbH, and Liquid Wind.

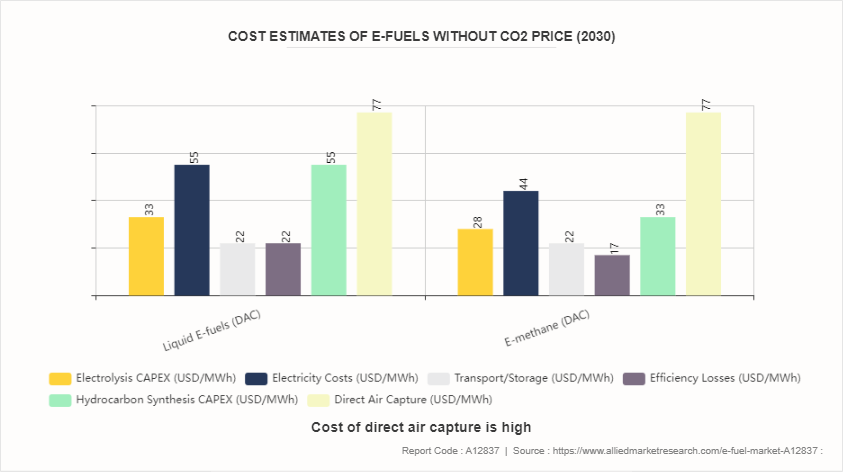

The cost estimation data for E-fuels without CO2 price from 2020 to 2050 provides insights into the evolving economics of E-fuels production over the next three decades. In 2020, liquid E-fuels produced through direct air capture (DAC) technology exhibited higher capital expenditure for electrolysis and hydrocarbon synthesis compared to E-methane. The electricity costs for E-fuel production were notably higher in 2020, with liquid E-fuels requiring investment in transport and storage infrastructure. However, by 2030, significant cost reductions are projected across both liquid E-fuels and E-methane categories, reflecting advancements in technology and efficiency improvements. The capital expenditure for electrolysis and hydrocarbon synthesis is expected to decrease by 2030, leading to more competitive production costs. By 2050, further cost reductions are anticipated, with both liquid E-fuels and E-methane showing significantly lower capital expenditure and operational costs, indicating a more cost-effective pathway for E-fuel production without factoring in the CO2 price. These cost trends suggest a promising outlook for the economic viability and scalability of E-fuels as a sustainable energy solution in the coming years.

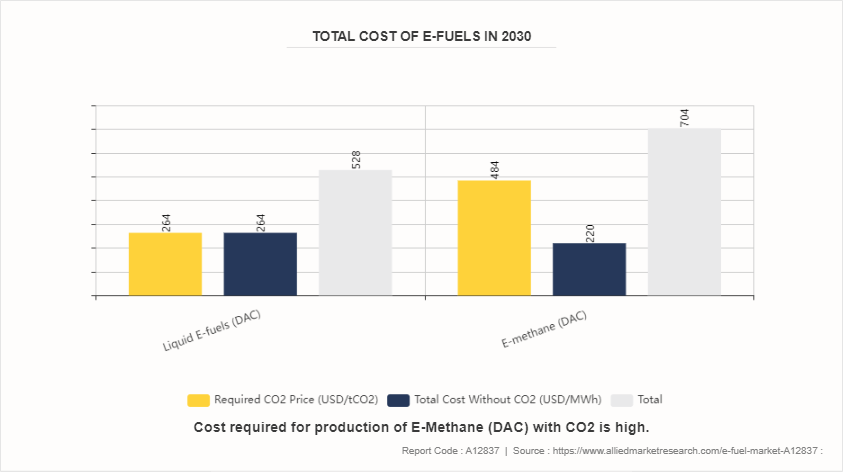

The data on E-fuel cost estimation from 2020 to 2050 reveals a significant trend towards decreasing production costs and reduced reliance on CO2 pricing. In 2020, the total cost without factoring in the CO2 price for liquid E-fuels (DAC) was $1100/MWh, with the CO2 price accounting for 69% of the total cost. For E-methane (DAC) , the total cost was $1298/MWh, with the CO2 price contributing to 78% of the total cost. By 2030, the total cost for liquid E-fuels decreased to $528/MWh, with the CO2 price representing 50% of the total cost. E-methane also saw a reduction in total cost to $704/MWh, with the CO2 price making up 69% of the total cost. Looking ahead to 2050, the total cost for liquid E-fuels dropped to $176/MWh, with the CO2 price accounting for only 19% of the total cost. Similarly, E-methane had a total cost of $341/MWh, with the CO2 price contributing to 65% of the total cost. These trends indicate a shift towards more cost-efficient E-fuel production methods and a decreasing reliance on CO2 pricing as a significant cost factor in the market.?

Industry Trends

- E-fuels are expected to witness increased adoption in the aviation industry as a sustainable alternative to traditional jet fuels, addressing the sector's carbon emissions and environmental impact.

- E-fuel is expected to grow in the maritime sector, offering a renewable solution for powering ships and vessels, especially for long-haul journeys where electric propulsion may not be feasible.

- In the chemical industry, E-fuel integration aligns with green chemistry initiatives, promoting sustainable practices and driving the development of eco-friendly products and processes.

- E-fuels have the potential to serve as a renewable feedstock source for the chemical industry, enabling the production of various chemicals while reducing reliance on fossil fuels and lowering carbon emissions.

- In the energy sector, e-fuels can be integrated with renewable energy sources like solar and wind power providing a pathway to convert excess energy into storable fuels for use during periods of high demand or low renewable generation.

- E-fuels are expected to play a role in energy storage solutions, offering a way to store excess renewable energy and support grid balancing, contributing to a more reliable and sustainable energy system.

Key Sources Referred

- IEA

- Efuel Alliance

- ICCT

- LEADVENT

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the e-fuel market analysis from 2024 to 2027 to identify the prevailing e-fuel market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the e-fuel market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global e-fuel market trends, key players, market segments, application areas, and market growth strategies.

E-Fuel Market Report Highlights

| Aspects | Details |

| Market Size By 2030 | USD 48.5 Billion |

| Growth Rate | CAGR of 34.3% |

| Forecast period | 2024 - 2030 |

| Report Pages | 305 |

| By Source |

|

| By Type |

|

| By State |

|

| By Application |

|

| By Region |

|

| Key Market Players | AUDI AG, Mitsubishi Corporation, Siemens Energy, Porsche AG, Uniper SE., Norsk E-fuel, Sunfire GmbH, Saudi Arabian Oil Co. (Saudi Aramco), MAN Energy Solutions, Repsol, S.A. |

$6.2 billion is the industry size of E-Fuel in 2023.

Rising demand for sustainable aviation fuels, Increasing awareness about environmental issues, Government incentives and subsidies, Growing adoption in aviation and maritime sectors, Integration with renewable energy sources are the leading application of E-Fuel Market

Transportation is the leading application of E-Fuel Market in 2023.

Europe is the largest regional market for E-Fuel in 2023.

Saudi Arabian Oil Co., Siemens Energy, Sunfire GmbH, Norsk E-fuel, Mitsubishi Corporation, Repsol, Man Energy Solutions, HIF Global, Orsted, INFINIUM, INERATECH GmbH, and Liquid Wind are the top companies to hold the market share in E-Fuel.

Loading Table Of Content...