E-waste Disposal Market Research, 2032

The Global E-Waste Disposal Market value was $64.4 billion in 2023, and is projected to reach $198.5 billion by 2032, growing at a CAGR of 13.6% from 2024 to 2032.The e-waste disposal market refers to the sector focused on managing the collection, recycling, and disposal of electronic waste (e-waste), including devices such as computers, mobile phones, and appliances.This market responds to the pressing need for sustainable handling of discarded electronics, driven by environmental concerns and regulatory requirements. E-waste disposal companies provide a range of services, including e-waste collection, dismantling, refurbishment, and recycling. The market is fueled by factors such as rapid proliferation of electronic devices, technological advancements leading to shorter product lifecycles, and the desire to recover valuable materials from e-waste streams.

Sustainability is a key focus, with efforts directed towards minimizing environmental impact, conserving resources, and adhering to strict waste management regulations. In addition, the e-waste disposal market addresses social and economic aspects by creating employment opportunities, fostering innovation in e waste recycling technologies, and promoting corporate responsibility initiatives aimed at reducing electronic waste generation and promoting circular economy principles.

Sustainability is a key focus, with efforts directed towards minimizing environmental impact, conserving resources, and adhering to strict waste management regulations. In addition, the e-waste disposal market addresses social and economic aspects by creating employment opportunities, fostering innovation in e waste recycling technologies, and promoting corporate responsibility initiatives aimed at reducing electronic waste generation and promoting circular economy principles.

Key Takeaways of E-Waste Disposal Market Report

The e-waste disposal market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($million). The e-waste disposal market forecast from 2024 to 2032.

The e-waste disposal industry report integrates high-quality data, professional opinions & analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

The e-waste disposal industry is highly fragmented, with several players, including Desco Electronic Recyclers, Aurubis AG, Boliden Group, MBA Polymers Inc., ERI, Sims Limited, Umicore, Stena Metall AB, Tetronics Environmental Technology Company, and MRI Technologies.

Segment Overview

The global e-waste disposal market is segmented into material, source, and region.

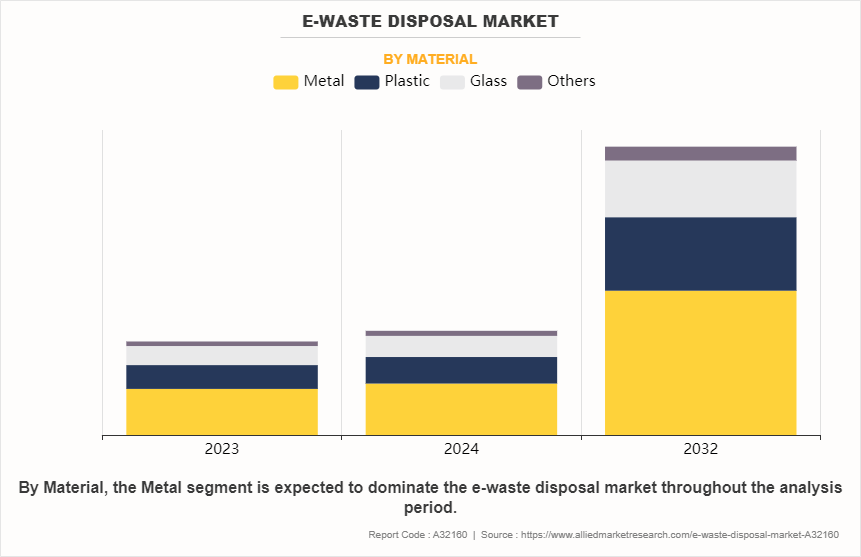

On the basis of material, the market is divided into metal, plastic, glass, and others. The metal segment accounted for the largest share in 2023 due to high value and recyclability of metals such as gold, silver, copper, and palladium found in electronic devices. With the proliferation of electronics, the demand for metal recycling surged. As industries and consumers prioritize sustainability, the metal material segment is poised to remain the fastest growing in the e-waste disposal market, fostering innovation and investment in recycling technologies.

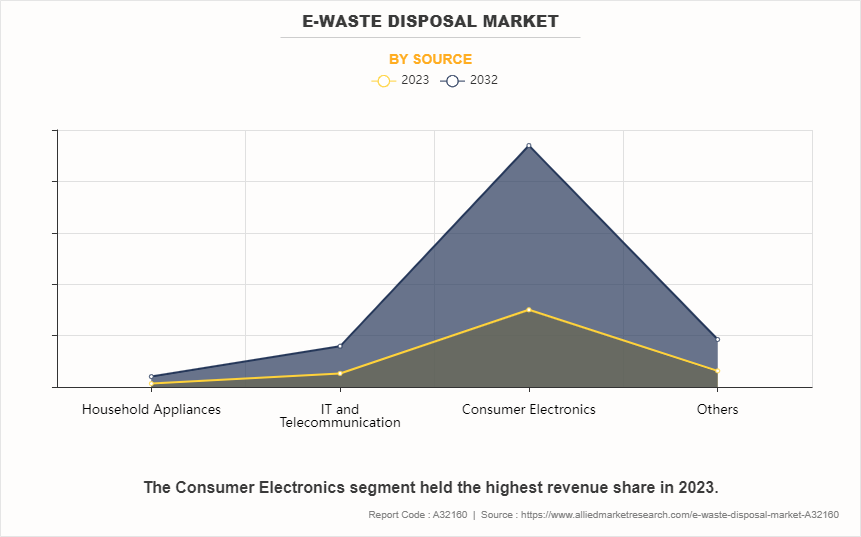

On the basis of source, it is categorized into household appliances, IT and telecommunication, consumer electronics, and others. The consumer electronics segment accounted for the largest share in 2023 due to the widespread adoption of smartphones, laptops, and other personal gadgets. Rapid technological advancements and shorter product lifecycles have fueled surge in electronic waste from consumers. In addition, increasing affordability and accessibility of electronic devices has expanded their market reach globally. Developing countries are focusing on increasing their domestic production of electronics to cater to the rise in demand for electronics, especially consumer electronics.

For instance, according to Invest India, domestic production of electronics was valued at $101 Bn in FY23 and is segmented (basis FY22 data) as mobile phones (43%), IT hardware (5%), consumer electronics (12%), strategic electronics (5%), industrial electronics (12%), wearables & hearables (0.3%), PCBA (0.7), auto electronics (8%), led lighting (3%), and electronic components (11%). Moreover, the consumer electronics segment is poised for continued growth as the demand for new electronic products persists, necessitating efficient recycling and disposal practices to mitigate environmental harm and meet regulatory standards.

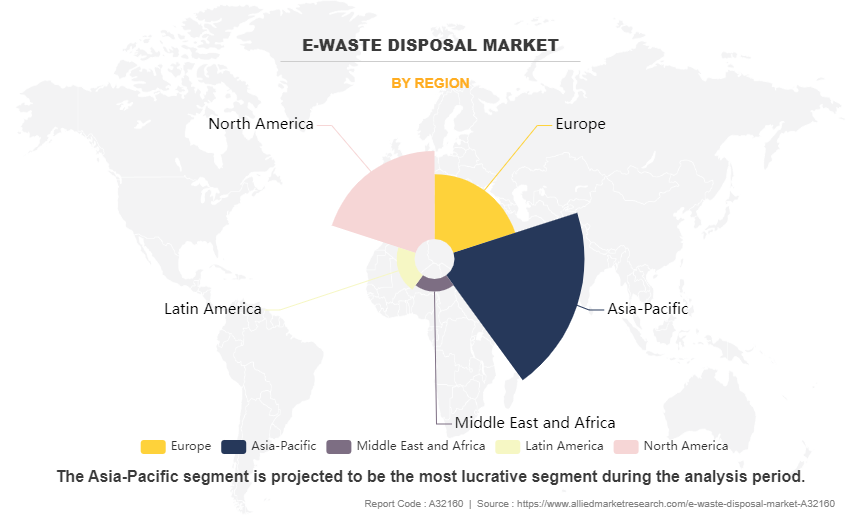

On the basis of region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Italy, Spain, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and rest of Asia-Pacific), Latin America (Brazil, Argentina, and rest of Latin America), and Middle East and Africa (UAE, Saudi Arabia, South Africa, and rest of Middle East and Africa).

The Asia-Pacific region dominated the e-waste disposal market in 2023 and is expected to continue its dominance during the forecast period. This leadership is attributed to the region's rising tech consumption and regulatory initiatives promoting responsible disposal. In Asia Pacific e-waste disposal market size by country lead by China. With rise in awareness and evolving regulations, Asia-Pacific remains at the forefront of managing electronic waste, showcasing sustained dominance in the global e-waste disposal landscape. Investments in Asia-Pacific regarding sustainable waste management are also increasing, which is increasing the awareness of proper disposal methods. For instance, in December 2023, IFU is invested $35 million in Blue Planet Environmental Solutions, a major sustainable waste management company with operations in India, South-East Asia, and UK. IFUs investments are expected to boost Blue Planets capabilities in two key areas in India, such as landfill reclamation and e-waste recycling.

Competitive Analysis

The players operating in the global e-waste disposal market are Desco Electronic Recyclers, Aurubis AG, Boliden Group, MBA Polymers Inc., ERI, Sims Limited, Umicore, Stena Metall AB, Tetronics Environmental Technology Company, and MRI Technologies. The key players in the e-waste disposal market are focusing on acquisition and partnership to increase e-waste management capabilities. Various e-waste disposal companies are investing in innovation of recycling solutions.

Market Dynamics

Rise in Use of Electronic Devices

The exponential rise in electronic device usage globally has resulted in a substantial surge in e-waste generation, necessitating efficient disposal solutions. With rise in accessibility and affordability of electronic gadgets, including smartphones, computers, and household appliances, consumers globally are continually upgrading their devices, contributing to the growing volume of e-waste. This trend is further fueled by rapid technological advancements, leading to shorter product lifecycles and rendering older devices obsolete. According to The International Telecommunication Union (ITU), the e-waste is expected to be 82 million tons by 2030. E-waste has increased by 82% from 2010. Rise in e-waste is expected to boost the growth rate of the e-waste disposal market during the forecast period.

The widespread adoption of electronic devices is not confined to developed nations; developing countries also experience a significant increase in e-waste generation as they embrace technology. As a result, the e-waste disposal market continues to expand, presenting both challenges and opportunities for waste management systems worldwide. The demand for efficient electronic waste disposal solutions is driven by the need to manage this ever-growing stream of discarded electronics responsibly. Electronic recycling is critical for recovering valuable materials such as metals, plastics, and rare earth elements, which are reused in manufacturing processes. Furthermore, proper disposal practices help prevent environmental contamination and reduce the depletion of natural resources.

Businesses specializing in e-waste disposal services play a crucial role in meeting this demand. They offer a range of solutions, including e-waste collection, dismantling, refurbishment, and recycling, to ensure that discarded electronics are managed in an environmentally sustainable manner. In addition, governments and regulatory bodies are implementing policies and regulations to promote responsible e-waste management practices, further driving the demand for efficient disposal solutions. Thus, the proliferation of electronic devices globally has led to a significant increase in e-waste generation, necessitating the development and adoption of efficient disposal solutions to address this growing environmental challenge.

Limited Awareness Among Consumers about Proper E-Waste Disposal

Limited awareness among consumers about proper e-waste disposal exacerbates environmental and health risks. Many individuals are unaware of the detrimental effects of incorrect disposal methods, such as throwing electronic devices into regular household waste or simply discarding them irresponsibly. This lack of awareness leads to e-waste ending up in landfills or being incinerated, releasing toxic substances like lead, mercury, and brominated flame retardants into the environment.

Furthermore, when e-waste is disposed of with regular household waste, it is difficult to separate and recycle, resulting in valuable resources going to waste. In addition, the improper disposal of e-waste contributes to the depletion of natural resources and exacerbates pollution, posing significant risks to ecosystems and human health. Addressing this issue requires comprehensive educational campaigns to raise awareness about the importance of proper e-waste disposal. Informing consumers about the environmental and health hazards associated with incorrect disposal methods encourages responsible behavior and promotes the use of designated e-waste collection points or recycling facilities. By increasing awareness, individuals make informed choices that contribute to the sustainable management of e-waste and the conservation of resources.

Technological Advancement in Recycling Technologies

Technological advancements in recycling technologies have the potential to revolutionize the e-waste disposal market by enhancing the efficiency and effectiveness of recycling processes. For example, robotic sorting systems utilize advanced sensors and artificial intelligence algorithms to automatically identify and sort different types of electronic waste materials. These systems significantly streamline the recycling process by reducing manual labor requirements and improving sorting accuracy. Innovative separation techniques also play a crucial role in improving e-waste recycling efficiency. Methods such as hydrometallurgical processes, electrostatic separation, and vacuum metallurgy enable the extraction of valuable metals and materials from electronic waste streams. These techniques offer higher recovery rates and increased purity levels as compared to traditional recycling methods, resulting in higher-value recycled materials.

Investing in R&D is essential to drive further advancements in e-waste recycling technologies. Companies and research institutions collaborate to explore novel recycling methods, optimize existing processes, and develop new technologies tailored to the unique challenges of e-waste recycling. The investment in advancement of e-waste recycling technologies led to the development of more efficient, cost-effective, and environmentally friendly recycling methods that handle the increasing volume and complexity of electronic waste. Furthermore, advancements in recycling technologies create new business opportunities and revenue streams within the e-waste disposal market. Companies that innovate and invest in cutting-edge recycling technologies differentiate themselves in the market, attract environmentally conscious customers, and gain a competitive advantage.

Overall, technological advancements present significant opportunities to improve the sustainability and efficiency of e-waste recycling processes, contributing to a more circular economy and reducing the environmental impact of electronic waste disposal. Various initiatives in developing countries help to boost the adoption and awareness of right e-waste disposal with increased reuse and recycling rates, and also adopt sustainable consumer habits. Examples of such initiatives are Extended Producer Responsibility; Design for Environment; and (3Rs) Reduce, Reuse, Recycle technology. These initiatives are expected to boost the e-waste disposal industry growth in the near future owing to rise in awareness and importance of disposal.

Historical data and information

The e-waste disposal market has experienced significant growth over the past few decades due to rise in technological advancements and digitalization. With rising concerns about environmental sustainability, governments globally have implemented regulations to promote responsible e-waste management. This has led to the emergence of a thriving industry focused on recycling, refurbishment, and proper disposal of electronic recycling, addressing the growing global challenge of e-waste accumulation.

Recent Developments in E-Waste Disposal Industry

In January 2020, Sembcorp Industries, through its wholly owned subsidiary, SembWaste, acquired Veolia ES Singapore (VESS) and public cleaning business of Veolia ES Singapore Industrial. The acquisition is expected to enhance the e-waste management capabilities of Sembcorp Industries.

Key Benefits For Stakeholders

This e-waste disposal market report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the e-waste disposal market analysis from 2023 to 2032 to identify the prevailing e-waste disposal market opportunities.

The e-waste recycling market research is offered along with information related to e-waste disposal market growth drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the e-waste disposal market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the e-waste disposal market share by company.

The report includes the e-waste disposal market insights of the regional as well as global e-waste disposal market trends, key players, market segments, application areas, and E-waste disposal growth drivers and strategies.

E-waste Disposal Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 198.5 billion |

| Growth Rate | CAGR of 13.6% |

| Forecast period | 2023 - 2032 |

| Report Pages | 250 |

| By Material |

|

| By Source |

|

| By Region |

|

| Key Market Players | Desco Electronic Recyclers, MBA Polymers Inc, Sims Limited, Stena Metall AB, Umicore, MRI Technologies, Boliden Group, AURUBIS AG, Tetronics Environmental Technology Company, ERI |

The E-Waste Disposal Market was valued at $64.4 billion in 2023 and is estimated to reach $198.5 billion by 2032, exhibiting a CAGR of 13.6% from 2024 to 2032.

The consumer electronics segment accounted for the largest share in 2023 due to the widespread adoption of smartphones, laptops, and other personal gadgets.

The trends in e-waste disposal include increased regulation, emphasis on recycling, growth in electronic device ownership, and innovation in sustainable disposal methods.

The Asia-Pacific region dominated the e-waste disposal market in 2023 and is expected to continue its dominance during the forecast period

The players operating in the global e-waste disposal market are Desco Electronic Recyclers, Aurubis AG, Boliden Group, MBA Polymers Inc., ERI, Sims Limited, Umicore, Stena Metall AB, Tetronics Environmental Technology Company, and MRI Technologies.

Loading Table Of Content...

Loading Research Methodology...