Edge Computing Market Overview

The edge computing market size was valued at USD 1.734 billion in 2017, and is projected to reach USD 16.557 billion by 2025, growing at a CAGR of 32.8% from 2018 to 2025. Factors such as increase in load on the cloud infrastructure globally and rise in number of intelligent applications are the major factors driving the growth of the global edge computing market.

Key Market Trends & Insights

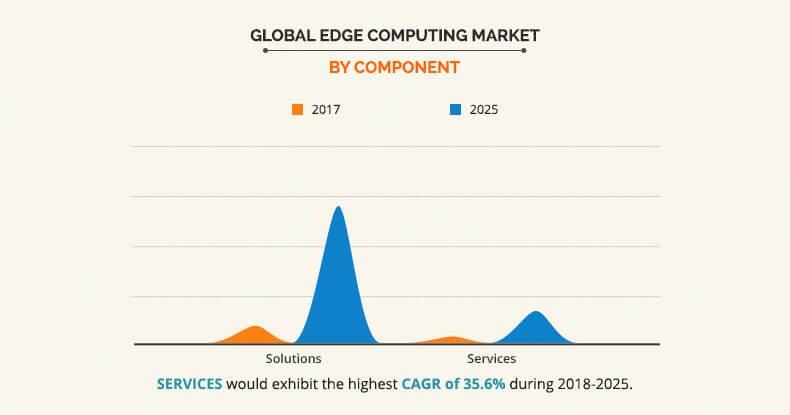

- By component, the solution segment expected to dominant the market during the forecast period

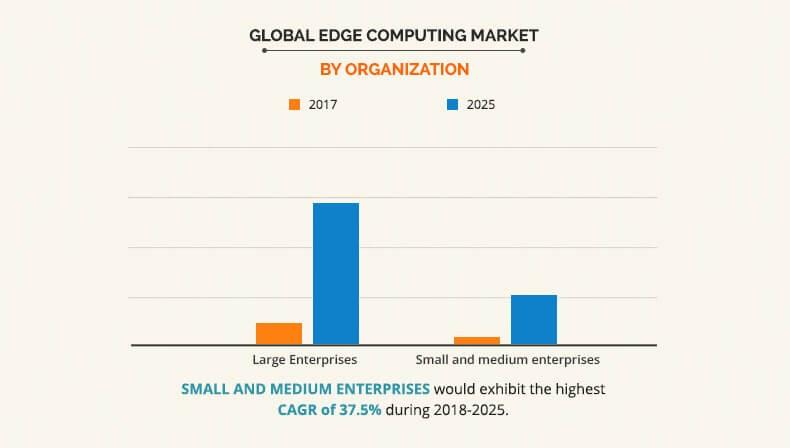

- By organization, large enterprises segment generated the highest revenue for edge computing market share in 2017.

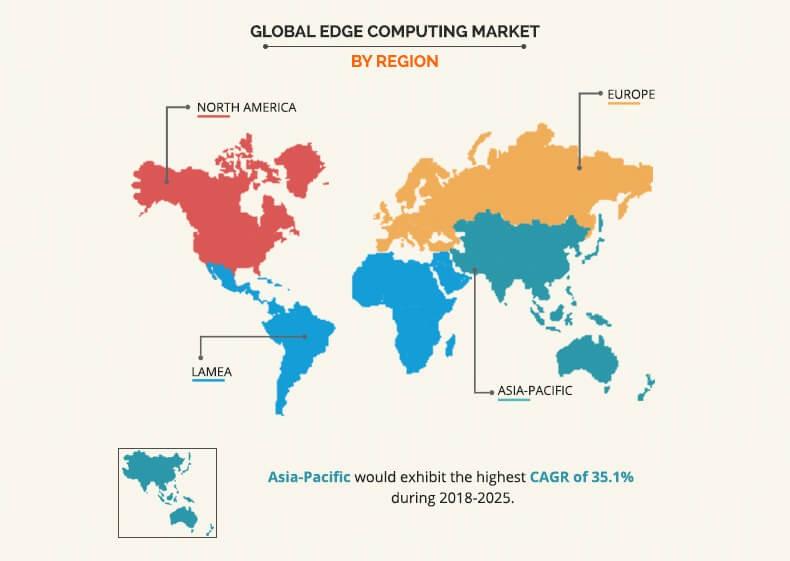

- Region wise, Asia-Pacific generated the highest growth rate during the forecast period

Market Size & Forecast

- 2017 Market Size: USD 1.734 Billion

- 2025 Projected Market Size: USD 16.557 Billion

- Compound Annual Growth Rate (CAGR) (2018-2025): 32.8%

What is Edge Computing?

Edge computing is an approach that processes data at the edge of the network. For example, in telecommunications, a mobile can be an edge device. Therefore, every device that generates data at the edge of the network functions as an edge device.

Edge computing assists real-time applications in analyzing and processing collected data, which is also one of the crucial factor that drives the market demand. However, more local hardware and higher maintenance costs are expected to hinder the edge computing market growth. Furthermore, advent of the 5G Network, and numerous frameworks and languages for IoT solutions are expected to provide major opportunities for the market growth in upcoming years.

Edge Computing Market Segment Review:

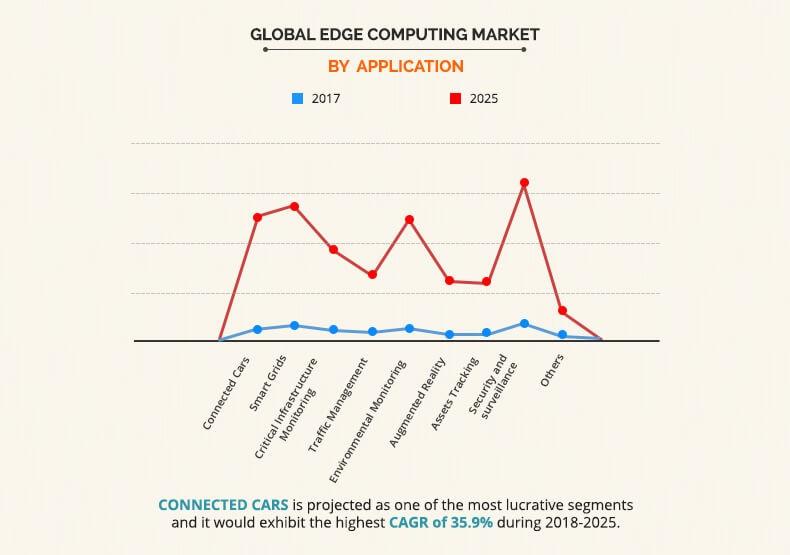

The global edge computing market is segmented based on component, applications, organization size, industry vertical, and region. Based on component, it is categorized into services and solution. On the basis of application, it is classified into connected cars, smart grids, critical infrastructure monitoring, traffic management, environmental monitoring, augmented reality, assets tracking, security and surveillance, others. By organization size, it is bifurcated into small & medium enterprises and large enterprises. On the basis of industry vertical, it is divided into energy & utilities, government & public sector, healthcare, manufacturing, media & entertainment, transportation, retail, telecom & IT, and others. Based on region, the global market is analyzed across North America, Europe, Asia Pacific, and LAMEA.

Based on component, the solution segment dominated the overall edge computing market size in 2017 and is expected to remain dominant during the forecast period. The growth of this segment is mainly attributed to increase in number of smart devices and to save the bandwidth on transporting the unnecessary data from data centers to the central cloud platforms.

The large enterprises segment generated the highest revenue for edge computing market share in 2017, the influx of data in the form of intelligent vehicles, machines, and other internet of things (IoT) devices; thus, boosting the growth of the global market across large enterprises.

The IT & Telecom sector dominated the overall market in 2017 and is expected to generate highest revenue during the edge computing market forecast period. The adoption of edge computing in this sector is mainly attributed to the increasing need to deploy products faster to their customers. Moreover, the retail sector is also expected to exhibit the highest growth rate during the forecast period.

The report focuses on the growth prospects, restraints, and trends of the edge computing market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the global market.

Top Impacting Factors:

Current and future edge computing industry trends are outlined to determine the overall attractiveness of the market. Top impacting factors highlight the edge computing market opportunities during the forecast period. Factors such as surge in load on the cloud infrastructure globally and rise in number of intelligent applications are the major factors driving the growth of the global market. In addition, edge computing assists real-time applications in analyzing and processing collected data, which is also one of the crucial factor that drives the market demand. However, more local hardware and higher maintenance costs are expected to hinder the edge computing market growth. Furthermore, advent of the 5G Network, and numerous frameworks and languages for IoT solutions are expected to provide major opportunities for the market growth in upcoming years.

Increase in load on the Cloud Infrastructure

- Edge computing is a type of cloud computing that brings computer data storage closer to the location where it is needed. Unlike conventional cloud computing platforms that integrate storage and processing in a single data center, edge computing pushes the computation or data processing power to the edge devices to handle. Moreover, with the technological advancements in IoT and 4G/5G, smarter and artificially intelligent devices are getting connected to the Internet every day. The huge data generated by all these smart devices thus, pushes the limits of cloud storage infrastructure, thus causing a huge burden on the cloud center. This burden further causes issues with network congestion and latency while processing the data between devices and cloud, which drives the demand for edge computing.

Assistance for real-time applications

- The major factor that drives the demand for edge computing is that it assists real-time applications in analyzing and processing collected data from various connected devices and sensors, at the edge of the network. The conventional cloud computing platforms are capable of providing real-time data, however they lack speed while providing real-time output due to latency issues. For example, voice assistants resolve requests in cloud, which involves numerous processes such as speech recognition, data compressing and uncompressing, and others. Fulfilling all these processes thus creates latency and thus, results in delayed output. On the contrary, edge application service decreases the volumes of data, traffic, and the distance, which results in lower latency and reduced transmission costs, which helps provide quick results. For instance, Amazon launched its edge computing platform AWS Greengrass that offers real-time connection and response features.

Numerous frameworks and languages for IoT solution

- Edge computing is essential for any successful and enhanced IoT solution. For edge computing in the IoT, numerous open source frameworks and languages are available. These include Kura, Spring Booot, Kapua, ThingsBoard, Eclipse Hono, and others. These frameworks provide various APIs, interfaces, connectivity, network, integration capabilities and other management features. This helps manage and integrate data for edge computing and provides major opportunities for the market growth.

Advent of the 5G Network

- The ongoing developments of 5G networks and its evolution is expected to provide major opportunities for the edge computing market. The number of connected devices is anticipated to exhibit substantial increase with the launch of 5G network. In addition, the connected device and 5G networks are expected to create huge data burden on physical data centers and result into higher demand for bandwidth and lower latency. Hence, all these factors are projected to create major growth opportunities for the market.

Key Edge Computing Companies:

The following are the leading companies in the edge computing market.

- Amazon Web Services (AWS)

- AT&T Inc.

- Cisco Systems Inc.

- Dell Inc.

- Fujitsu Limited

- Huawei Technologies Co. Ltd.

- IBM Corporation

- Hewlett Packard Enterprise (HPE)

- Microsoft Corporation

- Nokia Corporation

Key Benefits for Edge Computing Market Research Study:

- This study presents the analytical depiction of the global edge computing market trends and future estimations to determine the imminent investment pockets.

- A detailed analysis of the edge computing market segments measures the potential of the market. These segments outline the favorable conditions for the market.

- The report presents information related to key drivers, restraints, and opportunities.

- The current market is quantitatively analyzed from 2017 to 2025 to highlight the financial competency of the industry.

- Porter’s five forces analysis illustrates the potency of buyers & suppliers in the industry.

Edge Computing Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Application |

|

| By Organization Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | NOKIA CORPORATION, CISCO SYSTEMS INC., IBM CORPORATION, MICROSOFT CORPORATION, FUJITSU LIMITED, HUAWEI TECHNOLOGIES CO. LTD., DELL INC., HEWLETT PACKARD ENTERPRISE (HPE), AT&T Inc., AMAZON WEB SERVICES (AWS) |

Analyst Review

Edge computing is a type of cloud computing approach that brings computer data storage closer to the location where it is needed. Unlike conventional cloud computing platforms that integrate storage and processing in a single data center, edge computing pushes the computation or data processing power to the edge devices to handle. Moreover, increase in load on the cloud infrastructure globally and rise in number of intelligent applications are the major factors driving the growth of the edge computing market. In addition, edge computing assists real-time applications in analyzing and processing collected data, which is also one of the crucial factor that drives the market demand. However, more local hardware and higher maintenance costs are expected to hinder the edge computing market growth. Furthermore, advent of the 5G Network, and numerous frameworks and languages for IoT solutions are expected to provide major opportunities for the market growth in the upcoming years. Moreover, many government organizations across the globe are already investing in edge computing technology to develop smart city solutions and building more datacenters to cope with the 5G technology in upcoming years.

The global edge computing market is dominated by key players such as Amazon Web Services (AWS), AT&T Inc., Cisco Systems Inc., Dell Inc., Fujitsu Limited, Huawei Technologies Co. Ltd., IBM Corporation, Hewlett Packard Enterprise (HPE), Microsoft Corporation, Nokia Corporation, and others. The key players have adopted various growth strategies to enhance and develop their product portfolio, strengthen their edge computing market share, and to increase their market penetration. For instance, in January 2019, IBM Corporation and Vodafone Business partnered to launch a $550 million multi-cloud venture to provide European companies edge computing technology to integrate and manage multiple clouds.

Edge Computing Market is projected to reach $16,556.6 million by 2025.

Major Players are profiled in the study are Amazon Web Services (AWS),AT&T Inc.,Cisco Systems Inc.,Dell Inc.,Fujitsu Limited,Huawei Technologies Co. Ltd.,IBM Corporation,Hewlett Packard Enterprise (HPE),Microsoft Corporation and Nokia Corporation

To get Sample of Edge Computing market report

The global Edge Computing market is growing at a CAGR of 32.8% from 2018 to 2025

$16.56 billion revenve expected by Edge Computing market at the end of 2025.

To get company profiles of major key players

Major Factors includes Increasing load on the Cloud Infrastructure, Increasing number of Intelligent Applications and Assistance for real-time applications

Asia-Pacific is expected to exhibit highest growth rate throughout the forecast period.

Advent of the 5G Network, Numerous frameworks and languages for IoT solution and More local hardware and higher maintenance costs are major impacting factors.

Loading Table Of Content...