Edge Security Market Overview

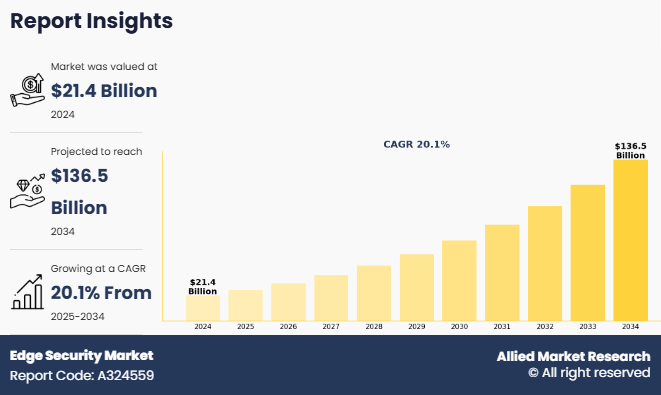

The global edge security market was valued at USD 21,360.0 million in 2024, and is projected to reach USD 136,453.0 million by 2034, growing at a CAGR of 20.1% from 2025 to 2034.

Edge security refers to protecting data, applications, and workloads at the “edge” of a network, close to where users and devices connect, rather than relying solely on centralized security measures. It addresses risks arising from distributed environments, such as IoT devices, remote work setups, and edge computing nodes, as threats are mitigated close to their origin. It helps maintain robust defenses against cyberattacks while enabling fast and reliable access to resources. It is particularly relevant for content delivered via content delivery networks (CDNs). CDNs operate at the edge of the network, distributing and accelerating content from servers located close to users and making it a critical point for securing data and applications.

Key Takeaways:

- By Component, the software segment held the largest share in the edge security market for 2024.

- By Enterprise Size, the large enterprise segment held the largest share in the edge security market for 2024.

- By End User Industry, the IT and telecom segment held the largest share in the edge security market for 2024.

- Region-wise, North America held the largest market share in 2024. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

Factors such as rise in the adoption of secure access service edge (SASE), coupled with the increase in cybersecurity concerns and rise in threat of cyberattacks, fuels the demand for more robust, integrated, and cloud-delivered security solutions, significantly driving market growth. In addition, the growth of 5G networks and the surge in demand for secure and scalable connectivity solutions are expected to fuel the market during the edge security market forecast period. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) for advanced threat detection across industries, enhancing real-time monitoring and automated response capabilities, is expected to provide lucrative growth opportunities for the growth of the edge security market size during the forecast period. Moreover, the rapid shift toward remote and hybrid work environments has further accelerated the edge security market demand for seamless and secure access to corporate resources, prompting organizations to adopt advanced network security architectures that deliver consistent protection and user experience across all locations. This is expected to create favorable environments for the edge security market size.

Segment Review

The edge security market is segmented into component, enterprise size, end-user industry, and region. On the basis of component, the market is segregated into hardware, software, and service. By enterprise size, the market is bifurcated into large enterprise and small & medium enterprises (SMEs). As per end-user industry, the market is classified into BFSI, manufacturing, government & defense, healthcare, IT & telecom, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of component, the global edge security market share was dominated by the software segment in 2024 and is expected to maintain its dominance in the upcoming years, owing to the increase in the adoption of advanced security solutions such as Zero Trust Architecture, AI-driven threat detection, and cloud-native security platforms that provide real-time protection at the edge. In addition, the growing proliferation of IoT devices and the expansion of 5G networks are driving demand for advanced software capable of securing distributed and diverse edge environments. However, the service segment is expected to experience the highest growth during the forecast period. This segment is experiencing an increase in demand for managed security services, consulting, and integration solutions as organizations seek expert support to deploy, monitor, and manage complex edge security infrastructures efficiently.

Region wise, North America dominated the market share in 2024 for the edge security market. This is due to the rise in advanced technological adoption, increasing cyber threats, and strong presence of key industry players, driving the demand for robust edge security solutions, including software and hardware components, contributing significantly to the region’s market growth. However, Asia-Pacific is expected to experience the fastest growth during the forecast period. The region is experiencing increase in the digital transformation initiatives, rapid expansion of IoT and 5G infrastructure, and growing investments in smart cities and industrial automation, which is expected to provide lucrative growth opportunities for the market in this region.

Top Impacting Factors

Driver

Increasing adoption of secure access service edge (SASE)

Increase in adoption of secure access service edge is a significant driver of the edge security market. Rise in remote and hybrid work models has led to increase in the demand for secure, scalable, and reliable access to resources, driving the edge security market growth. In addition, the rapid adoption of cloud infrastructure and SaaS applications has further accelerated the demand for robust edge security solutions, as organizations seek to protect distributed environments and ensure seamless access across diverse locations and devices, contributing to market growth. Furthermore, upsurge in number of cyberattacks, including ransomware, phishing, and advanced persistent threats (APTs), requiring more adaptive and intelligent security, fuels the growth of the market.

Furthermore, the increase in the demand for simplified security architectures has driven organizations to adopt integrated security solutions that reduce complexity, improve visibility, and enhance overall operational efficiency. In addition, organizations are increasingly aiming to streamline their security infrastructure by consolidating multiple tools and reducing operational complexity. Secure Access Service Edge (SASE) supports this goal by offering a unified, cloud-delivered solution that enhances visibility, simplifies policy management, and boosts operational efficiency. For instance, in February 2025, Kyndryl partnered with Palo Alto Networks to launch a new suite of Secure Access Service Edge (SASE) service, integrating the Prisma SASE platform powered by Precision AI. This collaboration aims to help enterprises adopt a cloud-first, zero-trust security model that enhances protection for distributed workforces and edge environments. The solution offers unified network and security capabilities, including granular access control, real-time threat protection, and support for IoT and edge technologies. This partnership is expected to accelerate SASE adoption by offering a scalable, AI-driven solution that simplifies security operations and strengthens threat protection, thereby augmenting market growth.

Restraints

High implementation and maintenance costs

The major challenge for the growth of the edge security market is the high implementation and maintenance costs required to deploy and manage distributed security infrastructure across diverse and often remote locations. Edge security involves protecting data and devices at the edge of the network, close to where data is generated, which often requires deploying advanced hardware, specialized software, and robust security protocols across multiple decentralized locations. This is often a costly undertaking, particularly for enterprises with large, distributed networks. In addition, initial implementation costs include purchasing edge-specific security appliances, integrating edge security solutions with existing infrastructure, and ensuring compatibility across diverse environments such as IoT devices, mobile endpoints, and on-premises systems. These complexities often necessitate hiring skilled professionals or third-party vendors, further increasing the financial burden.

Furthermore, maintaining edge security infrastructure involves regular updates, real-time monitoring, patch management, and threat intelligence integration. This continuous upkeep demands both human and technological resources, leading to high operational expenditures. For small and mid-sized businesses, these costs are a significant barrier, resulting in slower adoption rates. Even large enterprises may struggle to justify the expense if the return on investment is not immediately clear. As a result, organizations may delay implementation or opt for less secure, centralized solutions, exposing them to greater risk. To address these challenges, organizations adopt cloud-managed edge security platforms, which reduce on-site infrastructure needs and enable centralized management. This approach lowers both capital and operational costs by streamlining resources and minimizing the need for local IT staff. This helps to improve scalability, enhance operational efficiency, and maximize the impact of the edge security industry.

Opportunity

AI and ML integration for threat detection across industries

Surge in integration of AI and ML for threat detection across industries presents a significant edge security market opportunity to enhance real-time security, improve threat prediction accuracy, and automate response mechanisms, thereby strengthening overall network protection at the edge. AI and ML-powered real-time threat detection at the edge enables instant analysis of data from sensors, cameras, and IoT devices. This allows for immediate anomaly detection, automated threat prioritization, and rapid response without relying on cloud connectivity. Industries such as manufacturing, healthcare, and finance benefit through enhanced security and reduced downtime. In addition, the integration of edge with AI and ML helps organizations scale their security efforts cost-effectively by minimizing reliance on cloud resources and bandwidth, making advanced threat detection accessible even to smaller enterprises.

Moreover, AI-driven edge security supports the growing network of IoT devices by monitoring their behavior in real time, enabling automatic threat response and predictive maintenance. In addition, the integration of AI and ML at the edge secures IoT systems by detecting anomalies, auto-patching devices, and enabling predictive maintenance. This is crucial for industries such as manufacturing, utilities, and logistics, where downtime is costly. For instance, in October 2024, Infineon launched its Edge Protect, a comprehensive edge-to-cloud security solution designed to safeguard IoT devices throughout their lifecycle. The platform integrates secure microcontrollers and discrete Secure Elements from Infineon’s PSOC, AIROC, OPTIGA, and SECORA portfolios. It supports features such as secure cloud onboarding, late-stage provisioning, and compliance with evolving regulations such as the Cyber Resilience Act. Edge Protect aims to enhance device trust, reduce liability risks, and simplify security integration for manufacturers across various industries. This is expected to accelerate the adoption of secure edge solutions, streamline compliance efforts, and strengthen overall resilience in increasingly connected industrial environments.

Competition Analysis

The report analyzes the profiles of key players operating in the edge security market are Palo Alto Networks, Inc., Check Point Software Technologies Ltd., Fortinet, Inc., Juniper Networks, Inc., Zscaler, Inc., Broadcom Inc., Cloudflare, Inc., Forcepoint LLC, F5, Inc., AKAMAI TECHNOLOGIES, INC., Barracuda Networks, Inc.,Versa Networks, Inc., Cato Networks Ltd., Netskope, Inc., Sophos Limited, SonicWall, Inc, Musarubra US LLC, Infoblox Inc., iboss, Inc., and Cisco Systems, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the edge security industry.

Recent Developments in the Edge Security Market

In March 2025, Akamai Technologies partnered with VAST Data to usher in a new era of edge AI inference, aiming to make data-intensive AI workloads faster, more efficient, and more scalable. This collaboration integrates VAST’s AI data platform with Akamai’s globally distributed cloud infrastructure, enabling enterprises to run AI inference closer to users for lower latency, reduced costs, and improved performance. Unlike centralized cloud models, this edge-centric approach supports real-time, on-demand AI applications across a wide range of industries. The partnership also introduces a unified global data namespace, ensuring seamless access to data from edge to cloud.

In October 2024, Juniper Networks launched its Secure AI-Native Edge solution, a unified platform that merges network and security operations using cloud-based AI. This solution integrates Juniper Mist’s AI-driven network management with advanced security features to enhance visibility, control, and operational efficiency across enterprise environments. It addresses the limitations of siloed security systems by enabling centralized management of user authentication, application access, and traffic policies through the Mist Cloud. The platform supports Universal ZTNA (uZTNA) and delivers real-time, data-driven security responses, helping IT teams detect and mitigate threats faster. This innovation is a strategic step in aligning with the demands of edge security and digital transformation.

In May 2024, Lumen Technologies partnered with Versa Networks to launch a Sovereign Secure Access Service Edge (SASE) solution. This offering combines Lumen’s global network infrastructure with Versa’s advanced Secure SD-WAN and Unified SASE capabilities. The solution is designed to deliver AI-powered, in-line security with Zero Trust principles at the network edge. It supports deployment on Lumen’s global points of presence or on customer premises, offering flexibility and control. Key features include real-time threat detection, integration with technologies like DIA, MPLS, and SD-WAN, and advanced security services such as ZTNA, SWG, CASB, and DLP—making it ideal for remote and hybrid workforces.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the edge security market analysis from 2024 to 2034 to identify the prevailing edge security market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the edge security market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global edge security market trends, key players, market segments, application areas, and market growth strategies.

Edge Security Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 136.5 billion |

| Growth Rate | CAGR of 20.1% |

| Forecast period | 2024 - 2034 |

| Report Pages | 265 |

| By Component |

|

| By End User Industry |

|

| By Enterprise Size |

|

| By Region |

|

| Key Market Players | Sophos Limited, Palo Alto Networks, Inc., Infoblox Inc., iboss, Inc., Broadcom Inc., Cisco Systems, Inc., Cloudflare, Inc., AKAMAI TECHNOLOGIES, INC., F5, Inc., Forcepoint LLC, Fortinet, Inc., Zscaler, Inc., Barracuda Networks, Inc., Check Point Software Technologies Ltd., Juniper Networks, Inc., Musarubra US LLC, Cato Networks Ltd., Versa Networks, Inc., SonicWall, Inc., Netskope, Inc. |

Analyst Review

The edge security market is expected to witness considerable growth, driven by the rapid expansion of edge computing environments and the increasing demand to secure data and operations closer to the source of generation, ensuring low latency, enhanced performance, and robust protection against emerging cyber threats. The increase in organizations decentralizing IT infrastructures to support IoT, remote work, and latency-sensitive applications has led to a rise in demand for scalable, low-latency security solutions tailored for distributed networks. Edge security platforms are becoming a key focus for businesses, offering enhanced threat detection, real-time analytics, and autonomous response capabilities. The market is further supported by advancements in AI-driven threat intelligence, Zero Trust architectures, and secure access service edge (SASE) frameworks. Technologies such as software-defined perimeters (SDP), micro-segmentation, and encrypted edge communications are significantly improving risk mitigation and compliance. In addition, the rise in regulatory pressures, the increase in sophistication of cyber threats, and growing investments from cloud and enterprise infrastructure providers are accelerating the adoption of edge security solutions across various industries. These factors are expected to propel further growth of the edge security market in the upcoming years.

Furthermore, technological advancements in edge computing architectures, AI-driven threat detection, and automated response systems are significantly propelling the growth of the edge security market. Modern edge security solutions now offer advanced capabilities such as real-time risk analytics, policy-based access control, seamless integration with cloud and on-premises environments, and low-latency protection across distributed endpoints, enabling organizations to safeguard data and operations closer to the source. The rise of cybersecurity startups and edge-native infrastructure providers, coupled with increasing collaboration among cloud vendors, enterprise IT teams, and security leaders, presents remunerative opportunities to deliver more agile, context-aware, and scalable security solutions. These innovations are strengthening threat resilience & compliance and accelerating the adoption of edge security technologies across sectors such as manufacturing, healthcare, retail, and telecommunications.

Moreover, supportive initiatives and government policies focused on cybersecurity, digital infrastructure development, and data protection are significantly driving the growth of the edge security market. In many regions, regulatory support associated with data privacy, critical infrastructure protection, and secure edge deployments are encouraging organizations to adopt advanced edge security solutions. Policies such as cybersecurity funding programs, public-private partnerships, and national strategies for secure digital transformation are accelerating market expansion. However, the industry still faces challenges, including inconsistent regulatory standards across regions, integration complexities with legacy systems, and a shortage of cybersecurity talent equipped to manage decentralized environments. Limited network infrastructure in remote areas and concerns related to edge device vulnerabilities also remain a major concern within the industry. Despite these challenges, the edge security market is expected to grow steadily, particularly in emerging markets, driven by the rise in demand for real-time, scalable, and intelligent security solutions tailored to distributed IT environments, fueling market growth.

The edge security market is expected to witness notable growth due to rise in demand for secure access service edge (SASE) and increase in adoption of 5G networks.

The edge security market is projected to reach $136,453.0 million by 2034.

The edge security market is estimated to grow at a CAGR of 20.1% from 2025 to 2034.

The key players profiled in the report include Palo Alto Networks, Inc., Check Point Software Technologies Ltd., Fortinet, Inc., Juniper Networks, Inc., Zscaler, Inc., Broadcom Inc., Cloudflare, Inc., Forcepoint LLC, F5, Inc., AKAMAI TECHNOLOGIES, INC., Barracuda Networks, Inc.,Versa Networks, Inc., Cato Networks Ltd., Netskope, Inc., Sophos Limited, SonicWall, Inc, Musarubra US LLC, Infoblox Inc., iboss, Inc., and Cisco Systems, Inc.

The key growth strategies of edge security market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...