Edible Packaging Market Overview

Global Edible Packaging Market Size was valued at $697 million in 2016, and is projected to reach $1,097 million by 2023, growing at a CAGR of 6.81% from 2017 to 2023.

Edible packaging has witnessed increased adoption owing to factors such as high consumption of processed food products, rise in hygiene concerns among people, and increase in packaging waste by the usage of synthetic polymers thereby affecting the environment, which boost the edible packaging market growth.

These polymers are made of various materials such as lipids, polysaccharides, proteins, composites, and surfactants, which are considered safe for human consumption. Although the regulatory requirements for edible packaging are high in various regions such as Europe and high costs of manufacturing edible polymers are expected to hamper the edible packaging market growth.

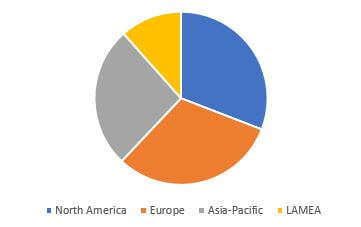

The report segments the global edible packaging market on the basis of material type, end user, and region. Based on material, it is classified into lipids, polysaccharides, proteins, composite films, and surfactants. On the basis of end user, the edible packaging market is bifurcated into food& beverages and pharmaceuticals. Region-wise distribution of the edible packaging market includes North America, Europe, Asia-Pacific, and LAMEA. Protein-based films are expected to grow at a CAGR of 7.5% owing to its benefits to the human body and the protein layers can be easily applied onto the small portions of food items. The pharmaceutical sector is expected to grow at CAGR of 7.1% in the forecast period.

Key players profiled in the global edible packaging market are WikiCell Designs Inc, MonoSol LLC, Tate & Lyle Plc, JRF Technology LLC, Safetraces, Inc., BluWrap, Skipping Rocks Lab, Tipa Corp, Watson, Inc., and Devro plc.

Segment Overview

The region-wise analysis of the global edible packaging market covers North America, Europe, Asia-Pacific, and LAMEA. Various countries covered under each region are studied and analyzed to identify the major trends demonstrated by these respective regions. Europe dominated the global edible packaging market share in 2016, followed by North America.

Global Edible Packaging Market, By Region, 2016 (%)

Top Impacting Factors

Reduction in Packaging Waste

Edible packaging helps preserve environment as the user can eat the package itself with the food product thereby reducing the packaging waste. According to Environmental Protection Agency (EPA), around 30.2% of the household waste is contributed by food containers and packaging. Edible packaging also contains the packaging films, which are made up of milk proteins vitamins, proteins, and probiotics, which have essential nutrients and are capable to provide oxygen barrier to the food thus preventing it from being contaminated. The plastic emissions and waste is considered harmful for the environment since plastic recycling takes a huge amount of time. All these factors have supported the edible packaging market growth.

Growth in Demand for Processed Food Products

The demand for processed food products is on an increase over a past few years. These food products contain added sugar, fats, oils, and salts to enhance the taste and flavor of the foods. Moreover, the processed foods require longer shelf life packaging, which edible coatings are capable of providing. Due to large consumption of processed foods, the usage of edible films and coatings is expected to drive the edible packaging market growth.

Advancement in Technologies

The edible packaging market is still at its nascent stage and various advancements are being made in the market. The nutritious features of food are enhanced by the usage of nanotechnological solutions such as nanoencapsulation and multifaceted systems. Nanoencapsulation of active composites with the edible coverings helps protect the food from moisture and heat and prevents other particles from entering the food.

High Cost

The cost of manufacturing edible packaging is high since the packaging needs to meet the sanitary requirements while in transit. Moreover, the edible layers are more prone to catch dirt and germs and other harmful particles, which can contaminate the food product. Therefore, to protect those layers from catching dirt and germs, the companies have to spend a lot of money.

High Regulatory Requirements

The edible films must be generally recognized as safe (GRAS) by the U.S. Food and Drug Administration. Moreover, the edible films must be consisted of a water-soluble polymer and must be manufactured on the machines, which is considered suitable for processing food products. The ingredients used in the edible polymers must contain general purpose additives. Another regulatory requirement specifies that if the ingredients used in edible polymers are prone to allergy, then it should be clearly defined on the label.

Increase in Shelf Life of Products

The edible films are in direct contact with the food products and are made up of safe and healthy ingredients such as protein-based namely gluten, soy, casein, zein, whey proteins, and collagen. Therefore, edible packaging helps maintain the shelf life of products and enhance the food quality thereby minimizing the usage of conventional/synthetic packaging while preserving the environment. Edible films prevent the foods from chemical damage thereby increasing shelf life.

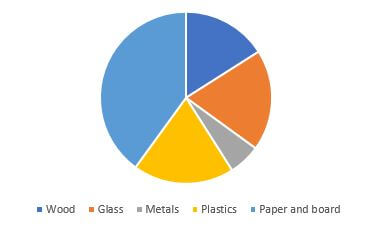

Shares of Packaging Waste Generated By Weight (%) EU

Source: Eurostat

The factors that affect the edible packaging market includes reduction in packaging waste, high consumption of processed products, increasing shelf life of products, high costs, high regulatory requirements, and advancement in technologies. These factors boost the adoption of edible packaging across verticals such as food & beverages and pharmaceuticals.

Key Benefits for Edible Packaging Market

- This report provides an in-depth analysis of the global edible packaging market trends to identify the potential investment pockets.

- It outlines the current trends and future scenarios to determine the overall market potential and gain stronger market foothold.

- Key drivers, restraints, and opportunities and their detailed impact analysis are elucidated.

- Quantitative analysis of the edible packaging market size from 2016 to 2023 is highlighted to recognize the financial competency of the market.

- Porter’s Five Forces model illustrates the threat of new entrants, threat of substitutes, and strength of the buyers & suppliers.

Edible Packaging Market Report Highlights

| Aspects | Details |

| By MATERIAL TYPE |

|

| By END USER |

|

| By Region |

|

| Key Market Players | DEVRO PLC, WATSON, INC, SAFETRACES, INC., JRF TECHNOLOGY LLC,, TATE & LYLE PLC, BLUWRAP, WIKICELL DESIGNS INC., SKIPPING ROCKS LAB, TIPA CORP, MONOSOL LLC |

Analyst Review

The edible packaging market is projected to depict a prominent growth during the forecast period owing to various factors such as environmental concerns, increase in hygiene concerns over packaging among people, and high consumption of processed food & beverages. Moreover, edible packaging enhances the food quality and increases shelf life of the products, which further supports the edible packaging market growth.

Although this market is still at its nascent stage, it is expected to grow at a higher rate in the coming years due to the growth of pharmaceutical industries and food industries in North America and Asia-Pacific. Edible packaging performs various functions such as carriers of antioxidants, antimicrobials, vitamins. The nano capsulation technique of packaging involves coating of active compounds with the edible polymers, which further helps protect the products from moisture, oxygen, heat, and other external exposure. The edible packaging market is expected to provide numerous opportunities in the future owing to its various benefits across verticals such as food & beverages and pharmaceuticals.

Loading Table Of Content...