Egypt Retail Fuel Stations Market Analysis - 2032

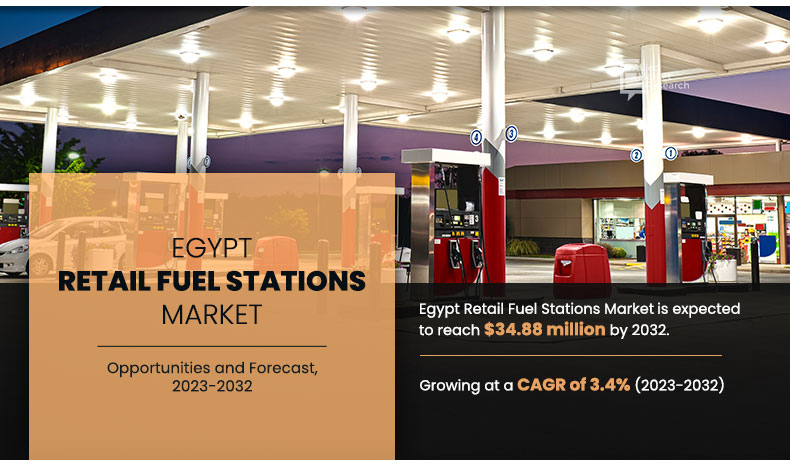

The Egypt retail fuel stations market was valued at $25.1 million in 2022, and is projected to reach $34.8 million by 2032, registering a CAGR of 3.4% from 2023 to 2032.

A fuel station, also known as a petrol station, gas station, service station, or filling station, is a retail outlet that sells motor vehicle fuel to vehicle owners. Fuel stations provide various fuels including diesel, petrol, gasoline, kerosene, and ethanol. The main components of a fuel station include gas pumps, pipelines, metal barriers, and drainage systems.

Rise in upcoming trends such as electric vehicle charging infrastructure alternative fuels, enhanced customer experience, digital transformation & connectivity, partnerships & collaborations, adoption of autonomous vehicles & technologies, and focus on sustainability practices drive Egypt retail fuel stations market. Furthermore, adoption of digital technologies for seamless customer interactions, efficient operations, and personalized services enhances the overall customer experience. It includes mobile apps for payments, ordering, and loyalty rewards. Expansion of retail fuel stations is attributed to a convergence of factors such as influencing consumer habits and market demands. Surge in vehicle ownership propelled by rise in incomes and population growth, the necessity for fuel stations naturally escalates to meet this growth in demand. The prevalent reliance on fossil fuels for internal combustion engines continues the need for retail fuel stations despite the rise awareness of environmental concerns.

Moreover, fuel providers now offer diversified services such as convenience stores, vehicle maintenance, and emerging features such as electric vehicle charging stations. This multifaceted landscape, change in consumer behaviors, technological advancements, and economic drivers, collectively propels the growth trajectory of Egypt retail fuel stations market within the transportation and energy sectors.

Egypt is one of the largest natural gas producers in Africa. According to the Organization of Petroleum Exporting Countries (OPEC), in 2021, it produced 0.461 million barrels of crude oil per day. According to the Minister of Petroleum and Mineral Resources, the Egypt petroleum sector has implemented an extensive drilling program in cooperation with foreign partners to explore new oil discoveries and increase in production of oil. Moreover, there are 3140 fuel stations in Egypt which further accelerates the growth of Egypt retail fuel stations market. In addition, in February 2022, United Arab Emirates company, Dragon Oil made its first discovery in Egypt in the Gulf of Suez, with reserves estimated at 100 million barrels of crude oil, which is one of the largest discoveries in the UAE in the last two decades.

Increase in R&D aims toward improving the quality of retail fuel stations, coupled with favorable policies by various governments toward pushing the growth of government-owned fuel stations are some of the crucial market-propelling factors. As per the Minister of Petroleum and Mineral Resources, Tarek al-Mulla, Egypt has planned to rise gas natural vehicle (GNV) of the country filling infrastructure from 306 to 1,300 stations by the end of 2023. In September 2023, ADNOC Distribution announced the inauguration of the first three service stations in Egypt located in key areas across Greater Cairo, this expansion is the result of acquisition of the company, a 50% stake in Total Energies Egypt. The joint venture includes a diversified downstream portfolio of 240 fuel retail stations, 100 convenience stores, 250 lube changing stations, car washes, lubricants, wholesale, and aviation fuel operations. However, Egypt retail fuel station market conditions and dynamics change rapidly, influenced by various factors such as government policies, economic changes, and Egypt energy trends.

The Egypt retail fuel stations market is dominated by state-owned companies, which account for over 70% of the market share. The largest state-owned company is Misr Petroleum, which operates over 600 fuel stations. The private sector plays an important role in the Egypt retail fuel stations market. There are a number of private companies operating in the Egypt retail fuel stations market, such as Emarat Misr., Shell, and GUPCO. Private companies invest heavily in new fuel stations and expanding its networks across the country. The market is expected to grow at a CAGR of 5% from 2023 to 2028, driven by a number of factors, which include population growth, rise in incomes, increase in popularity of electric vehicles, and the growth in demand for sustainable fuels.

The Egypt retail fuel stations market is competitive, with companies competing on price, location, and customer service. Furthermore, companies have invested in new technologies, such as mobile payment systems to improve the customer experience. The Egyptian government has played a major role in the development of the retail fuel stations market by investing in the development of new infrastructure, such as roads and highways, which make it easier for people to access fuel stations. In addition, the government has implemented policies to encourage the use of natural gas, which is a cleaner and more sustainable fuel than gasoline and diesel.

There has been rapid development of fuel stations across rural and semi-urban areas with an increase in number of vehicles plying the roads, both private and commercial. Furthermore, the increase in investments in modern fuel stations including automated pumping, brighter lighting systems, flexible payment modes, and innovative advertising, are some of the factors augmenting the Egypt retail fuel stations market growth. The Egypt government intends to increase the use of alternative fuels to reduce reliance on conventional fuels such as gasoline and diesel by introducing electric and hybrid vehicles in both public and private transportation, with a greater emphasis on converting more vehicles to run on natural gas. In addition, rise of electric vehicles and other alternative fuels, the rise of advanced mobility modes, and rapidly changing customer habits created huge challenges for the traditional fuel retail business.

The Egypt retail fuel stations market includes fuel types. On the basis of fuel type, it is classified into petrol, diesel, CNG and natural gas. The major companies profiled in this report include Misr Petroleum, TotalEnergies, Emarat Misr., ADNOC Distribution, Exxon Mobil Corporation, SGS Société Générale de Surveillance SA., Egyptian International Gas Technology Company – Gastec, TAQA, Shell AG and Gulf Oil International Ltd.

Egypt retail fuel stations market, by fuel type

In 2022, the petrol segment was the highest revenue contributor to the market, with a CAGR of 3.3%. Petrol is one of the most widely used fuels globally for transportation due to its energy density, ease of use, and suitability for internal combustion engines. Its availability and usage vary across regions, with different fuel standards and regulations governing its composition and sale. Furthermore, rise in consumers preference for contactless payment methods due to their ease of use and perceived security drive the Egypt retail fuel stations market.

By Fuel Type

Horizontal Split Case segment is the most lucrative segment

Key Strategies

In September 2023, ADNOC Distribution launched first ADNOC branded service stations in Egypt as its international growth strategy. It offers a wide range of food and beverages tailored to Egyptian customers, and a digitally enhanced shopping experience.

In August 2023, TAQA Arabia submitted a non-binding offer to buy an unspecified stake in Egyptian state-owned fuel retailer Wataniya to expands its business in Egypt.

In July 2022, TotalEnergies announced partnership with ADNOC partner for fuel distribution in Egypt. ADNOC Distribution is set to acquire a 50% stake in TotalEnergies Marketing Egypt LLC for around $200 million, as per the signed agreement.

Report Key Highlighters

- The Egypt retail fuel stations market is consolidated the major companies profiled in this report include Misr Petroleum, TotalEnergies, Emarat Misr., ADNOC Distribution, Exxon Mobil Corporation, SGS Société Générale de Surveillance SA., Egyptian International Gas Technology Company – Gastec, TAQA, Shell AG and Gulf Oil International Ltd.

- The Egypt retail fuel stations market includes company profiles of 10 key players who are actively engaged in producing various Egypt retail fuel stations.

Key benefits for stakeholders

- The report includes in-depth analysis of different segments and provides market estimations between 2022 and 2032.

- A comprehensive analysis of the factors that drive and restrict the growth of the Egypt retail fuel stations market is provided.

- Porter’s five forces model illustrates the potency of buyers & sellers, which is estimated to assist the market players to adopt effective strategies.

- Estimations and forecast are based on factors impacting the Egypt retail fuel stations market growth, in terms of value.

- Key market players are profiled to gain an understanding of the strategies adopted by them.

Egypt Retail Fuel Stations Market Report Highlights

| Aspects | Details |

| By Fuel Types |

|

| By Key Market Players |

|

Analyst Review

The Egypt retail fuel stations market is expected to witness increased demand during the forecast period due to a rise in transportation sector.?

Fuel retailing industry comprises companies that operate by selling automotive fuel or lubricating oils at retail stores such as service stations, fuel stations, and similar others. Contactless payment methods have a significant impact on the retail fuel station market. Its adoption enhances the customer experience and contributes to the overall competitiveness and operational efficiency at fuel stations. The market is impacted by a number of trends, such as the increase in popularity of electric vehicles and the growth in demand for sustainable fuels.

Furthermore, political, and regional instability in the Middle East sometimes disrupt oil production and exploration activities in Egypt and limited investment in modern technology and infrastructure hinders the Egypt ability to maximize its oil production potential further hamper the growth of Egypt retail fuel stations market. Fuel retailers adopt digitization to enhance operational efficiency and improve customer experience. For instance, ExxonMobil developed Speedpass+ to facilitate payment processes for customers. In addition, Shell heavily innovates in retail fuel stations through a mix of partnerships and internal capability building, to address market developments and fulfil customer needs.

The petrol segment was the highest revenue contributor to the market, with $11.41 million in 2022, and is estimated to reach $15.74 million by 2032, with a CAGR of 3.3%.

The lack of infrastructure development poses significant constraints on the growth and efficiency of the retail fuel station industry. The infrastructure required for dispensing alternative fuels differs significantly from traditional fuels. In addition, the existing stations require significant modifications or new construction for EV vehicles.

The Egypt retail fuel stations market was valued at $25.14 million in 2022, and is projected to reach $34.88 million by 2032, registering a CAGR of 3.4% from 2023 to 2032.

The shift toward alternative fuels represents a change in landscape in consumer preferences and government policies aimed at reducing carbon emissions and dependence on fossil fuels.

The leading players operating in the Egypt retail fuel stations market include, Misr Petroleum, TotalEnergies, Emarat Misr., ADNOC Distribution, Exxon Mobil Corporation, SGS Société Générale de Surveillance SA., Egyptian International Gas Technology Company – Gastec, TAQA, Shell AG and Gulf Oil International Ltd.

Loading Table Of Content...