E-Bus Market Overview

The global electric bus market size was valued at USD 35.3 billion in 2021 and is projected to reach USD 439.7 billion by 2031, growing at a CAGR of 29.5% from 2022 to 2031. The EV bus market is fueled by rising demand for fuel-efficient, low-emission buses, strict emission regulations, and falling battery costs. Technological innovations and supportive government policies further boost e-bus adoption, creating strong growth potential.

Key Market Trend & Insights

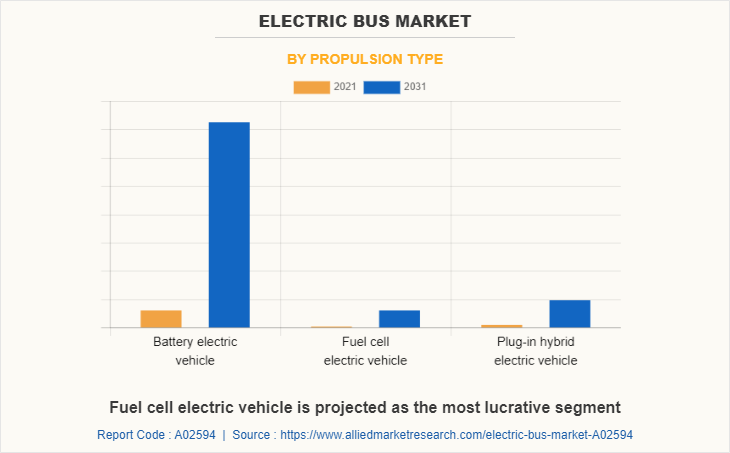

Propulsion Type: Fuel cell electric vehicle segment is expected to see notable growth in the near future.

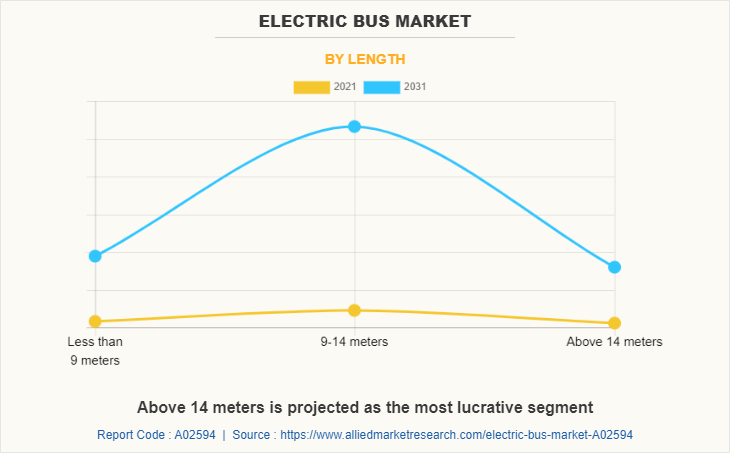

Length Type: Above 14 meters segment is projected to witness significant growth ahead.

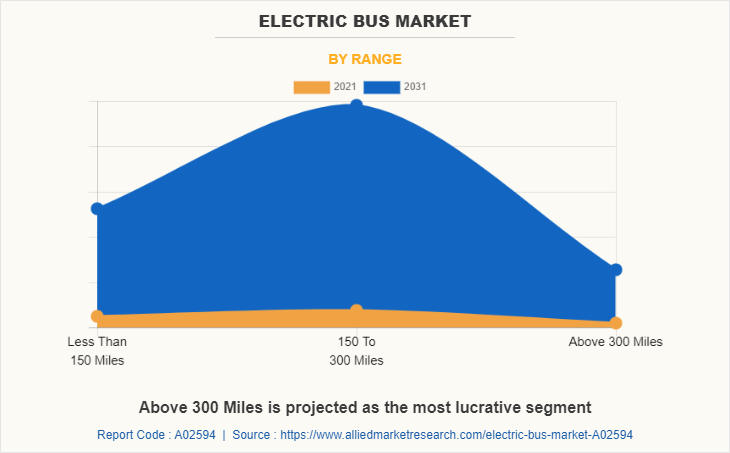

Range: Above 300 miles segment is anticipated to grow substantially in the coming years.

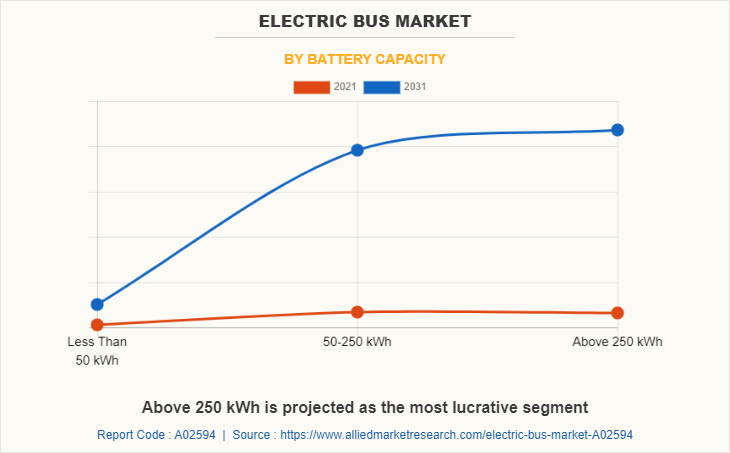

Battery Capacity: Above 250 kWh segment is set to record strong growth in the near future.

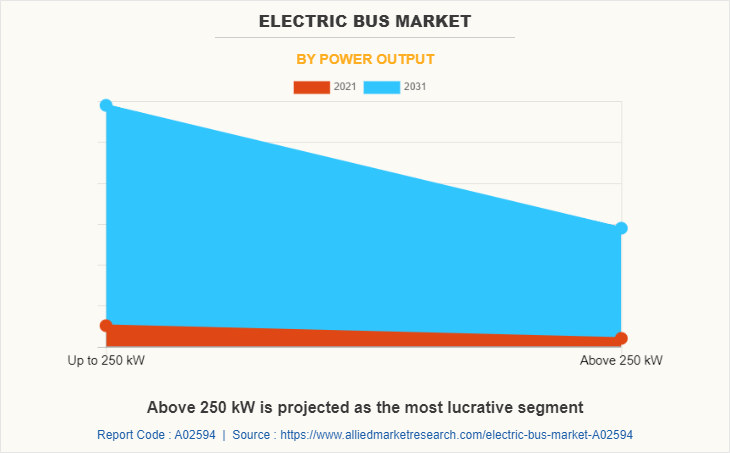

Power Output: Above 250 kW segment is expected to experience notable growth during the forecast period.

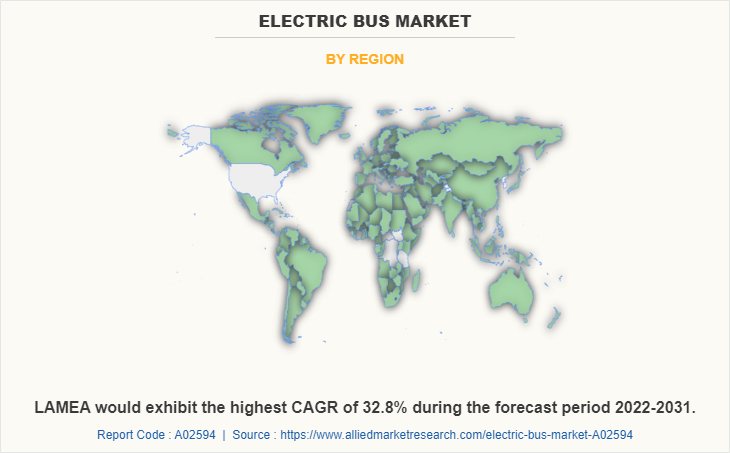

Region: LAMEA is forecast to register the highest CAGR.

Market Size & Forecast

- 2031 Projected Market Size: USD 35.3 billion

- 2021 Market Size: USD 439.7 billion

- Compound Annual Growth Rate (CAGR) (2022-2031): 29.5%

Introduction

An electric bus or e-bus is a bus that does not have a traditional ICE engine for its propulsion and is completely electric. An e-bus is driven by an on-board electric motor that receives the power from on-board batteries or a set of batteries. Electric buses are considered as eco-friendly as they do not produce any pollutants and are also economical when compared with traditional gasoline/diesel buses. Moreover, the electric bus market share contributes more than 80% to the electric commercial vehicles industry.

Market Dynamics

The EV bus market is driven by factors such as an increase in demand for fuel-efficient, high-performance, and low-emission buses, stringent government rules & regulations toward vehicle emission, and reduction in battery prices. However, high manufacturing cost and low fuel economy & serviceability restrict the market growth. Moreover, technological advancements and proactive government initiatives for the adoption of e-buses create lucrative growth opportunities for the market.

In addition, governments are taking various efforts to promote the introduction of electric buses around the world. For instance, the European government has set a goal to have 45% of city electric buses registered for alternative driving by 2025 and at least 65% under the Under Clean Vehicle Directive by 2030. Similarly, the Swedish government plans to expand e-buses penetration to 15% by 2022. Thus, these initiatives shown by the governments are further fueling the growth of the market.

Market Segmentation

The global electric bus market is segmented on the basis of propulsion type, length, range, battery capacity, power output, and region. By propulsion type, the market is segmented into battery electric vehicle, plug-in hybrid electric vehicle and fuel cell electric vehicle. Further, by length, the market is segmented into less than 9 meters, 9–14 meters, and above 14 meters. By range, the market is classified into less than 150 miles, 150 To 300 miles and above 300 miles. Moreover, the market is segmented on the basis of battery capacity into less than 50 kWh, 50-250 kWh and above 250 kWh. By power output, the market is bifurcated into up to 250kW and above 250 kW.

Based on region, the market is analyzed across North America, Europe, Asia-Pacific, and Latin America, Middle East & Africa (LAMEA) including country-level analysis for each region. Asia-Pacific comprises China, Japan, India, South Korea, and the rest of Asia-Pacific. The rest of Asia-Pacific includes countries such as Indonesia, Singapore, Thailand, Vietnam, and Malaysia. The electric bus market has great prospects in the Asia-Pacific, owing to increased investment in manufacturing capacity by key industry players and various measures announced by the Chinese and Indian governments to fully electrify public transport in their respective countries by 2030, India's Bharat Stage 6. The adoption of stringent vehicle emission standards, such as the Emissions Standard, and announcements by major countries such as China, India, Japan, and South Korea that they will ban the sale of new internal combustion engine vehicles by 2040 have reduced sales are soaring, creating demand in the electric mobility industry.

In addition, market players in the region are introducing vehicles with technological advancements to propel the market demand. Furthermore, Japanese automakers such as Toyota, Nissan, and Mitsubishi have been developing electric buses for the domestic and international markets. The Japanese government has also provided incentives and subsidies to promote the adoption of electric buses providing lucrative growth opportunities for the market.

Which are the Top E-Bus companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the E-bus industry.

- AB Volvo

- Ankai Bus

- BYD Company Ltd.

- Construcciones y Auxiliar de Ferrocarriles, S.A.

- Daimler AG

- NFI Group Inc.

- Proterra

- VDL GROEP BV

- Yutong Group

- Zhongtong Bus Holdings Co., Ltd.

What are the Recent Developments in the Electric Bus Market

Competitive analysis and profiles of the major electric bus market players include AB Volvo, BYD Company Ltd, VDL Groep BV, Anhui Ankai Automobile Co.,Ltd, Yutong, Proterra and others. The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

In February 2023, AB Volvo signed an agreement with Belgian public transport operator Operateur de Transport de Wallonie (OTW) to deliver 97 Volvo 7900 S-Charge buses. Volvo 7900 S-Charge bus is now in operation in more than 25 countries. It does not require charging infrastructure as it continuously self-charges while in operation, recovering energy when braking and driving downhill.

In February 2022, VDL Groep BV & Pinnacle Mobility Solutions entered into a partnership & invested $24,175 in electric buses and e-mini trucks manufacturing to cater to the booming last-mile mobility space in India.

In September 2022, Proterra entered into a partnership with Eldorado National California (ENC) for the next generation of electric transit buses. The EV tech manufacturer supplies battery tech, electric powertrain solutions, and other supporting components for an effortless fleet transition.

In September 2021, Daimler AG developed a fully electric eO500U bus chassis. The bus chassis is specially designed for Latin American cities and produced in São Bernardo do Campo, in the Brazilian state of São Paulo.

In July 2020, AB Volvo entered into a partnership with the Public Transport Authority of Western Australia (PTA) to bring Volvo’s first ever Electric Buses to Australia. These provisions for the introduction of alternatively powered vehicles into the public transport bus network when the technology became available in Volvo’s Australian product line.

What are the Top Impacting Factors

Key Market Driver

Increase in demand for fuel-efficient, high-performance, and low emission buses

As gasoline is a fossil fuel, it is not a renewable energy source and is expected to run out in the future. Developing and using alternative fuel sources is critical to supporting sustainable development. Electric buses are used, which do not require gasoline and are more economical than conventional buses. Electric buses convert more than 50% of the electrical energy from the grid into electricity at their wheels, while gas-powered buses can only convert about 17-21% of the energy stored in gasoline. In recent years, the demand for fuel-efficient buses has increased due to rising gasoline and diesel oil prices. This is due to the depletion of fossil fuel reserves and the increasing propensity of companies to seek maximum profit from these oil reserves. These factors, therefore, lead to the need for advanced fuel-saving technologies, leading to increased demand for electric coaches.

Reduction in cost of electric vehicle batteries

Technological advances and the mass production of electric vehicle batteries have significantly reduced the cost of electric vehicle batteries over the past decade. This has led to a reduction in the cost of the electric bus as batteries account for almost 30% to 40% of the total cost of an electric bus. For instance, in 2010, the price of an electric vehicle battery was about $1,100 per kWh. However, according to Bloomberg, that price has dropped to about $137 per kWh by 2020, while the price in China is just $100 per kWh. This is due to technological advances in battery technology, in addition to lower manufacturing costs, lower cathode material prices, and higher production volumes for these batteries. EV battery prices are expected to drop from about $40 to $60 per kWh by 2030, which will bring the price of the electric bus down significantly, making them similar to conventional gas-powered buses. Combined with the growing demand for low-pollution transport, this will lead to the widespread use of electric commercial vehicles including buses in the near future.

Restraints

High cost of investment and complication in operating advanced systems

As the automotive industry shifts to electrification and introduces advanced technologies in vehicles, high costs incurred during production and complex mechanisms of advanced systems may hamper the market growth. Automakers invest most of their research efforts in developing new bus technologies. The high cost of lithium-ion batteries used in buses, software installations, and large capital expenditures ultimately increase vehicle manufacturing costs. Advanced driving assistance systems, such as adaptive cruise control, driver monitoring, park assist, driver drowsiness detection, blind spot detection, and automated emergency braking, consist of sensors, cameras, radars mapping, and other software systems. This highly technical system presents many technical challenges and complexities. These systems can add a calculated risk of malfunction or failure, which can hamper market growth during the forecast year.

Opportunity

Environmental Benefits

At 29%, vehicle exhaust is the single source of ozone depletion, air pollution, and emissions of substances that adversely affect the climate. Consumption of unrefined petroleum and rise in fuel costs have increased the popularity and demand for vehicles that are less harmful to nature and use electrical energy. This has increased the introduction of these e-buses to reduce dependence on petroleum fuel. In addition, electric vehicles have fewer moving parts, making them lighter and more productive than traditional modes of transportation. As a result, vehicles require less maintenance and overall these vehicles are beneficial to the environment. According to a recent study by researchers at Kyushu University in Japan claimed that 74.67% of the total pollutant emissions from the existing bus fleet in Delhi can be reduced. Therefore, the market is expected to grow substantially owing to these drivers over the electric bus market forecast period.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the electric bus market analysis from 2021 to 2031 to identify the prevailing electric bus market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the electric bus market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global electric bus market trends, key players, market segments, application areas, and market growth strategies.

Electric Bus Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 439.7 billion |

| Growth Rate | CAGR of 29.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 450 |

| By Propulsion Type |

|

| By Length |

|

| By Range |

|

| By Battery Capacity |

|

| By Power Output |

|

| By Region |

|

| Key Market Players | YUTONG, CAF, Construcciones y Auxiliar de Ferrocarriles, S.A., NFI Group Inc., VDL Groep BV, Proterra, BYD Company Ltd, Zhongtog Bus Holding, AB Volvo, Daimler AG, Anhui Ankai Automobile Co.,Ltd |

Analyst Review

The electric bus market is projected to witness a moderate growth rate, owing to growth in population along with an increase in disposable income, which will result in an increase in domestic as well as international flights. Companies in this industry are adopting various innovative techniques to provide customers with advanced and innovative feature ranges.

In addition, electric buses are considered the future of electric mobility owing to their advantages over traditional ICE buses such as better acceleration, zero-emission, and noise-free operations. Furthermore, the market is expected to be boosted by advancements in battery technologies and a reduction in e-bus prices coupled with proactive government initiatives.

The key factor that drives the growth of the market is the surge in demand for energy-efficient & mass transit solutions in vehicles followed by a rise in the trend of self-driving vehicles. However, the high cost of the existing range of electric buses and the operating & maintenance costs of electric buses hinders the market growth. Furthermore, a reduction in the cost of electric vehicle batteries is expected to provide remarkable growth opportunities for players operating in the electric bus market.

Among the analyzed regions, Asia-Pacific is expected to account for the highest revenue in the global market throughout the forecast period, followed by North America, Europe, and LAMEA. Moreover, LAMEA is expected to witness the highest growth rate owing to the growth of the manufacturing industry in the region.

Further, the market is consolidated by the presence of major key players such as AB Volvo, Ankai Bus, BYD Company Ltd., Construcciones y Auxiliar de Ferrocarriles, S.A., Daimler AG, NFI Group Inc., Proterra, VDL GROEP BV, Yutong Group, and Zhongtong Bus Holdings Co., Ltd. These players have adopted efficient techniques to develop innovative products.

The global electric bus market was valued at $35,291.0 million in 2021 and is projected to reach $439,679.5 million by 2031.

AB Volvo, Ankai Bus, BYD Company Ltd., Construcciones y Auxiliar de Ferrocarriles, S.A., Daimler AG, NFI Group Inc., Proterra, VDL GROEP BV, Yutong Group, and Zhongtong Bus Holdings Co., Ltd.

In the electric bus market the leading application is Battery electric vehicle

The largest regional market for electric bus is Asia-Pacific.

An increase in demand for fuel-efficient, high-performance, and low-emission buses, a reduction in the cost of electric vehicle batteries, and an increase in government initiatives for the promotion of e-mobility are anticipated to drive the growth of the global electric bus market during the forecast period.

Loading Table Of Content...