Electric Construction And Agriculture Equipment Market Research, 2032

The global electric construction and agriculture equipment market size was valued at $3661.3 million in 2022, and is projected to reach $24271.2 million by 2032, growing at a CAGR of 21.1% from 2023 to 2032. Electric construction and agriculture equipment refers to equipment and machinery utilized in construction and agricultural activities that utilize electric power as opposed to traditional internal combustion engines. Environmental concerns, technology innovations, and growing focus on sustainability contribute to substantial change in the electric construction and farm equipment sector. The trend toward electric gear in construction, including excavators, loaders, and compactors, derives from the industry's desire to decrease emissions and noise pollution on job sites. Battery advancements, that offer longer battery life, faster charging, and more energy density, have boosted the viability of electric equipment, driving large manufacturers and start-ups to invest in creative solutions.

Construction & infrastructure developments are expected to further drive the market growth. The construction equipment market has grown along with rise in demand for industrialization, residential, and commercial infrastructure setup. In emerging economies, infrastructural development is creating a need for construction equipment and positively influencing the market for construction equipment. Real estate is also contributing to the growth of the construction equipment market.

Expenditure on infrastructure development, such as improvement of roads and bridges has been witnessed to increase. As stated by the Global Infrastructure Outlook, by 2040, the global population is estimated to grow by approximately two billion with the urban population growing by 46%, triggering massive demand for infrastructure support.

Increase in urbanization has led to the expansion of the industrial sector throughout the globe, which boosts the electric construction and agriculture equipment market growth. Industrialization has increased due to development in transportation, high immigration, new inventions, and high investment, majorly in Asia-Pacific.

Moreover, in agriculture the use of electric tractors, harvesters, and other agricultural equipment matches with sustainability goals by providing lower emissions, quieter operation, and long-term cost effectiveness. As manufacturers continue to engage in R&D, the electric construction and agricultural equipment sectors are positioned to grow, contributing to a more environmentally conscious future in both industries.

Growing adoption of advanced machinery in the field of agriculture, across the globe will increase in demand for food products has encouraged farmers to increase agriculture production. Farmers are focusing on advanced machines to reduce manual labor and simplify the processes of farming, such as cultivation, irrigation, and harvesting. Over the past few year, several regions have increased the usage of machines for agricultural activities. Bangladesh, in Southern Asia, has become one of the most mechanized agricultural economies.

Over the past few years, agricultural activities have transformed to a great extent. Surge in demand for food has encouraged farmers to opt for advanced agriculture machinery to increase production. In addition to this, the scarcity of labor has led to an increase in labor costs, which is why farmers prefer new and innovative farm equipment to be less dependent on manual labor. The increasing mechanization of agricultural activities is, thus, useful to propel the growth of the overall electric construction and agriculture equipment market.

The growing population of the world is continuously leading to an increased demand for agricultural commodities. To supply the required agricultural commodities, farmers increase the farm production by opting for mechanized farm equipment, thus making the agricultural activities fast and easy. Economic stability in countries has encouraged farmers to invest in farm machinery and thus equip their farms with innovative and modern agricultural machines. Thus, the aforementioned factors foster the growth of the electric construction and agriculture equipment market.

Precision farming has helped farmers to become aware of the most recent conditions of the farm and plan the farm activities accordingly. In addition, agricultural machines equipped with precision farming technology assist farmers in several activities, such as cultivation, sowing, and harvesting, with minimal manual interference. Farmers are opting for precision farming as it is easy to use, cost-effective, and more accurate, thereby fostering the growth of the electric construction and agriculture equipment market.

Tractors constitute a major part of the overall agriculture equipment industry. In developing markets, tractors have replaced manual labor and bullock carts because the cost of ownership of a lower electric tractor is less than the cost of owning bullock carts. The demand for small electric tractors, ranging around 30 HP, has grown in the market. In addition to this, market players launch new and innovative tractors, integrated with intelligent solutions, such as satellite navigation guidance systems. Presently, companies offer electric tractors comprising of different advanced features, such as cabins with noise protection and an air-suspended seat to protect the driver from vibrations, so as to make the farmers workplace ergonomic.

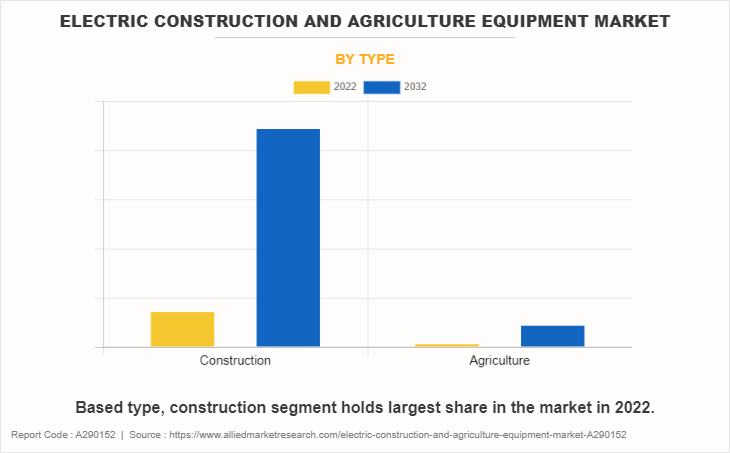

The construction segment was the highest revenue contributor to the market with a CAGR of 20.6%.Excavators, loaders, bulldozers, dump trucks, and other vehicles are among those propelled by electric motors fueled by rechargeable batteries. The capacity of these electric alternatives to reduce noise pollution, run with zero emissions, and offer increased efficiency is driving the transition from traditional diesel-powered machinery toward these battery-operated alternatives in the construction industry.

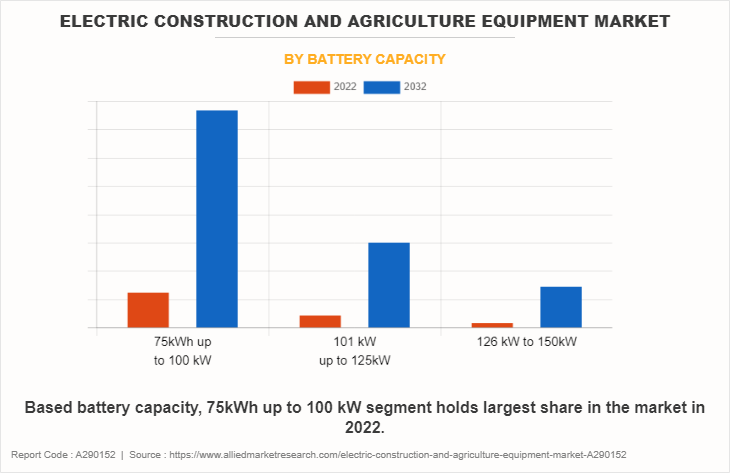

The 75kwh up to 100 kw segment was the highest revenue contributor to the market, with a CAGR of 20.3%. Wide range of machines, such as smaller excavators, loaders, tractors, and bigger construction equipment. Lower-end machines, approximately 75 kW, are often used for lighter agricultural duties or compact construction activities, providing mobility and adaptability in smaller scale operations. As the power capacity approaches 150 kW, these machines are oriented for heavier duty operations, such as bigger excavators, heavy loaders, or specialist agricultural equipment built to tackle more demanding construction and agricultural responsibilities.

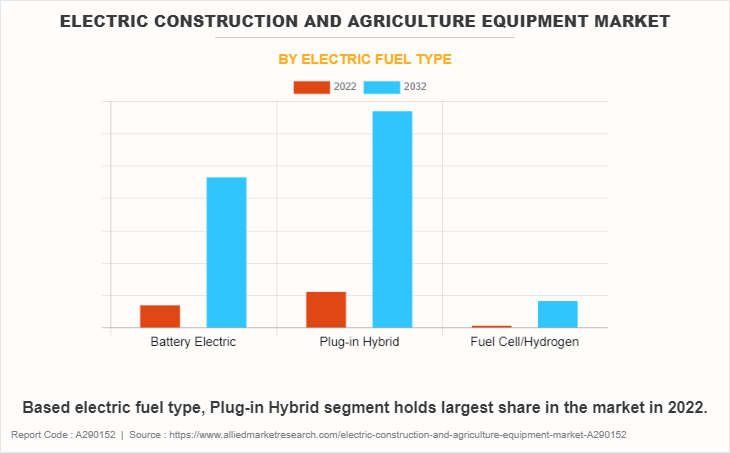

The plug-in hybrid segment was the highest revenue contributor to the market with a CAGR of 20.2%. The battery electric segment will grow, at a significant CAGR of 21.3% during the forecast period. BE machines run entirely on stored power, resulting in emission-free performance and lower noise levels, making them ideal for settings with recharging infrastructure. Plug-in hybrid (PHEV) vehicles use a combination of electric batteries and internal combustion engines to give the flexibility of electric power alongside the greater range afforded by traditional fuel sources, making them suitable for circumstances with limited recharging alternatives.

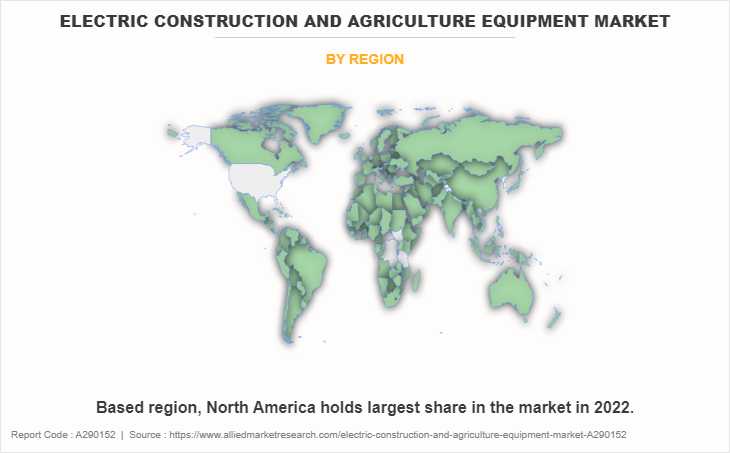

North America was the highest revenue contributor, accounting, with a CAGR of 16.5%. Europe is estimated to grow at a significant CAGR of 15.4%. North America and Europe collectively accounted for around 70.5% share in 2022.

The global market is segmented into type, battery capacity, electric fuel type, and region. Depending on type, the market is categorized into construction and agriculture. By battery capacity, it is fragmented into 75kwh up to 100 kw, 101 kw up to 125kw, and 126 kw to 150kw. By electric fuel type, it is divided into battery electric, plug-in hybrid, and fuel cell/hydrogen. Region wise, the electric construction and agriculture equipment market share is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The COVID-19 pandemic has led to several multinational corporations to stop operations to comply with new government restrictions aimed at limiting disease transmission. This suspension in operations has a direct influence on the worldwide market's revenue flow. Furthermore, manufacturers of industrial items has ceased owing to scarcity of raw materials and workers during the lockdown time. Furthermore, no fresh consignments are received by enterprises in this industry. As a result, the worldwide market in 2020 has been impacted by the suspension of industrial activity and lockdowns for several months.

The key players profiled in the electric construction and agriculture equipment market report include Komatsu Ltd., AB Volvo, KUBOTA Corporation, Caterpillar, Deere and Company, Doosan Corporation, Sandvik AB, Epicroc, Liebherr Group, and Hitachi.

Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging electric construction and agriculture equipment market trends and dynamics.

- In-depth electric construction and agriculture equipment market analysis is conducted by constructing market estimations for the key market segments between 2022 and 2032.

- Extensive analysis of the market is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive electric construction and agriculture equipment market opportunity analysis of all the countries is also provided in the report.

- Electric construction and agriculture equipment market forecast analysis is from 2022 to 2032, included in the report.

- The key market players within the market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the electric construction and agriculture equipment industry.

Electric Construction And Agriculture Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 24271.2 million |

| Growth Rate | CAGR of 21.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 520 |

| By Battery Capacity |

|

| By Electric fuel type |

|

| By Type |

|

| By Region |

|

| Key Market Players | KUBOTA Corporation, AB Volvo, Deere and Company, Sandvik AB, Liebherr Group, Hitachi, Ltd., Caterpillar, Epiroc AB, Doosan Corporation, Komatsu Ltd. |

Analyst Review

The technological advances, particularly in battery technology, are a cornerstone, offering higher energy density, faster charging, and longer battery life, consequently increasing the efficiency and effectiveness of electric machines. Furthermore, a global move toward stronger emissions restrictions and government incentives encourages the use of cleaner technologies, boosting the market's development trajectory. In addition, cost savings from greater production scale and technological maturity are projected to make electric equipment more affordable and competitive.

Increased awareness of environmental sustainability and performance & efficiency improvements, in addition, to the integration of IoT and smart technologies, boost the production and operational efficacy, which notably contribute toward the growth of the global electric construction and agriculture equipment market. One of the most important developments in the construction equipment sector is that electrification is becoming more cost-effective as supply and demand grow and technology advances. As fuel prices increase and other costs to run diesel-powered equipment stay high, the advantages of employing electric construction equipment become more obvious, and alternative-powered technology becomes more widespread, making it a more appealing choice.

Furthermore, unexplored potential in emerging countries, along with growing demand for sustainable solutions, indicate significant development potential for enterprises investing in cutting-edge electric construction and agricultural equipment. As the use of electric construction equipment expands, so does the demand for dependable and easily accessible charging infrastructure.

Technolocial advancements and adoption of zero emission equipments are the upcoming trends of Electric Construction And Agriculture Equipment Market in the world

Construction and mining are the leading application of Electric Construction And Agriculture Equipment Market

North America and Europe combined are the largest regional market for Electric Construction And Agriculture Equipment

The Electric Construction And Agriculture Equipment Market was valued for $3,661,283.40 thousand in 2022

Komatsu Ltd., AB Volvo, KUBOTA Corporation, Caterpillar, Deere and Company, Doosan Corporation, Sandvik AB, Epicroc, Liebherr Group, and Hitachi.

The Electric Construction And Agriculture Equipment Market is estimated to reach $24,271,192.80 thousand by 2032,

The product launch is key growth strategy of Electric Construction And Agriculture Equipment industry players.

: The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Loading Table Of Content...

Loading Research Methodology...