Electric Power Tools Market Research, 2031

The Global Electric Power Tools Market size was valued at $70.2 billion in 2021, and is projected to reach $124.4 billion by 2031, growing at a CAGR of 5.7% from 2022 to 2031.

An electric power tool is a tool that runs by an additional power source and mechanism other than the solely manual labor used with hand tools. The most common types of electric power tools use electric motors. Internal combustion engines and compressed air are also commonly used.

Electric Power Tools Market Dynamics

Electric power tools offer a diversified portfolio of its products that provides the utility of these tools for material modification, manufacturing and construction activities. It helps in saving time of operation and helps in providing ease during work. Thus, this makes these tools suitable for various applications such as commercial, residential and professional establishments.

These tools are available in cordless and corded platforms. The growing adoption of technology has led to improved mechanism of these tools that has improved the functionality of such tools for large scale jobs. Moreover, the electric power tools are used for hammering, compacting, grinding, cutting, planning, sawing and drilling operations which is growing its adoption in the electric power tools market.

The use of electric power tools for various applications such as grinding, hammering, drilling, chopping and cutting is growing the adoption of such tools for construction applications. Thus growth in adoption of electric power tools for construction activities is driving the electric power tools market growth.

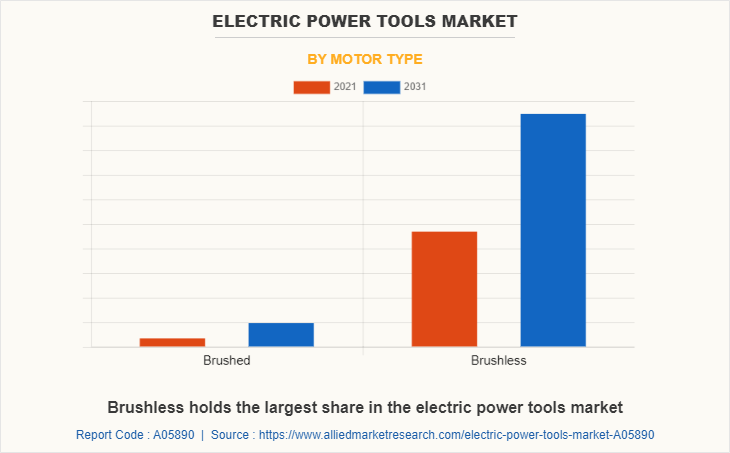

The growing adoption of technology for electric power tools is leading to development of these tools. This is leading to the use of brushless motors for corded and cordless power tools resulting in upgradation of capabilities of electric power tools to the greater extent. Moreover, growing popularity of the cordless electric power tools owing to its adaptability in different remote locations is growing the electric power tools market share.

Conversely, the high initial cost of electric power tools is one of the major restraining factors for the growth of the market. The pneumatic power tools have been popular for a long time, owing to their high productivity capacities and comparatively lower costs than the electric counterparts. This is likely to negatively affect the growth of the electric power tools market.

During the outbreak of the COVID-19 pandemic, construction, manufacturing, hotel, and tourism industries were majorly affected. Manufacturing activities were halted or restricted. This led to decline in manufacturing of various equipment used for electric power tools as well as their demand in the market, thereby restraining the growth of the electric power tools market.

Conversely, industries are gradually resuming their regular manufacturing and services. This is expected to lead to re-initiation of electric power tools companies at their full-scale capacities, that helped the electric power tools market to recover by end of 2021.

On the contrary, the major electric power tool manufacturers have employed automation technologies to manage their electric power tools during the operations. The penetration of automation has made it feasible for the operators to track, connect, and customize their tools on multiple jobsites and hence, attain more productivity through the same electric power tool. Such automation technologies are likely to assist in creating the global electric power tools market outlook during the forecast period.

The electric power tools market is segmented into Tools, Motor type and Application.

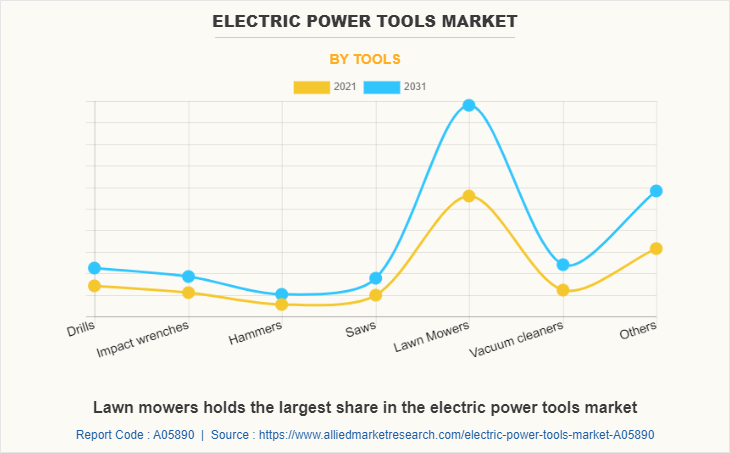

By tool, the market is divided into drills, impact wrenches, hammers, saws, lawn mowers, vacuum cleaners and others.

By motor type, the market is divided into brushed and brushless.

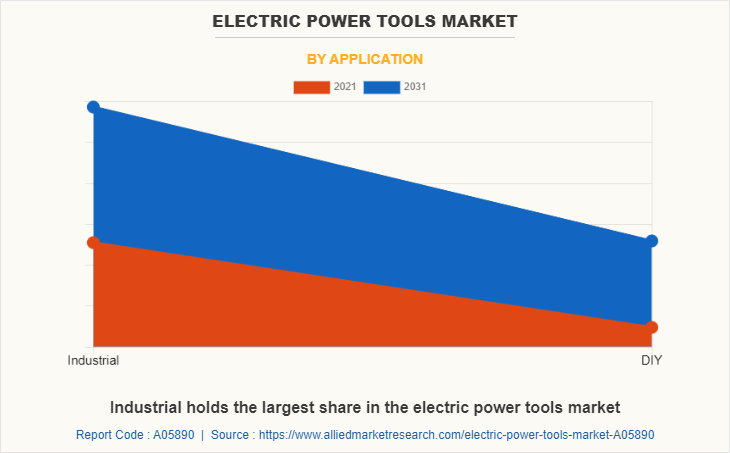

By application, the market is divided into industrial and DIY.

Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

On the basis of tools, in 2021 the lawn mowers segment dominated the electric power tools industry, in terms of revenue, and vacuum cleaners segment is expected to witness growth at the highest CAGR during the forecast period. As per motor type, in 2021, the brushless segment led the electric power tools market, and is expected to exhibit highest CAGR in the near future. By application, the industrial segment led the market in 2021, in terms of revenue and the DIY segment is anticipated to register highest CAGR during the forecast period. Region wise, North America garnered the highest revenue in 2021; however, LAMEA is anticipated to register highest CAGR during the forecast period.

Competition Analysis

The key players profiled in the electric power tools market overview report include Apex Tool Group, Atlas Copco AB, C&E Fein GmbH, Hilti Corporation, Ingersoll Rand Inc., Koki Holding, Co., Ltd., Makita Corporation, Robert Bosch GmbH, Stanley Black & Decker, Inc., Snap-on Incorporated and Techtronic Industries Co., Ltd. Major companies in the market have adopted product launch, business expansion, partnership, agreement and acquisition as their key developmental strategies to offer better products and services to customers in the market.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the electric power tools market analysis from 2021 to 2031 to identify the prevailing electric power tools market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the electric power tools market forecast.

- Major countries in each region are mapped according to their revenue contribution to the global electric power tools market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global electric power tools market trends, key players, market segments, application areas, and market growth strategies.

Electric Power Tools Market Report Highlights

| Aspects | Details |

| By Tools |

|

| By Motor type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Ingersoll Rand Inc., Techtronic Industries Co., Ltd, C&E Fein GmbH, Hilti Corporation, Stanley Black & Decker Inc., Robert Bosch GmbH, Makita Corporation, Snap-On Incorporated, Atlas Copco AB, Apex Tool Group, LLC, Koki Holding, Co., Ltd. |

Analyst Review

The electric power tools market holds a high potential in the cordless power tools segment. The cordless power tools are becoming very popular mainly because of their portability feature. In addition, introduction of brushless DC motors (BLDC) in the cordless electric power tools has enabled the users to achieve better tool performances at considerably less power consumptions. In addition, the easy to use nature of these cordless power tools has also increased their popularity between do-it-yourself (DIY) users, among which most of them are non-professional users. Hence, even the power tools manufacturers have launched separate product lines for non-professional household applications.

Moreover, the improved product qualities of electrically powered tools have increased their adoption in the construction industry. The diverse range of electrically powered tools proves them to be beneficial for various operations. For instance, previously, the power tools had limited usage for drilling, breaking, and cutting applications. However, the newly developed saws, power screwdrivers, polishers, shears, rotary hammers, mixers, and others have increased their usability for nearly every construction activity. Hence, the overall drive in the construction industry has propelled the growth of the electric power tools market. Furthermore, integration of brushless motors in electric power tools has changed the productivity scenario of electrically powered tools. Brushless motors generate less friction than brushed motors; thus, the power loss due to friction is reduced to a great extent, which enables the power tool to attain same productivity in comparatively less power consumption. Many major players in the electric power tools industry have developed their pre-established product portfolios with brushless motors, which have increased the tool efficiency by nearly 35%. This factor is expected to boost the growth of the electric power tools market.

The global electric power tools market was valued at $70,164.7 million in 2021, and is projected to reach $124,425.37 million by 2031, registering a CAGR of 5.7% from 2022 to 2031.

The forecast period considered for the global electric power tools market is 2022 to 2031, wherein, 2021 is the base year, 2022 is the estimated year, and 2031 is the forecast year.

Latest version of global electric power tools market report can be obtained on demand from the website.

The base year considered in the global electric power tools market report is 2021.

The top companies holding the market share in the global electric power tools market report include Apex Tool Group, Atlas Copco AB, C&E Fein GmbH, Hilti Corporation, Ingersoll Rand Inc., Koki Holding, Co., Ltd., Makita Corporation, Robert Bosch GmbH, Stanley Black & Decker, Inc., Snap-on Incorporated and Techtronic Industries Co., Ltd.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading 10 companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

By tool, the lawn mower segment is the highest share holder of electric power tools market.

Loading Table Of Content...