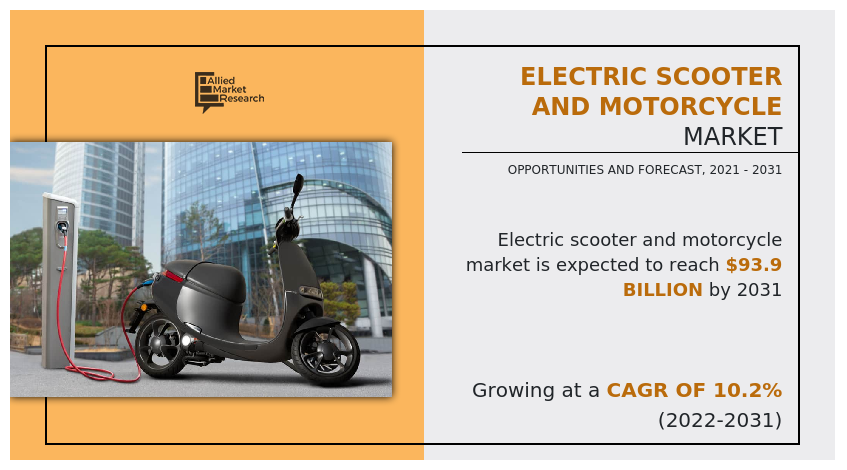

The global electric scooter and motorcycle market was valued at $35.3 billion in 2021, and is projected to reach $93.9 billion by 2031, growing at a CAGR of 10.2% from 2022 to 2031.

Electric motorcycles and scooters are also known as plug-in electric vehicles and have two or three wheels. The rechargeable battery is the power source of the electric two-wheeler and provides the fuel (electricity) to the electric motor. Modern electric bikes and scooters typically use a lithium-ion battery pack, which is usually the most expensive component in an electric two-wheeler. Compared with gasoline or diesel motorcycles, electric motorcycles & scooters are more comfortable. Electric motorcycles produce less vibration. Consumers look up to them (electric motorcycles/scooters) as an ideal substitute for traditional bikes & cars due to rising concern for air pollution caused by gasoline-based vehicles. Also, these bikes help to tackle traffic congestion, owing to the smaller size and can attain higher speeds with lesser effort. Moreover, these bikes include sensors & electric displays that provide additional assistance to the rider required for a smooth ride.

At present, governments of several countries are undertaking initiatives to promote clean sources of energy by implementing stringent emission norms and providing subsidies and tax benefits for the early adoption of electric two-wheelers and other low-emission vehicles to help meet the stringent emission regulations. For instance, in June 2019, the Indian Government announced a plan to lower the goods & service tax (GST) on e-vehicles including e-bikes & scooters from 12% to 5% for faster adoption of electric vehicles. Also, investments in developing new models of electric two-wheeled vehicles and electric bicycles/scooters with advanced performance characteristics and new technology for core parts and components is anticipated to drive the electric scooter and motorcycle market.

The factors such as increasing government initiatives towards electric mobility, rising fuel prices, and consumer inclination toward use of e-bikes as an eco-friendly & efficient solution for commute supplement the growth of the electric scooter and motorcycle market. However, high initial cost of e-bikes and scooter and ban on use of e-bikes in major cities of China are the factors expected to hamper the growth of the electric scooter and motorcycle industry. In addition, improvement in infrastructure and growing advancement in battery technology creates market opportunities for the key players operating in the market.

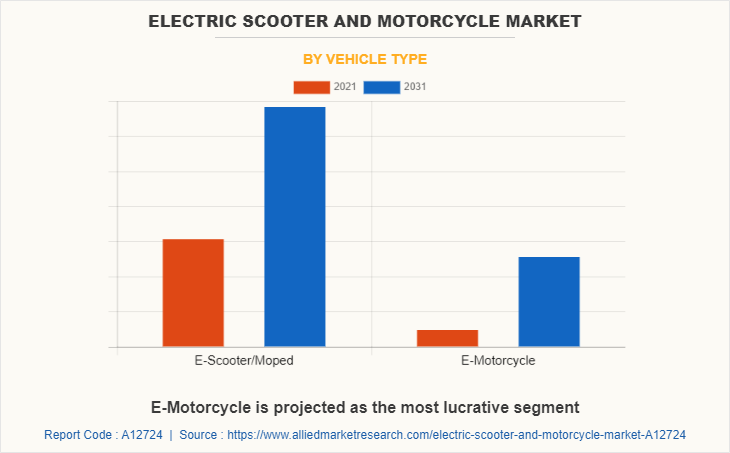

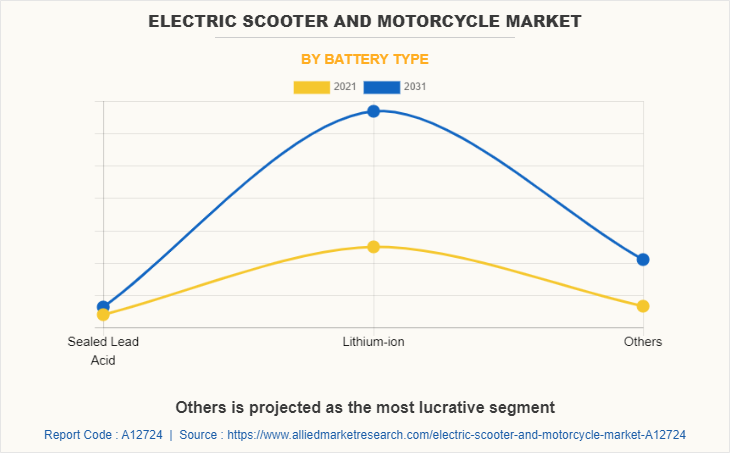

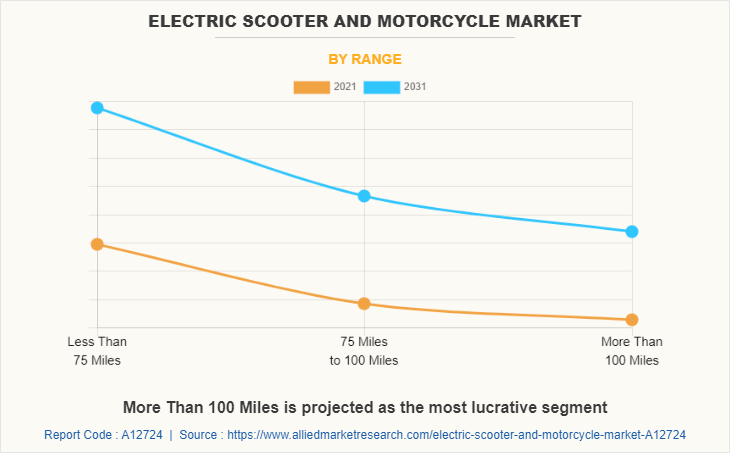

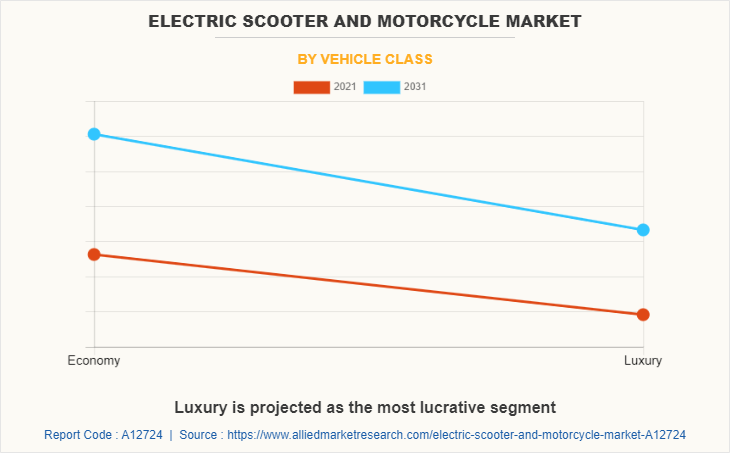

The electric scooter and motorcycle market is segmented into vehicle type, battery type, range, power, vehicle class, usage and region. By vehicle type, the market is divided into E-scooter/moped and E-motorcycle. By battery type, it is fragmented into sealed lead acid, lithium-ion, and others. By range, it is categorized into less than 75 miles, 75 miles to 100 miles, and more than 100 miles. By power, it is further classified into less than 3kW, 3kW to 5kW, and more than 5kW. By vehicle class, it is fragmented into economy and luxury. By usage, it is categorized into commercial and private. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading players operating in the electric scooter and motorcycle market are AIMA Technology Group Co. Ltd., Dongguan Tailing Electric Vehicle Co., Ltd., Energica Motor Co SpA, Govecs AG, Greaves Electric Mobility Private Limited, Harley-Davidson, Hero Electric, Jiangsu Xinri E-Vehicle Co., Ltd, KTM AG, Lightning Motorcycles, Okinawa Autotech Pvt. Ltd., Piaggio & C. SpA, Terra motors, TVS Motor Co Ltd, Vmoto limited, Yadea Technology Group Co., Ltd., Zero Motorcycles, Inc.

Increasing government initiatives towards electric mobility

Governments of various countries are taking initiatives to reduce the carbon footprints by encouraging the use of electric bikes/scooter, electric vehicles, and bicycles, owing to increase in awareness toward the hazardous effects of using vehicles running on fossil fuels. Moreover, governments are constructing bicycle-friendly streets, which are encouraging individuals to opt for bicycle as a key mode of commute. Electric bicycles, scooters, and motorcycles have gained significant attention from various governments as reliable and efficient types of light motor vehicles (LMVs), which help in reducing the carbon footprint. Furthermore, to encourage the use of these environment-friendly vehicles, governments around the world are supporting for the purchase of electric mobility, in terms of tax credits and incentives. For instance, in June 2019, the Indian Government announced a plan to lower the goods & service tax (GST) on e-vehicles from 12% to 5% for faster adoption of electric vehicles.

Furthermore, infrastructure facilities such as guarded bicycle parking facilities, construction of more bicycle (express) routes, and establishment of battery charging stations in many countries by the governments significantly boost the adoption of electric bikes by users, thereby propelling the growth of the electric scooter and motorcycle industry.

Rising fuel prices

Increase in fuel costs over the past decade has led to rise in adoption of electric bicycles as a mode of daily commute. Increase in fuel prices is the result of surge in crude oil costs, which are majorly controlled by the Organization of the Petroleum Exporting (OPEC) countries. Moreover, prices are expected to increase with limited sources of crude oil in the future. Although there has been an increase in the gasoline prices, electricity costs have been low in many countries such as China, Germany, and Denmark. Bicycles equipped with electric motors help in maintaining higher speed more effectively as well as make the ride more comfortable on rough roads. Therefore, increase in fuel cost is expected to fuel the consumer inclination toward e-bikes, thereby boosting the growth of the electric scooter & motorcycle market.

High initial cost of e-bikes and scooter

High cost of e-bikes and scooters is a major factor that restrains the growth of the electric scooter and motorcycle market. The cost of the battery and technology makes electric motorcycles costlier as compared to traditional bikes, conventional scooters, or motorcycles. Hence, consumers find conventional scooters or motorcycles superior in performance with same or less price. Moreover, the use of lithium–ion batteries or drive mechanism of motor incurs maximum cost, thereby restraining the growth of the market. Hence, upsurge in adoption of e-bikes in countries other than China is limited by high costs. However, the e-bike market is growing at a rapid rate globally, which may reduce the impact of this restraint in the near future.

By Power

More Than 5kW is projected as the most lucrative segment

Improvement in infrastructure

Electric motorcycles & scooters are less expensive than cars, do not require license, and can be used on existing road infrastructure. Moreover, rapid urbanization and less preference of consumers to use cars due to increased traffic congestion are anticipated to offer lucrative opportunities for market expansion with the enhancement in infrastructure. In addition, governments of various countries are focusing on the development of infrastructure for e-bikes, including bicycle tracks and public charging stations with the inclination of consumers toward e-bikes (motorcycles & scooters). For instance, in June 2020, Pittsburgh unveiled a 10-year plan to significantly expand bike infrastructure in the city by more than 120 miles of new trails, bicycle lanes, and other street improvements. Also, Sanyo (Japan) opened two solar parking lots in Tokyo where around 100 electric bikes can be recharged from solar panels. Therefore, increasing government initiatives for the development of electric bikes infrastructure and the proliferation of smart cities across the globe are anticipated to offer lucrative growth opportunities for the electric motorcycles & scooters market.

Key Benefits For Stakeholders

- This study presents analytical depiction of the global electric scooter and motorcycle market analysis along with current trends and future estimations to depict imminent investment pockets.

- The overall electric scooter and motorcycle market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the global electric scooter and motorcycle market with a detailed impact analysis.

- The current electric scooter and motorcycle market is quantitatively analyzed from 2022 to 2031 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Electric Scooter and Motorcycle Market Report Highlights

| Aspects | Details |

| By Vehicle Type |

|

| By Battery Type |

|

| By Range |

|

| By Power |

|

| By Vehicle Class |

|

| By Usage |

|

| By Region |

|

| Key Market Players | Harley Davidson, Husqvarna Motorcycles GmbH, KTM AG, Electric Motion, Bell Custom Cycles, Ampere Vehicles Pvt Ltd (Greaves Cotton), Govecs Group, Honda Motors, Energica Motor Company S.p.A, Hero Eco Vehicles Pvt Ltd, Johammer e-mobility GmbH, Blacksmith Electric, AIMA Technology Group Co. Ltd, Essence Motorcycles, Hero Electric, Lightning Motorcycles, Alta Motors |

Analyst Review

This section provides the opinions of various top-level CXOs in the global electric scooter and motorcycle market. Hence, based on the interviews of various top-level CXOs of leading companies, increase in government support for electric mobility including bikes & scooters and implementation of stringent laws toward CO2 emission drive the growth of the global electric scooter & motorcycle market. Moreover, consumer inclination toward the use of e-bikes as an eco-friendly and efficient solution for commute and increase in fuel costs supplement the market growth. In addition, rising energy costs and competition among emerging energy-efficient technologies are also expected to fuel the market's growth. For instance, in July 2021, Harley-Davidson announced the launch of the LiveWire ONE all electric bike under its LiveWire brand. The bike launched at a starting price of $21,999 and was capable of 146 miles of city range and featured fast DC Fast Charging from 0 to 100% in 60 minutes.

Furthermore, according to Paul Lee, Mark Casey and Craig Wigginton (Global Head of Research for the technology, media, and telecommunications (TMT) industry at Deloitte), between 2020 and 2023, more than 130 million e-bikes (motorcycles & scooters) are expected to be sold in 2023, e-bike sales are expected to top 40 million units worldwide. This is attributed to technological innovations in electric bikes, making them more attractive for commuters. Also, several pilot programs have been initiated to introduce e-scooters in a phased manner to reduce vehicle emissions in cities. The popularity of e-scooters is also encouraging conventional two-wheeler manufacturers to enter the market. For instance, in June 2022, Hero Electric partnered with Zypp Electric, India's leading D2C EV brand to supply 1.5 lakh electric scooters which supported the growth sustainable green alternatives for the logistics and delivery segment.

The market growth is supplemented by factors such as increasing government initiatives towards electric mobility, rising fuel prices, and consumer inclination toward use of e-bikes as an eco-friendly & efficient solution for commute supplement the growth of the electric scooter and motorcycle market. However, high initial cost of e-bikes and scooter and ban on use of e-bikes in major cities of China are the factors expected to hamper the growth of the electric scooter and motorcycle market. In addition, improvement in infrastructure and growing advancement in battery technology creates market opportunities for the key players operating in the electric scooter and motorcycle market.

Among the analyzed regions, Asia-Pacific is the highest revenue contributor, followed by Europe, North America, and LAMEA. On the basis of forecast analysis, LAMEA is expected to lead during the forecast period, due to increasing affordability of electric two wheelers and increasing government initiatives towards electric mobility.

Introduction of long range electric scooters & motorcycles are the upcoming trends of Electric Scooter and Motorcycle Market in the world

Increased application in private usage is the leading application of Electric Scooter and Motorcycle Market

Asia-Pacific is the largest regional market for Electric Scooter and Motorcycle

Global Electric Scooter and Motorcycle Market Expected to Reach $93.92 Billion by 2031

The leading players operating in the electric scooter and motorcycle market are AIMA Technology Group Co. Ltd., Dongguan Tailing Electric Vehicle Co., Ltd., Energica Motor Co SpA, Govecs AG, Greaves Electric Mobility Private Limited, Harley-Davidson, Hero Electric, Jiangsu Xinri E-Vehicle Co., Ltd., KTM AG, Lightning Motorcycles, Okinawa Autotech Pvt. Ltd., Piaggio & C. SpA, Terra motors, TVS Motor Co. Ltd., Vmoto limited, Yadea Technology Group Co., Ltd., and Zero Motorcycles, Inc.

Loading Table Of Content...