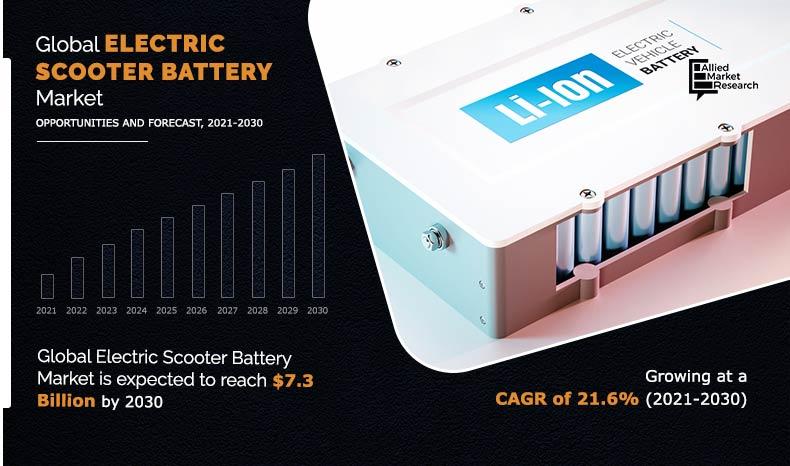

Electric Scooter Battery Market Outlook - 2030

The global electric scooter battery market was valued at $1.0 billion in 2020, and is projected to reach $7.3 billion by 2030, growing at a CAGR of 21.6% from 2021 to 2030. An electric scooter battery is a power storage unit used to provide voltage (power) to the DC motor, controller, lights, and other scooter accessories. It is made up of individual cells and electronics called a battery management system that keeps it operating safely with high energy density and longevity.

The prices of crude oil-based products are controlled by oil traders, current oil supply, and future supply & demand. These factors make fossil fuels a highly volatile commodity. Attributed to high volatility in fuel prices there is a rapid shift towards battery-operated lightweight electric vehicles. Moreover, it offers highly affordable last-mile transportation, less maintenance expense, enhanced comfort and safety as compared to vehicles running on fossil fuels. These factors together are expected to drive the growth of the electric scooter battery market.

However, the sealed lead-acid batteries (SLA) consist of lead and sulfuric acid that if discarded on the ground may contaminate groundwater and may cause a potential threat to both humans and the environment. Exposure to high levels of lead may cause several health-related disorders such as weakness, anemia, kidney failure, and sometimes death. Moreover, sulfuric acid being highly corrosive alters the soil chemistry and may cause toxicity in the subsurface environment. This factor is expected to restrain growth of the electric scooter battery market during the forecast period.

On the contrary, the rapid growth in the transportation sector consumes a lot of fuel that increases pollution and global warming. To promote the use of clean and energy-efficient vehicles lightweight lithium-ion (Li-ion) battery is used to provide voltage to the motor. It has high energy densities than other batteries and a smaller battery size makes it suitable for use in electric scooters. In addition, it uses lightweight lithium for the electrode instead of heavier graphite that enhances the mileage of electric scooters by reducing their overall weight. Moreover, rising completion among key manufacturers of electric scooters has made them more linear towards using the lightweight lithium-ion battery for providing affordable and last-mile transportation. This factor is anticipated to open up new opportunities in the market.

The global electric scooter battery market analysis is done on the basis of product type, capacity, and region. Depending on product type, the market is divided into Lithium-Ion (Li-ion), Lithium Iron Phosphate (LFP), Lithium Polymer (LiPo), Sealed Lead Acid Battery (SLA), and Nickel Metal Hydride (NiMH). On the basis of capacity, it is fragmented into 100-500 Wh, 500-1000 Wh, 1000-1500 Wh, 1500-2000 Wh, and 2000 Wh & Above. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The global electric scooter battery industry profiles leading players that include Contemporary Amperex Technology Co. Ltd., Dande Renewable Energy Pvt. Ltd., Hunan CTS Technology Co. Ltd., LG Energy Solution, Maxvolt Energy, Pastiche Energy Solutions, Pure EV, Samsung SDI Co. Ltd., SmartPropel Lithium Battery, and Xupai Battery Inc.

Electric scooter battery market, by region

The Asia-Pacific electric scooter battery market size is projected to witness growth at the highest CAGR of 21.7% during the forecast period and accounted for 97.2% of the electric scooter battery market share in 2020. The increasing youth population and purchasing power of middle-class communities in countries such as China, India, and others, are expected to surge the sales of electric scooters, which in turn may lead the electric scooter battery market to witness a significant increase in demand. Moreover, the rising environmental awareness among the customers may provide an additional push to the growth of the electric scooter battery market in the Asia-Pacific region.

By Region

Asia Pacific is the most lucrative region

Electric scooter battery market, by product type

In 2020, the Lithium-ion (Li-ion) segment was the largest revenue generator, and is anticipated to grow at a CAGR of 23.5% during the forecast period. The growing popularity of electronic scooters where lithium-ion (Li-ion) battery is used for its high energy density and longer charge retention is expected to be one of the key drivers for the growth of the electric scooter battery market.

By Product Type

Lithium-ion is fastest growing segment

Electric scooter battery market, by capacity

By capacity, the 1000-1500 Wh segment dominated the global market in 2020, and is anticipated to grow at a CAGR of 20.7% during forecast period. The rapid urbanization has surged the transportation & automotive sector where 1000-1500 watt-hour (Wh) electric scooter batteries are widely used for medium travel distances may boost the market growth. Moreover, the increasing per unit electricity charges has made people more linear towards purchasing electric scooters with economical battery capacity.

By Capacity

1500-2000 Wh is the fastest growing segment

Key benefits for stakeholders

- Porter’s five forces analysis helps analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- It outlines the current electric scooter battery market trends and future estimations from 2020 to 2030 to understand the prevailing opportunities and potential investment pockets.

- The major countries in the region have been mapped according to their individual revenue contribution to the regional market.

- The key drivers, restraints, and opportunities and their detailed impact analysis are explained in the study.

- The profiles of key players and their key strategic developments are enlisted in the report.

Impact Of Covid-19 On The Global Electric Scooter Battery Market

- The novel coronavirus is an incomparable global pandemic that has spread to over 180 countries and caused huge losses of lives and economies around the globe.

- The electronic scooter battery market has been negatively impacted due to the wake of the COVID-19 pandemic owing to its dependence on transportation sectors. According to a report published by the International Energy Agency, the global road transport activity was almost 50% below the average by the end of March 2020 as compared to March 2019.

- Also, several companies have either shut down or shrank their operations due to the risk of infections among the workforce, which in turn has slowed the production rates of electric scooter batteries during the COVID-19 period.

- In addition, the falling income of customers and travel restrictions imposed by both local and government bodies has decreased the sales of electric scooters which in turn has lead the electric scooter battery market to witness a downfall in demand.

- Also, around 180 countries have temporarily stopped the trade of unnecessary products, which in turn has hampered the demand-supply chain of electric scooter battery amid the COVID-19 situation.

Key market segments

By Product Type

- Lithium-ion (Li-ion)

- Lithium iron phosphate battery (LFP)

- Lithium Polymer (LiPo)

- Sealed Lead Acid Battery (SLA)

- Nickel Metal Hydride Battery (NiMH)

By Capacity

- 100 – 500 Wh

- 500 – 1000 Wh

- 1000 – 1500 Wh

- 1500 – 2000 Wh

- 2000 Wh & Above

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- South Africa

- Rest of LAMEA

Electric Scooter Battery Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Capacity |

|

| By Region |

|

| Key Market Players | SmartPropel Lithium Battery, Maxvolt Energy, SAMSUNG SDI CO., LTD, Contemporary Amperex Technology Co., Limited, Hunan CTS Technology Co., Ltd, XUPAI BATTERY, Inc., Pastiche Energy Solutions, LG Energy Solution, PURE EV, Dande Renewable Energy Pvt. Ltd. |

Analyst Review

According to CXOs of leading companies, the global electric scooter battery market is expected to exhibit high growth potential, owing to the growing popularity of electronic scooters where lithium-ion (Li-ion) battery is used for its high energy density and longer charge retention may act as one of the key drivers for the growth of the electric scooter battery market. Furthermore, they are capable of storing more energy and produce greater output as compared to other electric scooter batteries. This has made the key automobile manufacturers more linear toward using lightweight lithium-ion battery, which in turn is expected to propel the market growth. In addition, The increasing urbanization has surged the growth of the transportation sector where electric scooters having 100-500 watt-hour (Wh) battery are widely used for relatively small travel distances is the major key market trends in the global market.

The dependency on lightweight electric vehicles is increasing rapidly owing to zero carbon emission, low operating and maintenance costs, and other factors. Moreover, significant fiscal incentives spurred the uptake of light-duty electric vehicles; thus, scaled up the growth of electronic vehicles and battery industries. This has led both government and key manufacturing companies to invest in building charging infrastructure to provide efficient and advanced charging facilities to customers. Thus, increasing vehicle charging infrastructure in developed economies is predicted to offer lucrative growth opportunities for the market in the future.

Product launch and business expansion are the key growth strategies of electric scooter batteries Market players

Asia-Pacific will provide more business opportunities for electric scooter batteries in future.

To get latest version of electric scooter batteries market report can be obtained on demand from the website.

By product type, the lithium-ion (Li-ion) segment holds the maximum share of the electric scooter batteries market.

Contemporary Amperex Technology Co. Ltd., Dande Renewable Energy Pvt. Ltd., Hunan CTS Technology Co. Ltd., LG Energy Solution, Maxvolt Energy, Pastiche Energy Solutions, Pure EV, Samsung SDI Co. Ltd., SmartPropel Lithium Battery, and Xupai Battery Inc.

The top ten market players are selected based on two key attributes - competitive strength and market positioning

Increasing vehicle charging infrastructure in developed economies and increasing fuel prices are the driving factors. While, emergence of lightweight lithium-ion (Li-ion) battery to open up new opportunity in the electric scooter batteries market

Major electric scooter manufacturing companies.

It outlines the current electric scooter battery market trends and future estimations from 2020 to 2030 to understand the prevailing opportunities and potential investment pockets.The major countries in the region have been mapped according to their individual revenue contribution to the regional market.

the rapid growth in the transportation sector consumes a lot of fuel that increases pollution and global warming. To promote the use of clean and energy-efficient vehicles lightweight lithium-ion (Li-ion) battery is used to provide voltage to the motor. It has high energy densities than other batteries and a smaller battery size makes it suitable for use in electric scooters. In addition, it uses lightweight lithium for the electrode instead of heavier graphite that enhances the mileage of electric scooters by reducing their overall weight. Moreover, rising completion among key manufacturers of electric scooters has made them more linear towards using the lightweight lithium-ion battery for providing affordable and last-mile transportation. This factor is anticipated to open up new opportunities in the market

Loading Table Of Content...