Electric Three Wheeler Market Overview

The global electric three wheeler market size was valued at USD 0.77 billion in 2021, and is projected to reach USD 1.5 billion by 2031, growing at a CAGR of 7% from 2022 to 2031. The factors such as rise in the trend of last mile connectivity, increase in demand for affordable commercial vehicle, and inclination toward use of electric three wheelers as an eco-friendly & efficient solution for commute supplement the growth of the market. However, lack of standardization of EV charging and high cost of battery are the factors expected to hamper the growth of the market. In addition, growth in the trend of shared mobility and greater availability of credit and financing options creates market opportunities for the key players operating in the electric three wheeler market.

Key Market Trend & Insights

- Electric three-wheelers favored for last-mile delivery due to low cost and maneuverability.

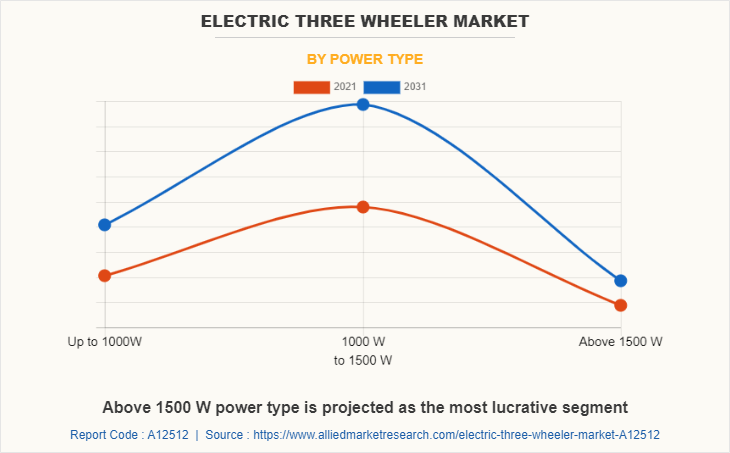

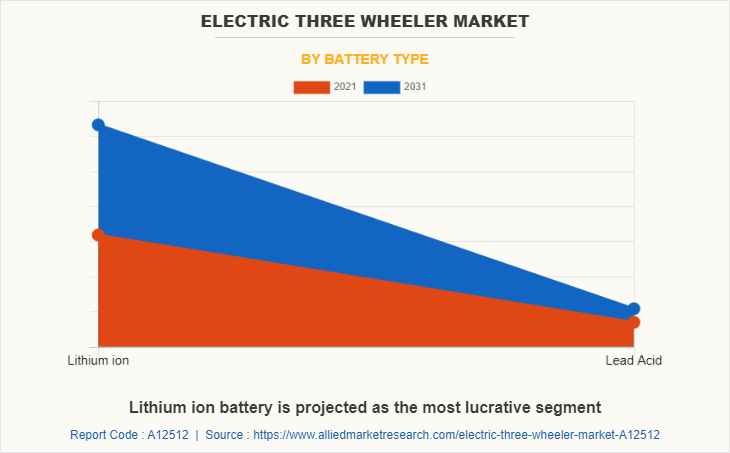

- Passenger carriers, 1000–1500W power, and lithium-ion batteries lead market growth.

- Demand rises for affordable commercial vehicles in developing regions like India and Africa.

- Expanding dealerships and partnerships boost market presence.

- Government and corporate EV adoption drives growth.

- Offers flexible, cost-effective transport and job opportunities in emerging markets.

Market Size & Forecast

- 2031 Projected Market Size: USD 1.5 billion

- 2021 Market Size: USD 0.77 billion

- Compound Annual Growth Rate (CAGR) (2022-2031): 7.0%

Introduction

Electric three-wheelers are electrically powered vehicles that are equipped with high torque motors and longer durability batteries. Three-wheelers with a combination of one single wheel in front and two at the back are tricycles, whereas one with two front wheels and a single back wheel is known as a tadpole. Electric three-wheelers have a wider application in different industries, such as passenger commuting within the city as well as transportation of goods and services from one place to another. Moreover, with the increased inclination toward electric vehicles, three-wheeler manufacturing companies have introduced numerous electric-propelled three-wheelers, which positively impacts the growth of the global electric three-wheeler market.

With the increasing fuel prices at the international level, growth in pollution, and traffic congestion, especially in urban areas, electric three-wheeler manufacturing companies have introduced numerous electric-propelled three-wheelers, which positively impacts the growth of the global electric three wheeler market. For instance, in October 2020, Mahindra Electric Mobility Limited launched the new Treo Zor electric 3-wheeler cargo vehicle. The vehicle was available at a starting price of $3,400 (INR 2.73 lacs) and was driven by an 8kW motor which allowed it to have a payload capacity of 550Kg.

Market Segmentation

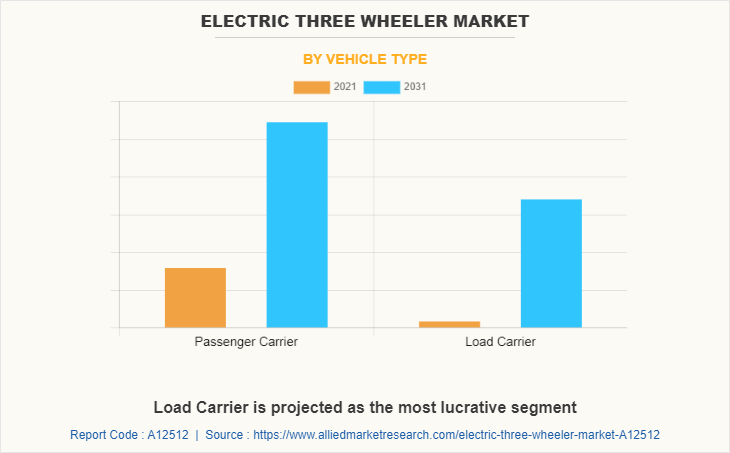

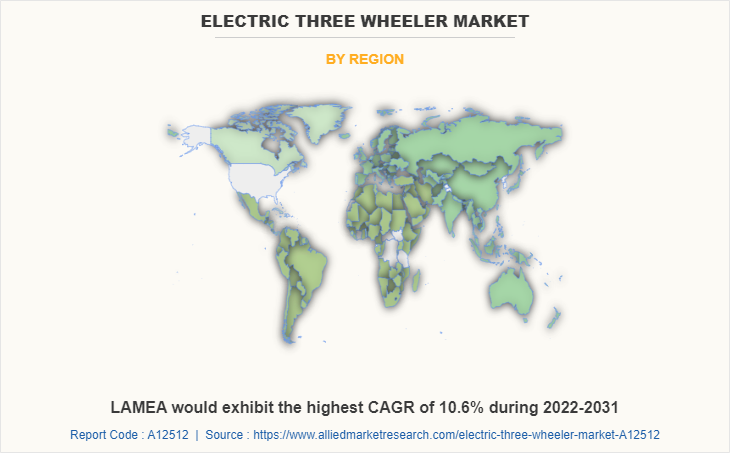

The market is segmented into vehicle type, power type, battery type and region. By vehicle type, the market is categorized into passenger carrier and load carrier. By power type, the market is divided into up to 1000W, 1000W to 1500W, and above 1500W. By battery type, it is fragmented into lithium-ion and lead acid. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Which are the Top Electric Three Wheeler companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the electric three wheeler industry.

- Adapt Motors

- Altigreen

- ATUL Auto Limited

- BILITI Electric Inc.

- Bodo Vehicle Group Co., Ltd.

- Chongqing Zongshen Vehicle Co., Ltd.

- E-TUK Factory

- Green Impex

- J.S. Auto Pvt. Ltd.

- Kinetic Green Vehicles

- Mahindra Electric Mobility Limited

- Piaggio & C. SpA

- Scooters India Limited

- Terra Motors Corporation

- Zuperia Auto Pvt. Ltd.

What are the Top Impacting Factors

Key Market Driver

Rise in trend of last mile connectivity

Many companies in e-commerce, pharma, textiles, retail, FMCG, and other utility segments, such as dairy, poultry, and gas, prefer three-wheelers as a last-mile connectivity solution as they offer excellent maneuverability at affordable prices. For Instance, an India-based company uses electric loader rickshaws (three-wheelers) to provide first and last-mile delivery services to e-commerce and food-tech players such as Amazon, Swiggy, and Bigbasket. In addition, with effective integration of advance technology, design, and workflow, many leading players are trying to bring the upfront cost of electric loader rickshaws, which further foresee the preference for loader rickshaws as a last mile connectivity solution. Furthermore, governments of many countries are keen to convert their last-mile delivery fleet to electric due to their added benefits. For instance, in 2021, Amazon India partnered with Mahindra Electric to deploy EVs in its delivery fleet. Amazon India announced that its fleet of delivery vehicles will include 10,000 electric vehicles by 2025, which is expected to reduce the overall transportation cost considerably.

Increase in demand for affordable commercial vehicle

The rise in expenditure on commercial vehicles in developed and developing countries is creating the need for affordable commercial vehicles. For instance, in January 2022, Goenka Electric Motor Vehicles Private Limited partnered with Omega Seiki Mobility, a manufacturer of electric mobility solutions for end-to-end deliveries, to jointly set up over 500 dealerships across India in a phased manner by FY24. This increased their market presence across India. Furthermore, electric three-wheeler mobility depends on affordability, maneuverability, and door-to-door accessibility. In many middle and low-income countries such as India, Africa, Nigeria, and others, electric three-wheelers offer significantly cheaper and faster travel options and better route flexibility than other means of transport. In many low- and mid-income countries, the three-wheelers can also be linked to enhanced employment opportunities, further bolstering the demand for electric three-wheeler in the global market.

Restraints

Lack of standardization of EV charging

The electric vehicles battery source does not have any alternative source for charging. The shortage of charging points in most of the cities is a major challenging factor for growth of the global market. Furthermore, thin & inconsistent charging infrastructure, and range anxiety can create a problem for electric vehicle and can put the traveler at risk. Moreover, the implementations of supportive infrastructure required for electric vehicle in developing countries are less. Furthermore, as the technology is not matured enough, apart from China, the sales of the electric vehicles are extremely less as compared to the internal combustion engine (ICE) vehicle sale. The automotive industry has standardized 120- and 240-volt plugs, which are primarily used in homes but have not yet set a standard on the plugs or ports that can charge vehicles in 30 minutes or less. Thus, all these factors coupled with the different prices at charging stations altogether are responsible for hindering the growth of the global electric three wheeler market.

Opportunity

Growth in the trend of shared mobility

Shared mobility services reduce city congestion and decrease overall vehicle emissions. Therefore, digitally enabled car-sharing and ride-hailing manage travel needs in the smartest way and also provide a hassle-free and environmentally sound alternative to private car ownership. This sharing & ride-hailing activity includes the entire process, from travel planning to a single mobile app that can handle payments. In the coming years, ride-hailing services are projected to play a significant role in this space by reducing manual tasks and minimizing overall time & cost. This trend is further foreseen to strengthen the growth of the three-wheeler market. The number of users relying on ride-sharing applications has increased in recent years. For instance, Uber launched its ride-hailing services in 30 cities to expand its business globally. To create awareness and promote new services, the key players offer customers discounts, free rides, and coupon facilities.

Moreover, California-based company Lyft Inc. is providing free rides to patients. Furthermore, Lyft also invested in several partnerships, most noticeably in healthcare transportation, which offers new mobility options for non-drivers, including older people, younger people, people with disabilities, and people without access to a vehicle. Shared transportation is taking a back seat amid the pandemic. However, the benefits of shared mobility, such as reduced congestion, reduced emission, and cost effective, are anticipated to strengthen the demand for three-wheeler during the forecast period.

Key Benefits for Stakeholders

- This study presents an analytical depiction of the global electric three wheeler market analysis along with current wheeler market trends and future estimations to depict imminent investment pockets.

- The overall electric three wheeler market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the global market with detailed impact analysis.

- The current market is quantitatively analyzed from 2022 to 2031 to benchmark the financial competency.

- Porter's five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Electric Three Wheeler Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1.5 billion |

| Growth Rate | CAGR of 7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 240 |

| By Vehicle Type |

|

| By Power Type |

|

| By Battery Type |

|

| By Region |

|

| Key Market Players | Mahindra Electric Mobility Limited, Zuperia Auto Pvt. Ltd., Chongqing Zongshen Vehicle, BILITI ELECTRIC, KINETIC GREEN VEHICLES, Altigreen, J.S. Auto Pvt. Ltd., E-TUK Factory, Terra Motors Corporation, Adapt Motors, Piaggio & C. SpA, SCOOTERS INDIA LIMITED, Atul Auto Ltd, Green Impex, Bodo Vehicle Group |

Analyst Review

This section provides the opinions of various top-level CXOs in the global electric three wheeler market. The market is supplemented by numerous developments carried out by the top electric three wheeler manufacturers, which has led to the market’s growth. Moreover, technological advancements in vehicles, followed by the need for smart vehicles to commute within cities, supplement the growth of the global electric three wheeler market.

Furthermore, rising industrialization and growing e-commerce segment have accelerated in recent years, which is propelling the electric three-wheeler market. Many e-commerce players are very keen to adopt gasoline as well as electric three-wheeler in their fleet, owing to their excellent maneuverability, low maintenance, and operating cost ever for shorter transits. For instance, an India-based company uses electric three-wheelers to provide first and last-mile delivery services to e-commerce and food-tech players such as Amazon, Swiggy, and Bigbasket. In 2021, Amazon India partnered with Mahindra Electric to deploy EVs in its delivery fleet. Amazon India announced that its fleet of delivery vehicles will include 10,000 electric vehicles by 2025, which is expected to reduce the overall transportation cost considerably. Hence, an increase in the penetration of electric vehicles will also help in reducing environmental impact, which in turn is expected to create lucrative opportunities for market expansion.

The market growth is supplemented by factors such as a rise in the trend of last mile connectivity, increase in demand for affordable commercial vehicle, and inclination toward use of electric three wheelers as an eco-friendly & efficient solution for commute supplement the growth of the electric three wheeler market. However, lack of standardization of EV charging and high cost of battery are the factors expected to hamper the growth of the electric three wheeler market. In addition, growth in the trend of shared mobility and greater availability of credit and financing options creates market opportunities for the key players operating in the electric three wheeler market.

Among the analyzed regions, Asia-Pacific is the highest revenue contributor, followed by Europe, LAMEA, and North America. On the basis of forecast analysis, LAMEA is expected to lead during the forecast period, due to rapid industrialization and rising level of emission and supportive government schemes for electric three wheelers.

Availability of Lithium Ion powered Electric Three Wheeler are the upcoming trends in the world

Passenger Carrier is the leading application of Electric Three Wheeler Market

Asia-Pacific is the largest regional market for Electric Three Wheeler

The global electric three wheeler market was valued at $773.3 million in 2021, and is projected to reach $1,481.1 million by 2031, registering a CAGR of 7.0% from 2022 to 2031

The leading players operating in the electric three wheeler market are Adapt Motors, Altigreen, ATUL Auto Limited, BILITI Electric Inc., Bodo Vehicle Group Co., Ltd., Chongqing Zongshen Vehicle Co., Ltd., E-TUK Factory, Green Impex, J.S. Auto Pvt. Ltd., Kinetic Green Vehicles, Mahindra Electric Mobility Limited, Piaggio & C. SpA, Scooters India Limited, Terra Motors Corporation, and Zuperia Auto Pvt. Ltd

Loading Table Of Content...