Electric Two-Wheeler Lithium-Ion Battery Management System Market Research, 2033

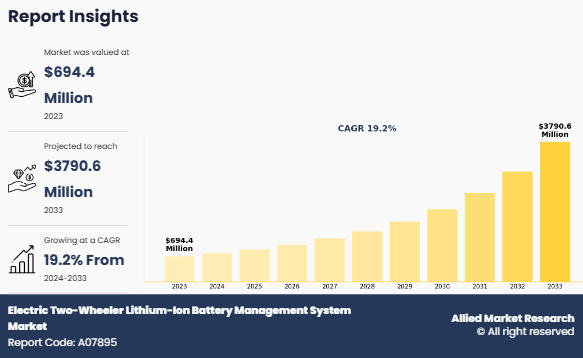

The global electric two-wheeler lithium-ion battery management system market size was valued at $694.4 million in 2023, and is projected to reach $3,790.6 million by 2033, growing at a CAGR of 19.2% from 2024 to 2033.

An electric two-wheeler lithium-ion battery management system (BMS) is a crucial technology that monitors and manages the health and safety of lithium-ion batteries in electric two-wheelers. It ensures optimal battery performance by overseeing parameters such as voltage, current, temperature, and state of charge (SOC). The BMS also protects the battery from overcharging, over discharging, and overheating, thereby extending its lifespan and improving the vehicle's overall safety and efficiency. For instance, in November 2024, Maxvolt Energy Industries Ltd., a lithium battery manufacturer, launched a new generation of electric two-wheeler battery packs that combine advanced safety features with enhanced performance. Equipped with modern technologies such as Bluetooth connectivity, these batteries enable real-time monitoring, offering users improved management, oversight, and a safer, more efficient EV experience

Key developments

November 2024: NXP Semiconductors launched MC33774 18-channel analog front-end device is ideal for electric two-wheeler lithium-ion battery management system (BMS). With high-precision cell measurement accuracy and robust cell balancing capabilities, it enhances battery performance and safety, particularly for high-voltage Li-ion batteries used in electric two-wheelers. The ASIL D support ensures the safety of critical systems, making it suitable for the demanding requirements of electric two-wheeler applications.

September 2024: NXP Semiconductors launched the MC33777, an advanced battery junction box IC designed to consolidate critical Battery Management System (BMS) functions, making it ideal for the electric two-wheeler lithium-ion battery management system (BMS) market. By continuously monitoring battery current and slope at high speeds, it ensures the protection of high-voltage batteries, enhancing the efficiency and safety of electric two-wheelers.

November 2023: Infineon Technologies partnered with Eatron Technologies to enhance automotive lithium-ion battery management systems(BMS) with machine learning capabilities on the Aurix TC4x microcontroller. Infineon’s BMS platform ensures precise monitoring and optimization of lithium-ion EV batteries while meeting ASIL D safety standards for hardware and software. This partnership supports diverse applications, including electric two- and three-wheelers. The platform is compatible with 12V to 1200V systems, catering to low-speed vehicles, energy storage, and high-voltage EVs, thereby improving lithium-ion battery performance and reliability across various sectors.

May 2023: Sensata Technologies launched c-BMS24X, a compact and advanced battery management system (BMS) designed for low-voltage electric vehicles(EVs), industrial applications, and energy storage systems. This system can handle applications with up to 24 cells in series and provide continuous current of up to 2000+A. The c-BMS24X includes enhanced software capabilities such as parallel battery pack connections, battery swapping, and improved fault tolerance in measurements and predictions, which contribute to better vehicle range, battery health, and uptime. The system is ideal for use in two-wheelers.

April 2022: Infineon Technologies AG launched TLE9012DQU and TLE9015DQU battery management ICs, designed for efficient battery cell monitoring and balancing. These ICs offer excellent measurement performance and robust application support, making them ideal for battery modules and advanced topologies like cell-to-pack and cell-to-car systems. They are suitable for various industrial and automotive applications, including electric two-wheelers and three wheelers, energy storage systems, and hybrid electric vehicles(HEVs). This product family ensures enhanced safety, performance, and reliability for lithium-ion battery management systems in lightweight EVs and other sectors.

Market Dynamics

Increase in adoption of electric vehicles(EVs) and hybrid electric vehicles(HEVs)

Increase in adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs) is significantly driving the demand in electric two-wheeler lithium-ion battery management system industry. As the EV market expands, there is surge in need for reliable, efficient, and safe battery management solutions to optimize battery performance, extend life, and ensure safety. Lithium-ion batteries, being the preferred choice for electric two-wheelers due to their energy density, longer life, and lower weight, require advanced BMS to manage their charge and discharge cycles effectively. These systems are crucial in maintaining battery health, preventing overcharging, and balancing cells, which ultimately improves the performance and reliability of the vehicles.

For instance, in November 2022, Hero Electric partnered with Battrixx, a subsidiary of Kabra Extrusion technik, to develop advanced lithium-ion batteries for their electric two wheelers. Hero Electric offers a variety of electric scooters, including the Comfort Speed models (Eddy and Atria) and City Speed models (Photon, Optima, and Nyx), along with the Velocity electric cycle. The partnership aims to enhance the performance and sustainability of Hero Electric’s products, leveraging Battrixx's expertise in battery technology. Hero Electric currently operates over 850 sales and service outlets across India, strengthening its presence in the growing EV market.

Moreover, rise in focus on sustainable and eco-friendly transportation solutions is contributing to the acceleration of electric two-wheeler adoption, further fueling the demand for advanced battery management systems. This trend is expected to continue as governments and consumers increasingly prioritize green technologies in mobility solutions. Therefore, increase in adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs) are driving the demand of electric two-wheeler lithium-ion battery management system industry.

Rise in industry preference for use of lithium-ion batteries

Rise in preference for lithium-ion batteries across industries is driving the demand for electric two-wheeler lithium ion battery management systems (BMS). Lithium-ion batteries offer superior energy density, long cycle life, and relatively low weight, making them the preferred choice for electric two-wheelers, such as e-scooters and e-bikes. For instance, in July 2022, Appear Inc. launched high-performance graphene battery packs as part of lithium-ion batteries, where graphene is integrated into components such as electrodes to enhance conductivity, charging speed, and energy density, improving the overall performance of traditional lithium-ion batteries designed for e-bikes, and e-scooter capable of recharging in under 60 minutes using standard home outlets. This breakthrough offers a six-fold improvement in charging speed compared to conventional batteries, significantly enhancing consumer convenience and the value proposition of electric mobility solutions. as the electric mobility market grows, especially in regions prioritizing sustainable transport solutions, there is a rise in need to ensure the safe, efficient, and reliable operation of these batteries.

Furthermore, battery management system plays a critical role in optimizing battery performance by managing charge cycles, temperature regulation, and ensuring safety protocols such as overcharging and over-discharge protection. Integration of these systems enhances battery longevity and overall vehicle reliability, making lithium-ion batteries even more appealing. The rise in reliance on lithium-ion technology across diverse electric vehicle sectors, combined with the rapid expansion of the electric two-wheeler lithium-ion market, is boosting the demand for advanced battery management systems. These systems play a vital role in enhancing safety, efficiency, and durability, making them essential for driving the growth of the electric two-wheeler lithium-ion market and accelerating the adoption of lithium-ion technology. Therefore, rise in industry preference for use of lithium-ion batteries is driving the growth of the electric two-wheeler lithium-ion battery management system market size.

Increase in overall price of product with addition of battery management system

Increase in cost of electric two-wheelers, driven by the addition of sophisticated BMS, is posing a challenge to the market growth. The integration of BMS adds to the overall price of electric two-wheelers, making them less affordable for a broader consumer base, especially in price-sensitive regions. For manufacturers, incorporating BMS technology increases production costs, which are often passed on to consumers, deterring potential buyers from purchasing electric two-wheelers. While BMS is essential for ensuring battery performance, safety, and longevity, its cost implications are limiting the electric two-wheeler lithium-ion battery management system market share. As a result, while BMS is crucial for ensuring battery performance, safety, and longevity, its cost implications are restricting the electric two-wheeler lithium-ion battery management system market growth.

In addition, competition from cheaper alternatives and the financial limitations of consumers further complicate adoption, particularly in emerging markets. These factors collectively inhibit the mass adoption of electric two wheelers and slow down the overall market expansion despite increasing interest in electric mobility solutions. Therefore, increase in overall price of product with addition of battery management system is hampering the demand for the electric two-wheeler lithium-ion battery management system.

Increase in adoption of cloud-connected battery management systems

Increase in adoption of cloud-connected battery management systems (BMS) presents a significant opportunity for the growth of the electric two-wheeler lithium-ion BMS market. Cloud-based BMS enable real-time monitoring, remote diagnostics, and predictive maintenance, allowing fleet operators and consumers to track battery health, charging patterns, and overall performance more effectively. This connectivity enhances user experience by providing actionable insights and facilitating over-the-air (OTA) updates to improve battery management. Cloud connected systems also contribute to more efficient energy usage, reducing operational costs. As electric two wheeler adoption grows, the demand for advanced, intelligent BMS that integrate with cloud platforms is expected to rise, boosting the market growth.

Furthermore, the ability to gather and analyze data remotely supports better lifecycle management of batteries and aligns with the growing trend towards smart, connected mobility solutions Therefore, increase in adoption of cloud connected battery management systems offers lucrative opportunity for the growth of the market.

Segmentation

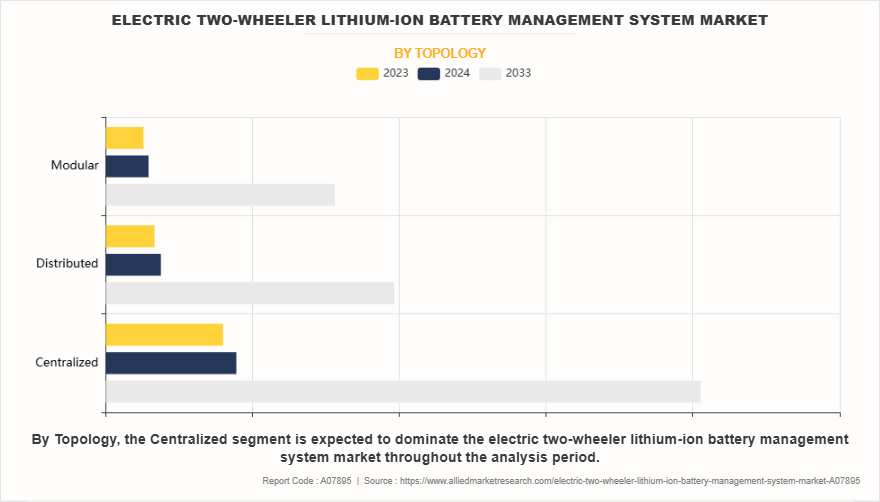

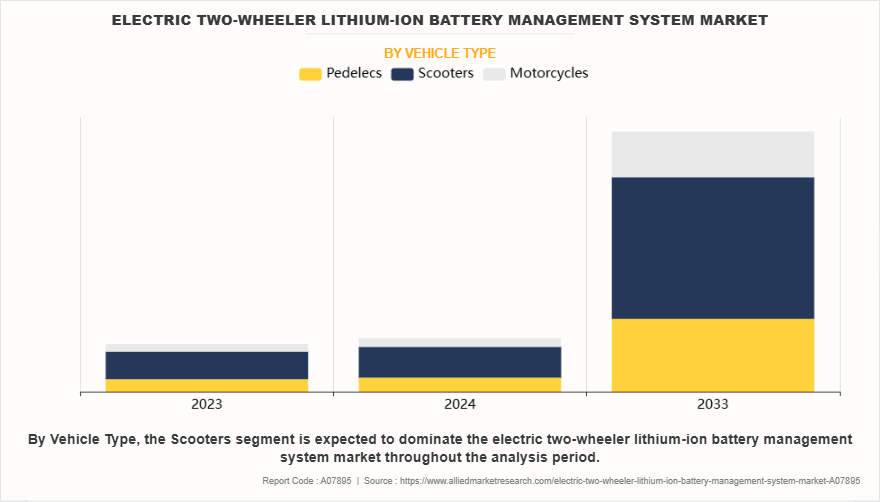

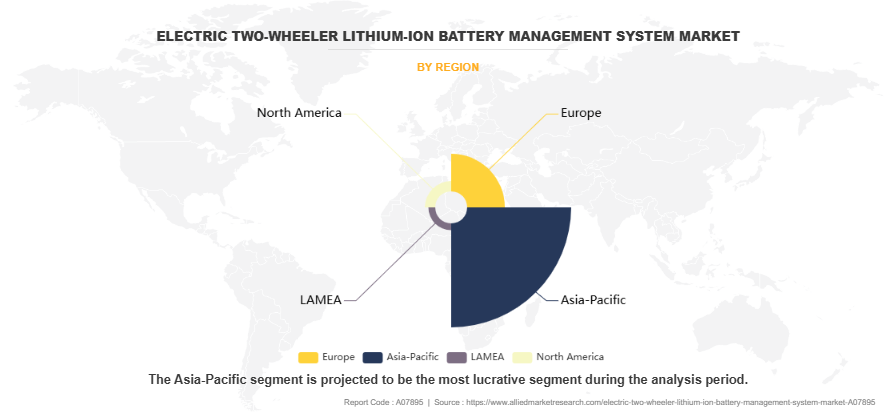

The electric two-wheeler lithium-ion battery management system market is segmented on the basis of topology, vehicle type, and region. By topology, it is classified into centralized, distributed, and modular. By vehicle type, it is segmented into pedelecs, scooters, and motorcycles. By region, the report is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Topology

On the basis of topology, the market is classified into centralized, distributed, and modular. The centralized BMS segment holds the highest market share due to its cost-effectiveness, simplified design, and widespread adoption in mass-produced electric two-wheelers like scooters and pedelecs. Its single-unit structure efficiently manages battery operations, reducing system complexity and manufacturing costs. Centralized BMS is particularly favored in price-sensitive markets like Asia-Pacific, where demand for affordable electric vehicles is high. Its compatibility with standard lithium-ion battery packs further drives adoption, making it the preferred choice for entry-level and mid-range electric two-wheelers globally.

By Vehicle Type

On the basis of vehicle type, the market is bifurcated into pedelecs, scooters, and motorcycles. The scooters segment holds the highest market share due to its widespread adoption for urban commuting, affordability, and suitability for short to medium-range travel. Scooters are particularly popular in densely populated regions like Asia-Pacific, where they dominate the electric two-wheeler market due to their compact design, lower maintenance costs, and government incentives promoting electric mobility. Additionally, their versatility, ease of use, and alignment with consumer preferences for eco-friendly transportation solutions make scooters the preferred choice, driving their dominance in the market.

By Region

On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific region dominated the global market in the year 2023 due to the region's high population density, rapid urbanization, and strong government initiatives promoting electric mobility. Countries like China and India dominate sales, driven by affordability, infrastructure development, and increasing environmental awareness. Additionally, local manufacturers' extensive product offerings and subsidies on electric vehicles further boost adoption. The region's dependence on two-wheelers for daily commuting and its emphasis on reducing air pollution have positioned Asia-Pacific as the leader in this market.

Competition Analysis

The key players in the electric two-wheeler lithium-ion battery management system market are Leclanché SA, Renesas Electronics Corporation, NXP Semiconductors N.V., Shenzhen Litongwei Electronics Technology Co., Ltd., Texas Instruments Incorporated, Microchip Technology Inc., Sensata Technologies, Inc., Infineon Technologies AG, Embitel, and Navitasys India Private Limited.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the electric two-wheeler lithium-ion battery management system market analysis from 2023 to 2033 to identify the prevailing electric two-wheeler lithium-ion battery management system market trends.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the electric two-wheeler lithium-ion battery management system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global electric two-wheeler lithium-ion battery management system market forecast, key players, market segments, application areas, and market growth strategies.

Electric Two-Wheeler Lithium-Ion Battery Management System Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 3.8 billion |

| Growth Rate | CAGR of 19.2% |

| Forecast period | 2023 - 2033 |

| Report Pages | 284 |

| By Topology |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | Infineon Technologies AG, Sensata Technologies, Inc., Texas Instruments Incorporated, NXP Semiconductors, Leclanché SA, Renesas Electronics Corporation, Microchip Technology Inc., Shenzhen Litongwei Electronics Technology Co., Ltd., Navitasys India Private Limited, Embitel |

Analyst Review

The sales of electric two-wheeler lithium-ion battery management systems (BMS) are expected to increase due to growing environmental awareness and government incentives promoting electric vehicles (EVs) are driving the demand for electric two-wheelers globally. Lithium-ion batteries, known for their efficiency and longer lifespan, are becoming the preferred power source in electric two-wheelers, necessitating the use of advanced BMS to optimize battery performance and ensure safety. Additionally, the rapid expansion of the electric vehicle market, particularly in regions like Asia-Pacific, and technological advancements in BMS are fueling market growth, contributing to the increasing adoption of these systems.

The Asia-Pacific electric two-wheelers lithium-ion battery management system (BMS) market is growing due to government incentives, low production costs, and the presence of a robust manufacturing ecosystem. Emerging trends include the development of low-cost smart BMS and partnerships between domestic manufacturers and global suppliers to enhance technological capabilities.

For instance, in November 2024, ZELIO Ebikes launched the XMEN 2.0 electric scooter in India, offering variants with advanced lithium-ion batteries. The lithium-ion models, priced at $1036.7 and $1,084.1, provide top-tier energy efficiency and a range of up to 100 km on a single charge, consuming only 1.5 units of electricity per charge. Designed for urban commuting, the scooter supports a top speed of 25 km/h, a robust build for a gross weight of 90 kg, and a loading capacity of 180 kg, making it a practical and eco-friendly choice for daily mobility needs. Therefore, rise in popularity of battery-swapping networks and integration of wireless BMS for enhanced user convenience are driving demand of electric two-wheelers lithium-ion battery management system (BMS) market in the Asia-Pacific region.

The Europe two-wheeler lithium-ion battery management (BMS) market growth is driven by stringent EU regulations on emissions, subsidies for electric mobility, and expanding network of charging stations. European consumers prioritize energy efficiency and performance, driving demand for advanced BMS with features such as predictive maintenance and regenerative braking.

For instance, in September 2024, NXP Semiconductors' launched the MC33777, an advanced battery junction box IC. With its ability to monitor battery current and slope at high speeds, the MC33777 enhances efficiency, safety, and performance of electric two-wheelers, aligning with Europe’s push for sustainable and efficient electric mobility solutions. Moreover, growth of shared mobility services such as e-scooter rental schemes and the integration of AI-driven battery analytics are also playing a significant role in the expansion of two-wheeler lithium-ion battery management in Europe.

The electric two-wheeler lithium-ion battery management system (BMS) market in the UK has witnessed rapid growth as electric two-wheelers gain popularity for urban commuting and environmental sustainability. Lithium-ion batteries, coupled with advanced BMS technology, are integral to managing the charge cycles, battery health, and overall performance of electric bikes and scooters. These systems ensure efficient energy use, enhanced safety, and optimal performance, essential for the growing demand in the UK’s electric mobility sector. For instance, in August 2022, Nexeon invested $200 million to scale up its silicon-based anode manufacturing, aligning with the growing demand for electric two-wheeler lithium-ion battery management systems (BMS) in the UK. This investment in advanced battery materials supports the development of more efficient, high-performance batteries, which are crucial for enhancing the performance and longevity of electric two-wheelers.

As the market for electric two wheelers expands, such investments are key to meeting the increasing demand for reliable and sustainable energy storage solutions. As Nexeon upgrades the production to supply global and regional battery manufacturers, its advanced materials enhance the performance and efficiency of lithium-ion batteries used in electric two-wheelers. The development of these high-performance anode materials supports the broader push for improved battery management systems, as better battery technology requires more sophisticated BMS solutions to optimize energy efficiency, safety, and longevity.

Integration of IoT and smart technology in BMS, adoption of modular and distributed BMS designs, and growing focus on thermal management in BMS are the upcoming trends of Electric Two-Wheeler Lithium-Ion Battery Management System Market in the globe.

Scooters are the leading vehicle type of Electric Two-Wheeler Lithium-Ion Battery Management System Market.

Asia-Pacific is the largest regional market for Electric Two-Wheeler Lithium-Ion Battery Management System.

The estimated industry size of Electric Two-Wheeler Lithium-Ion Battery Management System in 2033 is US$3,790.6 Mn.

Centralized is the leading topology in Electric Two-Wheeler Lithium-Ion Battery Management System Market

Loading Table Of Content...

Loading Research Methodology...