Electric Van Market Insights, 2031

The global electric van market size was valued at USD 6.1 billion in 2021, and is projected to reach USD 76.7 billion by 2031, growing at a CAGR of 28.9% from 2022 to 2031.

Electric vans run on electricity and utilizes an electric motor instead of an internal combustion engine. The electricity is provided by the batteries installed in the electric van. A traction battery pack powers the electric motor and vans are recharged by plugging into a charging station or wall outlet. In addition, electric van is generally used for commercial purposes such as cargo transportation, package delivery, last mile deliveries, and others. Moreover, electric vans have several advantages such as environment friendly, lower running costs, low maintenance costs, and others.

The growth of the global electric van market is driven by increase in government initiatives for the promotion of e-mobility, reduction in cost of electric vehicle batteries, and increase in demand for emission-free & high-performance electric vans. However, lack of charging infrastructure, and limited range of electric vans are the factors hampering the growth of the market. Furthermore, technological advancements is the factor expected to offer growth opportunities during the forecast period.

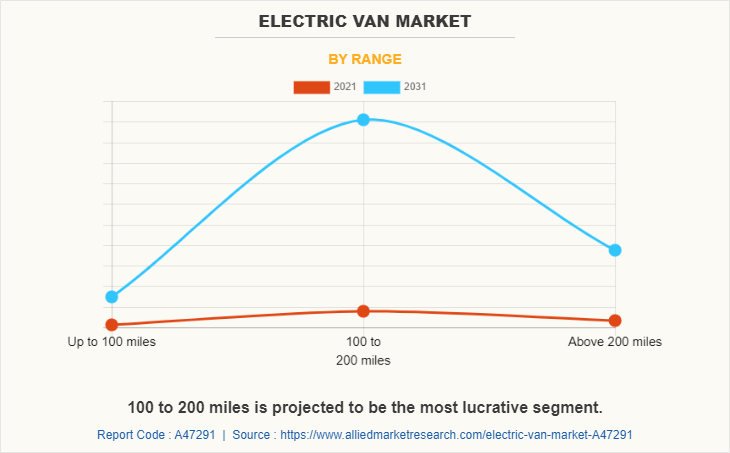

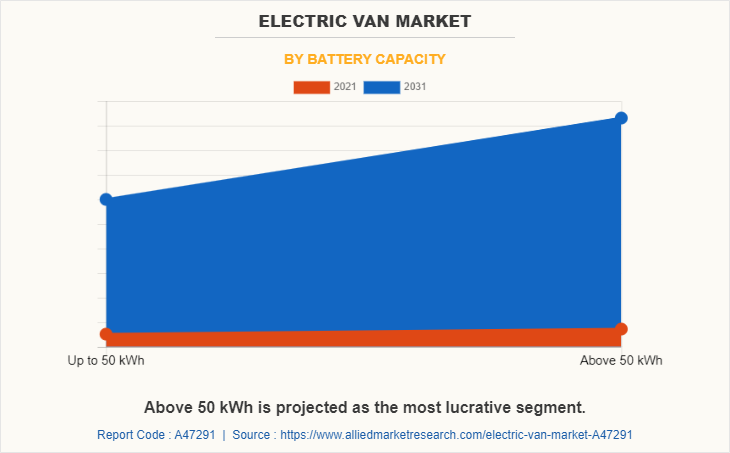

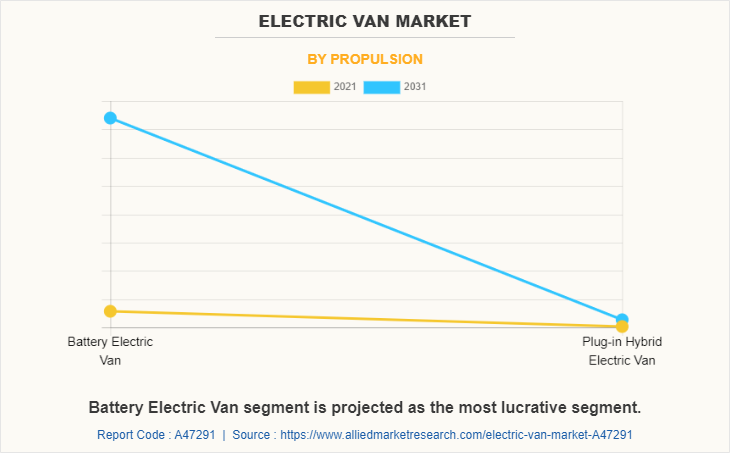

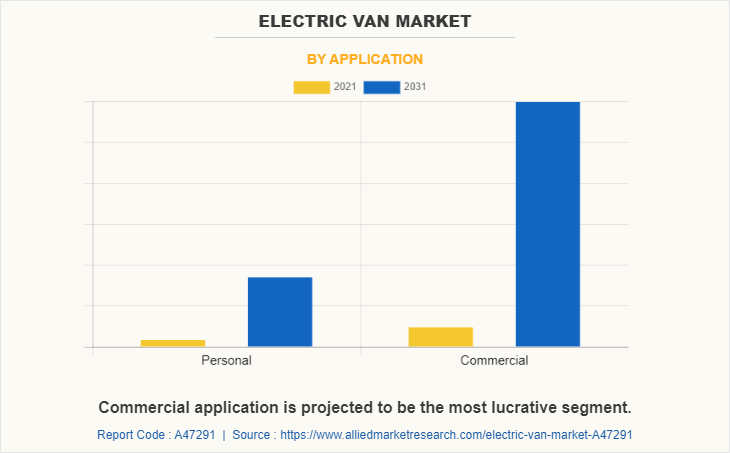

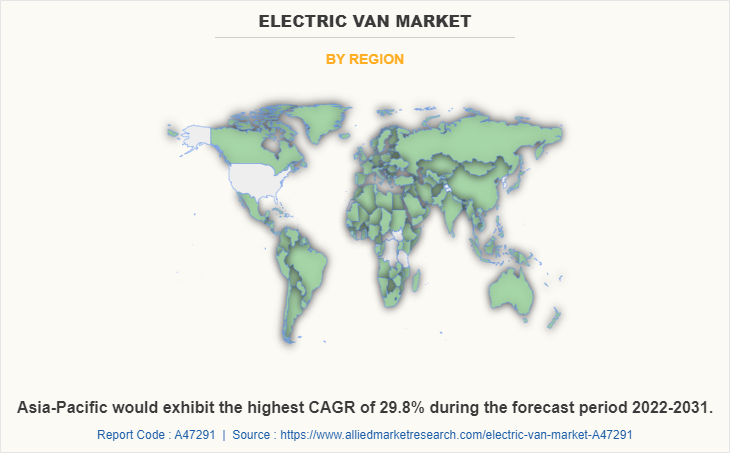

The electric van market is segmented into range, battery capacity, propulsion, application, and region. By range, it is fragmented into up to 100 miles, 100 to 200 miles, and above 200 miles. By battery capacity, it is categorized into up to 50 kWh, and above 50 kWh. By propulsion, it is fragmented into battery electric van, and plug-in hybrid electric van. By application, it is classified into personal, and commercial. By region, the report is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Europe includes countries such as the UK, Germany, France, Italy, and rest of Europe. Rest of Europe includes Spain, Netherlands, Sweden, Poland, and others. The Europe e-van market is governed by the presence of numerous companies, such as Volkswagen AG, Sevic, and others.

With growth in environmental concerns, European governments and environmental agencies are enacting stringent emission norms and laws that increases demand for electric vehicles in Europe. For instance, in Europe, the European Union (EU) is committed to achieve its 20% greenhouse gas reduction target in 2020 for the second phase of the Kyoto Protocol. By 2050, the EU aims to achieve the target of 0% greenhouse gas emission. The regulation EU 253/2014 sets the target of 147 gm of carbon dioxide emission per kilometer for 2020 and 2021, for commercial vehicles, based on the NEDC (New European Driving Cycle) test procedure. In addition, the European Union set a target of 31% reduction of carbon dioxide emission for Light Commercial Vehicles (LCVs) by 2030.

In the UK, companies operating in the market are receiving orders from EV charging infrastructure provider companies to deliver electric vans, boosts the growth of electric van market in the UK. For instance, in 2021, LEVC (London Electric Vehicle Company) received an order from BP Pulse to deliver 30 VN5 electrified vans. The VN5 electric vans are being utilized by BP Pulse’s electricians when installing EV charging points across the UK. Furthermore, the UK government has declared its commitment to ensure almost every car and van is a zero-emission vehicle by 2050. In July 2017, the Air Quality Plan of the Government announced that it will end the sales of the all-new conventional petrol and diesel cars and vans by 2040. In January 2018, the Committee on Climate Change said that three-fifths of new cars must be electric by 2030 to meet the greenhouse gas targets. Such initiatives and regulations are also opportunistic for market expansion.

In Germany, key players operating in market are introducing new electric vans and autonomous electric vans in the market, which boosts the growth of the electric van market in Germany. For instance, in September 2022, SAIC Maxus unveiled five of its premium electric vehicles at IAA Transportation Show 2022 in Hanover. The line-up comprises eDELIVER 3, eDELIVER 9, MAXUS MIFA 9 (MPV), the T90 EV (electric pickup) and MAXUS electric light truck. In addition, in 2021, Volkswagen unveiled an autonomous ID.Buzz AD (AD stands for Autonomous Driving) at IAA Munich. ID.Buzz AD feature a roof-mounted Lidar sensor which is capable of detecting objects from more than 400 meters away.

European countries, such as Russia, Spain, Switzerland, the Netherlands, Norway, Denmark, Sweden, Belgium, Luxemburg, Finland, and others are also among the major contributors to the rest of Europe electric van market. In Rest of Europe, numerous developments carried out by the key players of the market will contribute in the growth of the market across the region. For instance, in 2022, Mercedes announced that it will establish a new electric van plant in Jawor, southwestern Poland. The new plant will be the fourth in Mercedes-Benz’s European van production network, which the company is reorganizing toward producing only fully-electric vans built on the VAN.EA platform.

Some leading companies profiled in the electric van market report include BYD Company Ltd, Ford Motor Company, General Motors Company, Mercedes-Benz Group AG, Nissan Motor Co., Ltd., Renault S.A., Stellantis NV, Toyota Motor Corporation, Volkswagen AG, and Workhorse Group Inc.

Increase in government initiatives for the promotion of e-mobility

Governments across the globe are pressuring automakers to cut CO2 emissions from burning diesel fuel, address greenhouse gas emissions, and invest in developing electric vans. The government has provided incentives in programs and schemes for the manufacture of electric battery vehicles, which is expected to drive the growth of the market.

In addition, globally, governments of developing and developed countries support electric vehicle purchases in the form of tax credits and incentives. In addition, some national governments have exempted electric vehicles from highway tolls. For instance, to accelerate the adoption of electric vehicles, the Indian government plans to reduce the Goods and Services Tax (GST) on electric vehicles from 12% to 5%. Also, the governor of California issued an Executive Order requiring that by 2035 all-new car and passenger light truck sales be zero-emission vehicles. New York, New Jersey, and Massachusetts are considering similar bans on internal combustion engines. In addition, due to stringent emission standards, countries are planning a complete switch from conventional vans to electric vans. For instance, in November 2020, the UK government announced that all new petrol and diesel cars and vans will be phased out by 2030 and all the government car and van fleet to be 100% zero emission vehicle by 2027. Such initiatives are expected to drive the growth of the global electric van market.

Reduction in cost of electric vehicle batteries

Technological advancements and production of electric vehicle batteries on a mass scale has led to reduction in the cost of electric vehicle batteries over the past decade. This has led to reduction in the cost of electric vans as batteries cost almost 30% to 40% of the total cost of electric vans. For Instance, in 2010, the price of an electric vehicle battery was around $1,100 per kWh. However, according to Bloomberg, by 2020, electric vehicle battery price fell to around $137 per kWh while the price is as low as $100 per kWh in China. This is attributed to technological advancements in battery technologies along with reducing manufacturing costs of these batteries, reduced cathode material prices, and greater volumes of production. The prices of electric vehicle batteries are expected to fall to around $40-60 per kWh by 2030, which is expected to greatly reduce price of electric vans making them priced similar to conventional gasoline-powered vans. Combined with the growing demand for low-pollution transport, this will lead to widespread use of electric vans in the near future.

In 2020, Tesla, the world’s leading electric vehicle manufacturers, has already announced plans to significantly reduce the price of electric vehicle batteries over the next few years. Other leading electric vehicle battery manufacturers such as Samsung SDI, Panasonic, LG Chem, SK Innovative, and CATL have been working with leading electric vehicle manufacturers for achieving this goal over the next four to five years. Thus, a reduction in battery costs is expected to boost the growth of the electric van market.

Increase in demand for emission-free and high-performance electric vans

As gasoline is a fossil fuel, it is not a renewable energy source and is expected to run out in the future. Developing and using alternative fuel sources is critical to supporting sustainable development. Electric vans are used, which do not require gasoline and are more economical than conventional vans. Electric vans convert more than 50% of the electrical energy from the grid into electricity at their wheels, while gas-powered vans can only convert about 17-21% of the energy stored in gasoline. In recent years, the demand for emission-free electric vans has increased due to rising gasoline and diesel oil prices. This is due to the depletion of fossil fuel reserves and the increasing propensity of companies to seek maximum profit from these oil reserves. These factors, therefore, lead to the need for advanced fuel-saving technologies, leading to increased demand for electric vans.

In addition, as per the United Nations Environment Program (UNEP), the transport sector contributes around one-quarter of greenhouse gas (GHG) emissions. Therefore, several governments across the globe have introduced initiative to make their urban transport system more sustainable with the use of electric vans. The introduction of electric vans is expected to change the mass transit across the globe in upcoming years. Thus, increase in demand for emission-free and high-performance electric vans is driving the growth of market during the forecast timeframe.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the electric van market analysis from 2021 to 2031 to identify the prevailing electric van market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the electric van market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global electric van market trends, key players, market segments, application areas, and market growth strategies.

Electric Van Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 76.7 billion |

| Growth Rate | CAGR of 28.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 305 |

| By Application |

|

| By Range |

|

| By Battery Capacity |

|

| By Propulsion |

|

| By Region |

|

| Key Market Players | Stellantis NV, BYD Company Ltd, TOYOTA MOTOR CORPORATION, Nissan Motor Co., Ltd., Workhorse Group, Inc., General Motors Company, Volkswagen AG, Ford Motor Company, Mercedes-Benz Group AG, Renault S.A. |

Analyst Review

The global electric van market is expected to witness growth owing to increase in demand for emission-free & high-performance electric vans, and a reduction in cost of electric vehicle batteries. Companies in electric van industry are adopting various innovative techniques such as battery thermal management to provide customers with advanced and innovative feature ranges.

Experts also predict that the electric vans are considered as the future of electric mobility owing to their advantages over traditional ICE vans such as zero-emission, and noise-free operations. In addition, the market is expected to be boosted by advancements in the battery technologies and reduction in e-van prices coupled with proactive government initiatives.

Moreover, in order to gain a fair share of the market, major players adopted different strategies, for instance, product launch, and joint venture. Among these, product launch is the leading strategy used by prominent players such as BYD Company Ltd., Mercedes-Benz Group AG, Stellantis NV, and Volkswagen AG

The global electric van market was valued at $6,123.6 million in 2021, and is projected to reach $76,648.6 million by 2031, registering a CAGR of 28.9%.

Some leading companies profiled in the report include BYD Company Ltd, Ford Motor Company, General Motors Company, Mercedes-Benz Group AG, Nissan Motor Co., Ltd., Renault S.A., Stellantis NV, Toyota Motor Corporation, Volkswagen AG, and Workhorse Group Inc.

Asia-Pacific is the largest regional market for Electric Van.

The upcoming trends include reduction in the price of electric vehicle batteries and several initiatives taken by numerous governments in different countries to promote electric vehicles.

Commercial is the leading application of the Electric Van Market.

Loading Table Of Content...