Electric Vehicle Battery Thermal Management System Market Insights, 2031

The global electric vehicle battery thermal management system market was valued at $2.3 billion in 2021, and is projected to reach $8.4 billion by 2031, growing at a CAGR of 14.6% from 2022 to 2031.

The electric vehicle battery thermal management system market is segmented into Type, Technology, Propulsion Type and Vehicle Type.

Battery thermal management system (BTMS) is used to maintain a battery pack of electric vehicles at an optimum average temperature during the electrochemical processes occurring in cells. High battery temperatures can reduce performance, shorten battery life, and pose a risk of explosion. Therefore, battery thermal management system is essential for all battery modules. The main purpose of battery thermal management system is regulation of temperature of the battery cell to extend the life of the battery. The battery thermal management system is expected to allow the pack to work under a good range of climatic conditions and supply ventilation. Furthermore, in electric vehicles, thermal management makes it possible to not only improve battery power and longevity, but also to reduce the size of electric engines. Thus, temperature is the main parameter that needs to be controlled in a battery. Hence, it is necessary to employ battery thermal management system in electric vehicles.

Factor such as growing demand for electric vehicles, long range & fast charging technology, and favorable emission standards propel the electric vehicle battery thermal management system market growth. However, design challenges and complexities in components used for battery thermal management system and lack of sufficient infrastructure for electric vehicles are factors that hinder the growth of the EV BTMS market. Increase in technological changes in lithium-ion batteries and innovation in battery cooling system provide growth opportunities for the electric vehicle battery thermal management system market.

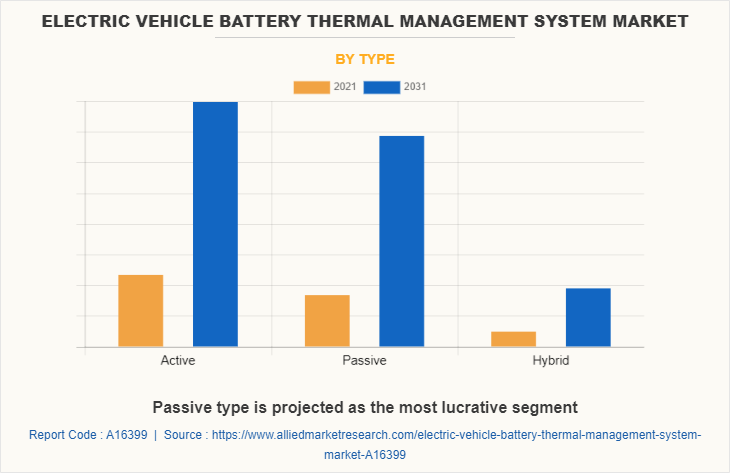

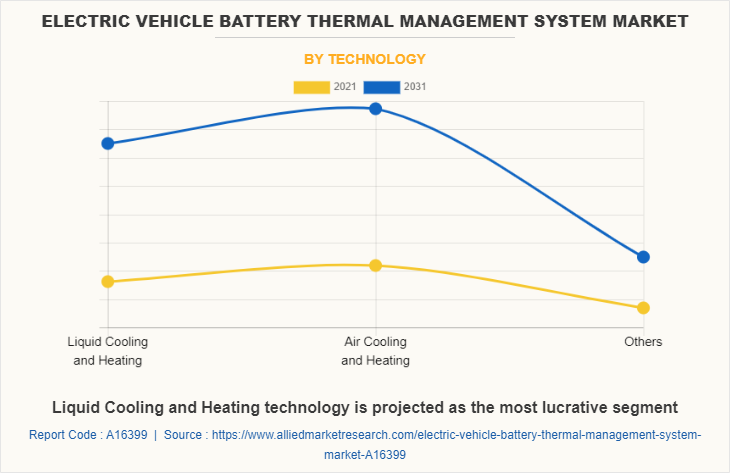

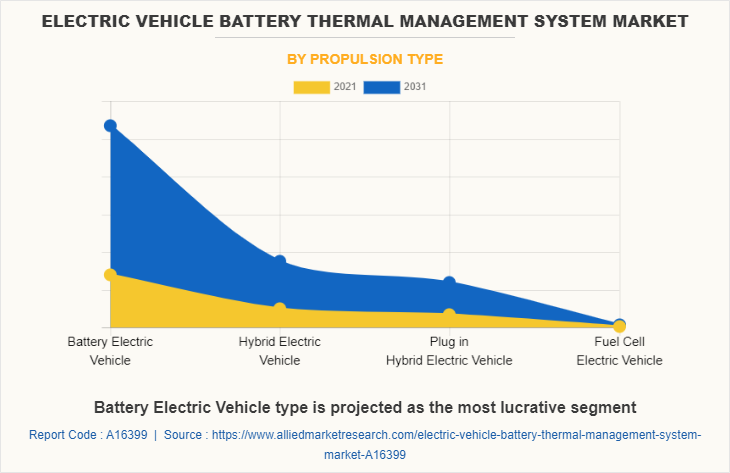

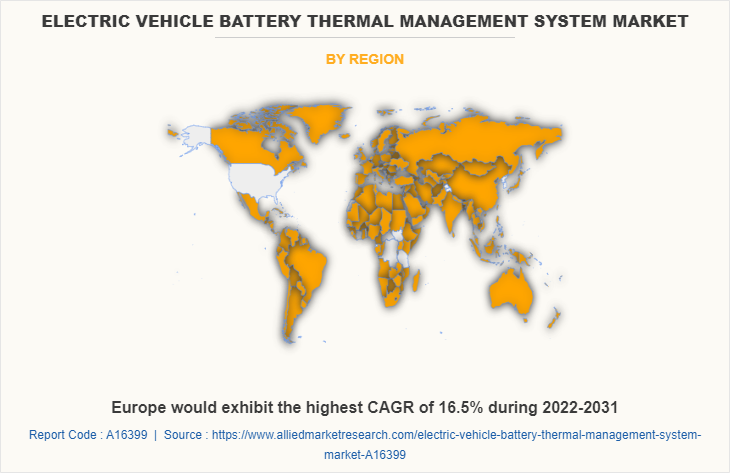

The electric vehicle battery thermal management system market is segmented on the basis of type, technology, propulsion type, vehicle type and region. By type, it is divided into active, passive, and hybrid. By technology, it is segmented into liquid cooling and heating, air cooling and heating, and others. On the basis of propulsion type, it is divided into battery-electric vehicles (BEV), hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), and fuel cell electric vehicles. By vehicle type, the market is bifurcated into passenger vehicles, commercial vehicles, and two-wheelers and three-wheelers. On the basis of region, it is divided into North America, Europe, Asia-Pacific, and LAMEA.

The key players operating in this electric vehicle battery thermal management system market are Modine Manufacturing Company, Continental AG, Gentherm, Dana Limited, Hanon Systems, Valeo, MAHLE GmbH, Robert Bosch GmbH, Grayson, and VOSS Automotive GmbH.

Surge in Demand for Electric Vehicles

The electric vehicle market is growing exponentially due to factors such as climate change and efforts to achieve net zero emissions. Moreover, favorable incentives and policies introduced by governments of different countries to promote electric vehicles boost the growth of the EV industry. For instance, in 2021, in California, the Clean Vehicle Rebate Project (CVRP) promoted clean vehicle adoption in California by offering rebates ranging from $1,000 to $7,000 for purchases or leases of new zero-emission vehicle. Also, in 2021, New Zealand proposed Clean Car Discount, in which new car buyers receive $8,625 rebate for electric vehicles (EVs) less than $80,000, including GST and road costs. Rise in awareness of climate change and surge in demand for electric cars leads to an increase in the production of electric vehicles. For instance, according to a report by the IEA organization, 2022, EV vehicles globally reached 6.7 million units in 2021, a 3.7 million units over 2020, accounting for 4.1% of the market share. In 2020, the electrical percentage of automobile income was about 2.4%, increasing from about 2% in 2019. Thermal management system is required to protect and insulate the battery of electric vehicles to ensure the safety and efficient performance of the battery cell. With the increasing popularity of battery-powered vehicles, manufacturers have begun to develop improved battery heat management systems. Thus, expansion of electric vehicle market promotes the growth of the battery thermal management system market. Moreover, some countries announced policies banning and phasing out gasoline and diesel cars. Such measures taken by various governments also encourage automakers and other market players to adopt the new electric vehicle trend. For instance, in 2022, Ford Motor plans to invest $20 billion in an effort to expand electrification of its lineup with an investment of $20 billion. Also, in 2021, China's tech giant, Xiaomi officially confirmed its plans to enter the smart electric vehicle business by investing RMB 10 billion (roughly $1.55 billion) in the first phase. Efficient battery thermal management system (BTMS) is one of the most important technologies for the success of electric vehicles. Therefore, increase in demand for electric vehicles boosts the demand for electric vehicle battery thermal management system.

Increase in long range and fast charging technology in electric vehicles

As EVs grow in popularity, new car buyers are skeptical about sufficient range provided by electric vehicles for normal driving needs. This range anxiety has encouraged automobile manufacturers to produce EV with longer range. Increasing the size of the battery pack is the simplest way to improve EV range. For instance, on April 20, 2022, Tata Motors launched a long-range Nexon EV with a larger 40kWh battery pack and a range of 400km. Electric vehicles equipped with a larger battery pack generate enormous amounts of heat; hence battery heat management becomes necessary to maintain adequate temperature range for effective functioning of vehicle. The battery temperature has a strong effect on the charging and discharging rate of the battery, which further affects the range of the vehicle, which develops the need for suitable battery heat management system. According to a report published by International Energy Agency (IEA) in 2021, the average driving range of electric vehicles has been steadily growing. The weighted average range of the new battery-powered electric vehicle in 2020 was about 350km (km), an increase from 200km in 2015. Thus, the increasing production of long range vehicles is expected to require a dedicated battery thermal management system to enhance safety and efficiency of electric vehicles, which promotes the growth of the battery thermal management system market. Moreover, fast-charging technology is rapidly expanding and evolving as it allows vehicles to be charged within a short period of time. For instance, in January 2022, Voltempo, a leading developer of new electric vehicle (EV) technologies, introduced Hyper Charging, the world's fastest charging system. Also, companies such as Tesla and EVgo are already building fast-charging infrastructure across North America. For instance, in February 2021, EVgo, the U.S.'s largest public fast charging network for electric vehicles (EVs) expanded its fast charging network for Tesla drivers to charge at more EVgo stations across the country. Moreover, in April 2022, Hyundai a South Korean global automotive manufacturing company, announced a collaboration with retail giant, Lotte Group and KB Asset Management to expand Korea's ultra-fast charging infrastructure. In addition, governments of different countries have taken initiatives to promote the deployment of fast charging stations. For instance, in 2019, the government of India decided to change the guidelines for charging stations for electric vehicles to give developers the freedom to choose the charging infrastructure technology. Government decided to install both CHAdeMO and Combined Charging System (CCS) fast charging technologies, in addition to the existing Bharat standard at public electric vehicle charging stations. The uniformity of the temperature distribution of the battery module affects the inconsistency between the battery cells, resulting in non-uniform aging rate and shortened battery module life. The fast charging technology is responsible for large heat generation and degradation of the battery as lithium-ion batteries generate enormous heat at high current charge rates. Thus, a battery thermal management system is required to extract heat efficiently and maintain uniform temperature distribution in the battery pack. Therefore, the growing trend of long range and fast charging technology propel growth of the electric vehicle battery thermal management system market.

Design challenges and complexities in components used for battery thermal management system

The design of battery thermal management system is complex. Increasing power requirements without compromising system performance and reliability is a major issue in thermal component design. Pipe connections are at risk of leaks as the battery gets older in liquid cooling battery thermal management system. The connections, battery modules pump, and valves of the system must all remain intact. Corrosion can occur in liquid cooling systems where cold plates can corrode as the liquid glycol ages. Therefore, the coolant is expected to be replaced as part of vehicle maintenance. Maintenance battery thermal management system (BTMS) is difficult due to high repair costs and bulky and cumbersome cables. Such complicated configuration and maintenance hinder the growth of the EV battery thermal management system market. There are also challenges posed during manufacturing of the thermal components of battery thermal management system, which comprises of selection of coolant, design of optimal flow channels, and complexity of the model and flow. Innovative yet fully functional battery thermal management system design requires rigorous monitoring, quality testing, and continuous improvement of the entire process. Also, all current quality and safety (Q & S) standards need to be taken into account during the design of battery thermal management system. Rapid temperature rises due to high power can be dangerous as they can cause internal short circuits, physical damage, fires or explosions, which is also called thermal runway. Thus, the system must be designed to withstand wide temperature ranges at all times. For instance, in August 2021, Tesla car ignited overnight while charging, igniting another Tesla (second Model S) next door, causing a major house fire. Battery of the electric vehicles is required to function properly in hot and humid conditions that prevail across India. Also, the effects of cold weather dramatically reduce battery life and increase internal impedance. The cold climate reduces range of electric vehicles by slowing down the chemical reaction in battery cells. Therefore, such design challenges and complexities associated with components of the battery thermal management system hinder the growth of the EV BTMS market.

Increase in technological innovations in lithium-ion batteries

Due to the high energy per unit of mass of lithium-ion batteries corresponding to other electrical energy storage systems, lithium-ion batteries are extensively used in electric vehicles. It offers high energy efficiency, high power-to-weight ratio, good high-temperature performance, and low self-discharge. The growing trend of electric vehicles puts high demands on the performance of a battery. A vast amount of public and private investment in lithium-ion batteries for technological innovations for better performance drives the growth of electric vehicles, hence, providing growth opportunities for the electric vehicles battery thermal management system market. For instance, in 2021, Ford Motor Co and BMW AG announced a $130 million funding round for Solid Power, an all-solid-state battery startup to develop solid state batteries for electric vehicles to store more energy and provide safety and charge faster. Moreover, in June 2020, researchers at the University of Waterloo, Canada and members of the Joint Center for Energy Storage Research (JCESR) U.S. have discovered a new solid electrolyte for solid-state lithium-ion batteries, which is expected to enhance safety, reduce the size of batteries, increase efficiency and offer fast charging. The ideal operating temperature range for automotive batteries is 20-45 ° C. Temperature higher or lower than the optimum temperature can lead to deformation of the batteries which causes spark a fire or explosion. For instance, in 2019, Hyundai Kona Electric exploded in its owner's garage in Montreal, Canada. Heat dissipation is significant in electric vehicles to prevent damage to the battery pack from the heat generated during charging and discharging of battery. Owing to this, innovations in lithium ion batteries are carried out by replacing the flammable liquid electrolyte in commonly used Lithium ion batteries with an inorganic solid-state electrolyte to provide more safety and mitigate explosion accidents. These advancements in technologies of lithium ion battery support EV efficiency and charging capabilities that require an efficient and compact battery thermal management system (BTMS) which bolster the growth of the electric vehicle battery thermal management system.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the electric vehicle battery thermal management system market analysis from 2021 to 2031 to identify the prevailing electric vehicle battery thermal management system market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the electric vehicle battery thermal management system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global electric vehicle battery thermal management system market trends, key players, market segments, application areas, and market growth strategies.

Electric Vehicle Battery Thermal Management System Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Technology |

|

| By Propulsion Type |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | Valeo, Grayson, Hanon Systems, Modine Manufacturing Company, continental ag, Dana Limited, VOSS Automotive GmbH, MAHLE GmbH, Robert Bosch GmbH, gentherm |

Analyst Review

The electric vehicle battery thermal management system market is expected to witness significant growth, due to rise in production and sales of electric vehicles across the globe. Manufacturers of battery heat management systems focus on providing compact, weightless, reliable, low power usage, easy to maintain, and responsive battery thermal management system. System manufacturers and developers are integrating technology with shared thermal management system for batteries and other applications to achieve greater efficiency. The battery thermal management system market is expected to grow at a remarkable rate in the future, owing to the rise in need for thermal management and protection of batteries in electric vehicles. The electric vehicle battery thermal management system market is driven by demand for electric vehicles and increased quicker charging times and greater traveling distance of electric vehicles per charge. However, factors such as difficulty in design and structure of battery thermal management system and slow adoption of electric vehicles due to less charging stations are expected to hamper the growth of the market. Further, increase in adoption of advanced technologies in lithium-ion batteries and new developments in battery cooling system are expected to create numerous opportunities for growth expansion.

Mmarket participants are concentrating on product launches to offer a diverse range of products and meet new business opportunities to gain a fair share of the market. For instance, in September 2021, Modine Manufacturing Company established a separate business unit to focus on thermal management systems for electric vehicles. Modine, currently produces complete electric vehicle heat exchange systems that regulate powertrain temperatures within optimal ranges under all operating conditions. In addition, market participants are continuously focusing on business expansion efforts to match changing end-user requirements and improve battery thermal management system. For instance, in October 2021, MAHLE launched an integrated thermal management system for battery electric vehicles at Aachen Colloquium. With this technology, MAHLE is able to maximize efficiency at system level, reduce costs, and facilitate the integration of motor, electronics, and battery temperature control into the overall system.

The electric vehicle battery thermal management system market is segmented on the basis of type, technology, propulsion type, vehicle type and region. By type, it is divided into active, passive, and hybrid. By technology, it is segmented into liquid cooling and heating, air cooling and heating, and others. On the basis of propulsion type, it is divided into battery-electric vehicles (BEV), hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), and fuel cell electric vehicle (FCEV). By vehicle type, the market is bifurcated into passenger vehicles, commercial vehicles, and two-wheelers and three-wheelers. Region-wise, it is divided into North America, Europe, Asia-Pacific, and LAMEA

The global electric vehicle battery thermal management system market was valued at $2.25 billion in 2021, and is projected to reach $8.37 billion by 2031.

Asia Pacific is the largest regional market for Electric Vehicle Battery Thermal Management System.

The Electric Vehicle Battery Thermal Management System Industry is expected to grow at a CAGR of 14.6% during the forecast period

Increasing adoption of liquid cooling and heating and hybrid cooling with advanced battery monitoring system is a major trend in Electric Vehicle Battery Thermal Management System Market

he report sample for global electric vehicle battery thermal management system market report can be obtained on demand from the website

Surge in demand for electric vehicles, Favorable emission standards and Increase in long range and fast charging technology in electric vehicles are key driving factors of the Electric Vehicle Battery Thermal Management System Market

Modine Manufacturing Company, Continental AG, Gentherm, Dana Limited, Hanon Systems, Valeo, MAHLE GmbH among others holds a significant share in Electric Vehicle Battery Thermal Management System Market

Loading Table Of Content...