EV Charging Connector Market Insights, 2032

The global electric vehicle charging connector market size was valued at $59.3 million in 2022, and is projected to reach $273.2 million by 2032, growing at a CAGR of 17% from 2023 to 2032.

Key Highlighters

- The report covers segments such as type, charging level, charging speed, end user and region.

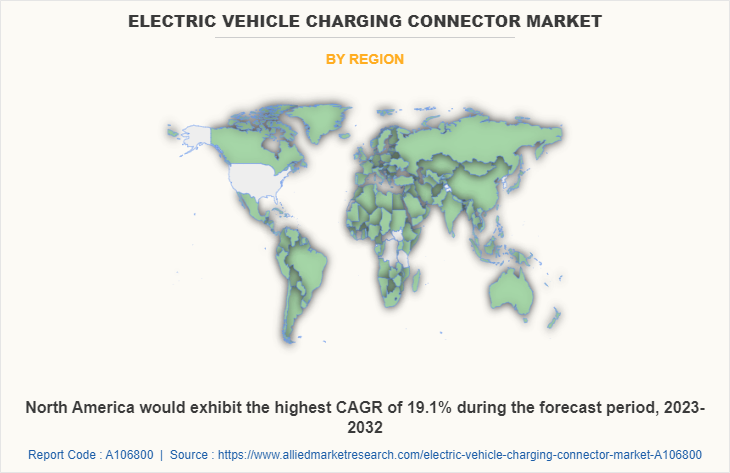

- The report is studied across different regions such as North America, Europe, Asia-Pacific and LAMEA.

- The report includes detailed analysis on the usage of electric vehicle charging connectors across the EV industry.

- The report also includes an Impact analysis of Russia-Ukraine war on the global market.

An electric vehicle (EV) charging connector is a device that is used to connect an EV to a charging station or a power source to charge its battery. It is essentially the interface that allows the transfer of electrical energy from the charging infrastructure to the vehicle. There are several types of EV charging connectors used worldwide, and specific connector type depends on the region and the charging standard employed. The most popular charging connector in North America is the SAE J1772 (known as a J-plug or Type 1 connector), which has five pins and is used for slow and fast charging.

Other popular connector types include the CCS (Combined Charging System), which is used for DC fast charging and has two extra pins on top of the J1772 connectors, and the CHAdeMO connector, which is mostly used by Japanese automakers. The Mennekes Type 2 connector standard, which has seven pins and is used for both slow and fast charging, is the most prevalent in Europe.

The factors such as government support toward adoption of electric vehicle (EV), demand for fast chargers, and development of charging infrastructure supplement the growth of the market. However, connector standardization and overheating issue of the charger or connector are the factors expected to hamper the growth of the electric vehicle charging connector market. In addition, expansion of Infrastructure and growth of service & support market creates market opportunities for the key players operating in the EV charging connector industry.

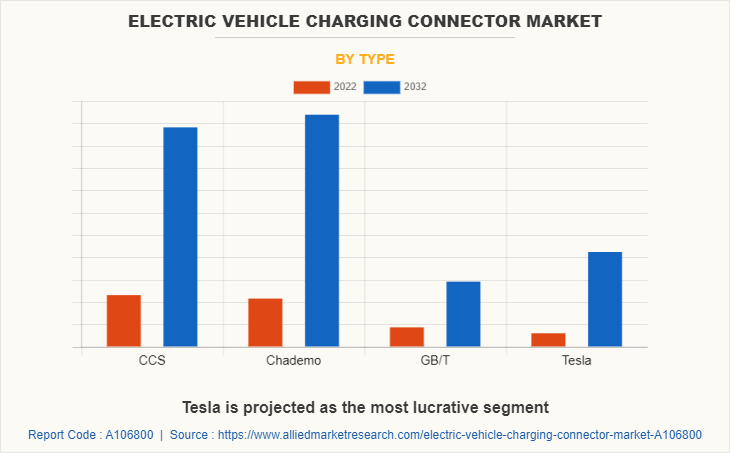

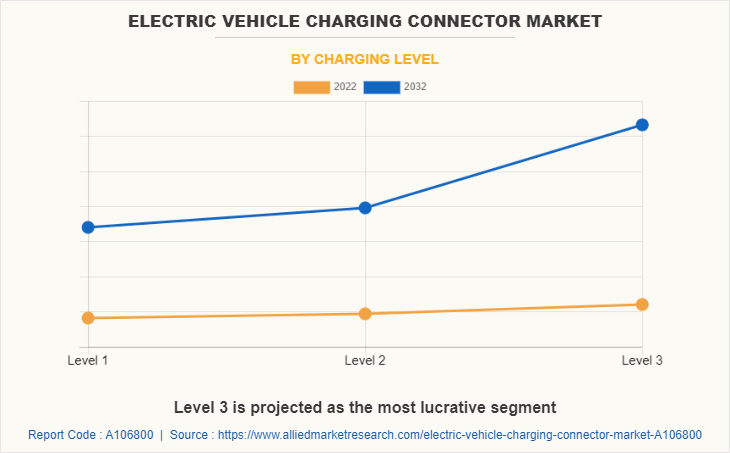

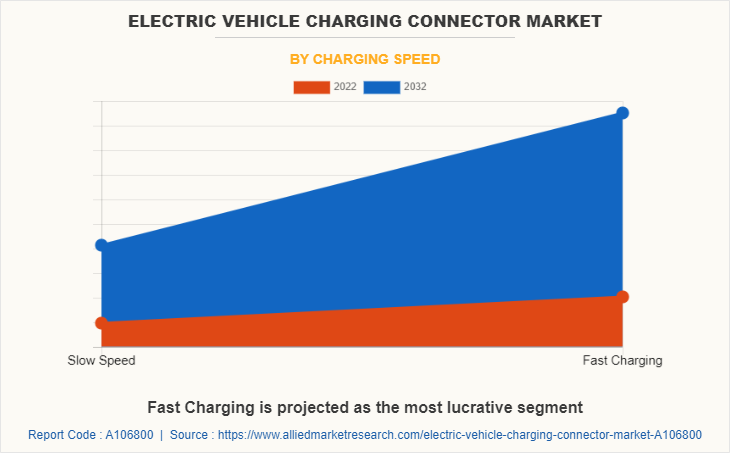

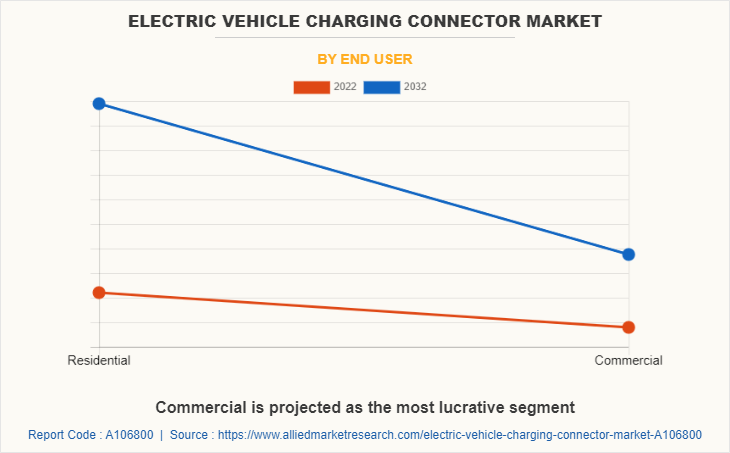

The electric vehicle charging connector market is segmented into type, charging level, charging speed, end user, and region. On the basis of type, the market is segmented into CSS, CHAdeMO, GB/T, and Tesla. On the basis of charging level, the market is segmented into Level 1, Level 2, and Level 3. On the basis of charging speed, it is bifurcated into slow speed and fast charging. On the basis of end user, the market is bifurcated into residential and commercial. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players operating in the global Electric vehicle charging connector market include ABB, Amphenol Corporation, Fujikura Ltd., Robert Bosch GmbH, Schneider Electric, Siemens AG, Sumitomo Corporation, Tesla, Yazaki Corporation, and TE Connectivity.

Government support toward adoption of electric vehicle (EV)

Government support for electric vehicles (EVs) varies across countries and regions, but there is a global trend of governments implementing policies and incentives to promote the adoption of EVs. Government financial incentives include tax credits, rebates, grants, and subsidies to reduce the upfront cost of purchasing an electric vehicle. These incentives make EVs more affordable and attractive to consumers. For instance, Indian government has boosted its subsidy system for the purchase of electric vehicles in order to increase the use of electric vehicles. According to the Budget 2022-23, the Faster Adoption and Manufacturing of Hybrid and electric vehicles (FAME) scheme, is anticipated to provide an incentive of up to $351 million. The first phase of FAME began in April 2015 and ended in 2019 following several extensions. Following the conclusion of phase 1, phase 2 was issued, with the goal of concluding in March 2022.

The government has, however, extended the deadline until March 2024. Over 200,000 automobiles have been supported by the phase-2 FAME plan, with a subsidy of $108 million. Government support for electric vehicles may vary from country to country. Some countries have more comprehensive and ambitious programs, while others are still in the initial stages of EV promotion.

Development of charging infrastructure

The infrastructure for charging electric vehicles is a significant component of the transition to electric mobility. To facilitate the rise of electric car use, charging stations and networks must be developed and deployed. The U.S. has been attempting to develop a statewide network of public charging stations, with a target of installing 500,000 publicly accessible charging stations that are compatible with all vehicles and technology. All the construction of EV charger infrastructure in the U.S. is supported by the Bipartisan Infrastructure Act.

As of 2022, about 50,000 electric vehicle charging stations have been projected to be there in service in the U.S., with 93% of them open to the public. Major networks, such as ChargePoint, have created large-scale charging stations, which have expanded the charging infrastructure.

Connector standardization

The lack of standardization in electric vehicle (EV) charging connectors presents several challenges. Different EV manufacturers have adopted various connector types, making it difficult to ensure compatibility between charging stations and EVs. This fragmentation has resulted in the fragmented charging infrastructure, with different networks supporting specific connector types, impeding the development of a seamless charging network.

Limited charging options and increased costs are additional consequences of the absence of a universal charging connector standard. EV owners may face restrictions in accessing charging stations that offer their specific connector type, while manufacturers and operators incur higher expenses due to the need to support multiple connector types.

Growth of service and support standards

The service and support standards in the electric vehicle (EV) charging industry involves numerous services to ensure the smooth operation and maintenance of charging infrastructure. Service provider offers installation services, conducting site assessments and handling electrical connections. They provide maintenance and diagnostic services to identify and address potential issues, as well as repair and replacement services for charging infrastructure components.

Software and firmware updates are offered to ensure compatibility and security. Moreover, service providers may offer monitoring and support services, remotely tracking performance and providing timely assistance. The service and support market are crucial in maintaining reliable charging infrastructure, maximizing uptime, and ensuring a positive user experience for EV owners and charging infrastructure operators.

Recent Developments

In September, 2022, ABB increases its manufacturing base in the U.S. by investing in a new EV charging facility. ABB E-mobility is equipped to handle increase in customer demand for electric vehicle chargers and connectors.

In February, 2021, Sumitomo Corporation has introduced the SEVD V3 DC charger for EV Discharger/Charger Connector cable assemblies for electric vehicles. The new assembly maintains high level of safety, durability, compactness, and light weight of previous models but boasts a completely new design with a revolutionary mechanism that allows the connection to be inserted into and removed from an EV in a single operation.

In October, 2021, TE Connectivity has introduced three new hybrid and electric commercial transportation devices. IPT-HD power bolt connector, HVA HD400 high-voltage accessories connector, and new ICT charging inlets are among the new features. The three fresh offerings address both security and dependability while also providing the tough designs required for outstanding performance in harsh environments. The company is expected to gain new customers due to the ruggedness and dependability of the product.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the electric vehicle charging connector market analysis from 2022 to 2032 to identify the prevailing electric vehicle charging connector market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the electric vehicle charging connector market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global electric vehicle charging connector market trends, key players, market segments, application areas, and market growth strategies.

Electric Vehicle Charging Connector Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 273.2 million |

| Growth Rate | CAGR of 17% |

| Forecast period | 2022 - 2032 |

| Report Pages | 308 |

| By Type |

|

| By Charging Level |

|

| By Charging Speed |

|

| By End User |

|

| By Region |

|

| Key Market Players | Tesla, Schneider Electric, Siemens, Amphenol Corporation, Fujikura, Sumitomo Corporation, ABB, Yazaki Corporation, Robert Bosch GmbH, TE Connectivity |

The key players operating in the global Electric vehicle charging connector market include ABB, Amphenol Corporation, Fujikura Ltd., Robert Bosch GmbH, Schneider Electric, Siemens AG, Sumitomo Corporation, Tesla, Yazaki Corporation, and TE Connectivity

The global electric vehicle charging connector market was valued at $59.25 million in 2022, and is projected to reach $273.16 million by 2032, registering a CAGR of 17.0%.

Asia-Pacific is the largest regional market for Electric Vehicle Charging Connector

Commercial is the leading application of Electric Vehicle Charging Connector Market

Introduction of Level 3 chargers are the upcoming trends of Electric Vehicle Charging Connector Market in the world

Loading Table Of Content...

Loading Research Methodology...