Electric Vehicle Charging System Market Overview

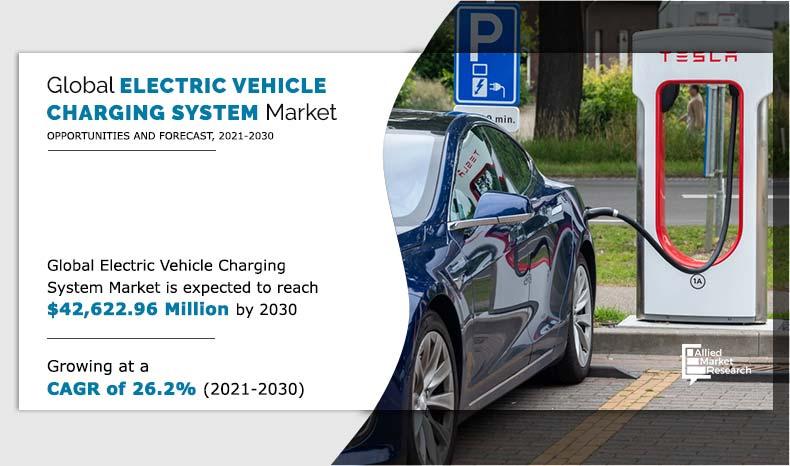

The global electric vehicle charging system market was valued at USD 4,269.6 million in 2020, and is projected to reach USD 42,623.0 million by 2030, registering a CAGR of 26.2% from 2021 to 2030. Electric vehicle charging systems are used to connect the plug-in electric vehicle and electric vehicle to an electricity outlet to charge the battery of the vehicle. In addition, various automobile giants and electric component companies are working toward the development of advanced electric vehicle charging system to meet the rise in demand for electric vehicles.

Key Market Trends

· Product Type: Home charging systems emerged as the leading revenue-generating segment.

· Mode of Charging: Plug-in charging systems accounted for the largest share of revenue.

· Charging Voltage Level: Level 2 charging systems dominated the market in revenue contribution.

· Regional Insights: Asia-Pacific led the market, followed by Europe, North America, and LAMEA.

Market Size & Forecast

- 2030 Projected Market Size: USD 42,623 million

- 2020 Market Size: USD 4,269.6 million

- Compound Annual Growth Rate (CAGR) (2021-2030): 26.2%

COVID-19 Impact Analysis:

The COVID-19 pandemic proved quite detrimental for the automotive sector. It has had a sudden impact on the global unified automotive industry. Indications include the interruption in export of Chinese automotive parts, huge manufacturing disruptions across Europe, and the shutting down of assembly plants in the U.S. This is placing an extreme pressure on an industry that is already managing a downshift in the global demand.

By Product Type

Home charging systems segment is projected as the most lucrative segment

The widespread outbreak of the novel coronavirus led to the sudden drop in import-export of non-essential items and only a small fraction of workforce was allowed to function in the factories. Further, the testing of systems was also impacted by the strict pandemic regulations. These caused a large supply-demand gap in the products and services related to electric vehicle charging system. The sales of automotive industry witnessed a drop After a miserable year for automotive industry (2019), which already witnessed a significant drop of approximately 5% in global auto production and that ended the upward trend of 10 years of progress, the global auto industry encountered a new, unique situation in 2020 owing to the COVID pandemic.

Over the first half of FY2020, global electric car sales were considerably lower than over the same period in 2019. The prominent exception was Europe where electric car sales were considerably higher due to the existing policy support schemes. Global market trends were noticeably different in the second half of year 2020, when lockdowns were relaxed for some time, and the automotive market started to recover. For electric cars, monthly sales surpassed those between July and December in 2019 in every month in all large markets including China, India, the European Union, Korea, the U.S. and the UK. However, some countries such as Canada, Japan and others regions witnessed decline in revenue as both the demand for new vehicles and their production was impacted severely.

Segment Overview

The electric vehicle charging system market is segmented on the basis of product type, mode of charging, charging voltage level, and region. By product, the market is classified into home charging systems and commercial charging systems. By mode of charging, it is categorized into plug-in charging system and wireless charging system. By charging voltage level, it is divided into level 1, level 2, and level 3. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Mode Of Charging

Plug-In charging system segment projected as the most lucrative segment

Which are the Top Electric Vehicle Charging System companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the electric vehicle charging system industry.

BorgWarner Inc.

Delta Electronics, Inc.

Eaton Corporation plc

General Electric

Moser Services Group, LLC

Plugless Power Inc.

Robert Bosch GmbH

Schneider Electric

Siemens AG

Tesla

Webasto Group

Market Dynamics

Key Market Driver

Rise in adoption of electric vehicle owing to government initiatives

Governments of the various countries are taking initiatives to support the adoption of electric vehicle to meet the fuel consumption standards and reduce emission of greenhouse gases. For instance, the Japan government prepared a policy for electric vehicles in August 2018 for better cooperation and smooth transition in the automotive industry. In addition, it has started an initiative named Faster Adoption and Manufacturing of hybrid and Electric Vehicles II (FAME). According to this, incentives will be provided to promote the local manufacturing of electric vehicle. Thus, such government initiatives are expected to drive the growth of the electric vehicle and electric vehicle charging system market.

By Category

Level 2 segment is projected as the most lucrative segment

Increase in demand for low-emission and fuel-efficient vehicles

Gasoline being a fossil fuel is not a renewable source of energy and is projected to exhaust in the future. To support sustainable development, it is important to develop and use alternative sources of fuel. This involves use of electric vehicles that do not use gas and are more economical than conventional vehicles. An electric vehicle converts over 50% of the electrical energy from the grid to power at the wheels, whereas the gas-powered vehicle only manages to convert about 17%–21% of the energy stored in gasoline. The demand for fuel-efficient vehicles has increased recently owing to rise in price of petrol and diesel. This is due to depleting fossil fuel reserves and growth in tendency of companies to gain maximum profit from these oil reserves. Thus, these factors give rise to the need for electrically powered vehicles for travel, which in turn is anticipated to propel the growth of the electric vehicle charging system market.

By Region

North America would exhibit the highest CAGR of 30.0% during 2021-2030.

Key Benefits For Stakeholders

- This study presents analytical depiction of the electric vehicle charging system market analysis along with the current trends and future estimations to depict the imminent investment pockets.

- The overall market potential is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities of the market with a detailed impact analysis.

- The current Electric Vehicle Charging System market size is quantitatively analyzed from 2020 to 2030 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the Electric Vehicle Charging System industry.

Electric Vehicle Charging System Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Mode Of Charging |

|

| By Charging Voltage Level |

|

| By Region |

|

| Key Market Players | PLUGLESS POWER INC., SIEMENS AG, BORGWARNER INC., GENERAL ELECTRIC COMPANY, TESLA, EATON CORPORATION PLC, MOSER SERVICES GROUP, LLC, Schneider Electric, ROBERT BOSCH GMBH, DELTA ELECTRONICS, INC., WEBASTO GROUP |

Analyst Review

The electric vehicle charging system market is expected to grow at a remarkable rate in future, owing to increase in adoption of electric vehicle and government initiative to boost the penetration of electric vehicles.

Factors such as growth in production of electric vehicles and rise in adoption of electric vehicle owing to government initiatives drive the market growth. In addition, increase in demand for low-emission and fuel-efficient vehicles is anticipated to propel the growth of the market. However, factors such as high cost of electric vehicles and high cost of electric vehicle charging infrastructure hamper the growth of the market. Further, development of wireless charging technology and incorporation of vehicle-to-grid (V2G) EV charging stations is expected to create numerous opportunities for the growth and expansion of the market.

The key market players profiled in the report include BorgWarner Inc., Delta Electronics, Inc., Eaton Corporation plc, General Electric, Moser Services Group, LLC, Plugless Power Inc., Robert Bosch GmbH, Schneider Electric, Siemens AG, Tesla and Webasto Group.

The global electric vehicle charging system market was valued at $4,269.6 million in 2020, and is projected to reach $42,622.96 million by 2030, registering a CAGR of 26.2% from 2021 to 2028.

The overall cost of installing a charging station may vary from $1,100 to around $2,000. However, the cost can vary depeding on the features reuired.

The sample for global electric vehicle charging system market report can be obtained on demand from the AMR website. Also, the 24*7 chat support and direct call services are provided to procure the sample report.

Robert Bosch GmbH, Schneider Electric, Siemens AG, Tesla are some of the prominent players operating in the EV charging station market

Factors such as growth in production of electric vehicles and rise in adoption of electric vehicle owing to government initiatives drive the growth of the market is foreseen to reinforce the demand for charging stations in near future.

The company profiles of the top market players of electric vehicle charging system market can be obtained from the company profile section mentioned in the report. This section includes analysis of top ten player’s operating in the electric vehicle charging system market.

Asia-Pacific region is leading the market presently in terms of revenue and foreseen to maintain it's dominance over the forecast period.

By charging voltage level, Level 3 segment is expected to gain traction over the forecast period in the global electric vehicle charging system market.

Europe region is expected to provide significant business opportunities for the key players operating in the global electric vehicle charging system market.

The key growth strategies adopted by the electric vehicle charging system industry players includes product launch, business expansion, collaboration. These strategies opted by various industry players is leading to the growth of the electric vehicle charging system market as well as the players.

Loading Table Of Content...