EV HVAC Market Overview

The global electric vehicle HVAC market size was valued at USD 4.6 billion in 2022, and is projected to reach USD 11.7 billion by 2032, growing at a CAGR of 10% from 2023 to 2032. Greater demand for energy efficient HVAC systems combined with rise in demand electric vehicles across the world supports the growth of the market. Furthermore, advancements in technology, such as advanced thermal management systems and integration with smart controls, present opportunities for innovation and market expansion in the EV HVAC market during the forecast period. However, the high cost of maintenance, and environmental effects of refrigerants used in HVAC system hamper the market growth during the forecast period.

Key Market Trend & Insights

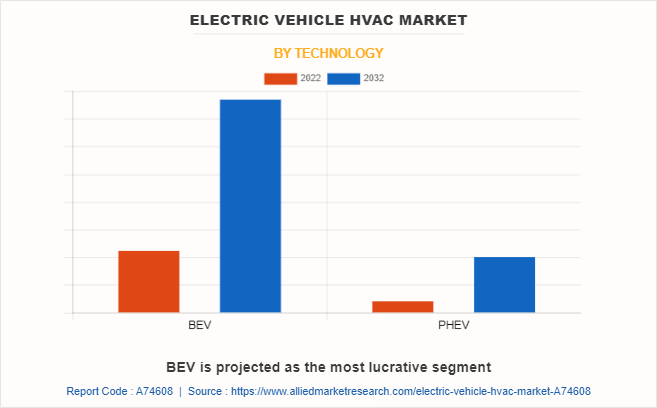

- BEV segment projected to witness notable growth.

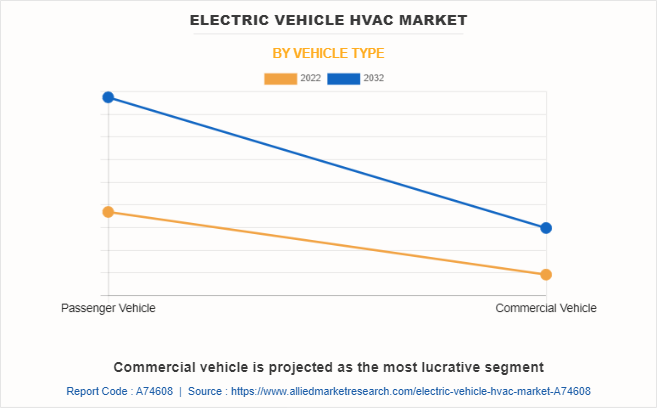

- Commercial vehicle segment emerging as a key growth driver.

- Condenser component segment anticipated to lead market share.

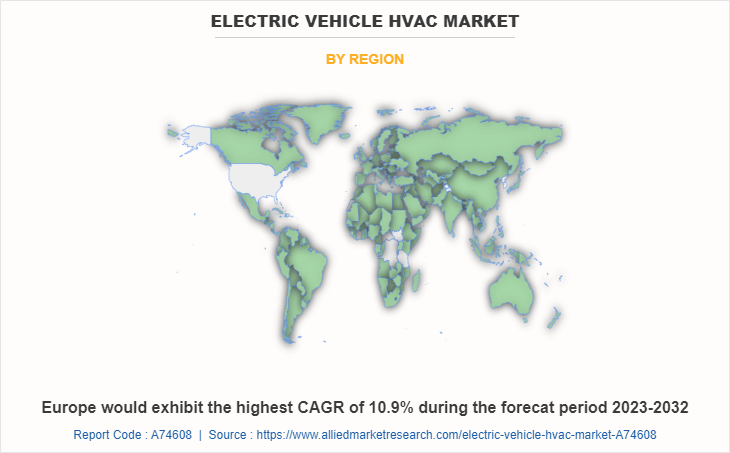

- Europe forecasted to record the highest CAGR.

- Rising demand for thermal comfort boosting HVAC adoption.

- Increasing penetration of automatic A/C systems in EVs.

Market Size & Forecast

- 2032 Projected Market Size: USD 11.7 billion

- 2022 Market Size: USD 4.6 billion

- Compound Annual Growth Rate (CAGR) (2023-2032): 10%

Key Highlighters:

- The report covers segments such as component, vehicle type, and technology. The report is studied across different regions such as North America, Europe, Asia-Pacific, and LAMEA.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literatures, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

Introduction

The heating, ventilation, and air conditioning system found in electric vehicles is referred to as an EV HVAC system. It controls and maintains the cabin's temperature while giving the occupants a cozy setting. The system runs on electric power from the car's battery, doing away with the requirement for conventional combustion engines to run the HVAC system.

The electric compressor circulates a refrigerant to remove heat from the cabin, while the condenser dissipates the heat generated by the process. The air is transported into the cabin by the blower and air vents after being cooled by the evaporator. Given the limited power provided by the vehicle's battery, these systems are created to be energy-efficient. Additionally, they frequently include intelligent controls and cutting-edge sensors to enhance performance and reduce energy usage. Therefore, EV HVAC systems play a crucial role in providing a comfortable and controlled interior climate for electric vehicle occupants while maximizing energy efficiency.

Market Segmentation

The electric vehicle HVAC market is segmented into technology, vehicle type, components, and region. By technology, it is divided into BEV and PHEV. By vehicle type, the EV HVAC market is classified into passenger vehicle and commercial vehicle. By component, the market is categorized into compressor, condenser, heater core, evaporator, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Market Dynamics

The manufacturers and suppliers in Europe will have to reduce the emission level of CO2 by manufacturing fuel-efficient HVAC systems, to achieve the set target of 95 grams CO2 per kilometer by 2021. This would help in reducing environmental contamination and fuel saving. In addition, the increase in adoption rate of fuel efficient and eco-friendly vehicles in the region is anticipated to boost the market growth. Additionally, greater demand for commercial vehicles from European countries is expected to boost the market growth.

Germany is a prominent market for electric vehicle HVAC market in Europe. Major automobile industry leaders are present in this country. These companies are supporting the automobile parts manufacturers based in Germany and other countries of Europe by manufacturing more premium cars and planning to become a global leader for developing efficient operable engines using versatile manufacturing processes. This factor is not only supporting the automobile parts industry but also propelling the demand for HVAC based components in this region.

The UK is known for premium and sports cars, including Jaguar, Bentley, Rolls Royce, and Morgan and is the second largest premium car manufacturing region in the world. The increase in sale of commercial vehicles and rise in technological advancement in the field of HVAC system is making way for different market growth opportunities in the UK. DuPont started providing Opteon YF an alternative refrigerant to help automakers meet CO2 standards while creating a comfortable cabin temperature. Such innovations from market players for HVAC system help create demand for advanced HVAC system to be equipped in vehicles.

The passenger car segment includes vehicles such as small cars, hatchbacks, sedan & luxury sedan, and others for transporting people. Major global players are concentrating on passenger cars as well as luxurious cars such as SUVs. The rise in disposable income of consumers, and production & sale of four-wheeler vehicles are the factors responsible for the adoption of HVAC system equipped in passenger cars. Automatic and manual technologies are majorly adopted in passenger vehicles from the leading players operating in the automotive industry.

Commercial electric vehicles (EVs) are experiencing significant market trends and opportunities. Government initiatives and policies worldwide are promoting the adoption of clean energy vehicles, including commercial EVs, creating a favorable market environment. Businesses are increasingly recognizing the cost savings and operational efficiency offered by commercial EVs. Lower fuel and maintenance expenses make EVs financially attractive for fleet operators, leading to long-term savings and improved operational efficiency.

Which are the Top EV HVAC companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the EV HVAC industry.

- Sanden Corporation

- Hanon Systems Corporation

- Denso Corporation

- Valeo S.A.

- Mahle GmbH

- Brose Fahrzeugteile SE and Co. KG

- Panasonic Corporation

- Johnson Electric Holdings Limited

- Marelli Holdings Co., Ltd

- Toyota Industries Corporation

What are the Top Impacting Factors

Key Market Driver

Increase in demand for thermal system and automatic climate control features in automobile

Thermal comfort in vehicles is considered as one of the most important factors when purchasing a vehicle. The installation of HVAC system ensures an ambient thermal environment for the driver as well as the passenger. The HVAC system not only contributes to a better thermal environment but also improves the efficiency of air conditioning; thereby, reducing fuel consumption.

Efficient HVAC systems ensure appropriate vehicular temperature levels, which can lead to enhanced vehicle passenger comfort, fuel economy, and others. Also, the rise in use of automatic A/C which automatically controls cabin temperature regardless of the outside air temperature and humidity boosted the growth of the electric vehicle HVAC market. Thus, rise in demand for thermal comfort coupled with increase in penetration of automatic HVAC system in automobiles are anticipated to propel the growth of the electric vehicle HVAC market globally.

Rise in safety and comfort due to adoption of HVAC systems

The growth in demand for safety, comfort, and aesthetic features have led to several technological advancements in vehicles. HVAC systems ensure comfortable rides for the driver as well as the passenger. In addition, the system contributes toward defrosting windows, demisting windshields, and dehumidifying air, which improves the comfort of the passengers. The safe and clean running of the system eliminates risk factors in future. Thus, increase in safety due to adoption of HVAC systems by providing safe and favorable conditions inside the vehicle cabin is anticipated to offer growth opportunities for electric vehicle HVAC market manufacturers.

Increase in vehicle production

Original equipment manufacturers in the developing regions such as China, India, and Japan, are adapting to the changing regional and segment patterns of supply and demand with respect to their production & supply base footprints, supply chains, and product portfolio. In addition, the rise in urbanization along with increase in population boosts the demand for vehicles among consumers.

Moreover, emergence of global potential automobile manufacturers including General Motors and Volkswagen AG concentrating their plants in China through joint ventures with local manufacturers is expected to enhance the HVAC demand and drive the growth of the HVAC system market globally.

Restaints

Environmental effects of refrigerants used in HVAC system

The refrigerant plays a crucial role in vehicle HVAC system. The vehicle HVAC system uses hydrofluorocarbon, chlorofluorocarbon, and hydrofluoro-olefins (HFO) refrigerants. However, these refrigerants are harmful to environmental sustainability, may lead to ozone depletion, and exhibit global warming potential (GWP). For instance, in March 2022, Indian government import policy of Hydrofluorocarbons (HFCs) has been revised from 'free' to 'restricted', subject to NoC (no objection certificate) from the Ministry of Environment, Forest and Climate Change," the directorate general of foreign trade (DGFT).

Moreover, these refrigerants affect the air quality, ecosystem, and consumer health & safety. Thus, various government authorities are implementing stringent regulatory framework to minimize environmental pollution and global warming. For instance, in Australia, The Minimum Energy Performance Standards (MEPS) levels are mandatory requirements for certain products (including air conditioners, refrigerators & freezers) manufactured in, or imported into, Australia and are specified in the relevant Australian Standards. Thus, vehicle manufacturers need to redesign their HVAC systems with environment-friendly refrigerants, which is anticipated to affect the growth of the electric vehicle HVAC market.

Opportunity

Production of cost-effective HVAC systems

Installation and maintenance of the HVAC components such as compressor, evaporator, condenser, and others are costly. For efficient working of the HVAC system in automobile proper level of liquids such as lubricants, refrigerants, and others and regular maintenance is required. Thus, production of cost-effective HVAC systems for electric vehicles provides lucrative growth opportunity for the players to increase their electric vehicle HVAC market share.

What are the Recent Developments in the Electric Vehicle HVAC Market

In March 2023, Panasonic Corporation acquired Systemair AC SAS, Systemair S.r.l. and Tecnair S.p.A. It is Swedish manufacturer of Heating and Ventilation A/C Company, which operates commercial air-conditioning businesses owned by Systemair AB.

In October 2022, Valeo S.A signed a contract with Stellantis in the field of thermal comfort for electric cars. Under the contract, it supplied electric vehicle air conditioning units and front-end cooling modules for the automaker's major electric platform.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the electric vehicle HVAC market analysis from 2022 to 2032 to identify the prevailing electric vehicle HVAC market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the electric vehicle HVAC market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global electric vehicle HVAC market trends, key players, market segments, application areas, and market growth strategies.

Electric Vehicle HVAC Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 11.7 billion |

| Growth Rate | CAGR of 10% |

| Forecast period | 2022 - 2032 |

| Report Pages | 248 |

| By Technology |

|

| By Vehicle Type |

|

| By Component |

|

| By Region |

|

| Key Market Players | Johnson Electric Holdings Limited., Sanden Corporation, Panasonic Corporation, MAHLE GmbH, Hanon Systems Corporation., Marelli Holdings Co., Ltd., Brose Fahrzeugteile SE & Co. KG, Coburg, Valeo S.A., Denso Corporation, Toyota Industries Corporation |

The global electric vehicle HVAC industry generated $4.6 billion in 2022, and is anticipated to generate $11.7 billion by 2032, witnessing a CAGR of 10.0% from 2023 to 2032

The largest regional market for electric vehicles is Asia-Pacific.

The leading application of electric vehicle HVAC system is passenger vehicles.

The top companies in the market include Sanden Corporation, Hanon Systems Corporation, Denso Corporation, Valeo S.A., Mahle GMBH, Brose Fahrzeugteile SE and CO. KG, Panasonic Corporation, Johnson Electric Holdings Limited, Marelli Holdings Co., Ltd, and Toyota Industries Corporation.

The upcoming trends in the electric vehicle HVAC market include adoption of eco-friendly refrigerants in HVAC systems and greater demand for thermal systems and automatic climate control features in vehicles.

Loading Table Of Content...

Loading Research Methodology...