Electric Vehicle Plastic Market Research, 2032

The global electric vehicle plastic market was valued at $1.8 billion in 2022, and is projected to reach $20.3 billion by 2032, growing at a CAGR of 27.8% from 2023 to 2032. Plastic is a synthetic material made from polymers, which are large molecules composed of repeating subunits. It is widely used in various industries, including electric vehicles (EVs) manufacturing. Plastic components are often used in EVs to reduce weight and improve overall energy efficiency.

Lighter vehicles require less energy to drive, leading to increased range and better performance. Many exterior parts of electric vehicles, such as bumpers, fenders, and side panels, are made from plastic. Plastic offers advantages like design flexibility, ease of molding, and resistance to corrosion and impacts.

The increasing demand for electric vehicles is a significant growth driver of the electric vehicle plastic market. Plastics are lightweight materials, which is crucial for EVs as lighter vehicles require less energy to operate. Reduced vehicle weight helps increase the driving range and overall energy efficiency of electric vehicles, ultimately enhancing their performance. Moreover, plastics exhibit excellent durability and impact resistance, making them suitable for various applications in EVs. They can withstand harsh environmental conditions, vibrations, and mechanical stresses commonly encountered in-vehicle components. Furthermore, plastics possess good thermal and electrical insulation properties, making them suitable for applications in EVs where electrical components need protection. Plastics can provide insulation for wiring, connectors, and electronic systems, ensuring reliable performance and safety. In addition, plastics provide a high degree of design flexibility, allowing manufacturers to create intricate shapes and forms that may be challenging to achieve with other materials. This versatility in design enables the development of streamlined, aerodynamic EV components, which can further enhance energy efficiency. As the demand for electric vehicles continues to rise, the electric vehicle plastic market is expected to grow significantly, driven by the need for lightweight, durable, and cost-effective materials in EV manufacturing.

The cost of the battery pack is a major contributor to the overall price of an electric vehicle. This higher cost can deter some potential buyers from choosing EVs impacting the overall demand for electric vehicles. Moreover, the higher upfront cost of EVs makes them less affordable for many consumers. Additionally, electric vehicle components, including battery packs and motor housings, generate substantial heat during operation. To ensure durability and prevent deformation or failure, plastics used in these applications must exhibit high-temperature resistance. However, not all plastics can withstand elevated temperatures, which limits the material options for electric vehicle manufacturers. Weight reduction is crucial for improving energy efficiency and extending the range of electric vehicles. Plastics, being lighter than metals, are appealing for EV components. However, not all plastics possess the necessary strength and mechanical properties, further constraining material options. These factors pose challenges that are expected to hinder the growth of the electric vehicle plastic market.

Electric vehicle batteries need durable and lightweight casings to protect the battery cells from external impacts and maintain their reliability. Plastics offer the advantage of being lightweight and can be molded into complex shapes, making them an attractive material for battery cell casings. The demand for plastic casings is likely to increase as the EV market expands. Moreover, electric vehicle batteries require efficient electrical connections between cells and other components. Plastics can be used to manufacture connectors that provide good conductivity, while also offering insulation to prevent short circuits. Plastic connectors can be designed to be lightweight and resistant to corrosion, contributing to the overall performance and safety of EV batteries. Furthermore, heat management is crucial for the optimal performance and longevity of electric vehicle batteries. Plastics have excellent thermal management properties, allowing for efficient heat dissipation and insulation. Plastics can be used to create thermal management systems such as heat sinks, thermal barriers, and cooling channels within the battery pack. As battery technology improves and energy densities increase, the demand for advanced thermal management solutions using plastics is likely to grow. As the use of electric vehicles increases, there will be a greater focus on sustainability and recycling. Plastics used in EV batteries can be recycled and reused, contributing to the circular economy. Developing efficient recycling processes and utilizing recycled plastics in battery applications can create opportunities for companies involved in the plastic recycling industry. These are the major factors are projected to offer growth opportunities for market players during the forecast period.

The key players profiled in this report include BASF SE, ABIC, LyondellBasell Industries Holdings B.V., Evonik Industries, Covestro AG., DUPONT, Sumitomo Chemicals Co. Ltd., LG Chem Ltd, Asahi Kasei, and LANXESS. Investment and agreement are common strategies followed by major market players. For instance, in May 2022, LG Chem created a cutting-edge polymeric solution to aid in the avoidance of thermal runaway in EV batteries. The product is constructed from several composites, including PA and Polyphenylene oxide (PPO) resin.

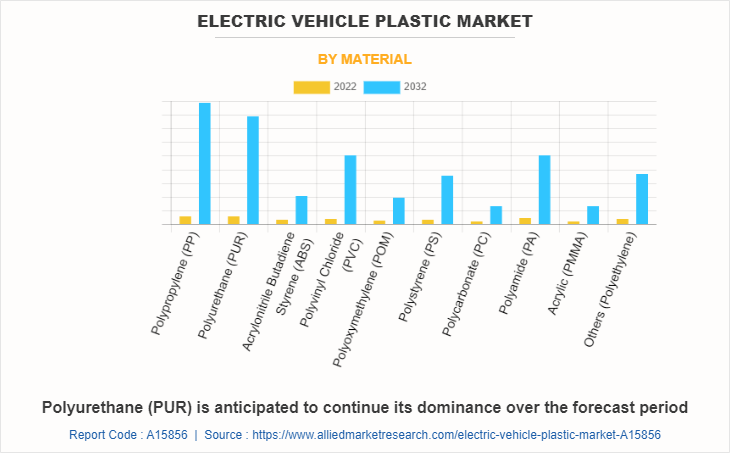

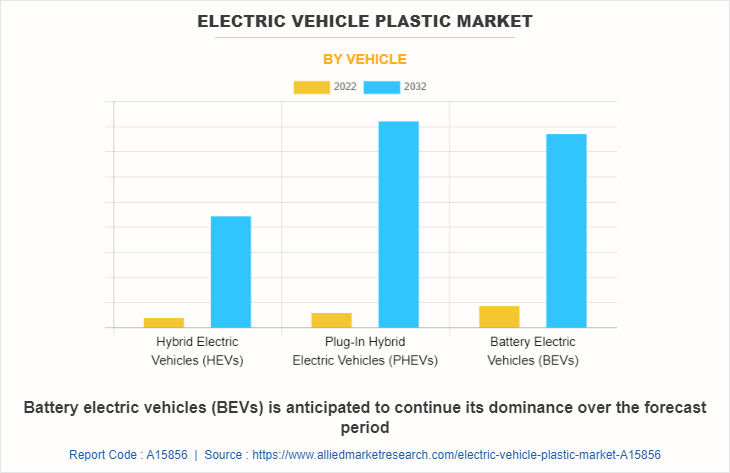

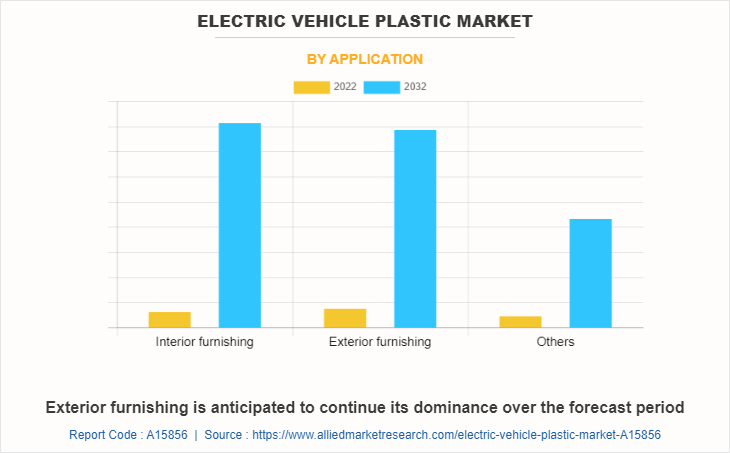

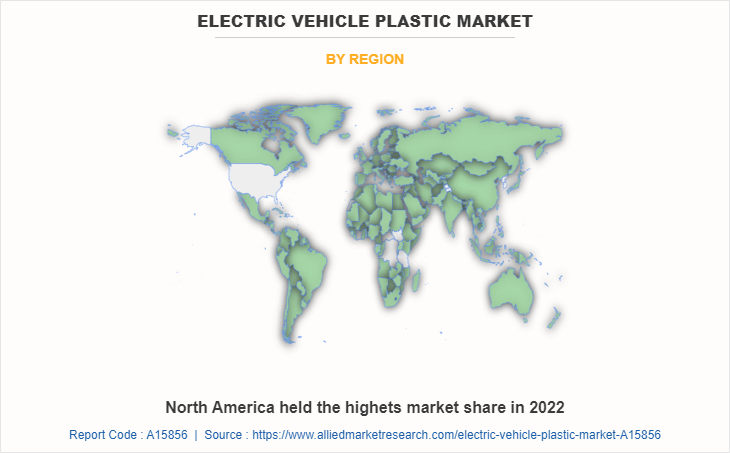

The electric vehicle plastic market is segmented on the basis of material, vehicle, application, and region. By material, the market is divided into polypropylene (PP), polyurethane (PUR), acrylonitrile butadiene styrene (ABS), polyvinyl chloride (PVC), polyoxymethylene (POM), polystyrene (PS), polycarbonate (PC), polyamide (PA), acrylic (PMMA), and others. By vehicle, the market is classified into hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), and battery electric vehicles (BEVs)). By application, the market is classified into interior furnishing, exterior furnishing, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The electric vehicle plastic market is segmented into Material, Vehicle and Application.

By material, the polyurethane (PUR) sub-segment dominated the market in 2022. Polyurethane is a lightweight material that helps reduce the overall weight of electric vehicles. By using PUR in various components such as bumpers, interior panels, and underbody parts, automakers can enhance the energy efficiency of EVs. The lightweight nature of PUR helps improve the vehicle's range and overall performance. Moreover, polyurethane offers excellent impact resistance and crashworthiness properties. It can absorb and dissipate energy during collisions, providing enhanced safety to passengers. As the adoption of electric vehicles increases, ensuring occupant safety becomes a crucial factor, and the use of polyurethane in structural components and safety systems becomes essential. Furthermore, polyurethane is a versatile material that can be molded into various shapes and sizes, allowing for design flexibility. This is particularly important for electric vehicle (EV) plastic manufacturers who want to differentiate their vehicles in terms of aesthetics and create unique designs. PUR enables the production of complex and aerodynamic parts, contributing to the overall visual appeal of electric vehicles. These are predicted to be the major factors affecting the electric vehicle plastic market size during the forecast period.

By vehicle, the battery electric vehicles (BEVs)sub-segment dominated the global electric vehicle plastic market share in 2022. Battery electric vehicles (BEVs) are gaining traction as they offer a sustainable and efficient transportation solution. BEVs produce zero tailpipe emissions, reducing air pollution and dependence on fossil fuels. Plastics play a vital role in BEVs by enabling lightweight construction, enhancing energy efficiency, and extending driving range. The demand for plastics in BEVs, such as battery casings, interior components, and exterior body parts, is projected to increase. Moreover, advancements in battery technology, particularly lithium-ion batteries, have significantly improved BEV performance and range. Plastics are crucial in battery casings, thermal management systems, and other components, ensuring safety, performance, and durability. The growing adoption of advanced plastics with properties like lightweight and thermal conductivity is driving the growth of the electric vehicle plastic market forecast period.

By application, the exterior furnishing sub-segment dominated the global electric vehicle plastic market share in 2022. EV manufacturers strive to reduce the overall weight of vehicles to enhance energy efficiency and extend driving range. Plastics, such as lightweight composites and thermoplastics, offer significant weight reduction compared to traditional materials like metal. Moreover, plastics provide greater design flexibility compared to other materials, allowing for unique and aerodynamic exterior shapes. EV manufacturers can leverage plastic components to create distinctive and stylish exteriors that align with their brand image and consumer preferences. Design flexibility is a crucial driver for the adoption of plastic exterior furnishings in EVs. Furthermore, plastics are generally more cost-effective than alternative materials like metal or carbon fiber. As the EV market expands and economies of scale are achieved in plastic manufacturing, the cost of producing plastic exterior furnishings decreases. This cost advantage makes plastics an attractive choice for EV manufacturers, contributing to the growth of this segment. Exterior furnishings in EVs need to withstand various environmental conditions, including extreme temperatures, moisture, and UV radiation. Plastics can be engineered to exhibit high durability, resistance to corrosion, and long-term weatherability, making them well-suited for exterior applications. The ability of plastics to provide adequate protection against harsh conditions is a significant driver in the adoption of plastic exterior furnishings.

By region, Asia-Pacific dominated the global electric plastic market in 2022. Many countries in the region have implemented aggressive policies and initiatives to promote the adoption of electric vehicles. Governments are providing various incentives such as tax benefits, subsidies, and infrastructure development to accelerate the growth of the EV market. These policies create a favorable environment for the electric vehicle plastic market as well. Moreover, Asia-Pacific has witnessed a significant increase in the demand for electric vehicles. Factors such as increasing urbanization, concerns over air pollution, and the need to reduce dependence on fossil fuels have driven the demand for EVs. As the production and sales of electric vehicles increase, so does the demand for plastic components used in EV manufacturing. Furthermore, Asia-Pacific is home to many leading automotive manufacturers and suppliers who are investing heavily on R&D of electric vehicle technologies. This includes the development of lightweight and durable plastic materials suitable for electric vehicle applications. Technological advancements in plastics are boosting the demand for plastic components in the electric vehicle plastic market growth.

Impact of COVID-19 on the Global Electric Vehicle Plastic Industry

- The COVID-19 pandemic has had a significant impact on the electric vehicle plastic market. Despite the initial setbacks caused by the pandemic, the demand for electric vehicles has been steadily growing. Governments around the world have been implementing policies and incentives to promote the adoption of EVs as part of their efforts to reduce greenhouse gas emissions. This increased demand for EVs has a direct impact on the plastic market, as more plastic components are required for the production of electric vehicles.

- The COVID-19 pandemic disrupted global supply chains in various industries, including the automotive sector. Plastic manufacturers faced challenges related to raw material availability, transportation disruptions, and workforce limitations. These disruptions affected the production and supply of plastic components for electric vehicles, potentially leading to delays or temporary shortages.

- The plastic industry, including the production of components for electric vehicles, has been increasingly focusing on sustainability. Automakers and suppliers are striving to incorporate more recycled and bio-based plastics in their products to reduce environmental impacts. This shift towards sustainable plastic materials aligns with the broader global push for a circular economy and reduced carbon footprint, which has been further emphasized by the COVID-19 pandemic.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the electric vehicle plastic market analysis from 2022 to 2032 to identify the prevailing electric vehicle plastic market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the electric vehicle plastic market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global electric vehicle plastic market trends, key players, market segments, application areas, and market growth strategies.

Electric Vehicle Plastic Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 20.3 billion |

| Growth Rate | CAGR of 27.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 310 |

| By Material |

|

| By Vehicle |

|

| By Application |

|

| By Region |

|

| Key Market Players | SABIC, LG Chem Ltd, Sumitomo Chemicals Co. Ltd., BASF SE, LyondellBasell Industries Holdings B.V., DUPONT, Evonik Industries, Asahi Kasei, LANXESS, Covestro AG. |

The growing demand for electric vehicles is a significant driver for the EV plastic market. As more consumers and governments embrace EVs as a sustainable transportation solution, there is a higher demand for lightweight and durable plastics to be used in various vehicle components which is estimated to generate excellent opportunities in the electric vehicle plastic market.

The major growth strategies adopted by electric vehicle plastic market players are investment and agreement.

Asia-Pacific is projected to provide more business opportunities for the global electric vehicle plastic market in the future.

BASF SE, SABIC, LyondellBasell Industries Holdings B.V., Evonik Industries, Covestro AG., DUPONT, Sumitomo Chemicals Co. Ltd., LG Chem Ltd, Asahi Kasei, and LANXESS are the major players in the electric vehicle plastic market.

The polyurethane (PUR) sub-segment of the material acquired the maximum share of the global electric vehicle plastic market in 2022.

Automotive manufacturers and electric vehicle component suppliers are the major customers in the global electric vehicle plastic market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global electric vehicle plastic market from 2022 to 2032 to determine the prevailing opportunities.

Plastics play a crucial role in lightweighting vehicles, which helps improve fuel efficiency and increase the driving range of electric vehicles. By replacing traditional metal components with lightweight plastic alternatives, automakers can reduce the overall weight of the vehicle and enhance its energy efficiency, which is estimated to drive the adoption of electric vehicle plastic.

The demand for battery electric vehicles, which solely relies on electricity for propulsion, is a key driver for the EV plastic market. BEVs require specialized plastic components to house and protect high-capacity lithium-ion batteries, ensuring their safety, thermal management, and insulation, which is anticipated to boost the electric vehicle plastic market in the upcoming years.

Loading Table Of Content...

Loading Research Methodology...