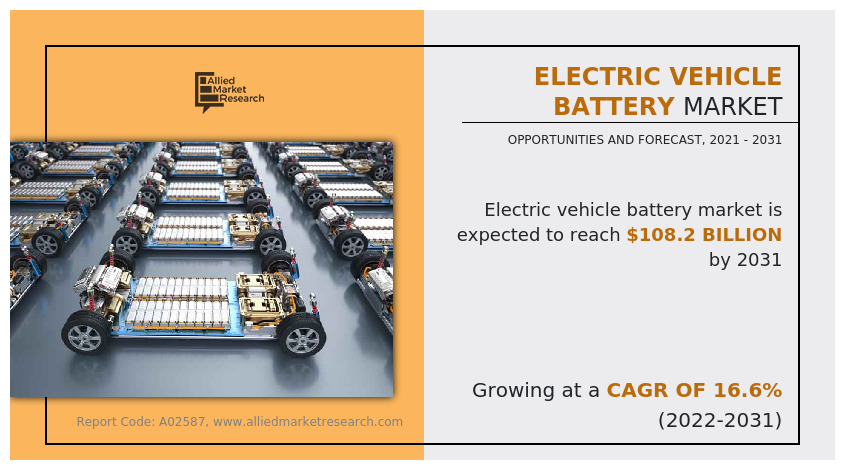

Electric Vehicle Battery Market Insights, 2031

The global electric vehicle battery market size was valued at USD 23.8 billion in 2021, and is projected to reach USD 108.2 billion by 2031, growing at a CAGR of 16.6% from 2022 to 2031. The factors such as the growth in demand for zero emission vehicles, reduction in cost of electric vehicle batteries, and technological advancement in battery system, supplement the growth of the electric vehicle battery market. However, stringent lead pollution norms, instability in the prices of the raw material, and high import taxes on EV batteries are the factors expected to hamper the growth of the market. In addition to this, the evolution of lithium-ion technology and proactive government initiatives are projected to generate market opportunities for the key players operating in the market.

Key Market Trends

- The commercial vehicle segment is set to lead the electric vehicle battery market growth by 2031.

- The hybrid electric vehicle (HEV) segment is projected to dominate market growth by 2031.

- The lithium-ion battery segment is expected to drive the highest growth in the market by 2031.

Market Size & Forecast

- 2031 Projected Market Size: USD 108.2 billion

- 2021 Market Size: USD 23.8 billion

- Compound Annual Growth Rate (CAGR) (2022-2031): 16.6%

Introduction

The fundamental piece of any electric vehicle (EV) is its battery. A battery is a device that converts chemical energy into electric energy by means of an electrochemical reaction. An electrochemical reaction involves the transfer of electrons from one material to another in an electronic circuit. The battery is often designed in such a way that all the requirements of the motor(s) and charging system that an electric vehicle needs, are met. A common pack of EV battery is composed of blocks of 18-30 parallel cells in series to achieve a desired voltage for propulsion.

Presently, automobile companies are focusing on production of advanced electric vehicle systems such as downsized engines & batteries that are expected to have lower emission at relatively lowers costs. For batteries used in electric vehicles, lithium-nickel-manganese-cobalt-oxide (NMC) is now the most used material. Moreover, lithium-nickel-cobalt-aluminum oxide (NCA) is used in electric vehicles in the U.S. (Tesla Model X, S, and 3). For instance, in March 2020, BYD Motors Inc. launched the new blade battery for electric vehicles that optimizes the battery pack structure by above 50%, as compared to the traditional lithium iron phosphate batteries. It also exponentially increases battery safety.

In addition, governments around the world are supporting purchase of electric vehicles, in terms of tax credits and incentives. Moreover, central governments of few countries such as India, China, and Japan are providing exemption from highway toll tax for electric vehicles. For instance, for faster adoption of electric vehicles, the government of India plans to lower the goods & service tax (GST) on e-vehicles from 5% to 12%. Similarly, the government of South Korea has announced that it will be providing $900 million tax exemptions and subsidies for development and purchase of electric and fuel cell vehicles. Thus, increase in government support for development and purchase of electric vehicles, in terms of tax credits, subsidies and incentives, is one of the major factors that propel the demand for electric vehicles, which is in turn predicted to create lucrative market opportunity for EV battery market share in the forecast period.

By Battery Type

Lithium ion Battery is projected as the most lucrative segment

Market Segmentation

The global electric vehicle battery market is segmented based on propulsion, battery, vehicle type, and region. Based on propulsion type, the market is divided into battery electric vehicle (BEV), hybrid electric vehicle (HEV), and plug-in hybrid electric vehicle (PHEV). On the basis of battery type, the market is categorized into lead-acid, nickel metal hydride, and lithium-ion. Based on vehicle type, it is bifurcated into passenger car, commercial vehicle, and two-wheeler. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Market Dynamics

China is expected to dominate the global electric vehicle battery industry during the forecast period. China is the leader in electric vehicle manufacturing and related infrastructures & technologies. China produced more than 200,000 all-electric commercial vehicles in 2020, amounting to nearly 5% of the total output of the world. In addition, the government of China has been implementing strict emission control rules to boost passenger and commercial electric vehicles on roads, therefore, it is expected to fuel demand for electric vehicles & battery technologies in China. For instance, all vehicles sold and registered after July 2020 should comply with the China VI Emission Standards (revised limits to reduce 50% hydrocarbon and 40% NOx emissions).

Increase in government initiatives toward adoption of electric vehicles (EVs) in the Asia Pacific region to limit the emission of greenhouses gases is one of the major factors that drives the growth of the market in the India. For instance, in March 2019, the Central Government of India introduced a Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles (FAME)-2 scheme and has announced an outlay of INR 10,000 crore for faster adoption and manufacturing of hybrid and electric vehicles to boost electric mobility and increase the number of electric vehicles in commercial fleets, which in turns fuels the EV battery market. Furthermore, in February 2021, the ministry of Road Transport & Highways launched the Go Electric campaign to boost the adoption of electric mobility vehicles in the country. It will help in reducing import dependency of the country in the coming years and be an important step toward cleaner and greener future. Moreover, several industrial equipment manufacturers are collaborating with electric vehicle manufacturers for the adoption of electric vehicles into their fleet.

The market for batteries for electric vehicles is anticipated to grow fastest in North America. Canada is attempting to grow EV adoption by funding charging infrastructure. For instance, the federal government of Canada announced to spend around $880 million over the next four years (2022–2025) to build about 65,000 new charging stations for electric cars & fuel celled-powered passenger vehicles. The Canadian government also provides a number of incentive to promote the purchase of zero-emission vehicles (ZEVs) in the country. Canadians who purchase EVs or plug-in hybrids are eligible for incentive from $2500 to $5000 depending on the dealer’s terms & conditions. Thus, the cohesive government initiatives & programs to supplement the adoption of EVs fuel the growth of the EV battery market in Canada

Which are the Top Eelectric Vehicle Battery companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the electric vehicle battery industry.

- BYD Company Ltd

- Contemporary Amperex Technology Co., Limited

- ENERSYS

- GS Yuasa International Ltd

- LG Chem Ltd

- Panasonic Corporation

- Pride Power

- Samsung Electronics Co. Ltd.

- Tianneng Rechargeable Battery Manufacturers

- Wanxiang Group Corporation

What are the Recent Developments in the Eelectric Vehicle Battery Market

In December 2022, Contemporary Amperex Technology Co., Limited. signed an agreement with Changan Automobile to help Changan Automobile with its innovation capabilities and core advantages in the value chain of EV battery R&D, manufacturing and aftermarket services.

In December 2022, Panasonic Corporation signed an agreement with Lucid Group to supply lithium-ion batteries to their electric vehicles (EVs).

In November 2022, LG Chem Ltd invested more than $3 billion to build a battery cathode factory in Tennessee, as it ramps up plans to meet rising demand for U.S. electric vehicle components. It's one of the first major EV-related investments announced by a South Korean firm in the U.S. to supply cathode materials to Ultium Cells, a battery joint venture between General Motors and LG Chem's subsidiary LG Energy Solution Ltd (LGES).

In November 2021, GS Yuasa International Ltd. launched its common lithium-ion batteries for launch vehicle, Epsilon-5. The common lithium-ion batteries for launch vehicles was developed under a contract with IHI Aerospace Co., Ltd., have been utilized in Epsilon Launch Vehicles ever since the very first Epsilon launch in 2013.

By Vehicle Type

Commercial vehicle is projected as the most lucrative segment

What are the Top Impacting Factors

Key Market Driver

Growth in demand for zero emission vehicles

Increase in global concerns regarding the negative effect of climate change along with alarming pollution levels recorded in the major cities have created a significant demand for electric vehicles. This involves the use of electric vehicles, which do not use gas and are more economical than conventional vehicles. An electric vehicle converts over 50% of the electrical energy from the electric power system (battery) to power at the wheels, whereas the gas-powered vehicle only manages to convert about 17%–21% of the energy stored in gasoline. The demand for fuel-efficient vehicles has increased recently owing to rise in prices of petrol and diesel. This has also resulted due to depleting fossil fuel reserves and growth in tendency of companies to gain maximum profit from these oil reserves. Thus, these factors give rise to the need for advanced fuel-efficient technologies, further leading to a surge in demand for electrically powered vehicles for travel.

Reduction in cost of electric vehicle batteries

Technological advancements and production of electric vehicle batteries on a mass scale has led to a decrease in the cost of EV batteries over the past decade. This has led to a decrease in the cost of electric vehicles, as batteries comprise almost 20% to 40% of the overall cost of electric vehicles. For instance, according to Bloomberg, in 2010, the price of an EV battery in China was around $1,100 per kWh. However, by 2020 their price dropped to around $137 per kWh, and now the price is as low as $100 per kWh.. This is attributed to the advancements in battery technologies along with the reducing manufacturing costs of these batteries, reduced cathode material prices, and greater volumes of production.

The prices of EV batteries are anticipated to drop to around $40-60 per kWh globally by 2030, which is further expected to reduce the price of electric vehicles, making them priced similar to conventional gasoline-powered vehicles. The growth in demand for low emission transportation will further lead to a rise in adoption of electric vehicles in the future. In 2020, Tesla, one of the world’s top manufacturers of EVs has already announced plans to reduce the prices of their EV batteries in the upcoming years. Other leading electric vehicle battery manufacturers such as Samsung SDI, Panasonic, LG Chem, SK Innovative, and CATL have been working with leading EV manufacturers for achieving this goal in the next 4–5 years. Thus, reducing the cost of batteries is anticipated to drive the growth of the electric vehicle market.

By Propulsion Type

Hybrid electric vehicle is projected as the most lucrative segment

Restraints

Instability of the raw material

The demand for rechargeable lithium-ion batteries has registered considerable growth in recent years. The supply of raw materials that make up the batteries such as lithium, cobalt, and lead fluctuates. The improper usage of the raw materials owing to their fluctuating prices leads to EV batteries shortage & wastage.. For instance, prices of cobalt, a raw material used in lithium-ion batteries, have rose by 26% in the first quarter of the year 2019, which can raise battery prices by 3-4%. The fluctuating prices of the raw materials in the EV battery manufacturing is further anticipated to hamper the growth of the market and act as a major hindrance.

Opportunity

Evolution of lithium-ion technology

The emergence of lithium-ion technology has fueled the growth rate for batteries over the last two decades. While early-stage hybrid vehicles used Nickel Metal Hydride (NiMH) batteries, Li-ion batteries have been the primary solution for automakers to power plug-in hybrid electric vehicles (PHEVs) and battery electric vehicles (BEVs). The high energy density and charge retention capacity along with low maintenance are some of the benefits that have accelerated the growth of Li-ion in battery technology. The price of lithium-ion batteries is usually on a higher side compared to other batteries.

However, major market players have been spending to improve their performance in the industry and achieve economies of scale in production and R&D activities, which has increased competition and led to a decline in lithium-ion battery prices. Also, by launching BEVs and PHEVs onto the market, with advanced battery technologies such as enhanced polymer coating and adoption of solid electrolytes in Li-ion battery are expected to provide higher energy-storage capacity & safety of vehicles. Thus, evolution and adoption in battery technology is predicted to create various market opportunities for the EV battery market.

By Region

North America would exhibit the highest CAGR of 18.4% during the forecast period 2022-2031

KEY BENEFITS FOR STAKEHOLDERS

- This study presents an analytical depiction of the global electric vehicle battery market analysis along with current trends and future estimations to depict imminent investment pockets.

- The overall electric vehicle battery market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the global electric vehicle battery market with a detailed impact analysis.

- The current electric vehicle battery market is quantitatively analyzed from 2021 to 2031 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Electric Vehicle Battery Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 108.2 billion |

| Growth Rate | CAGR of 16.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 255 |

| By Battery Type |

|

| By Vehicle Type |

|

| By Propulsion Type |

|

| By Region |

|

| Key Market Players | Pride Power, ENERSYS, BYD Company Ltd, Contemporary Amperex Technology Co., Limited., GS Yuasa International Ltd., LG Chem Ltd, Tianneng rechargeable battery manufacturers, Samsung Electronics Co. Ltd., Panasonic Corporation, Wanxiang Group Corporation |

Analyst Review

The market is expected to witness a significant growth due to stringent vehicle emission norms and an increase in the demand for fuel-efficient & low-emission vehicles. The market in the developed countries, such as the U.S., Canada, Mexico, and Germany, is projected to report a slower growth rate as compared to that of the developing regions, such as India, South Africa, and the Middle East, owing to rapid industrialization and high sales of vehicles in the developed region.

Moreover, the growing emphasis of prominent automobile manufacturers, including Ford Motors, General Motors, and BMW AG on launching EVs is anticipated to drive the market growth. For instance, in 2019, Ford entered into a partnership agreement with Rivian for production of an all-electric vehicle, which is under the Ford Motor’s luxury Lincoln brand. Similar developments carried out by other manufacturers supplement the growth of the market. Furthermore, factors such as stringent regulations on gasoline-powered vehicles, various purchasing incentives in terms of subsidies and tax resumption by governments, lower operating cost of electric vehicles, coupled with advancements in charging as well as battery technology are further increasing the demand for electric passenger cars across the world, which in turn is anticipated to propel the EV battery industry.

Similarly, the share of EVs in total passenger cars has been increasing and owing to the increased sales, the demand for lithium-ion batteries in Europe and North America has been increasing. Moreover, with the ‘Green Deal policy’ launched in 2019 by the European Union, the share of EVs is likely to increase, further driving the demand for lithium-ion batteries during the forecast timeframe. ‘Green Deal Policy’ aims to reduce the carbon emission by more than 50% by 2030 to achieve carbon neutrality target by 2050.? Thus, such initiatives are expected to dominate the electric vehicle battery market during the forecast period.

Among the analyzed regions, Asia-Pacific is the highest revenue contributor, followed by Europe, North America, and LAMEA. On the basis of forecast analysis, North America is expected to lead during the forecast period, due to increasing stringent government regulations on vehicle emissions, improved electric vehicle battery technology, and rising domestic production of EV batteries in the region.

The electric vehicle battery market is estimated to reach $108,219.9 million by 2031, exhibiting a CAGR of 16.6% from 2022 to 2031.

Asia-Pacific is the largest regional market for electric vehicle battery.

Advances in EV battery and associated technologies, shift of automotive industry toward EVs, and decline in EV lithium-ion battery cost are the upcoming trends of electric vehicle battery market in the world.

Battery electric vehicles (BEV) is the leading application of electric vehicle battery market.

BYD Company Ltd, Contemporary Amperex Technology Co., Limited., ENERSYS, GS Yuasa International Ltd., LG Chem Ltd, Panasonic Corporation, Pride Power, Samsung Electronics Co. Ltd., Tianneng rechargeable battery manufacturers, and Wanxiang Group Corporation are the top companies to hold the market share in electric vehicle battery.

Loading Table Of Content...