Electronic Components Market Research, 2032

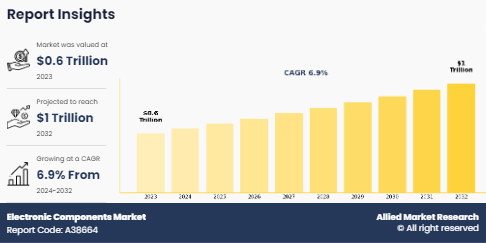

The Global Electronic Components Market was valued at $0.6 trillion in 2023 and is projected to reach $1.0 trillion by 2032, growing at a CAGR of 6.9% from 2024 to 2032. This is driven by rising demand in consumer electronics, automotive, telecommunications, and industrial automation. Growing adoption of smart devices, electric vehicles, and IoT technologies is fueling the need for components like semiconductors, capacitors, and resistors. Technological advancements and miniaturization are further boosting market expansion.

Market Dynamics & Insights

- The electronic components industry in North America held a significant share of over 21.6% in 2023.

- The electronic components industry in Germany is expected to grow significantly at a CAGR of 8% from 2024 to 2032.

- By type, the electromechanical components segment is one of the dominating segments in the market and accounted for the revenue share of over 35.2% in 2023.

- By application, the automotive segment is the fastest-growing segment in the market.

Market Size & Future Outlook

- 2023 Market Size: $0.6 Trillion

- 2032 Projected Market Size: $1.0 Trillion

- CAGR (2024-2032): 6.9%

- North America: Largest market in 2023

- Asia-Pacific: Fastest growing market

Electronic components are devices important for electrical circuitry and functioning. Integrated circuits (ICs) pack many electronic components such as transistors, resistors, capacitors, and more. into one chip, thereby making it possible to have more complex functioning in a smaller space. Electronic devices depend on these elements for functions ranging from rectification and signal modulation to amplification and feedback systems. Diodes allow current flow only in one direction, while sensors detect and measure various physical parameters for automation and feedback purposes. Optoelectronic devices manipulate light for communication, sensing, or display purposes. This is how today’s modern electronics equipment with cutting-edge technology has come about across different industrial sectors.

Key Takeaways:

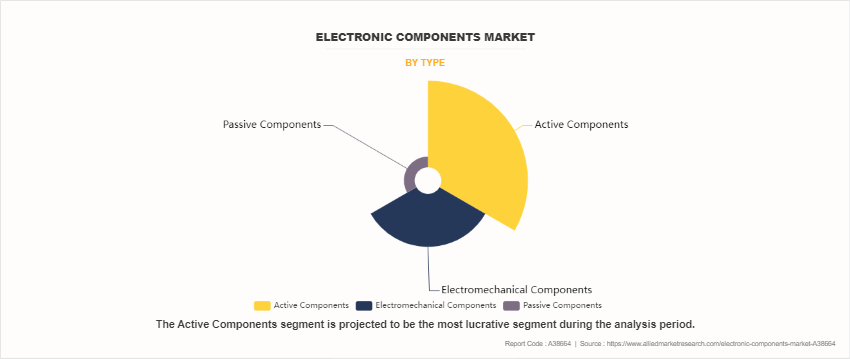

Based on type, the active components segment dominated the electronic components market in terms of revenue in 2022. However, the passive components segment is anticipated to grow at the fastest CAGR during the forecast period.

Based on application, the consumer electronics segment dominated the electronic components market forecast in terms of revenue in 2022. However, the automotive segment is anticipated to grow at the fastest CAGR during the forecast period.

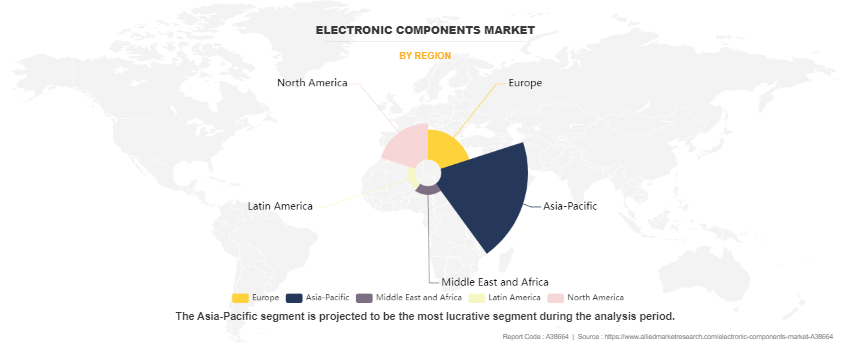

Region-wise, Asia-Pacific generated the largest revenue in 2022. However, Latin America is anticipated to grow at the highest CAGR during the forecast period.

The electronics components market is expected to grow at a significant pace, owing to the surge in investment by electronic components manufacturers in the next generation AI-integrated chips, resistors, and other advanced display technologies like 8K displays being used for various applications, thereby providing high resolution and clarity. Additionally, the electronic components growth drivers, including the integration with IoT technology, are foreseen as a lucrative opportunity for the market’s expansion during the forecast period. Nevertheless, investment costs remain a great concern, which hinders the significant growth of electronics components’ potential in the market. However, with emerging technology trends pushing demand for new electronic devices across industries, it appears that despite these challenges, there still exists a lot of room for growth

Segment Overview

The electronic components market is segmented into Type, Application, and Region.

Based on type, the electronic components market is divided into active components, passive components, and electromechanical components. In 2022, active components dominated the market in terms of revenue. Moreover, the passive components segment is projected to have the highest CAGR during the forecast period.

Based on application, the electronic components market is classified into consumer electronics, automotive, industrial automation, telecommunication, aerospace and defense, healthcare, energy and power, and others. In 2022, the consumer electronics segment dominated the market in terms of revenue. However, the automotive segment is expected to manifest the highest CAGR during the forecast period.

Based on region, the electronic components market value is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Italy, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), Latin America (Brazil, Argentina, and rest of Latin America), and Middle East and Africa (UAE, Saudi Arabia, and rest of the Middle East and Africa).

Based on the electronic components market size by country, the Asia-Pacific, specifically China, remains a significant participant in the electronics components market with a CAGR of 7.9% due to the presence of top electronic components manufacturers paired with a high-end manufacturing infrastructure, extensive supply chain networks, and a growing consumer electronics industry. China's strategic investments in research and development, coupled with government initiatives promoting technological innovation and domestic production, have propelled its dominance in the global electronics market. Additionally, favorable economic policies, competitive labor costs, and a large pool of skilled labor further contribute to the region's steady growth in electronics component manufacturing.

Competitive Analysis

The top electronic components companies listed in this report include Intel Corporation, Samsung, TSMC, Texas Instruments, Broadcom Inc., Bosch, NXP Semiconductors, STMicroelectronics, Skyworks Solutions, and Analog Devices. Product launch, partnership, and acquisition business strategies were adopted by the major electronic components market players in 2022.

For instance, on January 4, 2023, Samsung unveiled its latest generation of mobile processors, the Exynos 2300 series, promising improved performance and efficiency for smartphones. This new line promises significant advancements in performance and efficiency for future smartphones powered by Samsung's chips. The Exynos 2300 series is designed to deliver a smoother user experience and potentially extend battery life for mobile devices. Further, the electronic components market share by companies is divided into the top 5 companies, including Samsung, TSMC, Intel Corporation, and others.

Market Dynamics

Technological Advancements and Innovation

The electronic components industry report is driven by technological advancements and continuous innovation, resulting in the development of smaller, faster, and more efficient components. The use of such materials, developments like semiconductor technology and manufacturing processes, results in new generation electronic components with enhanced performance and functionality. For example, integrated circuits (ICs) have been miniaturized, which has facilitated the manufacture of high-density chips that power sophisticated electronic gadgets, including smartphones, wearable devices, as well as IoT-connected tools. Besides this, optoelectronic devices such as light-emitting diodes (LEDs) and photovoltaic cells have evolved, therefore providing energy-efficient lighting alternatives and renewable energy systems. Similarly, sensor technology advancements enable sensors to be incorporated into a wide variety of applications, ranging from automotive safety systems to healthcare monitoring devices. In conclusion, by addressing changing consumer desires for tinier, smarter, as well as more energy-efficient electronic products, technology leaps ahead, thereby propelling the market for electronic components.

Growing Demand for Connected Devices and IoT Solutions

The growth in the demand for connected devices and the Internet of Things (IoT) is a major driver of the electronics component market. With smartphones, tablets, smartwatches, and IoT devices everywhere, there is an increasing necessity for electronic parts such as microcontrollers, sensors, wireless communication modules, and memory chips. These components constitute the connected devices’ backbone that permits seamless data transmission and processing as well as interfacing to the internet. Also, exponential increases in IoT applications across various industry domains, including health care, automotive manufacturing, and smart cities, are prompting the need for customized electronic components suited for IoT use cases. For instance, sensors and actuators play an important role in receiving and transmitting data within smart home automation, while embedded systems, plus a communication module, allow industrial equipment monitoring remotely as well as for control purposes. In general terms, therefore, escalating demand for IoT-enabled products drives up the electronics component market, thereby spurring innovation and investment into next-generation technologies.

Supply Chain Disruptions and Component Shortages

The companies listed in the electronic components company list face significant challenges due to supply chain disruptions and component shortages. Issues such as natural disasters, geopolitical tensions, trade restrictions, and global pandemics can disrupt the flow of raw materials, components, and finished products along the entire supply chain.

In terms of production delays, elevated costs of production, and inadequate components for electronic devices, disruptions along the supply chain can significantly impact the efficiency and profitability of electronics companies. A case example is the COVID-19 pandemic, which exposed vulnerability in the global supply chain, resulting in low manufacturing operations and shortages of semiconductors, capacitors, among other electronic components. Furthermore, the consolidation of semiconductor manufacturing facilities together with reliance on a few key suppliers only heightens the risk of component shortages. In addition to this point, due to the complexity and interconnection among myriad stages, electronics companies’ ability to adapt quickly in case any disruption occurs becomes impossible, thereby undermining their capacity to mitigate hazards. Henceforth, it follows that disruptions in the supply chains alongside material shortages restrain growth in the electronics component market, thus emphasizing the importance of resilience as well as diversification when managing its chains.

Recent Developments in the Electronics Components Industry

March 8, 2023: Samsung’s partnership with Google marks a significant step in the evolution of display technologies. The collaboration aims to enhance the user experience on Pixel devices, with a focus on improving refresh rates for smoother visuals and reducing power consumption for longer battery life. This could potentially set new standards in the smartphone industry.

May 12, 2023: TSMC’s new fabrication plant in Arizona represents a strategic move to increase its presence in the North American market. The facility will focus on producing advanced chips, which are in high demand due to the proliferation of high-tech devices and systems. This expansion could boost TSMC’s global electronic components market share and strengthen its position as a leading semiconductor manufacturer.

June 7, 2023: Texas Instruments’ introduction of a new line of GaN power transistors is a game-changer for power electronics applications. GaN transistors offer higher efficiency and smaller form factors compared to traditional silicon-based transistors. This could lead to more compact and energy-efficient devices, from power adapters to electric vehicle chargers.

July 19, 2023: Broadcom’s acquisition of Inphi Corporation, a leader in high-speed networking chips, is a significant move in consolidating its position in the data center connectivity market. The $7 billion deal could enhance Broadcom’s product portfolio and enable it to offer more comprehensive solutions to its customers. This acquisition underscores the growing importance of high-speed data transmission in today’s digital age.

Report Coverage & Deliverables

This report delivers in-depth insights into the electronic components market overview, types, applications, regions, and major players' key strategies. It offers detailed market forecasts and emerging trends.

Type Insights

The electronic components market is categorized by type into active components, passive components, and electromechanical components. In 2022, active components led the market in revenue. Furthermore, the passive components segment is projected to experience the highest compound annual growth rate (CAGR) during the forecast period.

Application Insights

In terms of application, the electronic components market is segmented into consumer electronics, automotive, industrial automation, telecommunications, aerospace and defense, healthcare, energy and power, and others. In 2022, the consumer electronics segment was the dominant revenue generator; however, the automotive segment is anticipated to show the highest CAGR during the forecast period.

Regional Insights

Regionally, the electronic components market is examined across North America, Europe, Asia-Pacific, and LAMEA. Notably, the Asia-Pacific region, particularly Japan, is expected to grow at the highest rate during the forecast period. Japan plays a crucial role in the global supply chain, with significant investments in advanced technologies, including multifunctional displays and smart solutions for diverse applications.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the electronic components market from 2023 to 2032 to identify the prevailing electronic components market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the electronic components market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global electronic components market trends, key players, market segments, application areas, and market growth strategies.

Electronic Components Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1 trillion |

| Growth Rate | CAGR of 6.9% |

| Forecast period | 2023 - 2032 |

| Report Pages | 250 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Panasonic Corporation, fci electronics, Renesas Electric Corporation, Eaton Corp., Hitachi AIC, AVX Corporation, NXP Semiconductors N.V., Fujitsu Component, API Technologies Corp, Datronix Holdings |

Asia-Pacific is the largest region in the Electronics Components Market

in 2023 the electronics components market was valued at $0.6 trillion and is expected to reach the 1 trillion by 2032.

Intel Corporation, Samsung Electronics Co., Ltd., Qualcomm Incorporated, Broadcom Inc.,and Texas Instruments Incorporated

Consumer Electronics dominated the market in terms of market size and share in 2023.

The Electronic Components Market is driven by demand from multiple industries, miniaturization, IoT growth, and investments in AI chips and advanced displays.

Loading Table Of Content...

Loading Research Methodology...