Electronic Films Market Summary

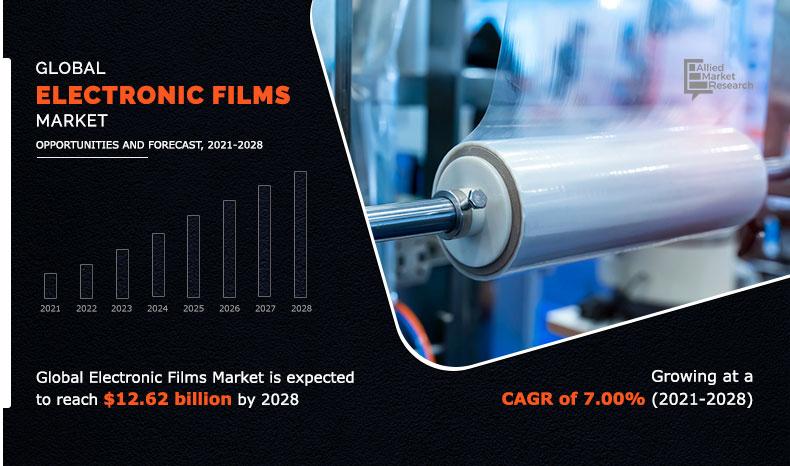

The global electronic films market size was valued at $7.75 billion in 2020 and is projected to reach $12.62 billion by 2028, registering a CAGR of 7.00% from 2021 to 2028. This is driven by increasing infrastructure development in smart residential and commercial buildings. The growing adoption of IoT devices, coupled with rapid digitalization across industries, further propels market expansion. These trends highlight the rising demand for advanced electronic materials in modern technology applications.

Market Dynamics & Insights

- The electronic films industry in Asia-Pacific held a significant share of over 34.7% in 2020.

- The electronic films industry in the U.S. is expected to grow significantly at a CAGR of 6.6% from 2021 to 2028.

- By film type, the conductive segment is one of the dominating segments in the market and accounted for the revenue share of over 45.5% in 2020.

- By application, the smart buildings segment is the fastest-growing segment in the market.

Market Size & Future Outlook

- 2020 Market Size: $7.75 Billion

- 2028 Projected Market Size: $12.62 Billion

- CAGR (2021-2028): 7%

- Asia-Pacific: Largest market in 2020

- LAMEA: Fastest growing market

An electronic film is a specialized polymer or ITO-based film used to sky-scrape the performance of electronic devices to improve their durability and performance. Electronic films are intended to safeguard electronic devices on account of their valuable and reliable properties, such as chemical resistance, optical transparency, high-temperature tolerance, and moisture resistance across consumer and industrial electronics devices. Further, the rise in digitization in the consumer electronics and industrial sectors drives the electronic films market growth.

The electronic film industry has a direct impact on the consumer electronics market. Electronic films have a wide array of applications across the electrical & electronics sector to offer various valuable properties, such as layered technology, designed to enhance electronic devices' properties. The non-conductive electronic film is one of the most utilized applications across the electrical and electronic market, owing to the surge in demand from the PCB market. Besides, the rise in demand for electronic films across electronic displays in laptops, TVs, PC, and industrial touch panels drives the growth of the consumer electronics sector. All these factors are opportunistic for the electronic films market.

The market for electronic films is expected to witness growth during the forecast period, owing to a rise in the trend toward digitization in developing economies. Further, the market is expected to be driven by a rise in demand for consumer electronics applications. Moreover, the rapid surge in penetration of the Internet of Things in smart home applications across the residential sector is expected to be opportunistic for market growth. Considering these factors, the electronic films market revenue is estimated to experience steep growth in the future.

The rise in demand for electronic display applications across consumer, industrial, and other sectors is expected to offer a lucrative growth opportunity for the electronic films market during the forecast period.

However, the rise in processing costs associated with indium tin oxide-based films acts as a major restraint for this market. Further, an increase in demand for smart city projects across the globe is opportunistic for the electronic films industry.

The emergence of the global pandemic has acted as a prime drawback for the manufacturing and selling industries. Major economies across the world have faced major losses due to partial and complete lockdowns, which hindered the growth of the electronic films market. However, the surge in demand from the electric and electronics market is expected to be robust during the forecast period due to the rise in demand from the printed circuit board segments. Moreover, COVID-19 has influenced the growth of the electronic film industries due to a fall in construction activities. Consequently, it resulted in decreased demand for electronic films.

By Film Type

Non-conductive segment is projected as one of the most lucrative segments.

The electronic film market share is segmented into film type, thickness, material, application, and region. Based on film type, it is fragmented into conductive and non-conductive. The non-conductive segment dominated the market in terms of revenue in 2020 and is expected to follow the same trend during the forecast period. Based on thickness, the market is segregated into thick (more than 1 μm) and thin (up to 1 μm). The polymer segment dominated the market in terms of revenue in 2020 and is anticipated to witness a significant market share during the forecast period. By material, the market is divided into polymer, ITO on glass, metal mesh, and others. The market share of the electronic segment was the highest in 2020 and is expected to grow at a high CAGR from 2021 to 2028. By application, the market is divided into electronic display, PCB, wire and cable, smart buildings, and others.

Region-wise, electronic films market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Italy, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and Rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). The Asia-Pacific electronic films market share is expected to grow at the highest rate during the conjecture time frame.

By Thickness

Thick segment is expected to secure leading position during forecast period.

Top Impacting Factors

Significant factors that impact the growth of the electronic films market include growing demand for consumer electronics applications, coupled with rising demand for digital technology across the industrial and commercial sectors. However, the endeavor in electronic film processing acts as a prime barrier to early adoption, which hampers the market growth. On the contrary, the surge in demand for printed circuit board applications across the electric and electronic market is expected to offer lucrative opportunities for the electronic film market during the forecast period.

Competition Analysis

Competitive analysis and profiles of the major electronic films market players, such as 3M, DuPont, Eastman Kodak Company, Gunze Ltd., Nitto Denko Co., Panasonic Co., Saint-Gobain S.A., TDK Co., Teijin Ltd., and TOYOBO Co., Ltd., are provided in this report.

By Geography

LAMEA region would exhibit the highest CAGR of 7.6% during 2021-2028

Key Benefits For Stakeholders

- This study comprises an analytical depiction of the electronic films market share along with the current trends and future estimations to depict the imminent investment pockets.

- The overall electronic films market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current electronic films market forecast is quantitatively analyzed from 2020 to 2028 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the market.

- The report includes the electronic films market share of key vendors and market trends.

Electronic Films Market Report Highlights

| Aspects | Details |

| By Film Type |

|

| By Thickness |

|

| By Material |

|

| By Application |

|

| By Region |

|

| Key Market Players | 3M Company, GUNZE LIMITED, TDK Corporation, Panasonic Corporation, DuPont de Nemours, Inc. (DuPont), Nitto Denko Corporation, Eastman Kodak Company, TOYOBO Co., Ltd., Teijin Limited, Saint-Gobain S.A. |

Analyst Review

Electronic film is a specialized type of film used in electronic devices to safeguard applications from chemicals, moisture, and other harms. It is further divided into thick and thin films used across consumer electronics, printed circuit boards, and other electronic application manufacturing sectors. In addition, the growing demand for smart infrastructure across prime economies drives the market growth.

Electronic film is popular for use in electric & electronics application sectors, owing to surge in demand for exception flatness, good insulation properties, and thermal stabilities. Moreover, electronic film application, such as thin film, is a highly advanced technology used across various electronic applications such as integrated circuits, solar cells, lithography, telecommunication, and wireless communication. Further, the surge in demand for consumer electronics coupled with 5G network technology is a significant opportunity for the market growth.

Globally, various key players are investing and developing new technology in electronic film applications to make them more compatible with multiple applications. For instance, TOYOBO signed an agreement with Teijin Film to develop and improve its product portfolio. Besides, Panasonic Co., the leading developer of electronic film technology, launched anti-glare type anti-reflection films for automotive display. These initiatives are expected to offer immense growth opportunities to the global electronic films market.

The key players profiled in the report include 3M, DuPont, Eastman Kodak Company, Gunze Ltd., Nitto Denko Co., Panasonic Co., Saint-Gobain S.A., TDK Co., Teijin Ltd., and TOYOBO Co. Ltd.

The Electronic Films Market is estimated to grow at a CAGR of 7.00% from 2021 to 2028.

The Electronic Films Market is projected to reach $12.62 billion by 2028.

The rise in demand for electronic film technology in the consumer electronics sector, owing to surge in demand for smart phones, tablets, and electronic display applications is anticipated to propel the electronic films market growth.

The key players profiled in the report include 3M, DuPont, Eastman Kodak Company, Gunze Ltd., Nitto Denko Co., Panasonic Co., Saint-Gobain S.A., TDK Co., Teijin Ltd., and TOYOBO Co. Ltd.

The Electronic Films Market is segmented on the basis of film type, thickness, material, and application, and region.

Loading Table Of Content...