E-Paper Display Market Statistics - 2030

The global e-paper display market size was valued at $1.6 billion in 2020, and is projected to reach $9.5 billion by 2030, growing at a CAGR of 17.3% from 2021 to 2030.

Electronic paper display (EPD) is a significant development in display technology owing to its advanced features, such as readability in direct light (indoor as well as outdoor ambience), low power consumption, flexibility, durability, lightweight, and convenient composition. It is also known as a bistable display, which refers to the retention of content on the screen even when the power is turned off.

Electronic paper display presents itself as a practical fusion of physics, chemistry, and electronics. The ink utilized in this display technology is termed e-ink, with a chemical composition similar to the pigment used in the conventional printing industry. Instead of being deposited on paper, this ink takes the form of tiny capsules (about the diameter of a human hair sandwiched between two electrodes) to produce a monochrome result or sometimes a result with limited colors. Two-pigment ink system is used for monochromatic EPDs, whereas for applications using multiple colors, like electronic shelf labels, a three-pigment ink system is used.

The e-paper display market growth across various applications is attributed to factors such as ongoing technological advancements in e-paper screens, positive environmental impact owing to very little energy consumption as compared to other display technologies, and an increase in application areas of large e-paper displays. The advantages offered by these papers displays in terms of readability, user experience, energy consumption, and manufacturing cost, are some of the factors that drive the global electronic paper display market. However, lack of awareness, low refresh rate, and absence of a wide color palette, along with video output limitations, restrict the overall e-paper display industry growth.

Segment Overview

The e-paper display market is segmented on the basis of product, application, and geography.

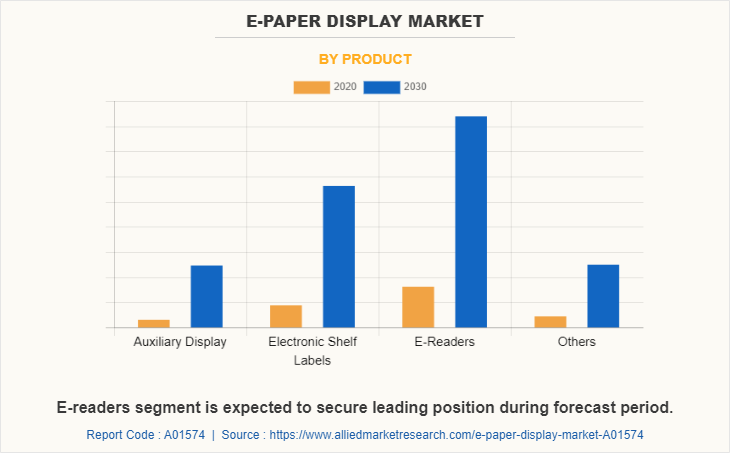

The products segment is classified into auxiliary displays, e-readers, electronic shelf labels, and others.

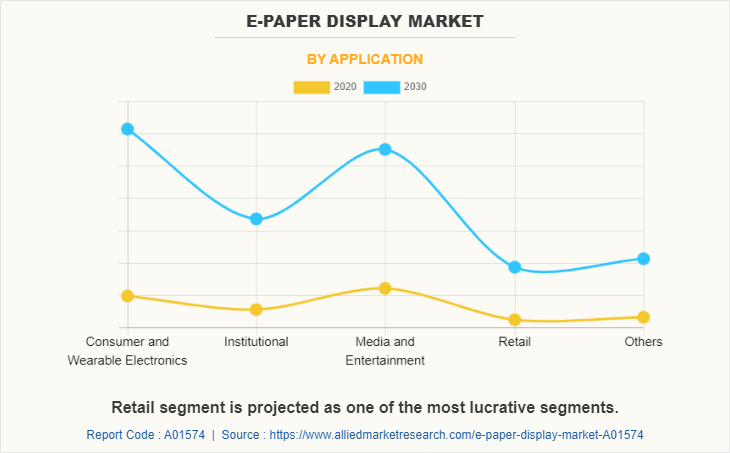

The application segment includes consumer & wearable electronics, institutional, media & entertainment, retail, and others.

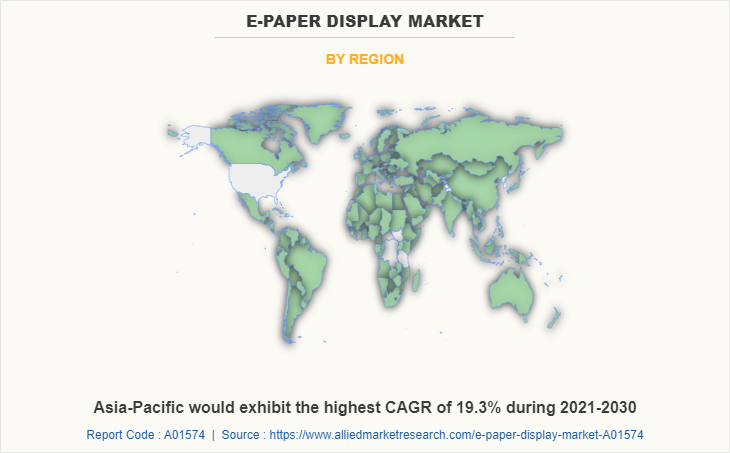

Geographically, the e-paper display market trends are analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Top Impacting Factors

The significant impacting factors in the e-paper display industry include technological innovation and ongoing advancement, growing application areas, and environmental impact, which impact the growth of the market. However, limitations related to color palette and video output, and the low refresh rate of e-paper displays are expected to hinder the growth of the e-paper display market. Conversely, an increase in participation of key players and growth in the retail automation industry are projected to offer remunerative e-paper display market opportunities. Each of these factors is anticipated to have a definite impact on the market during the forecast period.

Competitive Analysis

The key players profiled in the report include Liquavista B.V. (Amazon), Cambrios Technologies Corporation, CLEARink Displays, Inc., E Ink Corporation, Guangzhou OED Technology Inc., GDS Holding S.r.l., Plastic Logic, LG Electronics Inc., Pervasive Displays Inc., Samsung Electronics Co. Ltd., Ynvisible Interactive Inc. These key players have adopted strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations to enhance their position in the e-paper display market.

Key Benefits for Stakeholders

- This study comprises an analytical depiction of the global e-paper display market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall e-paper display market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The e-paper display market forecast is quantitatively analyzed from 2021 to 2030 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

- The report includes the e-paper display market share of key vendors and market trends.

E-Paper Display Market Report Highlights

| Aspects | Details |

| By Product |

|

| By Application |

|

| By Region |

|

| Key Market Players | E Ink Corporation, LG Electronics Inc., Samsung Electronics Co. Ltd., CLEARink Displays, Inc., Plastic Logic, GDS Holding S.r.l., Liquavista B.V. (Amazon), Pervasive Displays Inc., Guangzhou OED Technology Inc., Cambrios Technologies Corporation |

| Other Players In The Value Chain Include | Displaydata, Dke Co. Ltd, Epson Electronics America, Inc., Global Display Solutions, Motion Display, Mpicosys, Omni-Id, Solomon Systech Limited, Ubiik, Visionect |

Analyst Review

With the advent of digital publishing, paperless electronic display came into existence in 1990s. Over the years, research on electronic paper display (EPD) has gained significant momentum to bridge the gap between printing page and digital content. This technology is now integrated into various products, such as e-readers, shelf labels, smartphones & tablets, advertising displays, and information signage, as well as architecture and design.

The major market players in the e-paper display industry focus on R&D of products, with prime focus on technological advancements and addition of more colors in the existing monochromatic solution to tap the new application arenas. For instance, E Ink Holdings, a major player, launched a product line called, E Ink Prism that is more like an architectural skin and is used for creating impressive ambience for architectural applications.

Among the analyzed geographical regions, North America is expected to account for the highest revenue during the forecast period, followed by Europe and Asia-Pacific. However, LAMEA is expected to grow at a higher growth rate, predicting a lucrative growth for the e-paper display market.

Liquavista B.V. (Amazon), Cambrios Technologies Corporation, CLEARink Displays, Inc., E Ink Corporation, Guangzhou OED Technology Inc., GDS Holding S.r.l., Plastic Logic, LG Electronics Inc., Pervasive Displays Inc., and Samsung Electronics Co. Ltd. are the key market players that occupy a significant revenue share in the e-paper display market.

Media and Entertainment is the largest application of e-paper display market

North America is largest regional market for e-paper display market.

The global E-paper (electronic paper) display market size was valued at $1.6 billion in 2020.

The major companies operating in e-paper display market include Liquavista B.V. (Amazon), Cambrios Technologies Corporation, CLEARink Displays, Inc., E Ink Corporation, Guangzhou OED Technology Inc., GDS Holding S.r.l., Plastic Logic, LG Electronics Inc., Pervasive Displays Inc., and Samsung Electronics Co. Ltd.

The global e-paper display market is expected to grow at a CAGR of 17.3% from 2021 to 2030.

The electronic paper display market growth across various applications is attributed to factors, such as ongoing technological advancements, positive environmental impact owing to very less energy consumption as compared to other display technologies, and increase in application areas.

The e-paper display market is segmented on the basis of product, application, and geography.

The key players have adopted strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations to enhance their position in the e-paper display market.

By product, auxiliary display segment would grow at a highest CAGR during the forecast period.

Loading Table Of Content...