Electronically Scanned Arrays Market Research, 2033

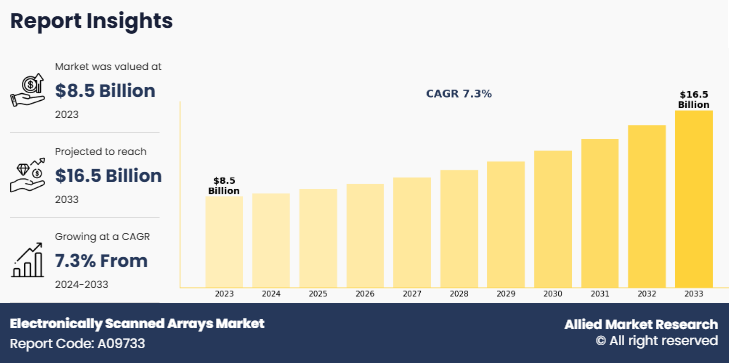

The global electronically scanned arrays market size was valued at $8.5 billion in 2023, and is projected to reach $16.5 billion by 2033, growing at a CAGR of 7.3% from 2024 to 2033.

Market Definition

An electronically scanned array is a sort of phased array antenna that uses computer control to electronically steer the radio wave beam to point in various directions

without moving the antenna. Each antenna element in the AESA is linked to a micro-sized transmit/receive module (TRM) that is controlled by a computer and serves as the antenna's transmitter and/or receiver.

One of the important factors such as rising investment to strengthen the capabilities of air defense fosters market growth. Further, technological advancements, such as GaN semiconductor technology, offer improved performance and cost efficiency, while government initiatives to modernize radars majorly drive the growth of the electronically scanned array market. However, high development and deployment costs, and stringent regulations to arm transfer are restraining the market growth. In November 2021, Saab AB launched Giraffe 4A active electronically scanned array radar. Giraffe 4A provides all-weather coverage against air targets from low, slow and small targets to fast moving fighters and supersonic missiles. Furthermore, it provides fast, highly accurate monitoring with a target revisit time of one second combined with 360° monitoring of the air volume.

Key Developments/Strategies in Electronically Scanned Array

- In April 2024, Israel Aerospace Industries signed a contract with Czech Republic for Sustainability and maintenance for the Czech Multi-Mission Radar (MMR) radars. The contract is valid for 20 years and includes Czech companies that will be responsible for a wide range of processes as local subcontractors. Each MMR radar uses an advanced 4-D Active Electronically Scanning Array (AESA) for electronic steering in azimuth and elevation, relying on high-performance Gallium Nitride (GaN) RF modules.

- In June 2023, Israel Aerospace Industries launched ELM-2060PES, a new generation AESA SAR/GMTI Pod for Fighter Aircraft. It is designed by its defense systems subsidiary, ELTA Systems Ltd. The ELM2060PES Pod is a self-contained Active Electronically Scanned Array (AESA) airborne radar system, offering advanced Synthetic Aperture Radar (SAR) and Ground Moving Target Indication (GMTI) capabilities. It features a bi-directional Line-of-Sight (LOS) wide-band datalink, connected to a Ground Datalink and Exploitation Station (GES).

- In July 2023, Thales delivered its SMART-L Multi-Mission Fixed (MM/F) long-range radar for integrated air and missile defense to Sweden. SMART-L is the next-generation Active Electronically Scanned Array (AESA) radar that provides very long-range air and surface surveillance and improved target designation. Additionally, the SMART-L features digital architecture and an AESA antenna that can be upgraded for future missions.

Market Dynamics

Increase in Purchase of Combat Aircraft to Surge the Demand for Electronically Scanned Array

There has been a rise in demand for new type of combat aircraft from countries like the U.S., Russia, India, and China owing to its capability to offer high tactical radars during warfare. The issues linked with coastal and border security have further enabled the demand for unmanned aerial vehicles equipped with radars.

In addition, the increasing demand for fleet modernization in military aircraft has led to growth in the new aircraft orders, which is also expected to push the sales. Similarly, the surge in spending in the military for purchasing fighter jets incorporated with advanced radar technology to reinforce the defense capabilities is expected to fuel the sales of electronically scanned array radar market during the forecast period. Moreover, the rise in the number of general aviation aircraft models across the globe is another major factor forcing the implementation of electronically scanned array in radar for the general aviation industry globally

High Development and Deployment Costs

The high development and deployment costs associated with the electronically scanned radar array market is hindering market growth. Owing to the complexity and sophistication of the technology involved in ESA, such as AESA radars, it requires investment in research, development, and manufacturing. This will include thousands of individual transmit/receive modules to integrate in ESA. These systems need to be tailored to specific platforms such as aircraft, naval vessels, or ground-based systems, further increasing costs. In addition, components such as transmit/receive modules, advanced software, and complex integration processes increase the financial liability on companies and governments. Hence, such factors are restraining market growth. consumer services segment in the North America region.

The rise in demand for the latest 4D dimension radar will create lucrative opportunities

The 4D electronically scanned array provides advanced capabilities such as multi-functional surveillance, target acquisition, tactical imaging, and weapon assignment. This radar can detect, track, and classify various air targets, including helicopters, low-flying aircraft, and missiles by utilizing multiple digitally generated beams on a solid-state gallium nitride active electronically scanned array sensor. Developed by Hensoldt AG in Germany, the TRML-4D radar can track over 1,500 targets simultaneously, offering 360-degree azimuth coverage and a range exceeding 250 kilometres. In 2021, Norway acquired five Thales Ground Master 200 Multi-Mission Compact (GM200 MM/C) radars through a government-to-government agreement with the Netherlands. This USD 94 million contract, with deliveries planned for 2023–2024, equips the Norwegian Armed Forces with a new mobile artillery position radar suitable for both domestic and international operations. The deal, managed by the Norwegian Defense Materiel Agency (FMA) and the Netherlands Defense Materiel Organization (DMO), also includes an option for three additional GM200 MM/C systems. The S-band GM200 MM/C is a palletized 4D dual-axis multi-beam AESA radar system, designed for tactical mobility, rapid deployment, and combat air observation to support very short-range and short-range air defense systems.

The electronically scanned arrays market is segmented into Component, Range, Type, Dimension and Platform.

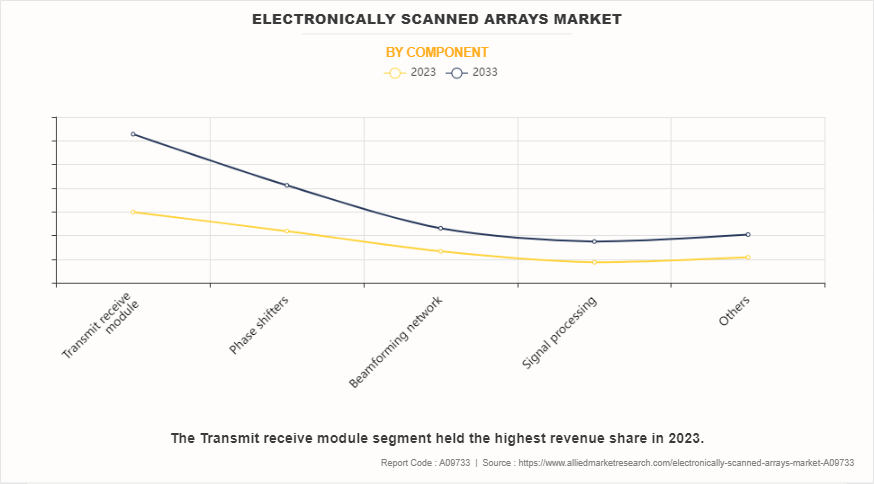

On the basis of component, the market is divided into transmit receive module, phase shifters, beamforming network, signal processing and others. Transmit receive module generated the largest electronically scanned arrays market share in 2023. The growing integration of electronically scanned arrays with traditional radar system components is fueling the expansion of the global electronically scanned arrays market. The rising demand for active electronically scanned arrays is primarily driven by geopolitical tensions in the Asia-Pacific and LAMEA. In addition, the adoption of advanced defense and surveillance technologies has played a key role in significantly boosting electronically scanned arrays market growth.

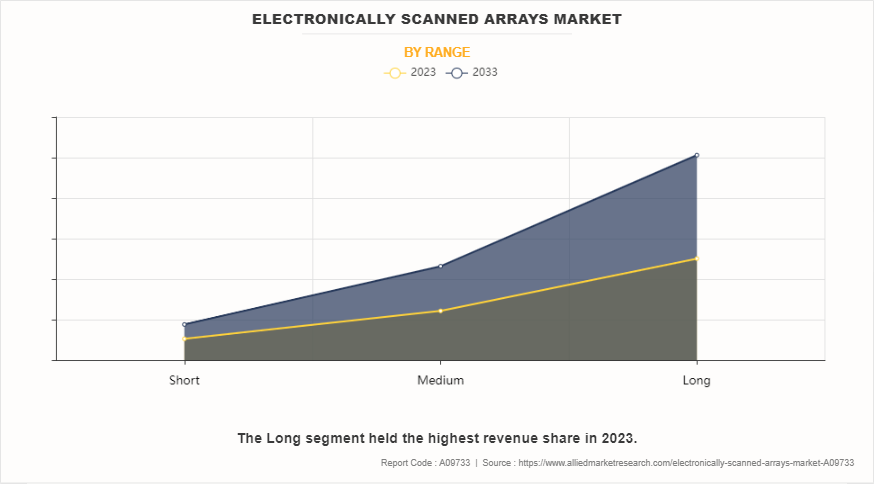

On the basis of range, the market is classified into short, medium and long. Long range accounted for largest share in 2023 and same is expected to follow the trend during the forecast period of 2023-2033.For instance, in 2021 the General Aviation Manufacturers Association (GAMA) released a report that witnessed a growth of 10% in jet deliveries whose shipments reported for 710 units compared to 644 in 2020. Globally, military spending increased to almost $2 trillion in 2021 despite COVID-19 pandemic. The major countries that contribute to rise in military expenditure comprise U.S., China, Japan, South Korea, Russia, and India. Numerous countries have also increased their budget for military to purchase several combat aircraft.

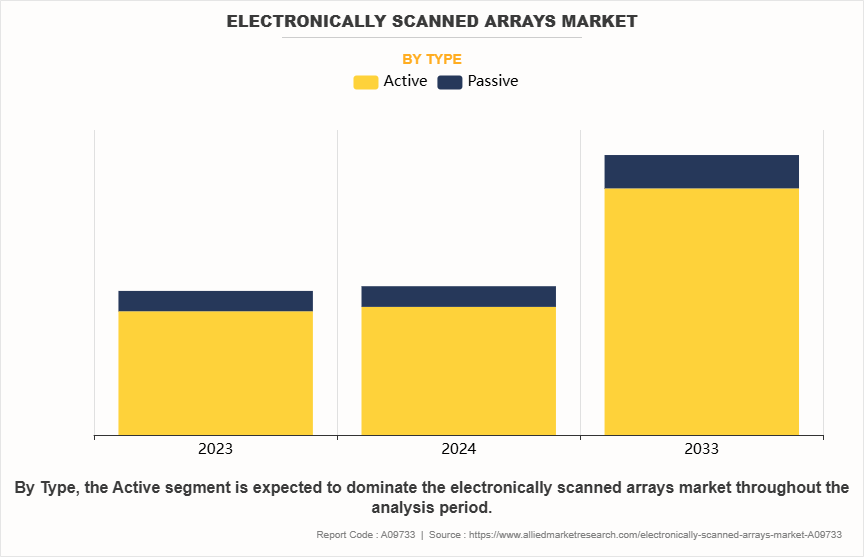

On the basis of type, the market is bifurcated into active and passive. The active segment generated the largest revenue in 2023.Active systems, which transmit their own signals and analyze the reflections, offer advantages in detecting and tracking objects in complex environments, making them ideal for defense, security, and surveillance applications. The rising investments in advanced radar and sensor technologies, along with the increasing focus on real-time data acquisition, have further fueled the electronically scanned arrays market demand for active systems.

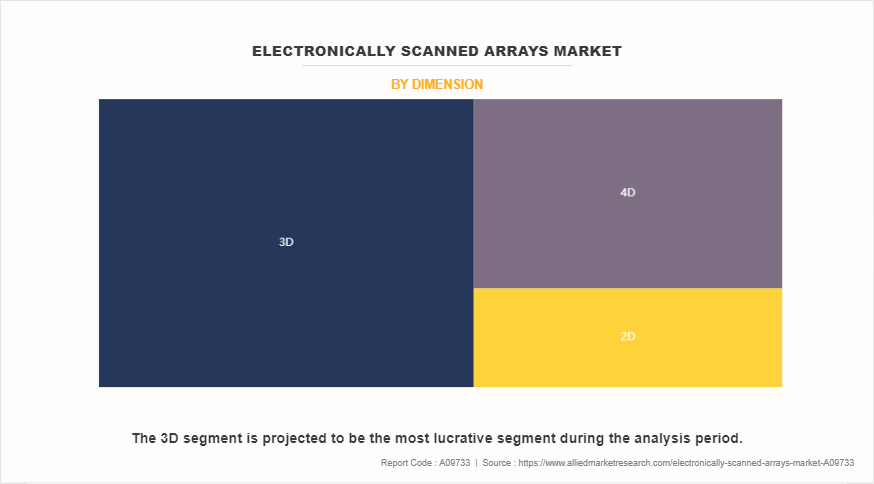

On the basis of dimension, the market is divided into 2D,3D and 4D. The 4D dimension segment dominated the market in 2023.due to its advanced capabilities in providing real-time, high-resolution imaging with enhanced depth perception and object velocity tracking. Unlike 2D and 3D systems, 4D technology offers an additional layer of data, capturing dynamic changes over time, which is highly valuable in applications like autonomous driving, defense, and aerospace.

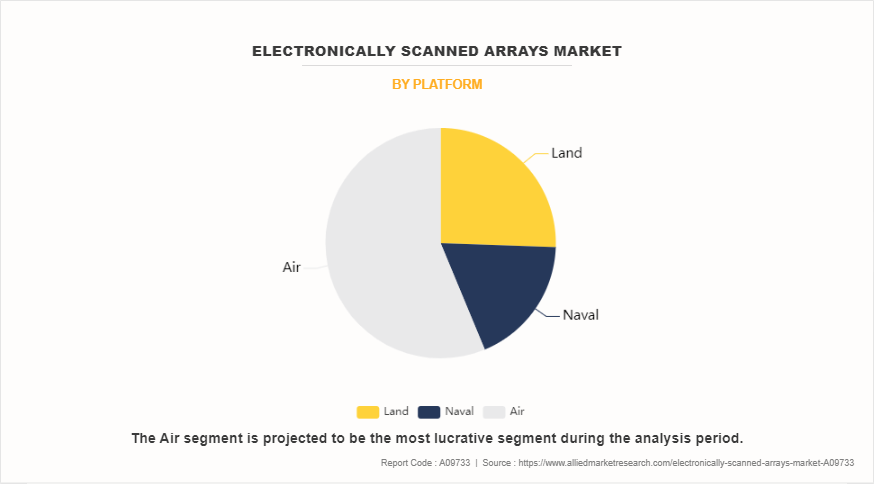

On the basis of platform, the market is divided into land, air, and navy. The air segment generated the largest revenue in 2023.With advancements in radar and sensor technology, air platforms have become integral for applications such as threat detection, border security, and air traffic management. The growing emphasis on enhancing national security and the adoption of unmanned aerial systems (UAS) further supported the revenue dominance of the air segment, positioning it as a critical area for future technological innovations.

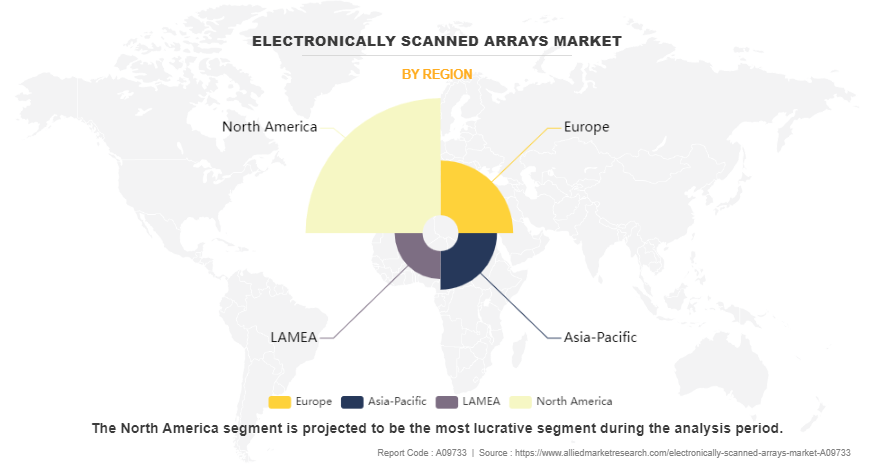

Region wise, the electronically scanned arrays industry is analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, Russia, Italy, and rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). North America anticipated for the largest share in 2023.

Competitive Analysis

Competitive analysis and profiles of the major global electronically scanned array market players that have been provided in the report include Lockhead Martin Corporation, Israel Aerospace Industries, Thales Group, BEL, Northrop Grumman, Saab AB, Raytheon Technologies, Mitsubishi Electric, Aselsan SA, Hensoldt, Telephonics Corporation, Leonardo S.P.A. and Blighter Surveillance Systems Limited. The key strategies adopted by the major players of the global electronically scanned array market are product launch and mergers & acquisitions.

Top Impacting Factors

The global electronically scanned array market is expected to witness notable growth registering a CAGR of 7.28%, The electronically scanned arrays market is expected to witness notable growth owing to surge in contracts and investments to strengthen the capabilities of air defense and increase in purchase of combat aircraft to surge the demand for electronically scanned array. Moreover, the rise in demand for the latest 4d dimension radar and growing demand for R&D activities in electronically scanned array radar will create lucrative opportunities and is expected to provide lucrative opportunity for the growth of the market during the forecast period. On the contrary, stringent regulations related to arm transfer and high development and deployment costs limits the growth of the electronically scanned arrays market.

Historical Data & Information

The global electronically scanned array market is competitive, owing to the strong presence of existing vendors. Vendors in the global electronically scanned arrays market forecast with extensive technical and financial resources are expected to gain a competitive advantage over their competitors as they can cater to market demands, which are higher than the supply. The competitive environment in this market is expected to increase owing to technological innovations, product extensions, and different strategies adopted by key vendors.

Report Key Highlighters

- The electronically scanned array market studies more than 16 countries. The analysis includes a country-by-country breakdown analysis in terms of value available from 2022 to 2032.

- The research combined high-quality data, professional opinion and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

- The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the market.

- The electronically scanned array market share is marginally fragmented, with players such as Lockhead Martin Corporation, Israel Aerospace Industries, Thales Group, BEL, Northrop Grumman, Saab AB, Raytheon Technologies, Mitsubishi Electric, Aselsan SA, Hensoldt, Telephonics Corporation, Leonardo S.P.A. and Blighter Surveillance Systems Limited. Major strategies such as contracts, partnerships, expansion, and other strategies of players operating in the market are tracked and monitored.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the electronically scanned arrays market analysis from 2023 to 2033 to identify the prevailing electronically scanned arrays market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the electronically scanned arrays market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global electronically scanned arrays market trends, key players, market segments, application areas, and market growth strategies.

Electronically Scanned Arrays Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 16.5 billion |

| Growth Rate | CAGR of 7.3% |

| Forecast period | 2023 - 2033 |

| Report Pages | 441 |

| By Component |

|

| By Range |

|

| By Type |

|

| By Dimension |

|

| By Platform |

|

| By Region |

|

| Key Market Players | Leonardo S.p.A., Bharat Electronics Limited (BEL), Lockhead Martin Corporation, Thales, Mitsubishi Electric Corporation, Blighter Surveillance Systems Limited, Saab AB, Northrop Grumman, HENSOLDT, RTX, ASELSAN, Telephonics Corporation, Israel Aerospace Industries |

The active is the leading type of Electronically Scanned Arrays Market.

The upcoming trends of electronically scanned arrays market include surge in contracts and investments to strengthen the capabilities of air defense and increase in purchase of combat aircraft to surge the demand for electronically scanned array.

North America is the largest regional market for electronically scanned arrays.

The electronically scanned arrays market was valued at $8.5 Billion in 2023.

The long range is the leading range of Electronically Scanned Arrays Market.

Loading Table Of Content...

Loading Research Methodology...