Electrosurgery Devices Market Overview :

The global electrosurgery devices market size was valued at $2,591 million in 2017 and is projected to reach $3,784 million at a CAGR of 4.8% from 2018 to 2025. Electrosurgery devices are used in surgical procedures such as cardiovascular surgery, gynecology surgery, general surgery, and others. These devices apply electric current for the thermal destruction of the targeted tissues. Electrosurgery devices are employed in surgical procedures to cut, coagulate, desiccate, and fulgurate the tissues. These devices are used in conjunction with specialized instruments.

Market Dynamics

The growth of the electrosurgery devices market is driven by rise in number of surgical procedures globally, large pool of geriatric population, increase in prevalence of chronic diseases, and technological advancements. However, stringent government regulations for product approval are expected to hamper the market growth. Conversely, high market potential in untapped emerging economies is expected to provide lucrative growth opportunities for the market.

Market Segmentation

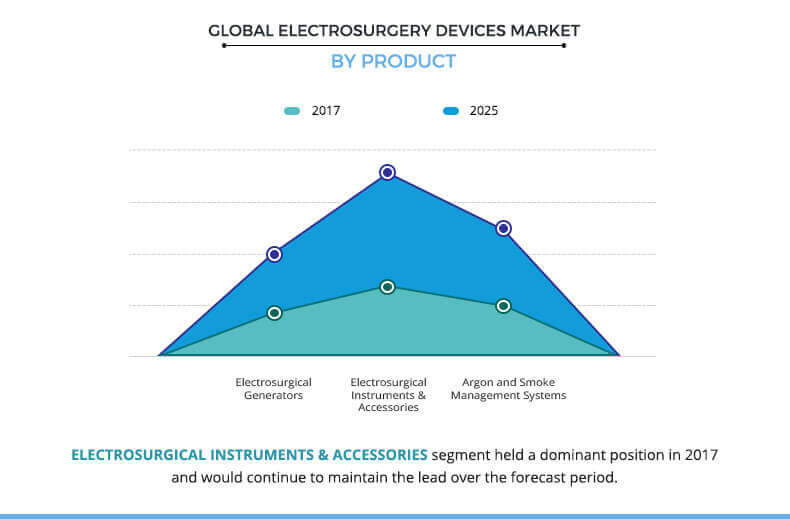

The global electrosurgery devices market is segmented based on product, application, and geography. Based on product, the market is categorized into electrosurgery generators, electrosurgery instruments & accessories, and argon & smoke management systems. The electrosurgery instruments & accessories segment is further bifurcated into electrosurgery equipment (bipolar electrosurgery instruments and monopolar electrosurgery instruments) and electrosurgery accessories (patient return electrodes, cords, cables, and adapters, and others). Electrosurgical instruments & accessories accounted for the largest market share in 2017 and is anticipated to grow at a significant CAGR of 5.6% during the forecast period.

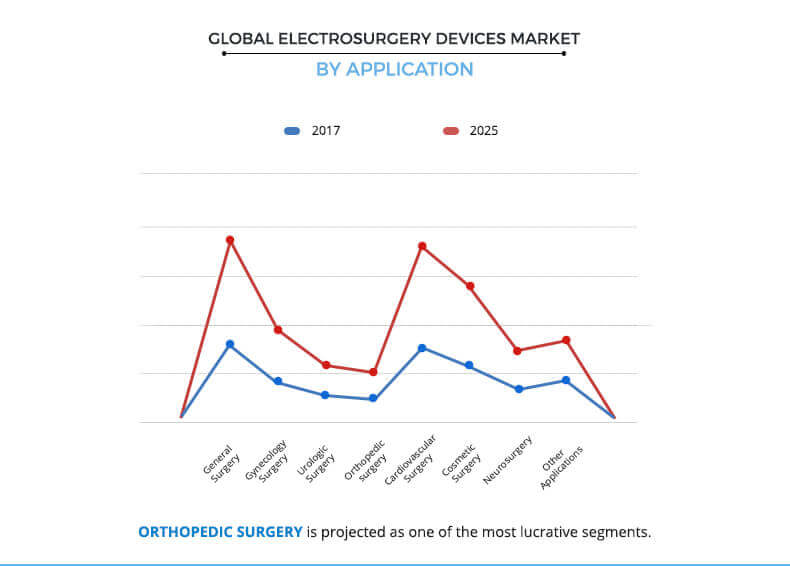

Based on application, the study includes general surgery, gynecology surgery, urologic surgery, orthopedic surgery, cardiovascular surgery, cosmetic surgery, neurosurgery, and others. General Surgery segment accounted for the largest market share in 2017. On the other hand, orthopedic surgery is anticipated to grow at a significant CAGR of 5.9% during the forecast period.

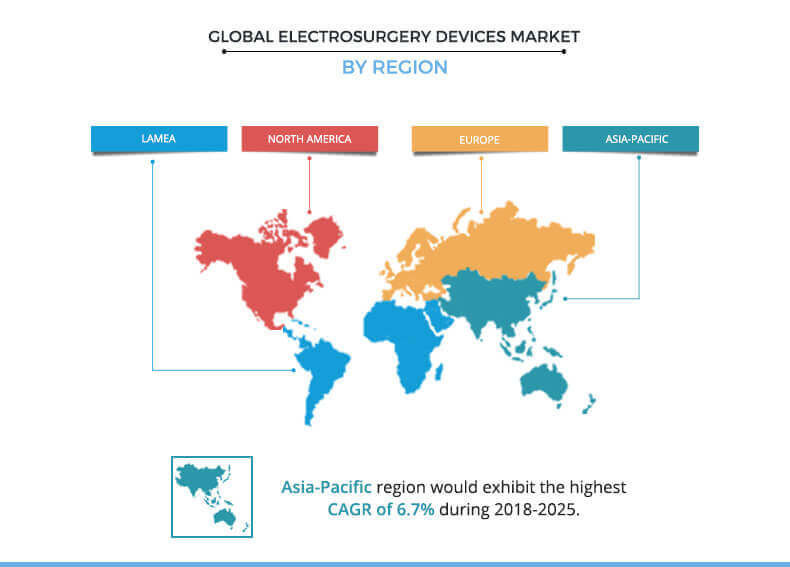

Based on region, the global market is studied across North America (U.S., Canada, and Mexico), Europe (Germany, France, the UK, and rest of Europe), Asia-Pacific (Japan, China, India, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa). North America accounted for the highest market share in 2017, followed by Europe. On the other hand, Asia-Pacific is anticipated to dominate the market during the analysis period, owing to high geriatric population base, increase in disposable incomes, and rise in awareness about various cancers in patients. Moreover, Asia is a large continent, and has emerged as an epicenter of chronic disorders.

The key players of this market include B. Braun Melsungen AG, Boston Scientific Corporation, Bovie Medical Corporation, BOWA-electronic GmbH & Co. KG, CONMED Corporation, Erbe Elektromedizin GmbH, Johnson & Johnson (Ethicon US, LLC.), Medtronic Plc., Olympus Corporation, and Smith & Nephew Plc.

Other players (these players are not profiled in the report and the same can be included on request) in the value chain include Megadyne Medical Products Inc., KLS Martin Group, and Utah Medical Products, Inc.

Key Benefits for Electrosurgery Devices Market :

The study provides an in-depth analysis of the global electrosurgery devices market with current trends and future estimations from 2017 to 2025 to elucidate the imminent investment pockets.

A comprehensive analysis of the factors that drive and restrict the market growth is provided.

Factors that are instrumental in changing the market scenario, rise in opportunities, and identification of key companies that can influence this market on a global & regional scale are provided.

Key players are profiled, and their strategies are analyzed thoroughly to understand the competitive outlook of the market.

Key Market Segments

By Product

Electrosurgery Generators

Electrosurgery Instruments & Accessories

Electrosurgery Instruments

Bipolar Instruments

Advanced Vessel Sealing Instruments

Bipolar Forceps

Monopolar Instruments

Electrosurgery Pencils

Electrosurgery Electrodes

Suction Coagulators

Monopolar Forceps

Electrosurgery Accessories

Patient Return Electrodes or Dispersive Electrodes

Cords, Cables, and Adapters

Others

Argon and Smoke Management Systems

By Application

General Surgery

Gynecology Surgery

Urologic Surgery

Orthopedic Surgery

Cardiovascular Surgery

Cosmetic Surgery

Neurosurgery

Other Applications

By Region

North America

U.S.

Canada

Mexico

Europe

Germany

France

UK

Rest of Europe

Asia-Pacific

Japan

China

India

Rest of Asia-Pacific

LAMEA

Latin America

Middle East

Africa

Electrosurgery Devices Market Report Highlights

| Aspects | Details |

| By TYPE |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | BOWA-electronic GmbH & Co. KG, Bovie Medical Corporation, B. Braun Melsungen AG, Olympus Corporation, Boston Scientific Corporation, Erbe Elektromedizin GmbH, Johnson & Johnson (Ethicon US, LLC.), Smith & Nephew Plc., CONMED Corporation, Medtronic Plc. |

Analyst Review

Electrosurgery devices are used to cut, desiccate, fulgurate, and coagulate biological tissue during a surgical procedure using high-frequency electric current/energy. This energy can be used by monopolar or bipolar devices to cut the tissues

Surge in number of surgical procedures across the globe is the major factor driving the growth of the global market. Relevant factors, such as large pool of geriatric population and the consequent rise in chronic diseases along with the technological advancements also contribute toward the growth of this market. However, factors such as stringent rules & regulations for product approval hamper the growth of this market. Conversely, rise in various growth opportunities in the emerging economies is expected to open new avenues during the forecast period.

The use of electrosurgery devices is the highest in North America, owing to rise in number of surgical procedures in the region, followed by Europe and Asia-Pacific. In addition, rise in geriatric population is anticipated to drive the market growth.

Loading Table Of Content...