Embedded Finance Market Overview

The global embedded finance market was valued at $82.7 billion in 2023, and is projected to reach $570.9 billion by 2033, growing at a CAGR of 21.3% from 2024 to 2033. Growing digital adoption, increasing demand for seamless financial services, growth of e-commerce, API integration advancements, fintech partnerships, personalized customer experiences, and increased non-financial company participation are contributing to the growth of the market.

Market Dynamics & Insights

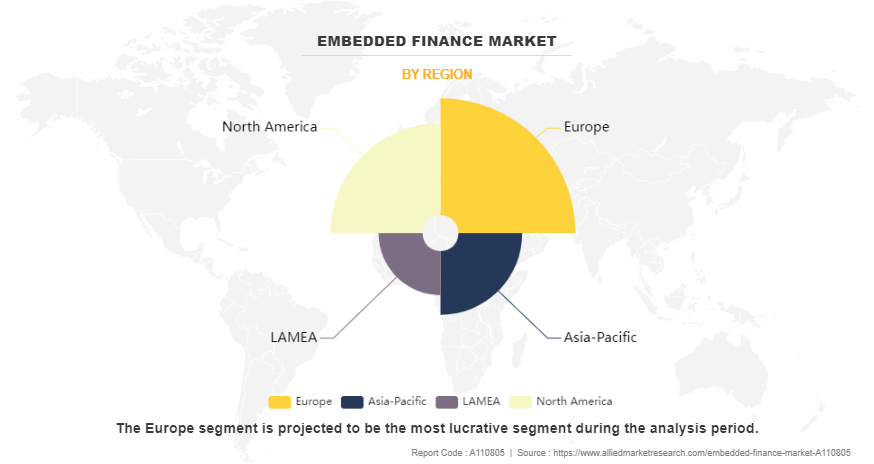

- The embedded finance industry in Europe held a significant share of 37% in 2023.

- The embedded finance industry in India is expected to grow significantly at a CAGR of 30.0% from 2024 to 2033.

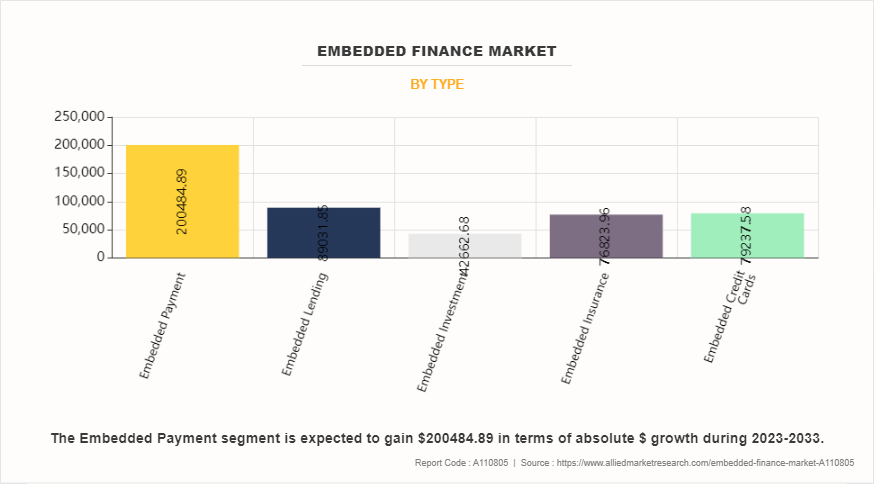

- By type, the embedded payment segment is one of the dominating segment in the market, accounting for the revenue share of 49% in 2023.

- By industry vertical, the retail & e-commerce segment dominated the industry in 2023 and accounted for the largest revenue share of 39%.

Market Size & Future Outlook

- 2023 Market Size: $82.7 Billion

- 2033 Projected Market Size: $570.9 Billion

- CAGR (2024-2034): 21.3%

- Europe: Dominated the market in 2023

- Asia Pacific: Fastest growing market

What is Meant by Embedded Finance

Embedded finance refers to the integration of financial products and services into non-financial companies’ platforms through the use of APIs. This approach enables businesses to seamlessly offer financial solutions provided by third parties, thus enhancing their service offerings. As a result, the embedded finance market creates numerous opportunities for both traditional financial institutions and innovative fintech startups to collaborate and expand their customer base in creative and effective ways in embedded finance industry.

Key Takeaways

By Type, the embedded payment segment dominated the embedded finance in 2023.

By Industry vertical, the retail & e-commerce segment dominated the embedded finance in 2023.

The rising trend of digital transformation in several sectors including finance is the key factor driving growth of embedded finance market, as it is revolutionizing the way financial services are delivered and consumed. Furthermore, as consumers increasingly prioritize seamless and hassle-free experiences, they seek out financial services integrated within their everyday activities and interactions.

Hence, customer demand for convenience acts as a catalyst, prompting businesses across various industries to embed financial services within their existing platforms and meet the evolving needs of their users. In addition, the expansion of embedded finance awareness on a global scale, driven by financial inclusion initiatives, has the potential to transform the way people manage their finances and drive economic growth in previously untapped markets. However, regulatory challenges act as a significant restraint for the embedded finance market, as the regulatory laws involve the integration of financial services into non-financial platforms or products and blur the traditional boundaries between different sectors and raises complex regulatory issues.

Moreover, different countries have varying regulatory environments, making it difficult for businesses operating across borders to navigate the complex compliance requirements. As a result, many companies face barriers to scaling their embedded finance worldwide offerings globally, limiting the market's expansion potential. On the contrary, by integrating financial services directly into platforms, companies can automate financial processes, reducing manual intervention and associated costs. This streamlines operations, improves efficiency, and enables real-time transactions, benefiting both businesses and consumers. Hence, automation and efficiency will provide lucrative opportunities for the growth of the embedded finance market.

Embedded Finance Market Segment Review

The embedded finance market is segmented on the basis of type, industry vertical and region. By type, it is segmented into embedded payment, embedded lending, embedded investment, and embedded insurance. By industry vertical, it is segmented into retail and e-commerce, transportation and logistics, healthcare, media and entertainment, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Based on type, the embedded payment segment attained the highest growth in 2023 of embedded finance market size. This is attributed to the fact that embedded payments not only provide access to alternative funding sources but also simplify the buying process for customers, resulting in higher levels of satisfaction and loyalty. In addition, partnerships between non-financial platforms and payment providers or fintech companies enable access to secure, reliable, and scalable payment solutions, accelerating the adoption of embedded payments.

However, the embedded lending segment is considered to be the fastest growing segment during the forecast period. This is because by presenting lending options at relevant touch points within non-lending platforms, users are exposed to lending products and encouraged to consider their lending needs. This increased awareness contributes to the growth of the embedded lending segment.

Region wise, Europe attained the highest embedded finance market share in 2023. This is because regulatory bodies in North America are actively considering policies and regulations to foster innovation and competition in the embedded finance platform space. Thus, they are aiming to strike a balance between consumer protection and enabling partnerships between financial and non-financial entities. Hence, such continuous innovation from fintech firms fuels the growth of embedded finance options in the North America region.

However, the Asia-Pacific region is considered to be the fastest growing region during the forecast period. This is attributed to the fact that Asia-Pacific region witnessing significant digital transformation across various sectors, including finance. Also, the increasing adoption of smartphones, internet connectivity, and digital payment platforms has created a favorable environment for embedded finance digitalization solutions. Hence, as more businesses integrate financial services into their existing platforms, the demand for embedded finance offerings has surged.

The report focuses on growth prospects, restraints, and trends of the embedded finance market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the embedded finance market.

The report analyzes the profiles of key players operating in embedded finance market such as Block, Inc., Cybrid Technology Inc, Fortis Payment Systems, LLC (“Fortis”), Finastra International Limited, FinBox, Lendflow, PAYRIX, PayPal Holdings, Inc, Stripe, and Zopa Bank Limited. These players have adopted various strategies to increase their embedded finance market penetration and strengthen their position in the embedded finance industry.

Market Landscape and Trends

Embedded finance refers to the integration of financial services into non-financial platforms and applications. This trend is reshaping how consumers access and utilize financial products, providing seamless experiences within the apps they already use. Embedded finance market is expanding rapidly due to the growing demand for convenient and integrated financial solutions across various industries, including e-commerce, travel, and health tech. The rise of application programming interfaces (APIs) is a significant driver of embedded finance. APIs allow non-financial companies to easily integrate financial services into their platforms, enabling features such as payments, loans, insurance, and investment products. This accessibility is encouraging businesses to adopt embedded finance solutions to enhance customer experiences.

What are the Top Impacting Factors in Embedded Finance Market

Increase in digital transformation

The rising trend of digital transformation in several sectors including finance is the key factor driving the growth of the embedded finance market, as it is revolutionizing the way financial services are delivered and consumed. Furthermore, businesses across industries strive to meet the evolving demands of customers in an increasingly digital world, they are embracing embedded finance as a means to enhance their products and services. For instance, in September 2024, Brex launched an embedded payments solution designed to make it easy for B2B software vendors to accelerate customer workflows with Brex virtual cards.

Moreover, by integrating financial capabilities into their existing platforms, companies can offer seamless and convenient financial experiences to their customers, eliminating the need for third-party intermediaries. Thus, this transformation enables businesses to create new revenue streams, deepen customer engagement, and gain a competitive edge in the embedded finance market. In addition, with the advent of advanced technologies such as cloud computing, artificial intelligence, and APIs, digital transformation provides the infrastructure and tools necessary to facilitate the integration of financial services into non-financial platforms.

This convergence of industries not only benefits businesses but also empowers consumers with greater access to financial products and services, driving financial inclusion and expanding the reach of traditional financial institutions. Hence, digital transformation acts as a catalyst for the growth and success of the embedded finance market, enabling businesses to leverage the power of technology and redefine the boundaries of financial services.

Customer demand for convenience

As consumers increasingly prioritize seamless and hassle-free experiences, they seek out financial services integrated within their everyday activities and interactions. For instance, consider the rise of embedded payment solutions in ride-hailing apps. Thus, by allowing users to pay for their rides directly within the app, eliminating the need for separate transactions or the hassle of cash payments, these platforms cater to the convenience-driven demands of customers. For instance, in September 2024, Magnati partnered with RAKBANK to introduce a merchant financing platform to deliver small and medium-sized enterprises (SMEs) access to credit facilities via the latter by utilizing real-time point-of-sale (POS) transaction data translated into decision metrics for augmented underwriting decisions. In addition, the two organizations' platforms plan to provide services such as business loans, invoice financing, equipment financing, POS financing, receivable financing, and insurance.

Furthermore, this integration not only enhances the user experience but also promotes loyalty and engagement, thereby fueling the embedded finance market's expansion. Thus, customer demand for convenience acts as a catalyst, prompting businesses across various industries to embed financial services within their existing platforms and meet the evolving needs of their users.

Regulatory challenges

Regulatory challenges indeed act as a significant restraint for the embedded finance market, as embedded finance involves the integration of financial services into non-financial platforms or products and blurs the traditional boundaries between different sectors and raises complex regulatory issues. Furthermore, now-a-days governments and regulatory bodies are often concerned about consumer protection, data privacy, anti-money laundering, and fair competition in this evolving landscape.

Moreover, the regulatory challenges arise due to the need to adapt existing regulations to encompass the unique features and risks associated with embedded finance. Consequently, it requires collaboration between financial institutions, technology companies, and regulators to develop new frameworks that adequately address these concerns without stifling innovation. However, this process can be time-consuming and challenging, impeding the rapid growth of the embedded finance market.

In addition, different countries have varying regulatory environments, making it difficult for businesses operating across borders to navigate the complex compliance requirements. As a result, many companies face barriers to scaling their embedded finance offerings globally, limiting the market's expansion potential.

Expanded customer base

With the integration of financial services into non-financial platforms, such as e-commerce websites, ride-sharing apps, and social media platforms, embedded finance has the potential to reach a much larger audience than traditional financial institutions alone. Thus, by leveraging the existing user base of these platforms, embedded finance providers tap into a diverse range of customers, including those who may not have previously had access to financial services or were underserved by traditional banking systems.

This expanded customer base allows embedded finance companies to capture new market segments, penetrate emerging markets, and provide tailored financial solutions to a wider range of individuals and businesses. In addition, the integration of finance into everyday platforms enhances convenience and accessibility, making financial services more seamlessly integrated into people's lives. Hence, this increased reach and accessibility ultimately contribute to the growth and expansion of the embedded finance market growth.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Embedded finance market forecast from 2023 to 2033 to identify the prevailing commercial property insurance market opportunities.

- The embedded finance market research is offered along with information related to key drivers, restraints, and embedded finance market opportunity.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the Embedded finance market segmentation assists to determine the prevailing market opportunities and embedded finance market outlook.

- Embedded finance market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as Embedded finance market trends, key players, market segments, application areas, and market growth strategies.

Embedded Finance Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 570.9 billion |

| Growth Rate | CAGR of 21.3% |

| Forecast period | 2023 - 2033 |

| Report Pages | 224 |

| By Type |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | FinBox, Stripe, PayPal Holdings, Inc, Zopa Bank Limited, Block, Inc., Lendflow, FPL Technologies Pvt. Ltd., Finastra International Limited, PAYRIX, Fortis Payment Systems, LLC (“Fortis”), Bajaj Finserv Limited., Cybrid Technology Inc |

Analyst Review

As per the insights of the top-level CXOs of leading companies in the embedded finance market, as technology continues to advance, it is expected to see financial services seamlessly integrated into non-financial platforms, such as e-commerce, ride-hailing, and healthcare. This integration allows consumers to access financial products and services conveniently, enhancing their overall experience. Furthermore, another important trend is the rise of open banking and API-driven ecosystems as open banking initiatives, and the development of robust Application Programming Interfaces (APIs) enable seamless connectivity and data sharing between financial institutions and third-party service providers.

This has helped to empower consumers to have greater control over their financial data and foster innovation in the development of new financial products and services. Moreover, as smartphone adoption and internet penetration continue to increase globally, underserved populations will also gain access to financial services for the first time through embedded finance.

This has the potential to drive financial inclusion and unlock new economic opportunities, fostering growth and development in these regions. Further, the future trends of the embedded finance market include widespread adoption across industries, open banking and API-driven ecosystems, personalized offerings, expansion into emerging markets, and a strong focus on security and privacy. These trends are projected to revolutionize the way financial services are accessed, delivered, and experienced, ultimately shaping a more inclusive and convenient financial landscape. Furthermore, market players are adopting strategies like business development for enhancing their services in the market and improving customer satisfaction. For instance, in August 2023, Parafin, Inc., an embedded finance startup in the U.S., announced that it raised $60 million through a series B funding round. The round was led by GIC, Singapore's sovereign wealth fund.

The company aimed to utilize funds for introducing new products designed for small businesses. Therefore, such strategies are expected to boost the growth of the embedded finance market in the upcoming years. Moreover, some of the key players profiled in the report are Block, Inc., Cybrid Technology Inc, Fortis Payment Systems, LLC (“Fortis”), Finastra International Limited, FinBox, Lendflow, PAYRIX, PayPal Holdings, Inc, Stripe, and Zopa Bank Limited. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Upcoming trends in the global embedded finance market include the rise of Banking-as-a-Service (BaaS), personalized financial services through AI, deeper integration with e-commerce platforms, and the expansion of digital wallets and buy-now-pay-later (BNPL) solutions.

The leading application of the embedded finance market is embedded payments, where financial transactions are seamlessly integrated into non-financial platforms such as e-commerce, ride-sharing, and digital wallets, providing a frictionless payment experience for users.

North America was the largest regional market for Embedded Finance in 2023.

The Embedded Finance Market was valued at $82,653.35 million in 2023 and is estimated to reach $570,894.30 million by 2033, exhibiting a CAGR of 21.3% from 2024 to 2033.

The report analyzes the profiles of key players operating in the embedded finance market such as Block, Inc., Cybrid Technology Inc, Fortis Payment Systems, LLC (“Fortis”), Finastra International Limited, FinBox, Lendflow, PAYRIX, PayPal Holdings, Inc, Stripe, and Zopa Bank Limited. These players have adopted various strategies to increase their market penetration and strengthen their position in the embedded finance industry.

Loading Table Of Content...

Loading Research Methodology...