Employment Screening Services Market Oerview

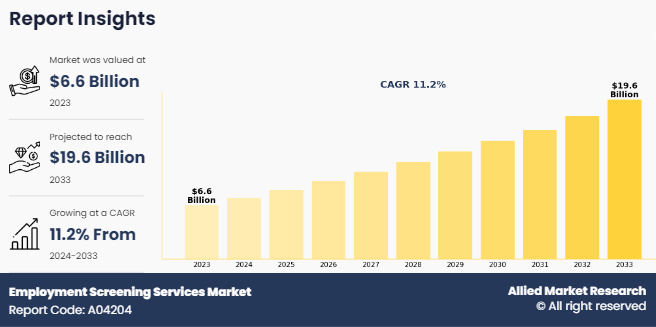

The global employment screening services market size was valued at $6.6 billion in 2023, and is projected to reach $19.6 billion by 2033, growing at a CAGR of 11.2% from 2024 to 2033. The rising focus on workplace safety and risk mitigation is driving demand for employment screening services, as organizations adopt background checks to ensure secure environments and foster trust among employees and customers, contributing to market growth.

Market Dynamics & Insights

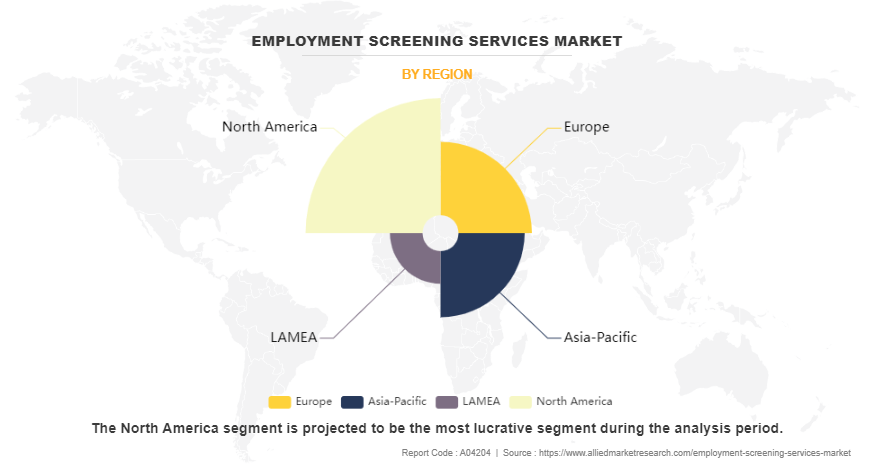

- The employment screening services industry in North America held a significant share of 40% in 2023.

- By service, the education & employment verification segment dominated the segment in the market, accounting for the revenue share of 32% in 2023.

- By application, the financial services segment dominated the industry in 2021 and accounted for the largest revenue share of 22%.

- By enterprise size, the large enterprise segment dominated the market, accounting for 69% in 2023.

Market Size & Future Outlook

- 2023 Market Size: $6.6 Billion

- 2033 Projected Market Size: $19.6 Billion

- CAGR (2024-2033): 11.2%

- North America: dominated the market in 2023

- Asia-Pacific: Fastest growing market

What is Meant by Employment Screening Services

The employment screening services market encompasses the industry that offers background verification and assessment services to help organizations evaluate potential employees. These services include employee verification, criminal record checks, education verification, credit checks, pre-employment screening and drug testing. The primary objective of employment screening is to ensure that candidates meet the necessary qualifications, uphold integrity, and comply with safety standards for specific roles.

Key Takeaways

- By service, the education & employment verification segment held the largest share in the Employment Screening services market share in 2023.

- By application, the financial services segment held the largest share in the employment screening service market for 2023.

- By enterprise size, the large enterprise segment held the largest share in the employment screening service market for 2023.

- Region-wise, North America held the largest market share in 2023. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

The increased focus on workplace safety drives the employment screening services sector owing to the heightened awareness of potential risks associated with hiring employees. Organizations recognize that thorough screening processes are essential to ensure a safe working environment for all employees and customers. By conducting background checks, employers can identify any past behavior that may pose a threat to workplace safety, such as criminal history or substance abuse. This proactive approach not only mitigates risks but also fosters a culture of safety and trust within the organization. Thus, these factors are expected to drive the employment screening services market growth.

Employment Screening Services Market Segment Review

The employment screening services market outlook is segmented into service, application, enterprise size, and region. By service, it is classified into education & employment verification, criminal background checks, credit history checks, drug & health screening, and others. By application, it is divided into healthcare, IT/technology/media, financial services, staffing, retail, industrial, travel/hospitality, government/education, transportation and others. By enterprise size, it is classified into large enterprise and SMEs. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Service

On the basis of service, the global employment screening service market share was dominated by the education & employment verification segment in 2023 and is expected to maintain its dominance in the upcoming years, owing the increasing emphasis on ensuring candidate qualifications and skills before hiring. Employment screening services providers are prioritizing background checks to mitigate risks associated with hiring unqualified individuals, which drives the segment growth. However, the drug & health screening segment is expected to grow at the highest rate during the forecast period, owing to the increasing awareness of workplace safety and the need to maintain a healthy workforce, which drives the segment growth.

By Region

Region wise, the employment screening services industry was dominated by North America in 2023 and is expected to retain its position during the employment screening services market forecast period, owing to stringent regulations and a robust emphasis on employee safety and compliance. The region's advanced technological infrastructure and high adoption of screening services by various industries, including healthcare and finance, fuel demand for employment screening service in region. However, Asia Pacific is expected to witness significant growth during the forecast period, owing to increasingly prioritize talent acquisition and compliance with local regulations, the demand for employment screening services is rising, which drives the employment screening service market in the region.

Competition Analysis

The report analyzes the profiles of key players operating in the employment screening service market including prominent employment screening services companies such as Reed Specialist Recruitment Limited, HireRight LLC, Experian Information Solutions, Inc., Checkr., Insperity Services, L.P., ADP, Sterling, Triton, Verifile, Disclosure Services Limited, Kroll, LLC, Neeyamo, Baldor Technologies Private Limited, AuthBridge Research Services Private Limited, KPMG and First Advantage. These players have adopted various strategies to increase their market penetration and strengthen their position in the employment screening service market.

What are the Recent Product Launch in Employment Screening Services Industry

- In May 2024, G-P (Globalization Partners) and ADP expanded partnership to enhance their global employment services. This collaboration aims to simplify the complexities of hiring and managing employees across different countries by providing advanced Global Employer of Record, Contractor, and Payroll solutions. With many businesses prioritizing global talent, this partnership combines G-P's expertise in compliance and workforce management that helping organizations navigate international regulations more effectively.

- In November 2023, ADP and Convera announced a strategic partnership aimed at delivering a comprehensive end-to-end payroll and payments solution to ADP's clients. The combined ADP's expertise in compliant payroll solutions with Convera's capabilities in B2B cross-border payments, enabling clients to streamline their payroll and payment processes through a single integrated platform. The partnership aimed to enhance efficiency, reduce manual complexities, and ensure compliance with local and international regulations, ultimately improving payroll accuracy and security for businesses worldwide.

- In January 2023, Disclosure Services has been acquired by The Citation Group, a leading provider of compliance and quality services. The acquisition is an amazing opportunity for the business to develop and will benefit clients by offering an extensive range of services. Paul Maddocks, Managing Director at Disclosure Services, expressed his excitement and commitment to continuing to deliver the same first-class service clients have come to expect.

- In December 2021, First Advantage Corporation has announced a technology integration agreement with human resources technology company Xref Limited for $2.2 billion in cash and stock. Xref offers reference checking and identity verification solutions that empower organizations worldwide to make stronger people decisions. First Advantage and Xref will cross promote services through the integration of their platforms, enabling all First Advantage clients to take candidate references and ID checks.

What are the Top Impacting Factors in Employment Screening Services Market

Rise in Remote and Hybrid Work Models

The rise in remote and hybrid work models significantly transformed the landscape of the employment screening services market. The businesses increasingly adopt flexible work arrangements, as they face new challenges in hiring, managing, and verifying the credentials of remote employees. This shift has increased the demand for employment screening services that verify the integrity, security, and qualifications of candidates who may never physically enter a traditional office. According to Forbes, in 2023, the remote work trend continued to rise, with 12.7% of full-time employees working from home and 28.2% adapting to a hybrid work model. This shift has necessitated a more comprehensive and global approach to background checks.

In addition, the growing prevalence of remote work has increased the importance of continuous screening practices, which thereby drives the demand for employee screening services. Companies are not only focusing on pre-employment checks but are also adopting ongoing monitoring strategies to ensure that their employees remain compliant and trustworthy throughout their tenure. For instance, a technology company employing software developers remotely may implement continuous background checks to monitor any changes in employees’ criminal records or professional licenses. According to a report of by the Professional Background Screening Association 2021, 95% of the U.S.-based organizations utilize background screening, and 76% of organizations adopt background screening worldwide. This has established a documented screening policy, thereby highlighting the importance of candidate evaluations across various industries.

Rise in Demand for Continuous Monitoring in Employment Screening Services

The rise in demand for continuous monitoring drives the employment screening services market growth due to an increasing recognition of the need for ongoing risk management and compliance in the workplace. As organizations navigate a rapidly changing environment marked by remote and hybrid work models, the limitations of traditional pre-employment background checks have become evident. Continuous monitoring offers a proactive solution, enabling companies to regularly assess employees' backgrounds and behaviors throughout their tenure, which drives the market growth.

In addition, technological advancements also play a vital role in the growth of continuous monitoring in employment screening services. The integration of data analytics and artificial intelligence enables organizations to analyze vast amounts of information efficiently and detect anomalies that may indicate potential risks. Solutions such as HireRight and Sterling offer comprehensive continuous monitoring services that streamline the evaluation process, making it easier for companies to uphold safety and compliance standards, which propels the employment screening services market growth.

Data Privacy and Security Concerns

Data privacy and security concerns significantly restrain the employment screening services market, owing to the sensitive nature of the information being handled. Organizations that conduct background checks collect and process personal data, including criminal records, credit histories, and employment histories. This data, if not managed properly, can lead to severe privacy violations, potentially exposing sensitive information to unauthorized access or breaches, which may hamper market growth.

In addition, the evolving landscape of cyber threats poses a significant risk to data security. With increasing incidents of data breaches and cyberattacks, organizations may hesitate to rely on third-party screening services that handle sensitive information. This fear of data compromise may lead to a preference for in-house screening processes, which can limit the growth of the employment screening services market.

High Cost of Screening Services

The high cost of screening services restrains the employment screening services market owing to budget constraints faced by many organizations, particularly small and medium-sized enterprises. The expenses associated with comprehensive background checks, credential verifications, and ongoing monitoring can add up quickly, making it difficult for these companies to justify the investment. In addition, some organizations decide for minimal screening processes to save costs, which can lead to increased risks associated with hiring unqualified or unsuitable candidates. This unwillingness to invest fully in screening services can hinder market growth and limit the adoption of robust hiring practices.

Adoption of Blockchain Technology

The adoption of blockchain technology presents a significant opportunity for the employment screening services platform by enhancing the efficiency, security, and reliability of background checks. Blockchain’s decentralized and immutable ledger system enables secure storage of verified candidate information, such as educational qualifications and employment history, which can be easily accessed and shared among authorized parties. This transparency reduces the risk of fraud and inaccuracies in candidate data and streamlines the verification process, which further drives market growth.

In addition, employers can verify credentials in real time, significantly reducing the time and costs associated with traditional screening methods. As businesses increasingly seek trustworthy and efficient ways to access candidates, the integration of blockchain technology into employment screening services can lead to increased demand for innovative solutions, which further propels the growth of the market.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the employment screening services market analysis from 2023 to 2033 to identify the prevailing employment screening services market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the employment screening services market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global employment screening services market trends, key players, market segments, application areas, and market growth strategies.

Employment Screening Services Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 19.6 billion |

| Growth Rate | CAGR of 11.2% |

| Forecast period | 2023 - 2033 |

| Report Pages | 344 |

| By Services |

|

| By Application |

|

| By Enterprise Size |

|

| By Region |

|

| Key Market Players | KPMG, Checkr., Sterling, Neeyamo, Triton, Experian Information Solutions, Inc., First Advantage, Disclosure Services Limited, Baldor Technologies Private Limited, Reed Specialist Recruitment Limited, uthBridge Research Services Private Limited, Insperity Services, L.P., Verifile, ADP, Kroll, LLC, HireRight LLC |

Analyst Review

Employment screening services involves background verification checks conducted by an employer to assess the qualification, criminal record, work history, and other personal detail of a potential candidate. These services include criminal background checks, credit history, drug testing, and education verification, ensuring that organizations make informed hiring decisions, reduce risks, and maintain compliance with regulatory standards.

The increased media coverage of workplace incidents has significantly raised public awareness about the importance of background checks. As more people become aware of the potential risks associated with hiring individuals with criminal records or other concerning backgrounds, there is a rise in demand for employers to implement robust screening procedures. In addition, organizations have recognized the value of adopting best practices in hiring and onboarding, which often include thorough background checks. This shift toward more stringent screening processes drives the employment screening services market growth.

However, data privacy concerns limit the scope of screening, particularly in regions with strict data protection laws, and delays in the screening process affects hiring timelines, creating inefficiencies for employers, thereby limiting market growth. Furthermore, the employment screening services market has undergone a transformative phase, driven by significant technological advancements. Artificial intelligence (AI) and machine learning have revolutionized the screening process by enhancing accuracy and efficiency. These technologies enable the analysis of vast datasets to identify patterns and anomalies that are overlooked by traditional methods

An employment screening service is a professional service that conducts background checks and verifications on job candidates or current employees on behalf of employers.

The forecast period for the employment screening service market is 2024 to 2033.

The base year is 2023 in employment screening service market.

The total market value of employment screening service market was $6.6 billion in 2023.

The market value of the employment screening service market is projected to reach $19.6 billion by 2033.

Loading Table Of Content...

Loading Research Methodology...