Global Empty Capsules Market Report, 2030

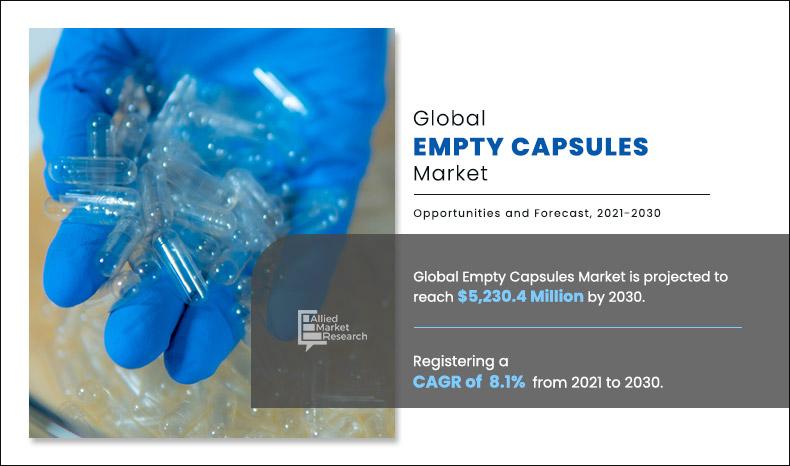

The global empty capsules market size was valued at $2,382.7 million in 2020, and is projected to reach $5,230.4 million by 2030, registering a CAGR of 8.1% from 2021 to 2030. The factors that drive the empty capsule segment growth includes increase in number of chronic diseases and surge in demand for therapeutic drugs. According to the report of British Heart Foundation, there are around 640 million people living with heart and circulatory diseases across the world in 2024 and this number is expected to rise further due to changing lifestyles, which contributes to the demand for varied dosage forms, thereby driving the demand for empty capsules.

Empty capsules are cylindrical, shell-like structures primarily made from gelatin or other plant-based materials, designed to encase powdered or liquid substances for oral consumption. These capsules serve as a delivery mechanism for various pharmaceutical, nutraceutical, and dietary supplement formulations. They are typically composed of two parts, the body and the cap, which fit together to form a sealed container. They are available in different sizes to accommodate varying dosages and are designed to dissolve or disintegrate in the stomach, releasing the contents for absorption. They offer a convenient, accurate, and palatable method for administering active ingredients, ensuring consistent dosing and enhancing the bioavailability of the substances enclosed.

Key Takeaways

- By product, the gelatin segment was the highest contributor to the market in 2020.

- On the basis of raw material, the pig meat segment dominated the market in 2020, and is expected to continue this trend during the forecast period.

- Depending on therapeutic application, the antibiotic & antibacterial drugs segment was the highest contributor to the market in 2020.

- Depending on end user, the pharmaceutical manufacturers segment was the highest contributor to the market in 2020.

- Region wise, North America garnered the largest revenue share in 2020, however, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Empty Capsule Market Dynamics

The growth of the empty capsule market is driven by several factors such as rise in prevalence of chronic diseases, increase in geriatric population, and surge in adoption of therapeutic products, vitamins, & dietary supplements. The elderly population is particularly vulnerable to chronic diseases such as cardiovascular conditions, diabetes, and arthritis, which necessitate regular medication. Consequently, there is an increase in demand for pharmaceutical formulations, including capsules, to enhance immunity and support general health. According to the United Nations, in 2019, the global population aged 65 years or older reached 703 million, highlighting the surge in need for healthcare solutions targeted at older adults.

Moreover, the Centers for Disease Control and Prevention (CDC) reported in 2021 that the consumption of dietary supplements increases with age. Approximately one-quarter of adults over 60 years of age consume four or more dietary supplements, fostering the need for empty capsules to deliver these supplements. This trend further accelerates the demand for empty capsules as the elderly population seeks convenient and efficient means of managing their health.

The demand for empty capsules is fueled by an increase in prevalence of chronic diseases, particularly in geriatric population, and a rise in awareness of the benefits of vitamins and dietary supplements. Capsules, especially those made from gelatin, offer an ideal solution for delivering various active ingredients, improving patient compliance by concealing unpleasant tastes or odors, and offering ease of swallowing.

In addition, the rise in the number of capsule production facilities and the surge in adoption of capsule drug delivery systems significantly contribute to market expansion. For example, in 2020, Lonza Group, a multinational chemical and biotechnology company, produced approximately 230 billion capsules. Similarly, Nector Lifesciences, one of India’s leading pharmaceutical companies, produced around 4 billion capsule shells in the same year. The functional advantages of capsules over tablets, such as simpler manufacturing processes, the ability to encapsulate solids, semi-solids, & liquids, and their flexibility in color & shape drive the demand for empty capsules. In addition, capsules improve patient compliance compared to tablets due to their ease of swallowing and ability to mask the taste of unpleasant active pharmaceutical ingredients (APIs).

However, there are challenges that could potentially hinder market growth. Empty capsules made from gelatin are primarily derived from animal sources, particularly pigs and cows, and this raises ethical concerns regarding animal slaughter. As consumer awareness around ethical issues increases, there is a surge in resistance to animal-derived products. In addition, there is a perception that gelatin could transmit diseases such as bovine spongiform encephalopathy (BSE), also known as “mad cow disease,” which has impacted consumer confidence in gelatin-based capsules. These concerns are expected to hamper the growth of gelatin-based capsules, particularly in regions where consumer awareness around animal welfare and health risks is high. Fluctuations in gelatin prices are another significant factor restricting market growth. For example, in 2020, ACG Worldwide, one of Asia's largest capsule manufacturers, reported that gelatin made up 85% of their capsules, and its price has increased, posing challenges for manufacturers.

Moreover, the advancement of technology in capsule manufacturing is expected to influence the market expansion significantly. The entry of new players into the market and the surge in demand for gelatin capsules boost innovation in capsule formation. Companies such as Lonza have been at the forefront of launching new capsule products, such as the Vcaps Plus White Opal capsule, which caters to the food supplement market. In May 2021, Qualicaps introduced high-quality, titanium dioxide-free capsules available in both gelatin and HPMC (hydroxypropyl methylcellulose), offering solutions for ingredient masking in the pharmaceutical industry. In 2019, Lonza launched the Capsugel Zephyr, a capsule designed for dry-powder inhalation products, highlighting the company’s commitment to advancing drug delivery technologies. Such innovations are expected to fuel market growth by catering to the increase in demand for more efficient and versatile drug delivery systems.

Segments Overview

The empty capsules market is segmented into product, raw material, therapeutic application, end user, and region. By product, the market is categorized into gelatin capsules and non-gelatin capsules. The gelatin capsules segment is further divided into hard gelatin capsules (HGC) and soft gelatin capsules (SGC). On the basis of raw material, it is classified into pig meat, bovine meat, bone, hydroxypropyl methylcellulose (HPMC), and others. Depending on therapeutic application, it is fragmented into antibiotic & antibacterial drugs, vitamin & dietary supplements, antacids & anti-flatulent preparations, cardiac therapy drugs, and others. Depending on end user, it is fragmented into pharmaceutical manufacturers, nutraceutical manufacturers, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Product

The gelatin segment dominated the market share in 2020, owing to advancements in R&D activities in the healthcare sector and advantages of gelatin capsules as compared to other drug delivery forms. There are various advantages of gelatin capsules such as thermo-reversibility & tableting, non-allergenic, viscoelasticity, and biocompatibility. However, the non-gelatin capsules segment is expected to witness considerable growth during the forecast period, owing to surge in demand for HPMC capsules and development of plant-derived capsule manufacturing units.

By Raw Material

The pig segment dominated the market share in 2020, owing to pigs being a primary source of gelatin, which is widely used in capsule production. Pig-derived gelatin offers superior properties such as smooth texture, easy digestibility, and cost-effectiveness, making it the preferred choice for pharmaceutical and nutraceutical applications.

By Therapeutic Application

The antibiotic & antibacterial drugs segment held the largest empty capsules market share in 2020, owing to increase in incidences of infectious & inflammatory diseases, rise in R&D activities for manufacturing of therapeutic drugs, and surge in adoption of capsule formulation. However, the vitamin & dietary supplements segment is expected to witness considerable growth during the forecast period, owing to increase in demand for immunity boosters, rise in number of geriatric populations, and surge in demand for nutraceutical products.

By End User

The pharmaceutical manufacturers segment held the largest empty capsules market share in 2020, owing to increase in demand for chemotherapy, rise in prevalence of chronic diseases, development of pharmaceutical capsule manufacturing sectors, and advancements in technology in capsule manufacturing. However, the nutraceuticals manufacturers segment is expected to witness considerable growth during the forecast period, owing to increase in demand for healthcare supplements, initiatives taken by governments to promote awareness about dietary supplements, and rise in number of soft gelatin capsules to encapsulate dietary supplements.

By Region

The empty capsules industry is analyzed across North America, Europe, Asia-Pacific, LAMEA. North America dominated the market share in 2020. This dominance is attributed to rise in prevalence of chronic diseases such as cardiovascular diseases and cancer; presence of key players for manufacturing of empty capsules; increase in number of production of capsules; and advancements in capsule drug delivery technology in the region.

However, the Asia-Pacific region is anticipated to register the highest CAGR during the forecast period. This is attributed to increasing healthcare investments, rising demand for dietary supplements, and expanding pharmaceutical industries. Rise in awareness about personalized medicine, improved healthcare infrastructure, and rise in prevalence of chronic diseases further boost the demand for empty capsules in the region. In addition, the availability of cost-effective manufacturing and raw materials supports market growth.

Competitive Analysis

ACG Worldwide, Bright Pharma Caps Inc., CapsCanada Corporation, have adopted product launch, collaboration, partnership as key developmental strategies to improve the product portfolio of the empty capsules market. For instance, in June 2020, Lonza announced the launch of double-blinded capsules which is designed to over-encapsulate drugs during clinical trial.

Recent Developments in the Empty capsules Industry

- In January 2021, Lonza announced the agreement with Next Pharma to enhance the business of liquid filled hard capsules, and soft gels for high potent and hormonal products.

- In February 2021, Qualicaps Europe expanded its presence in the South Asia region and offered good capsule manufacturing experts and a high standard of quality.

- In January 2021, Lonza announced its partnership with Glanbia for capsule-in-capsule innovation and offer unique delivery forms by combining the dose of ingredients.

- In May 2021, Qualicaps Europe announced the launch of a reliable and high-quality range of titanium dioxide-free capsules, which are available in both gelatin and HPMC form. It aims to provide best encapsulation solution for ingredient masking

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the empty capsules market analysis from 2020 to 2030 to identify the prevailing empty capsules market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the empty capsules market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional and global empty capsules market trends, key players, market segments, application areas, and market growth strategies.

Analyst Review

Growth of the empty capsules market is attributed to factors such as rise in advancements in development of capsules; rise in prevalence of chronic diseases; increase in funds from private & government organizations for development of various research laboratories; and growth in popularity of capsules over other drug delivery forms. The empty capsules market has gained interest of pharmaceutical manufacturing companies, owing to surge in demand for therapeutic drugs. Rise in demand for therapeutic drugs lead to increase in adoption of empty capsules. Moreover, increase in prevalence of geriatric population, who are more prone to chronic diseases notably contribute toward growth of the market. In addition, surge in demand for nutraceutical products propel growth of the market.

North America is expected to witness the highest growth, in terms of revenue, owing to rise in prevalence of chronic diseases such as cardiovascular diseases, cancer, presence of key players for manufacturing of empty capsules, increase in number of production of capsules, and advancements in capsule drug delivery technology in the region.

Asia-Pacific was the second largest contributor to the market in 2020, and is expected to register the fastest CAGR during the forecast period, owing to increase in geriatric population and rise in demand for immunity booster products.

However, ethical concerns along with price fluctuation regarding gelatin material and stringent regulations in the pharmaceutical industry are anticipated to restrain the market growth during the forecast period.

The total market value of empty capsules market is $2,382.7 million in 2020.

The forecast period in the report is from 2021 to 2030

The market value of empty capsules Market in 2021 was $2,599.6 million

The base year for the report is 2020.

Yes, empty capsules companies are profiled in the report

The top companies that hold the market share in empty capsules market are ACG Worldwide, Bright Pharma Caps Inc., CapsCanada Corporation, Lonza Group Ltd. (Capsugel), Medi-Caps Ltd., Mitsubishi Chemical Holdings Corporation (Qualicaps, Inc.), Roxlor LLC, Snail Pharma Industry Co. Ltd, Suheung Co., Ltd, and Sunil Healthcare Ltd.

Asia-Pacific is expected to register the highest CAGR of 9.5% from 2021 to 2030, owing to increase in geriatric population, and rise in demand for immunity booster products.

The key trends in the empty capsules market are by an increase in the prevalence of chronic disease, such as cardiovascular disease, cancer, diabetic, & gastrointestinal disease; rise in demand for gelatin capsule; increase in funding from private & government organizations for capsule manufacturing units; and rise in R&D activities for development of therapeutic products, which are enclosed in capsule.

Loading Table Of Content...