EMR and EHR Software For Hospital Market Research, 2033

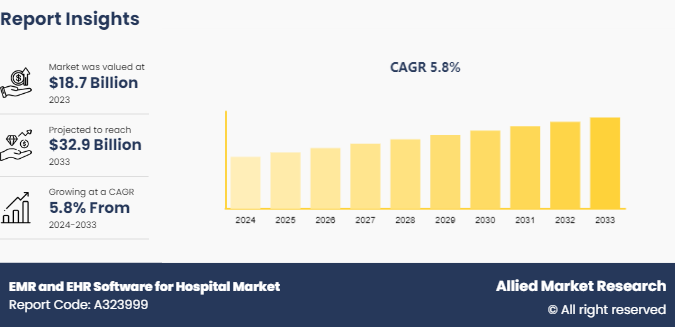

The global EMR and EHR software for hospital market size was valued at $18.7 billion in 2023, and is projected to reach $32.9 billion by 2033, growing at a CAGR of 5.8% from 2024 to 2033. Electronic Medical Record (EMR) and Electronic Health Record (EHR) software are pivotal for enhancing healthcare delivery.

Market Introduction and Definition

Electronic Medical Record (EMR) and Electronic Health Record (EHR) software are critical tools in hospital life sciences, enhancing patient care and operational efficiency. EMRs are digital versions of paper charts, containing patient medical history, diagnoses, medications, and treatment plans used within one healthcare organization. EHRs are more comprehensive, sharing real-time, patient-centered records that are accessible to authorized users across multiple healthcare settings. These systems support clinical decision-making, streamline workflows, and facilitate coordination among healthcare providers. EHRs also enable data-driven research and innovation in life sciences, contributing to improved health outcomes and advancements in medical science.

Key Takeaways

- The EMR and EHR software for hospital market share study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected EMR and EHR software for hospital market forecast period 2024-2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major EMR and EHR software for hospital industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

One significant driver for the adoption of EMR and EHR software is the increasing need for efficient and coordinated patient care. As healthcare becomes more complex, the ability to access and share patient information seamlessly across different departments and facilities is essential. EMR and EHR systems facilitate this by providing a comprehensive, real-time view of patient data, which improves diagnosis accuracy, treatment effectiveness, and overall patient outcomes. Additionally, these systems support compliance with regulatory requirements and standards, which is increasingly important as governments and healthcare bodies push for improved healthcare quality and accountability.

However, a major restraint in the adoption of EMR and EHR systems is the high initial cost and complexity of implementation. Hospitals and healthcare organizations often face significant financial barriers when investing in these technologies, including the costs of software, hardware, training, and ongoing maintenance. The transition from paper-based systems to digital platforms can also be disruptive, requiring extensive training and adaptation by healthcare staff. Moreover, concerns about data privacy and security pose additional challenges, as healthcare organizations must ensure that sensitive patient information is protected against breaches and cyberattacks. These factors can deter smaller healthcare providers or those with limited budgets from fully embracing EMR and EHR solutions.

Despite these challenges, there are substantial opportunities in the EMR and EHR software for hospital market growth, particularly with the rise of advanced technologies such as artificial intelligence (AI) and machine learning. These technologies can enhance EMR and EHR systems by enabling predictive analytics, personalized medicine, and more efficient data management. For instance, AI algorithms can analyze patient data to predict health trends, identify potential risks, and suggest preventive measures, thereby improving patient care and reducing healthcare costs. Additionally, the growing trend towards telemedicine and remote patient monitoring opens new avenues for integrating EMR and EHR systems with digital health platforms, further expanding their utility and market reach. As healthcare continues to evolve, the demand for sophisticated, interoperable EMR and EHR systems is expected to grow, presenting significant opportunities for innovation and market expansion.

National Trends in Hospitals Adoption for EMR and EHR Software

According to the National Coordinator for Health Information Technology (ONC) , the adoption rate of certified Electronic Health Record (EHR) systems in non-federal acute care hospitals has significantly increased over the past decade. In 2012, the adoption rate was 44%, highlighting the initial stages of widespread EHR implementation. By 2014, this rate surged to 97%, driven by government incentives and the recognition of EHR's benefits in improving patient care and operational efficiency. The adoption rate remained stable at 96% from 2016 to 2021, indicating a mature market with near-universal EHR utilization. This high adoption rate underscores the critical role of EHRs in modern healthcare infrastructure.

National Trends in Hospitals Adoption of Electronic Health Records

Year | % adoption |

2012 | 44% |

2014 | 97% |

2016 | 96% |

2018 | 96% |

2021 | 96% |

Source : Diabetes around the world in 2021

Market Segmentation

The EMR and EHR software for hospital industry is segmented into product type, delivery mode, hospital size and region. On the basis of product type, the market is bifurcated into EMR software, and EHR software. The EMR segment is further categorized into general EMR solution, and specialty EMR solution. The EHR segment is further categorized into general EHR solution and specialty EHR solution. As per delivery mode, the market is categorized into on-premises and cloud-based. On the basis of hospital size, the market is segmented into small and medium sized hospitals, and large hospitals. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The regional and country outlook for EMR and EHR Software for Hospital Market Sizeshows significant variation. North America, particularly the U.S., leads due to advanced healthcare infrastructure, favorable government initiatives, and high adoption rates of digital health technologies. Europe follows, with countries like Germany and the UK investing in healthcare IT to enhance patient care. Asia-Pacific is rapidly growing, driven by increasing healthcare expenditure, rising awareness, and government support, especially in China and India. Latin America and the Middle East & Africa are also emerging markets, albeit at a slower pace, with gradual adoption driven by improving healthcare infrastructure and policies.

Industry Trends

- In October 2021, the University of New Mexico Health System launched the MyHealthUNM patient portal along with a new personal health record application called mCharts. These tools provide patient information in an interactive and user-friendly format, enabling patients to access their medical records online. Patients within the University of New Mexico Health System are positively embracing these new digital resources.

Competitive Landscape

The major players operating in the EMR and EHR software for hospital market include Allscripts Healthcare Solutions Inc., Cerner Corporation, Computer Programs and Systems Inc., CureMD Corporation, eClinicalWorks, Epic Systems Corporation, General Electric Company, Greenway Health, LLC., Meditech, and Praxis EMR.

Recent Key Strategies and Developments

- In November 2022, Anumana, an AI-driven health technology company and portfolio company of nference, announced that it has acquired NeuTrace, a medical technology company advancing novel in-procedure AI applications for electrophysiology (EP) . The acquisition positions Anumana as a leader in AI medical software development for cardiac electrophysiology, with a combined development capability - powered by nference’s nSights real world evidence generation platform - that can integrate a patient’s entire electronic medical record (EMR) with corresponding electrocardiograms (ECG) taken from the surface of the body and cardiac electrograms (EGM) taken from within the heart.?

Key Sources Referred

- World Health Organization (WHO)

- Centers for Medicare & Medicaid Services (CMS)

- National Health Service (NHS)

- National Coordinator for Health Information Technology (ONC)

- National Health Mission (NHM)

- Institute for Health Metrics and Evaluation

- Centers for Disease Control and Prevention (CDC)

- Food and Drug Administration (FDA)

- National Institutes of Health (NIH)

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the EMR and EHR Software for Hospital Market analysis from 2024 to 2033 to identify the prevailing EMR and EHR Software for Hospital Market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the EMR and EHR Software for Hospital industry segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global EMR and EHR Software for Hospital Market trends, key players, market segments, application areas, and market growth strategies.

EMR and EHR Software for Hospital Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 32.9 Billion |

| Growth Rate | CAGR of 5.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 216 |

| By Product Type |

|

| By Delivery Mode |

|

| By Hospital Size |

|

| By Region |

|

| Key Market Players | Kareo, MEDITECH, Allscripts Healthcare Solutions, Greenway Health, LLC, GE Healthcare (Centricity), AdvancedMD, Practice Fusion, eClinicalWorks, Athenahealth, NextGen Healthcare |

The total market value of EMR and EHR Software for hospital market was $18.7 billion in 2023.

The forecast period for EMR and EHR Software for hospital market is 2024 to 2033

The market value of EMR and EHR Software for hospital market is projected to reach $32.8 billion by 2035

The base year is 2023 in EMR and EHR Software for Hospital market .

Electronic Medical Record (EMR) and Electronic Health Record (EHR) software are critical tools in hospital life sciences, enhancing patient care and operational efficiency. EMRs are digital versions of paper charts, containing patient medical history, diagnoses, medications, and treatment plans used within one healthcare organization.

Loading Table Of Content...