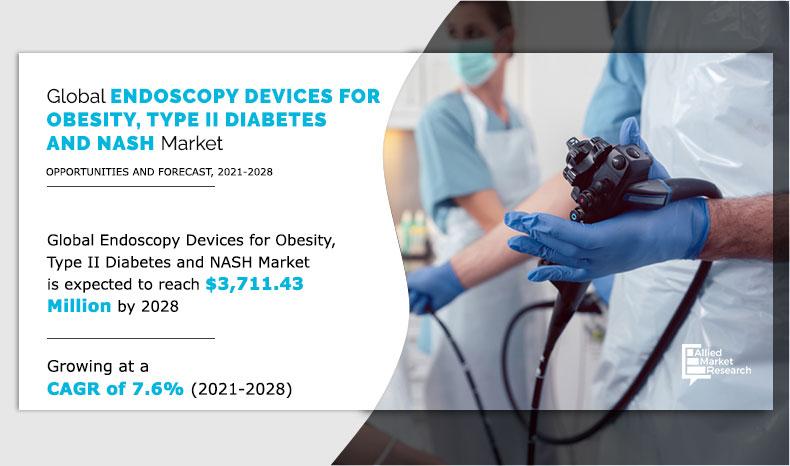

The global endoscopy devices for obesity, type II diabetes and NASH market was valued at $2,638.99 million in 2019, and is projected to reach $3,711.43 million by 2028, registering a CAGR of 7.6% from 2021 to 2028. Endoscopy devices are used in the endoscopic procedures that lie between the medication based treatment and surgical treatment because they provide better weight loss. These devices reduce the cases of side effects which are generally experienced with medications, but they call for less introduction of surgical instruments and other devices into the body cavity than other surgical options. Likewise, endoscopy procedures are non-surgical procedures that utilize endoscopy devices and supplies to examine the interior of a patient’s digestive tract. Endoscopy may also be used to treat disorders, such as obesity, type II diabetes and NASH. These procedures are mainly preferred owing to their advantages such as less invasiveness, length of stay at hospitals, and cost savings in terms of pre- and post-operative care.

Surge in prevalence of obesity across the globe has been supplemented by growing frequency in its associated comorbid ailments including coronary heart disease, stroke, hypertension, diabetes, dyslipidemia, gallbladder disease, GERD, nonalcoholic fatty liver disease (NAFLD), sleep apnea, osteoarthritis, and cancer. Obesity is linked with major risk of mortality and accounts for almost 2.5 million avoidable deaths every year. The economic concerns of obesity are huge, and estimated increase may jeopardize the integrity of health care systems globally. Overweightness and obesity among individuals are some of the main drivers of metabolic diseases and NAFLD across the globe and may require some type of surgery. However, not all patients are qualified for surgical treatment, which in turn, is responsible for driving the demand for endoscopic procedures in near future. On the other hand, dearth of trained physicians & endoscopists and infections associated with the use of endoscopes are expected to hinder the growth of the market.

COVID-19 Impact

COVID-19 pandemic has affected endoscopy devices production and import & export of raw material and finished goods, owing to shutdowns in various COVID-19 affected countries, and rise in number of healthcare workers falling ill in the pandemic, leading to short supply. Temporary disruptions of inputs or production might stress some companies, particularly those with inadequate liquidity. Moreover, delayed shipments & production schedules create financial problems for companies with heavy debts. This, in turn, has negatively impacted the market growth.

The major reason for decline in endoscopy procedures during the COVID-19 pandemic was the decrease in patient volume in hospitals, owing to rescheduling and delaying of procedures for safety reasons.

Moreover, these delays happened after careful review of patient history and if feasible, healthcare providers rescheduled endoscopic procedures to minimize the risk of getting exposed to COVID-19 during hospital visits. Furthermore, regions that are severely affected by COVID-19, have reduced endoscopy procedures, owing to new government directives or hospital guidelines. Thus, the overall impact of the COVID-19 pandemic on the endoscopy devices for obesity, type II diabetes and NASH market is fairly negative.

Product Segment Review

On the basis of product, the market is categorized into endoscope, mechanical endoscopic equipment, visualization & documentation systems, accessories, and other endoscopy equipment. The endoscope segment accounted for the largest revenue in 2019. Advancements in the endoscopy devices for its use in weight loss procedures have created numerous opportunities for endoscope manufacturers worldwide.

By Product Type

Endoscope segment held a dominant position in 2019 and would continue to maintain the lead over the forecast period.

Manufacturers have focused on the development of proprietary technology platforms to differentiate from the competitors to take advantage of these opportunities. In addition, they have developed cost-effective and patent-protected proprietary solutions to stand-alone and maintain their positions in the endoscopy devices for obesity, type II diabetes, and NASH market. Moreover, endoscopes are used in the weight loss surgeries such as gastric balloon, aspiration therapy, endoscopic sleeve gastroplasty, gastric injection, and lap band surgery while implanting as well as removing these implants from a patient’s body. Gastric balloon uses a soft durable balloon that is inserted into stomach through mouth with the help of endoscope. Endoscopic sleeve gastroplasty uses suturing devices which are inserted into the stomach through mouth with the help of endoscope and sutures are placed in the stomach to make it smaller. Thus, this increase in adoption of endoscopes in minimally invasive procedures for weight loss management are anticipated to propel the segment growth throughout forecast period.

Procedure Segment Review

By procedure, the endoscopy devices for obesity, type II diabetes and NASH market is classified into gastric balloons, aspiration therapy, endoscopic sleeve gastroplasty, gastric injections, and lap band surgery.

By Procedure

Endoscopic sleeve gastroplasty segment is projected as one of the most lucrative segment.

Endoscopic sleeve gastroplasty segment is estimated to grow at a substantial pace during the forecast period, as it offers long term relief from weight gain and obesity. Furthermore, rise in prevalence of diseases related to obesity and awareness about obesity treatments coupled with advances in minimally invasive procedures are the major factors anticipated to drive the growth of the endoscopy devices for obesity, type II diabetes and NASH market for endoscopic sleeve gastroplasty segment during the forecast period. Moreover, ongoing clinical trials with respect to endoscopic sleeve gastroplasty procedures are anticipated to boost the segment growth in the coming years. For instance, a randomized interventional clinical study on safety and efficacy endoscopic sleeve gastroplasty versus laparoscopic sleeve gastrectomy in obese subjects with NASH (TESLA-NASH) using Overstitch device is under investigation. Thus, surge in popularity of such procedures among obese patient population is expected to drive the growth of the endoscopy devices for obesity, type II diabetes and NASH market.

Disease Indication Segment Review

By disease indication, the endoscopy devices for obesity, type II diabetes, and NASH market is classified into obesity, type II diabetes, and nonalcoholic steatohepatitis (NASH). The type II diabetes segment is anticipated to garner largest share in the market throughout the analysis period. According to several research studies conducted, individuals with severe obesity are at greater risk of type II diabetes than people with a lower BMI. Being overweight (BMI of 25-29.9), obese (BMI of 30-39.9) or morbid obese (BMI of 40 or greater), greatly increases the insulin resistance in muscles and tissues in the human body. For instance, Diabetes.co.uk (one of the largest diabetes community in Europe), in 2019, stated that obesity is supposed to account for 80-85% of the risk of developing type II diabetes, whereas recent research indicates that obese people are up to 80 times more likely to develop type II diabetes than those with a BMI of less than 22. Therefore, rise in incidences of diabetes among population is estimated to drive the growth of the endoscopy for obesity, type II diabetes, and NASH devices market.

By Disease Indication

Type II Diabetes segment held a dominant position in 2019 and would continue to maintain the lead over the forecast period.

Region Segment Review

Europe accounted for a major share in the endoscopy devices for obesity, type II diabetes, and NASH market in 2019, and is expected to maintain its dominance during the forecast period, owing to surge in obese population, technological advancements, rise in prevalence rate of diseases that require endoscopy devices, growth in patient preference for minimally invasive surgeries, favorable CE approvals and reimbursement policies in developed economies, shorter recovery time and minimal postoperative complications. Asia-Pacific endoscopy devices for obesity, type II diabetes, and NASH market is expected to register significant growth rate during the forecast period, owing to rise in prevalence rate of diseases that require endoscopy devices and technological advancements in the region.

By Region

Europe was holding a dominant position in 2019 and would continue to maintain the lead over the analysis period.

The report provides a comprehensive analysis of the key players that operate in the global endoscopy devices for obesity, type II diabetes and NASH market such as Apollo Endosurgery, Fractyl Laboratories, GI Dynamics, GI Windows, Aspire Bariatrics, Reshape LifeSciences, Inc., USGI Medical, Obalon Therapeutics, Spatz Fgia and Endo Tools Therapeutics.

Key Benefits For Stakeholders

- This report provides a detailed quantitative analysis of the current endoscopy devices for obesity, type II diabetes and NASH market trends and forecast estimations from 2019 to 2028, which assists to identify the prevailing market opportunities.

- An in-depth market analysis includes analysis of various regions, which is anticipated to provide a detailed understanding of the current trends to enable stakeholders formulate region-specific plans.

- A comprehensive analysis of factors that drive and restrain the growth of the global is provided.

- The projections in this report are made by analyzing the current trends and future market potential from 2021 to 2028, in terms of value.

- An extensive analysis of various regions provides insights that are expected to allow companies to strategically plan their business moves.

- Key market players within the endoscopy devices for obesity, type II diabetes and NASH market are profiled in this report and their strategies are analyzed thoroughly, which helps in understanding competitive outlook of the global endoscopy devices for obesity, type II diabetes and NASH market.

Key Market Segments

By Product

- Endoscope

- Mechanical endoscopic equipment

- Visualization and documentation systems

- Accessories

- Other endoscopy equipment

By Procedure

- Gastric balloon

- Aspiration therapy

- Endoscopic sleeve gastroplasty

- Gastric injection

- Lap band surgery

By Disease indication

- Obesity

- Type II Diabetes

- Nonalcoholic Steatohepatitis (NASH

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Rest of Europe

- Asia-Pacific

- Japan

- China

- India

- Australia

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- South Africa

- Rest of LAMEA

Endoscopy Devices for Obesity, Type II Diabetes and NASH Market Report Highlights

| Aspects | Details |

| By Product |

|

| By Procedure |

|

| By Disease indication |

|

| By Region |

|

| Key Market Players | ENDO TOOLS THERAPEUTICS S.A., GI DYNAMICS INC., OBALON THERAPEUTICS INC., RESHAPE LIFESCIENCES INC., GI WINDOWS INC., SPATZ FGIA INC., APOLLO ENDOSURGERY INC., ASPIRE BARIATRICS INC., .FRACTYL LABORATORIES INC., USGI MEDICAL INC., MEDTRONIC PLC. |

Analyst Review

The endoscopy devices for obesity, type II diabetes and NASH market is expected to witness a healthy growth with the rise in demand for minimally invasive surgical procedures. The endoscopy devices for obesity, type II diabetes and NASH market has pulled interest of the healthcare industry, owing to rise in number of endoscopy procedures and increase in use of these devices in emerging applications to diagnose and treat obesity and its comorbid conditions. In addition, favorable FDA approvals pertaining to endoscopy devices in developed economies, surge in patient preference for minimally invasive surgeries, and shorter recovery time & minimal postoperative complications drive the growth of the global endoscopy devices for obesity, type II diabetes and NASH market. On the contrary, unmet medical demands in developing countries are expected to provide remunerative opportunities for market expansion.

Increase in awareness regarding technologically advanced devices and rise in knowledge about weight loss procedures are expected to boost demand for endoscopy devices. Therefore, use of endoscopy devices in treating obesity and diabetes is expected to increase in the future.

The total market value of Endoscopy Devices for Obesity, Type II Diabetes and NASH market is $2,638.99 million in 2019

The forecast period in the report is from 2021 to 2028

The market value of Endoscopy Devices for Obesity, Type II Diabetes and NASH market in 2020 was $2,818.44 Million

The base year for the report is 2019

Yes, Endoscopy Devices for Obesity, Type II Diabetes and NASH Market companies are profiled in the report

The top companies that hold the market share in Endoscopy Devices for Obesity, Type II Diabetes and NASH market are Apollo Endosurgery, Aspire Bariatrics, Reshape LifeSciences, Inc., and, Obalon Therapeutics.

No, there is no value chain analysis provided in the Endoscopy Devices for Obesity, Type II Diabetes and NASH market report

The key trends in the Endoscopy Devices for Obesity, Type II Diabetes and NASH market are Surge in obese population and Growth in patient preference for minimally invasive surgeries

Loading Table Of Content...